Europe Construction Equipment Market Size, Share & Analysis, By Equipment Type (Earthmoving Equipment, Material Handling Equipment & Cranes, Concrete Equipment, Road building equipment, Civil engineering equipment, Crushing and screening equipment, and Other Equipment), By Application (Residential, Commercial, and Industrial), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

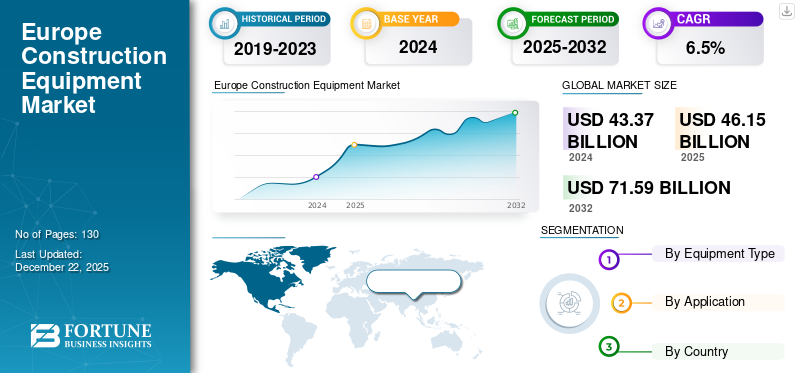

The Europe Construction Equipment market size was valued at USD 43.37 billion in 2024. The market is projected to grow from USD 46.15 billion in 2025 to USD 71.59 billion by 2032, exhibiting a CAGR of 6.5% during the forecast period.

Expansion of EV manufacturing, Green Energy deals, investment in urban infrastructure renewal, and expansion of transit solutions are influencing the market growth. Growing demand for warehouses and distribution centers, further supported by government policy and regulatory frameworks, are driving the market demand for excavators, mobile machinery, and material handling equipment in the region.

- For instance, in August 2023, the German Federal Government planned an investment of over USD 45 billion by 2027 in rail transportation.

- For instance, Municipal Construction sites in Oslo have been mandated with zero-emission machines starting from January 2025.

Government regulations and policies supporting the electrification of construction equipment to further drive the demand for energy-efficient and battery-powered equipment, driving the market share.

Europe Construction Equipment Market Trends

Industrial Automation and Electrification Trends Supported by Regulatory Policies to Bolster Market Growth

Automation, technology advancements, and stringent regulatory policies are all driving the demand for battery-powered equipment and machines across the region. Increasing adoption of battery-operated excavators, loaders, dozers, and compactors in urban development is surging the demand for construction equipment. Low-emission and carbon neutrality targets set by several European countries to drive the demand for electric equipment. Several advantages of telematics, such as GPS, sensor-based components, allow easy operability of construction equipment, gaining significant market traction across the region.

- For instance, SANY, in collaboration with DNL Machine and Equipment, introduced its electric excavator in the Netherlands, offering low-noise operation and 5-7 hours of battery life.

Get comprehensive study about this report by, Download free sample copy

Growing residential construction, increasing investment in residential dwellings positively impact the construction equipment sales, including concrete mixers, loaders, and excavators. Countries such as Germany, Italy, France, and Spain are expected to exhibit increasing investment for construction activity, driving the demand for machinery and compact equipment.

Key takeaways

|

Europe Construction Equipment Market Growth Factors

Urban Development and Logistics Facilities Expansion to Drive Market Growth

Public infrastructure investment and urbanization in several European countries are generating demand for construction machinery. Public transit expansion, such as high-speed rail projects, to further drive the Europe construction equipment market growth of lifting and earthmoving equipment. The region is witnessing the expansion of industrial facilities, logistics centers, warehouses, and heavy investments in renewable energy projects. E-commerce growth is spurring the market for distribution centers and logistic parks, increasing unit sales of material handling equipment such as forklifts and reach trucks.

- For instance, in March 2025 21st Starline high-speed rail network was proposed by the European government that linked over 39 European countries.

Europe Construction Equipment Market Restraints

Shortage of Skilled Workforce and Supply Chain Dependence Might Pose a Challenge

Limited availability of skilled workforce, components, and raw material dependencies on international markets such as China and Japan might limit the demand for construction equipment across European countries. Increasing interest rates and tighter financial situations might further challenge the market in the region.

Europe Construction Equipment Market Segmentation Analysis

By Equipment Type

Based on equipment type, the market is divided into earthmoving equipment, material handling equipment & cranes, concrete equipment, road building equipment, civil engineering equipment, crushing and screening equipment, and other equipment.

Earthmoving equipment is expected to dominate the market revenue share in 2024. The growth is due to several factors such as infrastructure, increased investment in public transit solutions, redevelopment of urban infrastructure, port expansions, and clean energy projects. Growing housing demand in Western European countries and large-scale investments in residential projects are expected to further enhance the market growth of construction equipment in the region.

- In June 2025, Volvo Construction Equipment plans to invest over USD 260 Mn in Sweden and other countries to expand the manufacturing of the excavator assembly line.

Material handling equipment and cranes, such as racking, storage, and lifting equipment to witness the highest growth rate during the forecast period. Growing demand for warehouse automation and adoption of robotics across a wide array of sectors, such as pharmaceuticals, food and beverages, and e-commerce, is expected to boost the demand.

By Application

Based on the application, the market is trifurcated into residential, commercial, and industrial.

Residential construction is gaining strong momentum in emerging European countries such as Poland, owing to significant investments and renovation programs. Adoption of modular and prefabricated homes is further boosting the strong demand for construction and material handling equipment in the region.

- For instance, residential investment volume in Europe accounted for over USD 9 billion in Q1 2025.

By Country

Based on country, the market is segmented into the UK, Germany, France, Italy, Spain, and the rest of Europe.

Germany accounted for the highest revenue Europe construction equipment market share, owing to rising transit infrastructure, residential projects, and renewable energy projects supported by technology and sustainability trends. Growing housing needs and construction investments are expected to bolster the market growth for construction equipment in the country.

- For instance, the Establishment of Verbund Visiolar solar PV Park in Berlin, Germany, is set to begin its development in 2026 and start operation by 2028.

List of Key Companies in the European Construction Equipment Market

Liebherr Group, Volvo Construction Equipment, CNH Industrial, and a few other players in the region cater to a significant portion of the construction equipment market revenue. Established manufacturing hubs, electrification of equipment, a reliable dealer, and distribution network in the region, further supported by rental markets, to strengthen the market share of key players. Key players are focusing on new product launches and rental collaboration with domestic market participants to penetrate the market.

- For instance, in April 2025, Liebherr exhibited its electric XPower 20-ton wheel loaders at the Bauma Trade Show in Munich, Germany.

LIST OF KEY COMPANIES PROFILED

- Liebherr Group (Switzerland)

- Volvo Construction Equipment (Sweden)

- Caterpillar Inc. (U.S.)

- Wacker Neuson (Germany)

- JCB (U.K.)

- CNH Industrial (U.S.)

- Jungheinrich AG (Germany)

- KION Group AG (Germany)

- Hyundai Construction Equipment (South Korea)

- Manitou Group (France)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Hitachi Construction Machinery has unveiled its LANDCROS Concept, a fleet management system for construction equipment manufacturers and rental providers.

- June 2024: Doosan Bobcat has planned an investment of about USD 300 million in a new production facility. The new compact loader facility development is expected to begin in 2026.

REPORT COVERAGE

The European construction equipment market report provides a detailed analysis of the market. It focuses on market dynamics and key industry developments, such as mergers and acquisitions. Additionally, it includes information about the growth in earthmoving equipment, concrete and material handling equipment, and applications. Besides this, the report also offers insights into the latest industry trends and the impact of various factors on the demand.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.5% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type

|

|

By Application

|

|

|

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the Europe market was worth USD 43.37 billion in 2024.

The market is expected to exhibit a CAGR of 6.5% during the forecast period.

By equipment type, the earthmoving equipment segment is set to lead the market.

Liebherr Group, Volvo Construction Equipment, and CNH Industrial, are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us