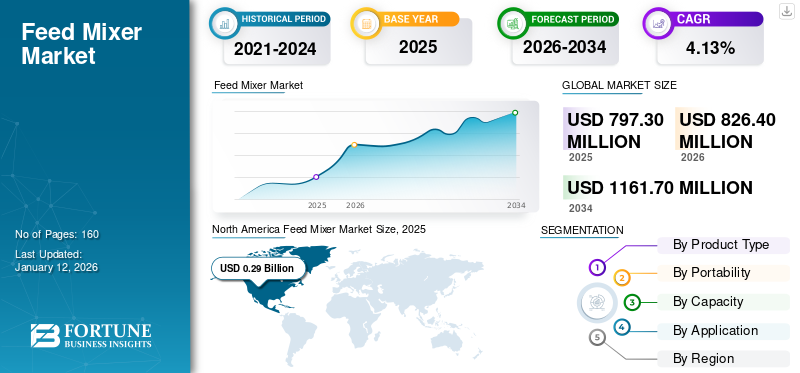

Feed Mixer Market Size, Share & Industry Analysis, By Product Type (Vertical and Horizontal), By Portability (Self-Propelled, Pull, and Stationary), By Capacity (<10^3 M, 10-20^3 M and >20^3 M), By Application (Farms and Feed Factory) Regional Forecast, 2026–2034

FEED MIXER MARKET SIZE AND FUTURE OUTLOOK

The global feed mixer market size was valued at USD 0.797 billion in 2025. The market is projected to grow from USD 0.826 billion in 2026 to USD 1.161 billion by 2034, exhibiting a CAGR of 4.4% during the forecast period. The North America dominated global market with a share of 36.9% in 2025.

The market comprises machinery which is used to blend various feed ingredients mainly for livestock nutrition and animal husbandry operations, it is experiencing steady growth, which is driven by increasing demand for high-quality animal feed and the adoption of advanced mixing technologies. The rising global population, leading to increasing demand for animal-based products, such as meat and dairy, requires efficient feed mixing solutions to ensure optimal animal nutrition. Technological advancements such as automation, artificial intelligence (AI), and the Internet of Things (IoT) are further enhancing the efficiency as well as accuracy of feed mixers, attracting more users, thus leading to market growth. Additionally, due to the growing awareness of animal health and nutrition, farmers and feed producers are now investing in high-quality feed mixing solutions.

The COVID-19 impact initially disrupted global supply chains. It halted production activities that led to a short-term decrease in demand and sales; however, in the long term, it accelerated the adoption of precise feeding technologies.

Kuhn Group, Trioliet B.V., Faresin Industries S.p.A., and Bucher Industries AG are some of the major players in the global market, focusing on product innovation and technological advancements to cater changing demands of the livestock industry. These companies are producing mixers that come with advanced features, such as precision weighing mechanisms and automated loading/unloading systems that enhance functionality as well as efficiency. The global market is also seeing a rise in the adoption of self-propelled mixers that offer maneuverability and independence from tractors or loaders, making them flexible and efficient for farm operations.

Download Free sample to learn more about this report.

IMPACT OF TARIFFS

Tariffs on Imported Machinery and Raw Materials Lead to Higher Costs and Slowed Growth of the Market

Recent implementations of tariffs on imported machinery as well as raw materials have significantly impacted the global feed mixing equipment market by not only increasing production costs but also limiting access to critical components. Major manufacturers who are heavily dependent on international trade are facing increased input expenses, which are often transferred to end-users in the form of higher equipment prices. This has resulted in reduced competition in global markets, disrupted supply chains, and a slowdown in taking procurement-related decisions by livestock farms and feed producers. This uncertainty surrounding future trade policies has also discouraged investment in manufacturing expansion and technological upgrades, which has further hampered the industry's growth.

MARKET DYNAMICS

FEED MIXER MARKET TRENDS

Data-Driven Decision Making & Connectivity, and IoT Are the Trends

Data analytics and sensors are being used to collect and analyze data related to feed mixing processes. This data-driven approach helps farmers make informed decisions about feed formulations, production efficiency, and resource utilization. These mixers are increasingly incorporating Internet of Things (IoT) capabilities. This enables remote monitoring, real-time data analysis, and ability to adjust mixing parameters from a centralized location, thereby enhancing the overall operational efficiency.

MARKET DRIVERS

Farm Mechanization and Modernization Are Boosting the Utilization of Feed Mixing Machines

The adoption of modern farming practices, including mechanization, is growing in agriculture. Farms are increasingly investing in advanced machinery, including feed mixing machines, to streamline operations and improve overall efficiency. An increase in the feed production output is another factor prompting farmers and producers to become more aware of the importance of feed efficiency in optimizing production costs. Efficient feed mixing can contribute to better feed conversion rates, making it economically favorable for livestock farmers.

MARKET RESTRAINTS

High Initial Investment Cost and Limited Availability of Skilled Labor Force to Obstruct the Market Growth

The operation of feed mixing machines requires a certain level of skill and knowledge. Farms with limited access to skilled labor or lacking expertise in using these products may opt for simpler feeding methods. The initial cost and operational expenses associated with these mixers can be a barrier for farmers with limited financial resources. Some farmers may opt for more budget-friendly feeding methods that do not involve specialized equipment.

In regions where a variety of high-quality feed ingredients are readily available, farmers may choose to formulate their feeds using locally sourced ingredients, eliminating the need for specialized feed mixing equipment. Thus, some farmers may prefer traditional feeding methods, such as providing whole grains and forages separately, without the need for a mixer. This approach may align with established farming practices and local preferences, thereby hindering the feed mixer market growth.

MARKET OPPORTUNITIES

Emphasizing Advanced Features and Establishing Robust Manufacturing Facilities to Leverage Opportunities

In the current period, the agriculture sector is productively feeding the livestock animals. As per a study, by 2050, arable farm land will increase by nearly 120 million hectares in developing countries, and it will see a decrease by ~70 million hectares in developed countries. Additionally, as per the study, the arable and pasture land dedicated to the production of feed represents nearly 80% of the agriculture land.

It is therefore providing opportunities for the feed mixing machine manufacturers to establish robust manufacturing facilities across the developing and developed countries so as to cater to farmers and feed mill owners across the globe. By establishing robust facilities, companies can provide opportunities to reduce wastage of feedstuff and improve nutrition benefits, thus contributing to animal health and fertility.

- For instance, in December 2022, Vermeer Corporation in adjacent to its existing production facility in Lowe, U.S., is developing its new production line for critical parts manufacturing.

SEGMENTATION ANALYSIS

By Product Type

Horizontal Mixers Will Retain Their Popularity Due to Greater Volume and Form Flexibility

In terms of product type, the market is categorized into horizontal mixers and vertical mixers.

In terms of market size, vertical feed mixers held a 53.18% of major share in 2026. However, horizontal mixers are set to achieve a better growth rate throughout the market forecast.

Horizontal mixers are often less sensitive to variations in batch size. Whether mixing small or large batches, the horizontal design of these machines offers consistent results. Moreover, adding liquid supplements or medications to the feed is often easier with horizontal mixers. The design allows for effective incorporation of liquids throughout the mixture.

Moreover, achieving uniform mixing in vertical mixers can be challenging, especially when dealing with different particle sizes and densities of feed ingredients. The vertical auger action may lead to uneven blending, resulting in variations in nutritional content within the feed, and thereby limiting the use of vertical mixers.

By Portability

Self-Propelled Mixers to Become Popular Owing to Better Maneuverability and Operational Benefits

In terms of portability, the market classification is made as self-propelled, pull, and stationary. Amongst all three categories, self-propelled is estimated to witness the fastest growth in the global market.

Self-propelled mixers will exhibit a CAGR of 44.45% over 2026-2034, often come with features that enhance the mixing process, ensuring a more consistent and thorough blend of ingredients. This leads to improved feed quality, which can positively impact the health and performance of livestock production. Moreover, its ability to mix and deliver feed directly to feeding areas reduces the chances of feed spoilage and waste. Farmers can control the portions more accurately, ensuring that animals receive the right amount of nutrition without excess feed being left uneaten.

The stationary segment is set to capture a limited share of the global market. In stationary setups, the feed must be manually transported from the mixing location to the feeding areas. This can be labor-intensive and time-consuming, especially on larger farms where animals are located at a distance from the mixing point. This can reduce the segment’s growth prospects.

Pull-type segment is expected hold 25% of the market share in 2025, which are dependent on the availability and condition of the tractor or pulling vehicle. If the tractor is not operational or requires maintenance, it can disrupt the feed mixing and delivery schedules on the farm. The speed of the pulling vehicle influences the speed of feed mixing and delivery with a pull mixer. This can result in variations in mixing times and feed distribution, impacting operational efficiency. These critical factors tend to discourage the farm and feed factory operators from using pull mixers.

To know how our report can help streamline your business, Speak to Analyst

By Capacity

Better Mixing and Utilization Will Increase Sales of Mixers with 10-20 M^3 Capacity

By capacity, the market is categorized across <10^3 M, 10-20^3 M, and >20^3 M.

Due to the increasing demand for feed mixers amongst the medium and small farms 10-20^3 M will observe a fast-paced CAGR of 42.81% over 2026-2034 outpacing other categories and will also emerge as a major shareholder in the market during the forecast period. These mixers are highly preferred in different applications as they allow farmers and feed factory owners to utilize double auger or single auger knives to mix the feedstock better.

Additionally, mixers with a capacity of <10 M^3 are anticipated to capture 28% share in 2025 and record a steady growth rate in the coming years. The segment’s growth is due to the machine’s usefulness in feed factories having less roof space.

Mixers with >20 M^3 capacity allow the utilization of three auger knives, designed specifically for horizontal mixers. Thus, this segment is expected to witness moderate yet steady growth.

By Application

Feed factories Dominates the Market Owing to Large Scale Requirement

The global market is segmented by application into feed factories and farms.

Among both, the feed factories dominate the global market share, with a CAGR of 3.80% owing to their capacity to handle large scale feed production catering mainly to largescale livestock operation. These factories are known to invest in advanced feed mixers to maintain consistency as well as efficiency. In addition, the rising industrialization of the animal husbandry sector along with growing demand for nutritionally optimized formulation of feed is further strengthening the position of feed factories

On the other hand, farms are expected to display highest CAGR over the forecast period and capturing 43% of the market share. The growing need for cost-effective and customized feeding solutions among the small and medium scale farmers is driving the adoption of on farm feed mixers. Increasing awareness about quality of feed is also pushing the adoption of feed mixers at farm level.

FEED MIXER MARKET REGIONAL OUTLOOK

In terms of region, the market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America is anticipated to hold the majority of the share in the global market. On the other hand, in terms of market development prospects, Asia Pacific is set to attain a considerable rate of growth, outpacing its peers in the market.

North America

North America captured a majority of feed mixer market share valued at USD 0.294 billion in 2025. Factors such as rising demand for high-nutrition animal feeds and increasing expenditure on livestock husbandry complement the market’s growth.

In addition, farmers of the U.S. and Canada have quickly accepted mechanized mixers with Total Mixed Ration (TMR) processors for mixing quality feed materials that stand out among the other regions.

North America Feed Mixer Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The U.S. is projected to hold USD 0.199 billion in 2026 as the majority of the share of the North American market during the forecast period. Growing awareness of the importance of balanced nutrition in livestock will contribute to the adoption of feed mixers. Farmers are increasingly recognizing the role of feed quality in the health and productivity of their animals, thereby driving the demand for feed mixers.

Most of the manufacturers are trying to venture into the lucrative market of the U.S., which will subsequently increase the competition among manufacturers in the agricultural machinery sector. This factor can lead to continuous innovation in machines. New features, improved efficiency, and competitive pricing can prompt farmers to upgrade their equipment, including feed mixing machine.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe holds second highest market share of USD 0.247 billion in 2026 with a decent CAGR of 3.75% over 2026-2034, and the U.K. market will reach USD 0.02 billion in 2026. The region has a vast livestock industry, including cattle, pigs, poultry, and other animals. The growing demand for meat, dairy, and other animal products is driving the need for efficient feed production, thus boosting the sales of mixers. Additionally, there is a growing emphasis on sustainable agriculture practices in Europe, including reducing waste and optimizing resource utilization. Feed mixers can help farmers minimize feed wastage by ensuring accurate mixing and distribution, aligning with these sustainability goals. The Germany market stands at USD 0.070 billion and France is valued at USD 0.04 billion in 2026.

Asia Pacific

Asia Pacific is projected to continue its stellar performance in terms of market growth throughout the forecast period, with a value of USD 0.19 billion in 2026. Many countries in the region, such as China, India, and Vietnam, have experienced significant growth in livestock industries due to rising population and income levels. This increased demand for meat, dairy, and poultry products drives the need for efficient feed production, thus boosting the demand for these mixers. Intensive farming practices, such as Confined Animal Feeding Operations (CAFOs), are becoming more prevalent in the Asia Pacific to meet the growing demand for animal feed products. Feed mixers are essential equipment in such intensive farming systems, where precise formulation and distribution of feed are critical to maximize animal growth and health. The Indian market will reach USD 0.05 billion and China will hit USD 0.06 billion, along with Japan at USD 0.03 billion in 2026.

Latin America

In some areas of Latin America, inadequate infrastructure, such as poor road networks and limited access to electricity, can hinder the adoption of mechanized agricultural equipment, such as feed mixing equipment. Without proper infrastructure, farmers may face challenges in transporting and operating these machines effectively. In certain regions, traditional feeding technologies may still dominate, and there could be resistance to adopting modern technologies in animal husbandry. Farmers may be accustomed to manual or traditional methods, and there may be a lack of awareness or incentives to switch to mechanized mixers. Latin America market holds the market value of USD 0.05 billion in 2026.

Middle East & Africa

The Middle East & Africa feed mixer market share is showcasing a slow yet steady growth, which is majorly driven by the growing need for livestock products along with increasing investments in developing the animal husbandry sector. Countries including South Africa, Saudi Arabia, and the UAE are the frontrunners in the adoption of advanced feed mixing technologies that help improve feed efficiency and livestock productivity. However, market expansion is constrained due to economic volatility in the region, limited access to financing for small-scale farmers, and heavy reliance on imported equipment. Nevertheless, initiatives taken by the governments in the region are further boosting local agriculture, which in turn has resulted in lucrative opportunities for feed mixing machine manufacturers in the region. The GCC market will hit USD 0.01 billion in 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Increasing Participation of Local Manufacturers to Spur Market Competition

The market is highly matured with the presence of prominent and emerging players. Supreme International Limited, NDEco (Hi-Tec Group Company), Trioliet, SILOKING Mayer Maschinenbau GmbH, Seko Industries Srl, Schuler Manufacturing (Vermeer Corporation), Grupo Tatoma, Faresin Industries Spa, RMH Lachish Industries Ltd, Groupe Anderson, KUHN NORTH AMERICA, INC., and Tetra Laval International S.A. are some prominent players in the global market, covering a significant market share.

These players are mainly focusing on enhancing their product penetration by leveraging cross-marketing and product line combination opportunities. Additionally, they are focusing on driving organic sales growth through the introduction of innovative and technologically advanced products. Moreover, major manufacturers are emphasizing on minimizing the fuel consumption of their machines, leading to a reduction in the operational costs of the dairy farmers and the generation of early returns on investments.

Furthermore, key players are also increasing their engineering efforts and research & development activities to develop smart products that communicate and allow for monitoring, diagnostics, and predictive maintenance.

Long List of Companies Studied (Including but not limited to):

- Alltech (Kennan) (U.S.)

- Bucher Industries AG (Kuhn Group) (Switzerland)

- BVL Maschinenfabrik GmbH & Co. KG (Germany)

- Deve Engg. Works (India)

- Faresin Industries S.p.A. (Italy)

- Groupe Anderson (Canada)

- Grupo Tatoma (Spain)

- Hi-Tech Industries Inc (Canada)

- JAYLOR INTERNATIONAL (Canada)

- Kruger GmbH & Co. KG (Peeters Group) (Germany)

- Lachish Industries Ltd (Israel)

- Lucas G (France)

- Pellon Group (Finland)

- Siloking Mayer Maschinenbau GmbH (Germany)

- Seko Industries S.r.l. (Italy)

- Sgariboldi S.r.l. (Italy)

- Supreme International Limited (Canada)

- Tetra Laval International S.A. (Switzerland)

- Trioliet B.V. (Netherlands)

- Vermeer Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

November 2023: SILOKING Mayer Maschinenbau GmbH, which is one of the specialist manufacturers of feeding technology, developed a SILOKING Feeding Management Software with some advanced features.

October 2023: FarmTech, an Australia-based agriculture product manufacturer, received an award for its latest mixer. The recognition will help the company scale new heights in the agriculture machinery & component sector.

August 2023: BvL Maschinenfabrik GmbH & Co. KG launched a new range of feeders at an event named Ploughing 2023. The new range of products will increase the product diversity of the company and help it increase its sales.

March 2023: DeLaval launched a feed distribution robot, which will complete its product portfolio of complete feeding solutions. The product will help increase automation standards in the feeding & animal husbandry sector.

October 2022: Trioliet unveiled its compact, self-propelled mixer named Triotrac M. The product is most suited for cramped yards due to its substantial agility and easy maneuverability.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product types, portability, capacity, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors listed above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Growth Rate |

CAGR of 4.4% from 2026 to 2034 |

|

|

Unit |

Value (USD Billion) |

|

| Segmentation | By Product Type, By Portability, By Capacity, By Application, and By Region | |

|

Segmentation |

By Product Type

By Portability

By Capacity

By Application

By Region

|

|

|

Companies Profiled in the Report |

Bucher Industries AG (Kuhn Group) (Switzerland), Trioliet B.V. (Netherlands), Tetra Laval International S.A. (Switzerland), Faresin Industries S.p.A. (Italy), JAYLOR INTERNATIONAL (Canada), Supreme International Limited (Canada), Hi-Tech Industries Inc. (Canada), Siloking Mayer Maschinenbau GmbH (Germany), Groupe Anderson (Canada), and Vermeer Corporation (U.S.) |

|

Frequently Asked Questions

The market is projected to reach USD 1.161 billion by 2034.

In 2026, the market was valued at USD 0.826 billion.

The market is projected to record a CAGR of 4.4% during the forecast period.

By portability, the self-propelled segment is leading the market.

Increasing demand for experiential learning platforms and access to remote locations across the globe are the key factors driving the market’s growth.

NDEco (Hi-Tec Group Company), Trioliet, SILOKING Mayer Maschinenbau GmbH, Seko Industries Srl, Schuler Manufacturing (Vermeer Corporation), Faresin Industries Spa, and Groupe Anderson are the top players in the market.

North America held the highest market share in 2024.

By application, the farms segment is expected to record the highest CAGR during the forecast period.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us