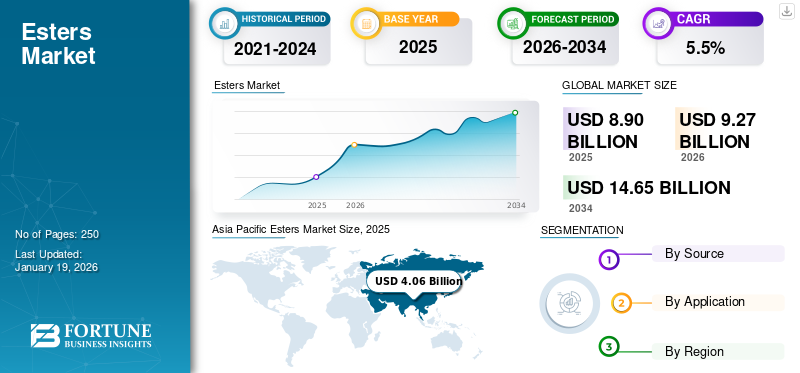

Esters Market Size, Share & Industry Analysis, By Source (Natural and Synthetic), By Application (Automotive, Chemical, Food & Beverage, Personal Care & Cosmetics, Paints & Coatings, Pharmaceutical, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global esters market size was valued at USD 8.90 billion in 2025 and is projected to grow from USD 9.27 billion in 2026 to USD 14.65 billion by 2034, exhibiting a CAGR of 5.5% during the forecast period. Asia Pacific dominated the esters market with a market share of 46% in 2025.

Esters are organic compounds derived from the reaction between acids and alcohols, where an alkoxy group replaces the hydroxyl group. These compounds are widely used across multiple industries due to their distinctive fragrances, solubility, and chemical versatility. They play a crucial role in producing solvents, plasticizers, synthetic flavors, fragrances, and biodiesel. The market is witnessing steady growth driven by increased demand for cosmetics and personal care products, rise in processed food consumption, and growing use of bio-based esters in lubricants and plasticizers. Furthermore, the global shift towards eco-friendly and sustainable chemicals accelerates bio-based product adoption across industrial applications. Major players in the market include Mitsubishi Chemical Group Corporation, BASF SE, Exxon Mobil Corporation, The Dow Chemical Company, Solvay, and Evonik Industries AG.

Esters Market Trends

Growing Focus on Bio-Based Esters and Sustainable Production Practices

As industries strive to decrease carbon footprints and transition to greener alternatives, the market is experiencing a significant shift towards bio-based and eco-friendly production methods. Manufacturers are increasingly adopting renewable feedstocks such as vegetable oils and animal fats to produce esters used in lubricants, personal care products, and food additives. This trend aligns with global sustainability goals and regulatory pressures to reduce reliance on petrochemicals. Innovation in enzymatic and green chemistry processes further enhances the efficiency and environmental compatibility of ester production, paving the way for a more circular and responsible supply chain.

MARKET DYNAMICS

MARKET DRIVERS

Growing Personal Care Sector and Shift Towards Natural Ingredients to Boost Product Demand

The exponential growth of the personal care and cosmetics industry, particularly in developing economies, is driving the demand for esters. As consumer awareness rises around product safety, sustainability, and skin-friendly formulations, manufacturers increasingly turn to products derived from natural sources for use in lotions, creams, sunscreens, and hair care products. These compounds offer excellent emollient properties, smooth texture, and enhanced skin absorption, making them ideal for high-performance and eco-conscious formulations. The shift towards clean beauty and plant-based ingredients further propels the demand for bio-based esters. This trend, coupled with continuous innovation in formulation science, is set to strengthen the product's role in shaping the future of the personal care industry and driving the global esters market growth.

- According to the World’s Top Exports, global beauty, cosmetics, and skincare exports reached USD 73 billion in 2023, creating growth opportunities for esters as essential ingredients in formulations offering texture enhancement and sustainability.

MARKET RESTRAINTS

Volatility in Raw Material Prices to Hinder Market Growth

Shifts in the prices of key raw materials such as fatty acids, alcohols, and petrochemical derivatives can significantly affect manufacturers' cost structure and profitability. A surge in raw material costs raises production expenses, while price drops may disrupt supply chain stability and planning. This unpredictability often leads manufacturers to seek cost-effective alternatives or adjust formulations, which can delay production cycles. Consequently, such volatility in input prices is likely to constrain the market growth over the forecast period.

MARKET OPPORTUNITIES

Advancements in Synthesis Technologies to Expand Future Market Potential

Innovations in product synthesis techniques create promising market growth opportunities across multiple industries. Techniques such as enzymatic synthesis, solvent-free production, and precision catalysis make manufacturing processes cleaner and more efficient. These innovations enable product synthesis with specific properties tailored to the needs of industries such as pharmaceuticals, food processing, and advanced lubricants. By offering greater flexibility in formulation and better environmental performance, these technologies are expected to drive product adoption in both existing and emerging applications.

MARKET CHALLENGE

Environmental Regulations & Availability of Substitutes Present Challenges to the Market Development

Growing environmental concerns around using petrochemical-based inputs in product synthesis are attracting increased regulatory attention. Many countries are introducing stricter guidelines to decrease industrial emissions and promote using sustainable raw materials. Adhering to these regulations often demands considerable investment in cleaner, eco-friendly production methods. Additionally, the market is noticing the rise of alternative ingredients, particularly in sectors such as personal care, food, and industrial formulations, that offer comparable performance with lower environmental impact. These developments are expected to pose notable challenges for manufacturers in maintaining competitiveness and compliance.

Download Free sample to learn more about this report.

Segmentation Analysis

By Source

Rising Popularity of Synthetic Segment Due to Its Various Applications to Accelerate Segment Growth

Based on source, the market is classified into natural and synthetic.

The synthetic segment held the largest global esters market share in 2024. The notable share is due to their exceptional performance features, such as excellent thermal stability, high lubricity, and strong oxidation resistance. These qualities make them ideal for use in demanding applications include industrial lubricants, aviation oils, and synthetic base fluids. Their reliability, extended shelf life, and consistent formulation makes them a preferred choice in high-performance environments. However, increasing environmental concerns and regulatory pressures on petrochemical-based products are prompting manufacturers to explore more sustainable, bio-based synthetic alternatives.

On the other hand, the natural segment is anticipated to grow significantly due to the momentum towards environmentally sustainable and biodegradable products. Originating from renewable sources such as vegetable oils and animal fats, natural esters are widely used in personal care items, food additives, and transformer oils for their non-toxic and environmentally safe properties. Moreover, increasing consumer awareness, stringent environmental regulations, and the global push for green chemistry further accelerate their adoption across various industries.

By Application

Personal Care Segment Dominates the Market with Growing Demand for Clean-Label Formulations

Based on application, the market is segmented into automotive, chemical, food & beverage, personal care & cosmetics, paints & coatings, pharmaceutical, and others.

The personal care & cosmetics segment holds the largest share of the market, primarily driven by the growing consumer shift toward natural, non-toxic, and skin-friendly ingredients. Esters are widely used in creams, lotions, hair conditioners, and makeup, where they contribute to a lightweight feel, improved spreadability, and enhanced product stability. The trend toward sustainable beauty, combined with the growth of premium and organic skincare lines, continues to accelerate the use of bio-based products in this segment.

In the food & beverage industry, esters are widely used as flavor enhancers, emulsifiers, and preservatives due to their ability to improve aroma, texture, and shelf life. They are commonly found in products such as beverages, baked goods, and ready-to-eat foods. With increasing urbanization and demand for packaged and processed food, manufacturers rely more on food-grade products to meet quality, safety, and sensory expectations. Additionally, the shift toward clean-label and high-performance ingredients continues to support their growing application in this sector.

In the automotive industry, esters are increasingly used to produce high-performance lubricants, engine oils, and hydraulic fluids because of their excellent thermal resistance, low volatility, and effective lubrication capabilities. These properties make them ideal for enhancing engine efficiency and longevity. With the rising utilization of electric and hybrid vehicles, the demand for advanced, environmentally friendly fluids is growing, further accelerating product use in modern automotive systems.

Esters Market Regional Outlook

By geography, the market is categorized into Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Esters Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region leads the global market, driven by robust growth in key end-use industries such as food & beverage, cosmetics, and automotive. Rapid industrialization, expanding urban populations, and increasing consumer awareness of sustainable and high-quality products contribute to the region’s dominance. The Asia Pacific market size was valued at USD 4.06 billion in 2025. Countries including China, India, Japan, and South Korea are witnessing rising demand for bio-based esters in cosmetics, processed food, and specialty lubricants. Moreover, supportive government policies promoting green chemistry and foreign investments in manufacturing and R&D activities further propel market growth.

North America

The growth of the North America market is largely due to rising demand from the personal care and cosmetics sectors. Consumers’ shift toward natural, sustainable ingredients has boosted bio-based product use in lotions, sunscreens, and makeup products. The U.S., being a global leader in the cosmetics industry, continues to see innovation and expansion in premium cosmetics, further accelerating product consumption. Additionally, supportive regulations promoting safer, plant-based ingredients are encouraging broader product adoption across the industry in the region.

- According to the World's Top Exports, the U.S. exported USD 6.2 billion worth of beauty cosmetics and skincare products in 2023, accounting for 8.6% of global exports. This boosts product demand, which is widely used in makeup products.

Europe

In Europe, the market is strongly influenced by strict environmental regulations that promote the adoption of sustainable and bio-based chemicals. Increasing focus on green manufacturing practices and eco-friendly formulations is boosting product demand in industries such as food processing, automotive lubricants, and pharmaceuticals. Leading economies such as Germany, France, and U.K. are investing in innovative technologies to advance sustainable product solutions. With a firm commitment to innovation and environmental responsibility, Europe remains a key product consumer in the global market.

- According to OEC, Germany led the baked goods exports in 2023 with USD 5.89 billion, boosting demand for food-grade esters used to improve flavor, texture, and shelf life in bakery products.

Latin America

Latin America market is growing due to rising industrialization and demand for sustainable products. Increased use of bio-based products in personal care, food, and automotive industries is driving growth. Key countries such as Brazil and Mexico are boosting production and strengthening regulations to support greener manufacturing, making the region an important market.

Middle East & Africa

The market is advancing in the Middle East and Africa as industrial growth and consumer demand for sustainable products rise. Expanding product use in personal care, food, and lubricant sectors fuels the market growth. Furthermore, increased investments in eco-friendly technologies and stricter environmental regulations in countries including the UAE, Saudi Arabia, and South Africa support the region’s market development.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in Their Dominating Positions

The global market is highly competitive, with key players focusing on technological advancements, mergers & acquisitions, and capacity expansion to increase their market presence. Key global companies include Mitsubishi Chemical Group Corporation, BASF SE, Exxon Mobil Corporation, The Dow Chemical Company, Solvay, and Evonik Industries AG. These companies compete based on purity levels, cost-effective processing techniques, supply chain integration, and regional dominance while investing in sustainable extraction technologies to address environmental concerns. While global leaders dominate the market, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY ESTERS COMPANIES

- Mitsubishi Chemical Group Corporation (Japan)

- Esters and Solvents LLP (India)

- Croda International Plc. (U.K.)

- BASF SE (Germany)

- Estelle Chemicals Pvt. Ltd. (India)

- Exxon Mobil Corporation (U.S.)

- The Dow Chemical Company (U.S.)

- Arkema (France)

- Solvay (Belgium)

- Evonik Industries AG (Germany)

KEY INDUSTRY DEVELOPMENTS

- March 2024: Mitsubishi Chemical Group announced the expansion of its Sugar Ester emulsifier production capacity by adding a new line at its Kyushu Plant in Japan. The new facility, with a capacity of 2,000 tons per year, has begun its full-scale operation in March 2024, while an additional line with a capacity of 1,100 tons per year is planned to start operations in March 2026.

- December 2023: Croda International Plc. opened a new facility, Pastillator 4 (PS04), at its Seraya site in Jurong Island, Singapore. With an investment of approximately USD 16 million, the expansion increased the site’s production capacity by 4.6 kilotons, bringing the total capacity to 15 kilotons, to serve the growing demand for pastille-format alkoxylates and esters.

- March 2022: BASF announced plans to nearly double the production capacity of synthetic ester base oil at its Jinshan site in China. This expansion aimed to meet the rising demand for high-performance lubricants in Asia Pacific.

REPORT COVERAGE

The global market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and trends expected to drive the market in the forecast period. It offers information on the key regions/countries, key industry developments, new product launches, details on partnerships, and mergers & acquisitions. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.5% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation

|

By Source

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 9.27 billion in 2026 and is projected to reach USD 14.65 billion by 2034.

In 2025, the market value stood at USD 4.06 billion.

The market is expected to exhibit a CAGR of 5.5% during the forecast period.

The synthetic segment led the market by source.

The key factor driving the market is the rising personal care and cosmetics industries and the shift toward bio-based ingredients.

Mitsubishi Chemical Group Corporation, BASF SE, Exxon Mobil Corporation, The Dow Chemical Company, Solvay, and Evonik Industries AG are the top players in the market.

Asia Pacific dominated the market in 2025.

Growing demand for sustainable and bio-based ingredients, rising usage across diverse industries such as personal care, food, and automotive, and advancements in ester synthesis technologies are key factors expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us