Europe Smart Building Market Size, Share & Industry Analysis, By Solution (Security System, Safety System, and Others), By Application (Residential and Commercial), and Europe Forecast, 2025-2032

KEY MARKET INSIGHTS

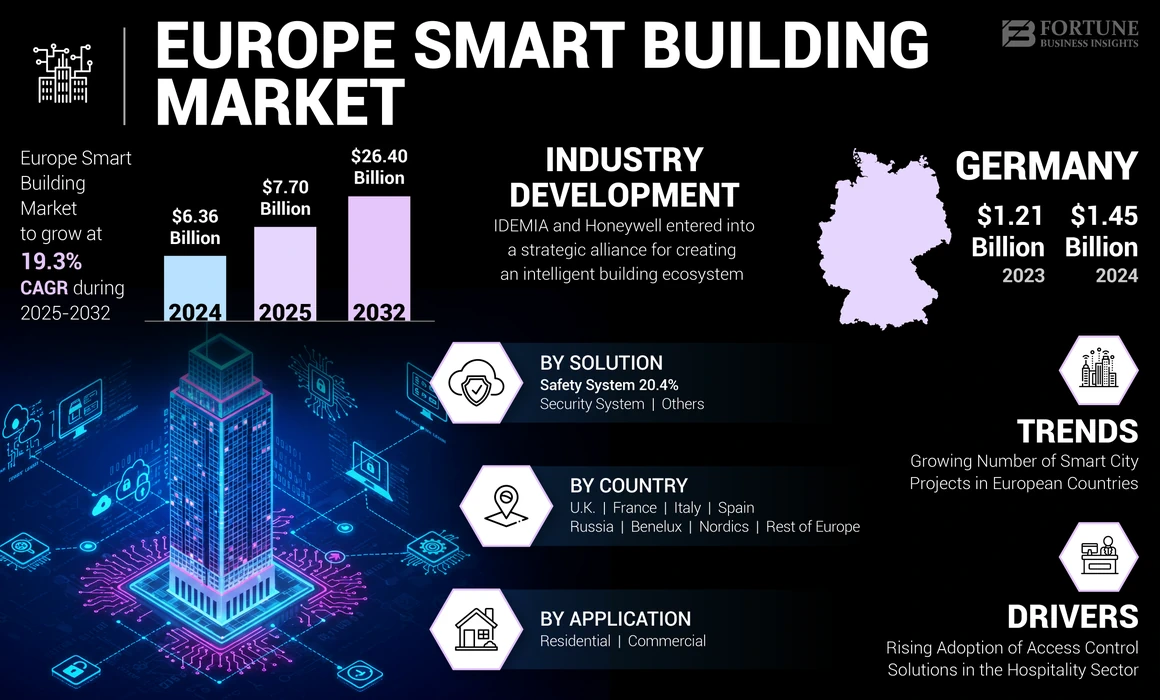

The Europe smart building market size was valued at USD 6.36 billion in 2024. The market is projected to grow from USD 7.70 billion in 2025 to USD 26.40 billion by 2032, exhibiting a CAGR of 19.3% during the forecast period.

Smart devices associated with doors, such as access control systems, smart door locks, safety systems, and other door hardware accessories, have been considered in the European market research report. An increasing number of crimes, such as theft and burglary at a residential or commercial property, have urged the need for smart security devices to protect the property from thieves.

As per the European Union Agency for Law Enforcement Cooperation, at least one burglary is committed every 1.5 minutes in the European Union, with some Member States recording 1000 burglaries almost daily.

Thus, rising security and privacy concerns and the growing Internet of Things (IoT) trend are propelling the penetration of smart building devices in European countries.

COVID-19 IMPACT

Growing Demand for Access Control Door Solutions Uplifted the Market During Pandemic

The COVID-19 pandemic has undoubtedly brought hygiene and health concerns into sharp focus, thereby augmenting the need to adopt emerging and existing technologies to create a safer environment. It has accelerated the need for intuitive and smart systems for building infrastructure. Automatic activation of doors is one of the critical technologies that is gaining popularity in this pandemic. Touch-less buttons, voice-activated technology, or mobile apps integrated with smart door systems are in huge demand.

As social distancing and maintaining a hygiene environment have become a norm, commercial buildings in European countries convert their existing manual doors to automatic doors. The easy-to-use and simple features of access control systems and smart door-related hardware is increasing its demand in co-working spaces, purpose-built student accommodation, co-living buildings, multi-tenant housing, hotels, retail, gyms, and others. Companies such as SALTO Systems, in partnership with BioCote, an antimicrobial technology provider, have already integrated antimicrobial silver ion technology in their locker locks, electronic cylinders, and smart electronic lock range.

Despite that, there was a high demand for smart doors, safety systems, and access control systems, the pandemic adversely affected profitability in the first and, to some extent, in the second quarter of 2020. Economic uncertainty, disrupted manufacturing, supply chain constraints, consumer spending constraints, installation restrictions, and distribution have curbed business sales.

LATEST TRENDS

Download Free sample to learn more about this report.

Rising Number of Smart City Projects in European Countries is a Crucial Trend

The Europe smart building market share is growing at a rapid pace. The U.K., France, Germany, Italy, the Netherlands, and Spain are leading European countries considering the adoption of connected devices. Smart city projects have thrived in past years in the country, especially in large cities such as Eindhoven, Amsterdam, and Rotterdam. Despite Brexit's uncertainty, investments in smart building projects and connected technologies have remained solid in the U.K. Companies invest in office space to enhance and improve employee collaboration and security.

Central and Eastern Europe (CEE) is expected to show large, unexploited potential for development and growth. Presently, smaller cities are lagging in economic growth, and in many areas, CEE city productivity is below the EU-28 average. Smart investment in CEE can unlock innovative potential and address the existing infrastructure gaps. With European Investment Bank (EIB) support, a new momentum accelerates smart city developments across Europe. Furthermore, the European Investment Bank is working on new techniques to support smart city investment in the CEE region.

Such investments in smart cities and building projects increase the demand for access control systems, safety systems, and smart door locks.

DRIVING FACTORS

Surging Adoption of Access Control Solutions in the Hospitality Industry to Accelerate Market Growth

The hospitality industry is one of the main segments that have advanced in adopting secure access control systems. The hospitality industry's important motto is providing guests comfort, convenience, security, and a safe experience throughout their stay. Access control systems offer guests a safe and secure environment, supporting hoteliers in delivering the optimal guest experience.

Most hotel chains operate with key card access systems offered by companies such as Assa Abloy AB, Salto, GEZE GmbH, and others. Even though magnetic key cards are the most popular, Radio-Frequency Identification (RFID) and Near-Field Communication (NFC) cards, which are easier for guests to use, are set to gain traction in Europe. Besides, biometric door locks, electric strike door locks, keypad door locks, and others are striving to enter the smart building industry. The user need not have to look for keys or keycards in bags or pockets that may already be occupied with other things. With these solutions, fingerprint recognition and keypad code are at the staff and guests' fingertips, becoming the safest keys to the door locks.

Besides, access control technology continues growing beyond just offering hotel room access. It has become a part of the visitant experience and a way to enhance overall satisfaction. It also provides hotel operations and management a way to cut costs and streamline processes. Thus, a surge in the adoption of access control solutions in the hospitality industry is driving the Europe smart building market growth.

RESTRAINING FACTORS

Technical Issues and High Prices of Smart Door Locks May Impede Market Growth

While there are many benefits associated with smart door locks, there are some pitfalls as well. Any technical fault in the connected lock system can cause the door to malfunction, fail, or cause other security risks. The most frequent problem comes with those lock systems operating with smartphones. The possibility of not closing or opening the door when the smartphone is lost or the smartphone's battery is down cannot be neglected.

Besides, smart locks are expensive compared to standard lock-and-key boxes. While European homeowners are starting to embrace innovative home technologies for convenience and security, they are not yet ready to spend much. For instance, a smart lock's average selling price is approximately USD 200, whereas conventional mechanical locks are as low as USD 60. Even though investors and startups progressively recognize the core value of such smart products, most end-users consider only a marginal value of the cost, which is not enough to justify the higher prices of devices. Thus, technical issues and higher price tag devices are likely to restrain the adoption of smart locks.

SEGMENTATION

By Solution Analysis

To know how our report can help streamline your business, Speak to Analyst

Security System Segment to Hold the Largest Share Owing to Rapid Adoption of Access Control and Smart Door Lock Solutions

Based on solution, the market is categorized into security system, safety system, and others (fire door control systems, other parts, and accessories). The security system segment is further bifurcated into an access control system and smart door lock. Smart door look is further segmented into biometric door locks, electric strike door locks, smart card door locks, and others (keypad door locks).

The security system segment captures the maximum share owing to the surge in penetration of smart solutions that can be accessed remotely. Also, the growing demand for access control systems and smart door locks from residential and commercial sectors is driving the growth of security system solutions.

The safety system segment is predicted to show the highest growth rate during the forecast period. The rising installation of panic door hardware and electronic panic hardware in high-density buildings such as large arena complexes, movie theaters, or restaurants will boost the growth of the safety system segment.

By Application Analysis

Rising Product Adoption in Hotel Industry to Boost the Commercial Segment Growth

Based on application, the market is categorized into residential and commercial. The commercial segment is further sub-segmented into hotels, healthcare, retail, and others (commercial buildings, and airports).

The commercial segment holds the largest market share in Europe. The hotel, retail, and healthcare industries largely implement access control, safety solutions, and smart door locks to meet visitors' and guests' safety needs.

Growing incidents, such as burglary and invasion, are expected to increase the demand for smart door locks and access control systems in the residential sector.

REGIONAL INSIGHTS

The major countries studied in this market are the U.K., Germany, France, Italy, Spain, Russia, Benelux, Nordics, and the rest of Europe.

Germany is one of Europe's most mature and established markets for building technology products such as automation, smart locks, and access control systems. German businesses are investing in digital technology to seek opportunities to build home-grown platforms to compete globally.

In the U.K., the market has great growth potential. Deploying the smart solution in buildings would benefit and secure buildings from various crimes. However, the government must facilitate collaboration between multiple diverse businesses and remove barriers to innovation.

The market potential of France for smart building solutions is large. The use of smart solutions – access control, smart door lock, and safety systems – provides a catalyst for further growth in Europe.

On the other hand, the Denmark and Irish markets are considered slow in adopting connected smart building solutions compared to other Western European countries.

The Netherlands is expected to be the forerunner in integrating smart devices that control building equipment, as the country has always been open to modernizations and innovations. In recent years, smart building projects have flourished in the country, especially in large cities such as Eindhoven, Amsterdam, and Rotterdam.

KEY INDUSTRY PLAYERS

Companies are Investing in Acquisitions, Product Launches, and R&D Activities to Strengthen their Presence

Prominent players in the market share continue to invest in developing existing and new products and modernizing their production facilities. The companies are also investing in digital transformation to shape their competitive position in the market further and create new products to address market opportunities. The established players in the market are facing competitive pressure from emerging smart-building startups. Therefore, in response to this competitive pressure, companies have increased their investments in innovation through in-house R&D, acquisitions, early-stage incubator programs, and startup funding.

January 2022 – Johnson Controls announced its acquisition of FogHorn, a leading developer of Edge AI software for industrial and commercial Internet of Things (IoT) solutions.

November 2022 – ZKTeco UK Limited, a global security solutions manufacturer, announced its new distribution partnership with Vision Security Distribution for its Access and Entrance Control solutions.

List of the Key Companies Profiled:

- Novoferm GmbH (Germany)

- Bosch GmbH (Germany)

- GEZE GmbH (Germany)

- Johnson Controls (Ireland)

- Hormann (Germany)

- Schüco International (Germany)

- ZKTeco Europe, S.L. (Spain)

- Dormakaba (Switzerland)

- SALTO (Spain)

- SimonsVoss (Germany)

- Schneider Electric (France)

- ABB (Switzerland)

- Honeywell International Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2021 – Honeywell and IDEMIA announced a strategic alliance for creating and cultivating an intelligent building ecosystem that offers operators and occupants a seamless and enhanced experience.

- January 2022 – PassiveLogic, an intelligent building system provider, raised USD 34 million in funding to develop its physics-based digital twin software for automating smart buildings.

- February 2022 - View Inc., a California-based smart building technology company, announced its product installation of smart windows at Hood Park Drive, office, and laboratory building.

- March 2023 – Samsung showcased its latest smart home appliances and digital tools at the European Samsung Summit. The smart product includes IoT Hub integrated with Samsung TVs.

- April 2023 – SALTO Systems, an innovative smart access control solutions provider, introduced a secure and seamless face recognition access control system with the acquisition of TouchByte, a U.K.-based technology innovator.

REPORT COVERAGE

The report highlights leading countries across Europe to give a better understanding to the user. Furthermore, the report provides insights into the latest industry trends and analyzes technologies deployed rapidly at the European level. It further highlights some growth-stimulating factors and restraints, helping the reader gain an in-depth knowledge about the market.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 19.3% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Solution

|

|

By Application

|

|

|

By Country

|

Frequently Asked Questions

The market is projected to reach USD 26.40 billion by 2032.

In 2024, the market size stood at USD 6.36 billion.

The market is projected to grow at a CAGR of 19.3% over the forecast period.

The security system segment is likely to lead the market.

The surging adoption of access control solutions in the hospitality industry is driving the market growth.

Novoferm GmbH, Bosch GmbH, GEZE GmbH, Johnson Controls, Hormann, Schüco International, Assa Abloy AB, ZKTeco Europe, S.L., dormakaba, SALTO, and SimonsVoss are the key players in the market.

Germany is expected to hold the highest market share.

Based on security system, the safety system segment is expected to grow with the highest CAGR over the estimated period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us