Flexible Packaging Market Size, Share & Industry Analysis, By Material (Plastic, Paper & Paperboard, and Aluminum), By Product Type (Pouches & Sachets, Bags, Films & Wraps, Tubes, Tapes & Labels, and Others), By End-use Industry (Food & Beverage, Pharmaceutical, Personal Care & Cosmetics, Homecare, Industrial, E-commerce, and Others), and Regional Forecast, 2026-2034

Flexible Packaging Market Size

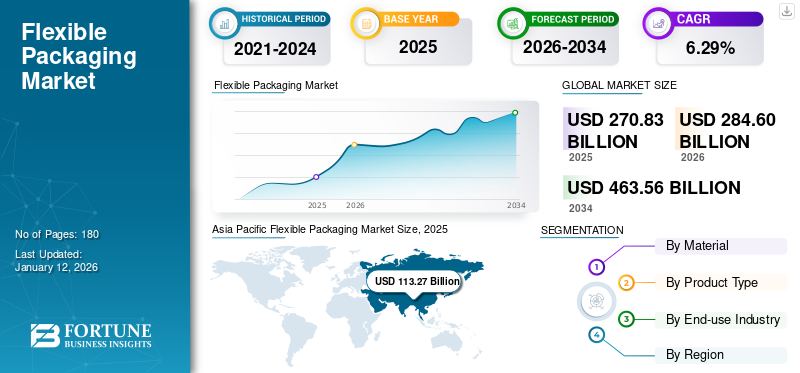

The global flexible packaging market size was valued at USD 270.83 billion in 2025 and is projected to grow from USD 284.6 billion in 2026 to USD 463.56 billion by 2034, exhibiting a CAGR of 6.29% during the forecast period. Asia Pacific dominated the flexible packaging market with a market share of 41.82% in 2025.

Flexible packaging is a type of packaging made from flexible materials that can easily be molded or shaped. This packaging solution includes bags, pouches, films, envelopes, and wraps. It is known for its versatility, cost-effectiveness, and efficiency in protecting products while reducing material usage and waste. It combines the best qualities of plastic, film, paper, and aluminum foil to deliver a broad range of protective properties while minimizing the weight of the package. This packaging format is extensively used across various industries, such as food and beverages, cosmetics, consumer goods, and pharmaceuticals. The food and beverage industry is the largest end-use segment for flexible packaging. It is widely used for packaging snacks, confectionery, dairy products, meat, beverages, and others.

During the peak of the COVID-19 pandemic, the demand for medical supplies and pharmaceutical products, such as masks, gowns, and protective equipment, surged. This led to increased demand for products, such as films, pouches, and bags, for safer delivery and protection of products. Increased demand for such packaging products thrived in the market growth during the pandemic.

GLOBAL FLEXIBLE PACKAGING MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 270.83 billion

- 2026 Market Size: USD 284.6 billion

- 2034 Forecast Market Size: USD 463.56 billion

- CAGR: 6.29% from 2026–2034

Market Share:

- Asia Pacific led the global flexible packaging market in 2025 with a share of 41.22%, driven by the region's expanding retail sector and increasing demand for packaged food. Asia Pacific witnessed a growth from USD 1113.27 billion in 2025 to USD 112.12 billion in 2026.

- By material, plastic dominated the market in 2024 due to its flexibility, durability, and customization properties.

- By product type, bags held the largest share in 2024, supported by rising demand for FIBCs and customizable formats across food, industrial, and agricultural applications.

- By end-use industry, the food & beverage segment held the largest share in 2024, driven by increasing demand for packaged food and extended product shelf life. The food & beverage segment is expected to hold a 33.03% share in 2024.

Key Country Highlights:

- China: A key driver of Asia Pacific’s dominance, China's booming food sector and packaging innovation continue to bolster market growth.

- India: Growth in e-commerce, rising disposable incomes, and government support for packaging manufacturing are fueling flexible packaging demand.

- United States: Strong demand from the food, pharmaceutical, and personal care sectors contributes to North America’s position as the second-largest market.

- Germany: Focus on sustainable packaging and increased use of flexible films in the consumer goods and healthcare sectors is boosting market adoption.

- Brazil: Rapid urbanization and consumer preference for convenience-based packaging formats are accelerating market expansion in Latin America.

Flexible Packaging Market Trends

Eco-friendly Solution and Widespread Use of Flexible Packaging Products will Propel Market Growth

Sustainability in flexible packaging is used to position the brand as ecological and attract an environmentally conscious group of customers. The momentum is building to gain a competitive advantage and a positive image for your brand by choosing a sustainable packaging solution.

Key drivers in eco-friendly packaging include reuse and recycling, the use of recycled and bio-based raw materials, and sustainability messages on the package and packaged product using rough paper boards, earth colors or green design, and similar environmental symbols. The increase in the number of sustainable alternatives is anticipated to increase the demand for packaging over the forecast period. Asia Pacific witnessed a flexible packaging market growth from USD 101.60 Billion in 2023 to USD 107.23 Billion in 2024.

Download Free sample to learn more about this report.

Flexible Packaging Market Growth Factors

Increasing Utilization in Food Industry Contributes to Market's Growth

Packaging of food products requires extra safety as they are more prone to damage and can lose their properties after coming in contact with air and moisture. Flexible packaging provides solutions to these problems as it is airtight and durable, protects the product from the outside elements, and maintains the quality and freshness of the food products, increasing the shelf life of products and reducing food waste.

The people’s preference toward portioned food and beverages is increasing, as it helps with better digestion, reduces binge eating, and lowers food wastage. According to the Frontiers in Nutrition organization, around 100 million tons of foods are wasted annually during the supply chain, leading to a huge impact on the environment.

The flexible packaging is easy to customize and has better printability, which differentiates the food and beverage products from the competitors and attracts customers due to its attractive visual appearance. The easy printability of the packaging helps the manufacturers to provide the details of the products, making it easier for the consumer to get the important details. These features enhance the demand for flexible packaging in the growing food & beverage industry.

Rising Initiatives for Development of Circular Flexible Packaging is Bolstering Growth of this Market

Flexible packaging is extremely efficient. It can package relatively large quantities of product at a low weight, minimizing carbon emissions while providing various benefits, including product protection, preservation, and quality assurance. According to the Flexible Packaging Initiative, flexible packaging accounts for around 44% of all post-consumer packaging waste in the EU.

Manufacturers and governments in many nations are taking initiatives to recycle packaging waste and reuse the material to make new products. One of these initiatives is taken by the 180 European associations, companies, and organizations representing the entire flexible packaging value chain, called CEFLEX (Circular Economy for Flexible Packaging). It aims to collect all flexible packaging, and over 80% of it recycled materials will be used to create valuable new markets, replace virgin materials, and make it all circular.

According to the U.S. government's Division of Energy Efficiency and Renewable Energy, the U.S. Department of Energy (DOE) has announced USD 13.4 million in funding for next-generation plastics technologies that reduce the carbon emissions and energy use of single-use plastics. The plastic films will be converted into valuable materials, and more biodegradable and recyclable plastic will be developed to meet the country's sustainability goals. Such initiatives will encourage the development of bioplastic as a sustainable material for flexible packaging and highlight flexible packaging as an economical replacement for rigid packaging.

RESTRAINING FACTORS

Growing Environmental Concerns & Stringent Regulations Hinder Market Growth

This packaging is known for its ability to mold to the shape of its contents, has gained widespread acceptance across diverse industries owing to its versatility and cost-efficiency. However, like any market segment, it confronts various constraints that hinder flexible packaging market growth.

One of the primary challenges facing the industry is its environmental impact. This type of packaging often consists of multiple layers of materials, such as plastics, laminates, and adhesives, which pose difficulties in terms of recyclability. This complexity makes it less environmentally sustainable compared to traditional materials such as glass or paper.

Furthermore, regulatory frameworks worldwide are increasingly emphasizing environmental sustainability and the management of packaging waste. Flexible packaging must adhere to stringent regulations concerning recyclability, food safety, and chemical composition. These regulations vary across different regions, creating substantial barriers to market entry and growth.

Flexible Packaging Market Segmentation Analysis

By Material Analysis

Flexibility and Barrier Properties of Plastic Has Made it a Dominating Segment in the Market

Based on material, the market is segmented into plastic, paper & paperboard, and aluminum.

The plastic segment dominated the global flexible packaging market in 2026, accounting for 46.82% of the total market share. It accounts for the largest market share and is expected to witness significant growth in the upcoming years. Plastic packaging is a very flexible and adaptable form of packaging, which allows manufacturers to customize its shape, size, and style as per their customers' requirements.

Paper & paperboard are the second-dominating material segment in the global market. The material is 100 percent recyclable and does not harm the environment, which, in turn, increases its demand for manufacturing flexible packaging products.

By Product Type Analysis

Properties Such as Ease of Handling and Adaptability of Bags Have Made them a Leading Market Segment

Based on product type, the market is segmented as pouches & sachets, bags, films & wraps, tubes, tapes & labels, and others.

The bags segment dominated the global market in 2026, accounting for 33.72% of the total market share. FIBC is a kind of flexible bag generally used for bulk cargo transportation. A flexible intermediate container can hold a variety of materials and product quantities and can also help prevent damage.

Films & wraps are the second-dominating product type segment. Films & wraps are increasingly used in the packaging of fruits, vegetables, and other food items to keep the product fresh. Moreover, the use of films and wraps to protect fragile and breakage-prone products further facilitated the growth of this segment.

By End-use Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Demand for Packaged Food and Extended Product Life are Increasing Demand for Flexible Packaging

Based on the end-use industry, the market is segmented as food & beverage, pharmaceutical, personal care & cosmetics, homecare, industrial, e-commerce, and others.

The food & beverages segment dominated the end-use industry in 2026, accounting for 33.57% of the total market share. The segment will experience noteworthy growth in the forecast period due to the rapidly growing food and beverage sector. The growing demand for packaged food and the requirement for extended product life are key factors driving this dominance. Moreover, the rising number of online food outlets, coupled with the door-to-door delivery system, is surging the demand for these packaging types, thus contributing to the growth of this segment.

Pharmaceuticals are the second-dominating segment. The rising demand for the packaging of over-the-counter drugs is majorly encouraging the segment's growth. The food and beverage segment is expected to hold a 33.03% share in 2024.

REGIONAL INSIGHTS

The market is analyzed across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Flexible Packaging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific was the dominant and fastest-growing region, with the market size valued at USD 113.27 billion in 2025 and increasing to USD 120.12 billion in 2026. The region is analyzed to witness exponential growth during the forecast period. The presence of major players in the region, along with the growing retail industries, is a key prime factor boosting the region's market growth. Major manufacturers in the region have started investing in enhancing their production processes to protect their product integrity and boost brand awareness, which, in turn, propels the market growth in Asia Pacific. The Japan market is projected to reach USD 19.49 billion by 2026, the China market is projected to reach USD 36.07 billion by 2026, and the India market is projected to reach USD 25.88 billion by 2026.

North America is the second-dominating region of the global flexible packaging market share. The U.S. has experienced a huge demand for these packaging solutions from the food & beverage, pharmaceutical, cosmetics, and consumer goods sectors, which, in turn, is boosting the market growth in the region. The US market is projected to reach USD 65.46 billion by 2026.

The growth of the personal care & cosmetics sectors and the increasing demand for sustainable packaging solutions are boosting the European market. The UK market is projected to reach USD 8.83 billion by 2026, while the Germany market is projected to reach USD 14.34 billion by 2026.

KEY INDUSTRY PLAYERS

Key Participants in the Market Witnessing Significant Growth Opportunities

The global market is highly fragmented and competitive. In terms of market share, the few major market players dominate the market by offering innovative packaging in the packaging industry. These major players in the market are constantly focusing on expanding their customer base across the regions and innovation.

Major players in the market include Amcor plc, Constantia Flexibles, Sonoco Products Company, Berry Global, Mondi, and others. Numerous other players operating in the industry are focused on delivering advanced packaging solutions.

List of Top Flexible Packaging Companies:

- Amcor Plc (Switzerland)

- Constantia Flexibles (Austria)

- Sonoco Product company (U.S.)

- Mondi (U.K.)

- Huhtamaki Oyj (Finland)

- Berry Global (U.S.)

- Sealed Air (U.S.)

- Graphic Packaging International (U.S.)

- Transcontinental Inc. (U.S.)

- UFlex Limited (India)

- SCG Packaging (Bangkok)

- ProAmpac (U.S.)

- Coveris Holdings (Austria)

- CCL Industries (Canada)

- American Packaging Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024 – Klöckner Pentaplast (kp), a significant food packaging industry company, declared the launch of the first food packaging trays comprising 100% recycled PET (rPET) deriving from trays. The newly launched kp tray is the first to be composed entirely of recycled tray material. This innovation is the major result of KP's Tray2Tray initiative, intending to rewrite the PET recycling rules. The president of food packaging at KP also stated that this achievement is a breakthrough in the packaging industry.

- April 2024 – Parkside announced the launch of Recoflex Paper for sustainable, flexible packaging solutions. The new range of versatile Recoflex Papers is accessible as a single-ply or laminate in numerous specifications. It offers durability, barrier performance, and excellent heat sealability, changing the game for paper-based flexible packaging in a number of market applications. With the launch, the company is stepping up its efforts to help solve the global packaging problem.

- March 2024 – INEOS announced the launch of an innovative and new, premium quality snack packaging comprising 50% recycled plastics. The packaging is made by recycling plastic waste into food-grade packaging material. It is done using an advanced recycling process, a complementary approach to mechanical recycling. It enables recycled materials to satisfy the demanding EU regulatory requirements for applications such as food contact packaging and contact-sensitive and medical devices.

- February 2024 – American Packaging Corporation, a leader in flexible packaging solutions, announced the launch of another RE Design for Recycle flexible packaging technology, especially for frozen food products such as frozen fruits and vegetables. The new technology joins a portfolio of packaging technologies in APC's RE sustainable packaging portfolio, comprising designs for compost, circular content, & renewable content and varied designs for recycling options. The flexible packaging structure is amenable to the Association of Plastic Recyclers' (APR) guidelines.

- April 2023 – Huhtamaki, a leading global packaging solutions company, introduced a sustainable, flexible packaging innovation with groundbreaking mono-material technology. The game-changing technology is essential to offering a unique combination of best-in-class protection, full recyclability, and affordability. The company provides mono-material flexible packaging in three solutions, such as paper, PE, and PP retort, which are fit for the most demanding applications.

REPORT COVERAGE

The market research report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, competitive landscape, product/service types, Porter’s five forces analysis, and leading end-use industries of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the above factors, it encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.29% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Product Type

|

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was USD 270.83 billion in 2025.

The global market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.29% during the forecast period.

The market size of Asia Pacific stood at USD 113.27 billion in 2025.

Based on the material, the glass segment dominates the global market share due to the prominent material used for beverage packages.

The global market size is expected to record a valuation of USD 463.56 billion by 2034.

The key market drivers are the increasing utilization of flexible packaging in the food industry, which contributes to the markets growth.

The top players in the market are Amcor plc, Constantia Flexibles, Sonoco Products Company, Berry Global, Mondi, and others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us