Food Subscription Market Size, Share & Industry Analysis, By Service Type (Meal-based Subscriptions, Pantry Subscriptions, and Snack and Beverage Subscriptions), By Serving Size (Single and Multiple), By Distribution Channel (Online and Offline), and Regional Forecast, 2026-2034

Food Subscription Market Size and Future Outlook

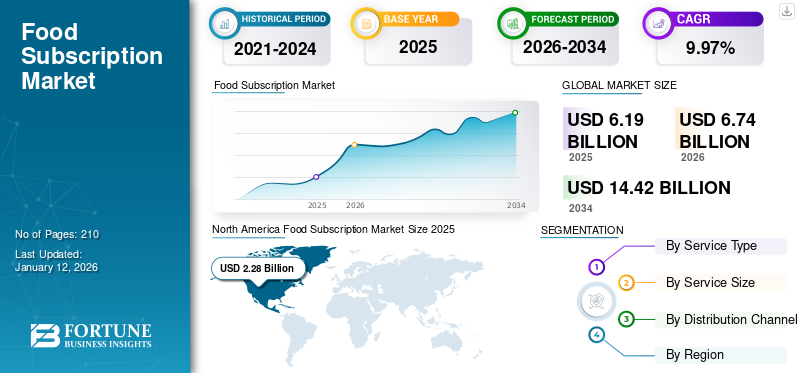

The global food subscription market size was valued at USD 6.19 billion in 2025 and is projected to grow from USD 6.74 billion in 2026 to USD 14.42 billion by 2032, exhibiting a CAGR of 9.97% during the forecast period. North America dominated the food subscription market with a market share of 34.04% in 2025.

A food subscription service is a business model that delivers pre-portioned, ready-to-cook, or ready-to-eat food items to customers on a regular basis, typically weekly or monthly. These services offer a range of menus, cuisines, and dietary options driven by changing consumer preferences, allowing subscribers to enjoy the convenience of having nutritious meals delivered directly to their doorsteps. Overall, food subscription services aim to enhance convenience, variety, and personalization in food consumption, addressing the needs of busy individuals and families looking for healthy meal solutions.

As companies adapt to these trends and expand their offerings, the market is set to evolve significantly over the coming years, making it an attractive space for both existing players and new entrants.

HelloFresh, Wonder Group, HomeChef, Sunbasket, and Marley Spoon are a few of the top players in the market.

Food Subscription Market Snapshot & Highlights

Market Size & Forecast

- 2025 Market Size: USD 6.19 billion

- 2026 Market Size: USD 6.74 billion

- 2034 Forecast Market Size: USD 14.42 billion

- CAGR: 9.97% from 2026–2034

Market Share

- North America dominated the food subscription market with a 34.04% share in 2026, supported by fast-paced lifestyles, strong e-commerce infrastructure, and increasing preference for convenience among millennials and Gen Z.

- By service type, meal-based subscriptions are expected to retain the largest market share in 2025, fueled by a growing preference for home-cooked meals, pre-portioned meal kits, and healthier eating habits among urban professionals and families.

Key Country Highlights

- United States: Rising number of working professionals and digital-native consumers is accelerating the adoption of personalized and time-saving meal kits, with growth bolstered by the well-developed e-commerce landscape.

- United Kingdom: Players like Gousto are expanding into regions such as Northern Ireland to tap into increasing demand for convenient home-cooking solutions, supporting regional growth.

- India: Urban millennials and middle-income consumers are driving significant demand for affordable meal kits, with growth fueled by rising disposable incomes and changing dietary preferences.

- Brazil: While still in early stages, the ready-meal subscription segment is gaining traction amid growing demand for affordable, high-quality meal solutions and recovery in consumer spending.

- UAE & Saudi Arabia: Economic growth and urbanization are driving demand for premium and gourmet food subscription services, with busy professionals and families opting for convenient and high-quality options.

Market Dynamics

Market Drivers

Rise of Working Professionals to Foster Market Growth

The increasing number of working individuals, particularly in urban areas, has created an increasing demand for convenient meal solutions that fit busy lifestyles. Food subscription services cater to this need by providing hassle-free meal options that require minimal preparation time. As urban populations continue to grow, the appeal of these services is expected to expand. According to the U.S. Bureau of Labor Statistics, in 2022, 169.8 million people worked at some point during 2022, up by 2.9 million from 2021.

Market Restraints

Logistics and Delivery Issues to Limit Market Growth

Efficient logistics management is crucial for food subscription services, as delays or errors in delivery can lead to customer dissatisfaction. Factors such as traffic congestion, poor infrastructure, and high demand during peak times can complicate delivery operations. Maintaining food quality during transport is also a critical concern, as meals must arrive fresh and ready to eat.

Market Opportunities

Growing Expansion into Emerging Markets to Ensure Success for Market in Foreseeable Future

Emerging markets, especially in regions such as South Africa, are experiencing rapid urbanization and a growing middle class. This demographic shift presents a significant opportunity for food subscription services to cater to busy professionals and families seeking convenient meal options. The food subscription market in emerging economies also presents significant growth opportunities through targeted acquisition strategies. For instance, in July 2021, UCook, a South African online meal kit delivery service, recently acquired Granadilla Eats, marking a significant development in the food subscription market within the region. This acquisition reflects broader opportunities in the meal kit delivery services market, particularly in emerging markets such as South Africa.

Market Challenges

Customer Churn and Construction and High Operational Costs to Pose Challenge for Market Growth

One of the most pressing issues for subscription-based food services is customer retention. Many subscribers may cancel their memberships after a short period due to dissatisfaction with food quality, limited menu options, or changes in personal preferences. This high churn rate necessitates continuous efforts in customer engagement and satisfaction to maintain a stable subscriber base. Furthermore, food subscription businesses often encounter substantial overhead costs associated with food procurement, storage, preparation, and delivery. These expenses can erode profit margins, especially for startups that may not yet have established a robust customer base. Companies must invest in technology infrastructure and logistics to manage subscriptions effectively, which adds to the financial burden.

Food Subscription Market Trends

Growing Trend Toward Offering Customization Options to Fuel Market Growth

The trend of meal kit companies providing enhanced customization options is significantly fueling global food subscription market growth. Many meal kit services now allow consumers to customize their meals by selecting specific ingredients, adjusting portion sizes, and choosing add-ons. This flexibility enables customers to create meals that suit their tastes and dietary restrictions. For example, companies such as Home Chef offer a variety of proteins, sides, and sauces, allowing users to tailor their meals according to personal preferences. This trend reflects a broader shift toward personalized dining experiences that cater to individual tastes and dietary requirements.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic significantly influenced various sectors, including the global food subscription market. During the pandemic, many consumers sought convenience as they faced lockdowns and social distancing measures. Food subscription services provided a practical solution by offering ready-to-cook meal kits and fully prepared meals. This shift in consumer preference led to a surge in demand for such services as people looked for ways to minimize grocery shopping trips and reduce exposure to the virus. Reports indicate that the market saw a substantial increase in subscriptions as consumers prioritized convenience and safety during this period. Blue Apron, a meal kit firm, experienced a sharp spike in consumer demand during the pandemic.

Segmentation Analysis

By Service Type

Increased Demand for Home-Cooked Meals to Drive Segment Growth for Meal-Based Subscriptions

On the basis of service type, the market has been divided into meal-based subscriptions, pantry subscriptions, and snack and beverage subscriptions.

The meal-based subscriptions segment dominated the global food subscription market share of 61.08% in 2026. There is a growing preference among consumers, particularly millennials and Gen Z, for home-cooked meals over dining out. Meal subscriptions offer convenient solutions that allow individuals to prepare meals at home without extensive planning or shopping, catering to this trend effectively. Meal kits simplify the cooking process by delivering pre-portioned ingredients and recipes directly to consumers. This convenience appeals to busy individuals who wish to save meal preparation time while still enjoying home-cooked food.

The snack and beverage subscriptions segment is expected to experience significant growth during the forecast period. The convenience of having snacks and beverages delivered directly to consumers' doors aligns with busy lifestyles. This ease of access is particularly appealing to individuals who may not have the time or inclination to shop for these items regularly. The popularity of snack boxes and unique beverage offerings has been amplified by social media platforms, where influencers showcase unboxing experiences and product reviews. This visibility drives interest and subscription sign-ups.

To know how our report can help streamline your business, Speak to Analyst

By Serving Size

Portion Control and Reduced Food Waste to Fuel Segment Growth for Single-Serving Segment

In terms of serving size, the market has been integrated into single and multiple segments.

The single-serving segment holds the major share of the global food subscription market and is estimated to reach 66.86% of share in 2026. Single-serving options cater to consumers seeking convenience, allowing them to enjoy meals without the commitment of larger quantities. This is particularly appealing for individuals living alone or those with busy lifestyles. These subscriptions help consumers manage portion sizes, making it easier to adhere to dietary goals. This is particularly appealing for health-conscious individuals who want to monitor their caloric intake. Moreover, single servings minimize food waste since consumers purchase only what they can eat in one sitting. This aligns with growing sustainability concerns, as many customers are increasingly aware of the environmental impact of food waste.

The multiple segment is expected to grow significantly in the forecast period (2025-2032) with a CAGR of 9.83%. With an increasing number of households comprising two working parents, there is a growing demand for meal solutions that accommodate family needs. Multiple serving sizes allow families to enjoy meals together without the hassle of extensive meal preparation, making it a convenient option for busy lifestyles. Purchasing multiple servings often proves to be more economical than buying single servings. Families and larger households can benefit from bulk purchasing, which typically reduces the cost per meal and enhances value for consumers.

By Distribution Channel

Convenience and Doorstep Delivery to Enlarge Online Segment Growth

In terms of distribution channels, the market has been integrated into online and offline segments.

The online segment is anticipated to capture the foremost share of the overall market share of 86.73% in 2026. The convenience of online shopping has led to a surge in demand for food subscription services, allowing consumers to receive fresh ingredients or prepared meals directly at their doorstep. Online food subscription services are diversifying their offerings, catering to various dietary preferences and lifestyles, such as vegan, keto, or organic options. The COVID-19 pandemic accelerated the shift toward online shopping, as many consumers became accustomed to the convenience of ordering food online rather than visiting grocery stores or restaurants. Various models are emerging within the market, including weekly meal kits, snack boxes, and gourmet food subscriptions, which cater to different consumer needs and preferences.

The offline segment is predicted to account for a significant share in the coming years and is expected to grow with a CAGR of 10.50% during the forecast period (2025-2032). Offline food subscription services often emphasize local sourcing and community involvement, which appeals to consumers interested in supporting local farmers and businesses. This trend fosters a sense of community and connection that online services may lack. The offline segment is expanding its product range, including meal kits, specialty foods, and ready-to-eat meals tailored to various dietary needs. This variety can attract a broader customer base.

Food Subscription Market Regional Outlook

North America

North America Food Subscription Market Size 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2024, North America attained a major share of 1.95% in the overall market with a valuation of USD 2.11 billion in 2025 and USD 2.28 billion in 2026. The fast-paced lifestyles of many consumers in countries such as the U.S. and Canada, particularly working professionals, contribute to the growing demand for convenient meal solutions. Food subscriptions provide an easy way to access meals without the need for extensive preparation, catering to those who prioritize time-saving options. Younger generations, especially millennials and generation Z, are driving the market as they show a preference for meal kits and subscription services that offer convenience and variety. The well-developed e-commerce infrastructure in the region enhances the accessibility of food subscription services. With the rise of smartphones and internet penetration, consumers are increasingly reliant on online platforms for their food needs, making subscription services more appealing.

Europe

Europe is the second leading region and is expected to grow significantly in the global market with a CAGR of 9.30% during the forecast period (2025-2032) and capture a share of USD 2.04 billion in 2026. Manufacturers are expanding their operations into new regions and countries within Europe. The U.K. market is set to be worth USD 0.56 billion in 2026. This involves entering markets with high growth potential, where demand for food subscription services is on the rise. For instance, in June 2024, Gousto, a prominent meal kit brand in the U.K., announced its expansion into Northern Ireland. By entering Northern Ireland, Gousto aims to tap into a new demographic that values the convenience of meal kits. Through these base expansion strategies, manufacturers in the European food subscription market aim to strengthen their market positions, enhance customer satisfaction, and ultimately drive growth in a rapidly evolving industry landscape. Germany is expected to reach USD 0.44 billion in 2026, while France is projected to be valued at USD 0.34 billion in the same year.

Asia Pacific

Asia Pacific is the third largest market, anticipated to hold a share of USD 1.35 billion in 2026. The expanding middle class in countries such as China and India is leading to increased disposable income, resulting in higher spending on food services. China is predicted to capture a share of USD 0.51 billion in 2026. As consumers seek diverse dining options, food subscription services are well-positioned to cater to this demand by offering a variety of meal choices that align with evolving tastes and preferences. Rapid urbanization has transformed lifestyles across the region, particularly among millennials and working professionals who often have limited time for meal preparation. Food subscription services provide a convenient solution for these consumers by offering ready-to-eat meals or meal kits that can be prepared quickly at home. India is set to be valued at USD 0.15 billion in 2026, while Japan is poised to reach a market value of USD 0.29 billion in the same year.

South America

South Amrica is the fourth largest market expected to hold the valuation of USD 0.65 billion in 2025. The ready-meal subscription segment in Brazil is still in its nascent stages compared to other regions. While there is a growing interest in convenience foods, the overall market remains small, limiting the scalability of many subscription services. Although economic challenges have influenced consumer spending habits, there is a resurgence in demand for convenient food options as consumers seek affordable yet quality meal solutions. This has led to a growing interest in ready-to-eat meals and subscription services that provide value.

Middle East & Africa

Rapid urbanization across the region is leading to increased demand for convenient food options. As more people move to urban areas, they often have less time for grocery shopping and meal preparation, making food subscriptions an attractive choice for busy professionals and families. Economic growth in several Middle Eastern countries has increased disposable incomes, allowing consumers to spend more on premium food products and services. This trend is particularly relevant for subscription models that provide high-quality ingredients or gourmet meal options. GCC market is anticipated to hit USD 0.05 billion in 2025.

Competitive Landscape

Key Market Players

Key Market Players Are Offering Products And Services Based On Consumer Preferences For Convenience And Quality

The competitive landscape of the global food subscription market is characterized by a mix of established players and emerging startups, reflecting a moderately consolidated environment. The preference for quick and easy meal solutions continues to rise, especially post-pandemic, driving growth in the food subscription sector. As the market continues to evolve, companies must adapt to changing consumer demands for convenience, healthiness, and sustainability to maintain their competitive edge. The moderate consolidation allows for both competition and innovation, benefiting consumers through diverse meal options and improved services.

Get comprehensive study about this report by, Download free sample copy

HelloFresh, Wonder Group, HomeChef, Sunbasket, and Marley Spoon are some of the major players in the market. HelloFresh remains the dominant player in the market, followed by Blue Apron LLC and Home Chef. The overall market is characterized by increasing competition, with companies continuously adapting to consumer preferences for convenience and quality. The presence of a few dominant players alongside numerous smaller companies indicates a moderately consolidated market. This structure allows for competition and innovation, particularly from niche providers focusing on specific dietary needs or local markets.

List of Key Companies Profiled

- Wonder Group (U.S.)

- HelloFresh (Germany)

- Sunbasket(U.S.)

- Marley Spoon (Germany)

- Freshly (U.S.)

- Purple Carrot (U.S.)

- Every Plate (U.S.)

- Gousto (U.K.)

- Dinnerly (U.S.)

- Chefs Plate (Canada)

Key Industry Developments

- October 2024 – HelloFresh celebrated the Thanksgiving season by introducing a unique offering for fans of the iconic TV show FRIENDS. The company launched Rachel Green’s Trifle Meal Kits, inspired by the memorable dessert that became a running gag in the series.

- April 2024 – HelloFresh launched a new Ready-to-Eat meal service in Sweden and Denmark, marking a significant expansion of its offerings in the Nordic region. This initiative is designed to cater to the growing demand for convenient meal solutions among consumers who seek quick and easy dining options without compromising on quality.

- December 2023 – Blue Apron expanded its Ready-to-Eat category by launching a new line of Prepared & Ready Meals aimed at providing customers with ultimate convenience. This move reflects the growing demand for easy meal solutions among consumers who prioritize quick and hassle-free dining options.

- October 2023 – Kroger launched a new meal subscription service called Tempo, which focuses on heat-and-eat meals. The launch of Tempo aligns with current trends in the meal delivery and subscription market, where convenience is increasingly prioritized. As more consumers seek ways to simplify their meal preparation while still enjoying quality food, Kroger's entry into this segment positions it well to capture a share of the growing demand for ready-to-eat solutions.

- May 2023: Home Chef launched a new meal kit plan specifically designed for families. The plan aims to provide convenient and nutritious meal solutions that cater to the needs of busy households. The new meal kits focus on recipes that appeal to both adults and children, ensuring that all family members can enjoy the meals together. This includes a variety of options to suit different tastes and dietary preferences.

Report Coverage

The global food subscription market report analyzes the market in-depth and highlights crucial aspects such as prominent companies, the food subscription market regional, the food subscription market segmentation, competitive landscape, product types, distribution channels, and application usage areas. Besides this, it provides insights into the global food subscription market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.97% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service Type

By Serving Size

By Distribution Channel

|

|

By Region North America (By Service Type, Serving Size, Distribution Channel, and Country) · U.S. (By Service Type) · Canada (By Service Type) · Mexico (By Service Type) Europe (By Service Type, Serving Size, Distribution Channel, and Country) · Germany (By Service Type) · U.K. (By Service Type) · France (By Service Type) · Italy (By Service Type) · Spain (By Service Type) · Rest of Europe (By Service Type) Asia Pacific (By Service Type, Serving Size, Distribution Channel, and Country) · China (By Service Type) · India (By Service Type) · Japan (By Service Type) · Australia (By Service Type) · Rest of Asia Pacific (By Service Type) South America (By Service Type, Serving Size, Distribution Channel, and Country) · Brazil (By Service Type) · Argentina (By Service Type) · Rest of South America (By Service Type) Middle East & Africa (By Service Type, Serving Size, Distribution Channel, and Country) · UAE (By Service Type) · South Africa (By Service Type) · Rest of the Middle East & Africa (By Service Type) |

Frequently Asked Questions

Fortune Business Insights says that the worldwide market size was valued at USD 6.19 billion in 2025 and is anticipated to record a valuation of USD 14.42 billion by 2034.

Fortune Business Insights says that the global market value stood at USD 6.19 billion in 2025.

The global market is projected to grow at a significant CAGR of 9.97% during the forecast period.

By service type, the meal-based subscriptions segment is predicted to dominate the market during the forecast period.

Increasing consumer preference for healthy and nutritious food is likely to drive the demand in the market.

HelloFresh, Wonder Group, HomeChef, Sunbasket, Marley Spoon, and others are some of the leading players globally.

North America dominated the global market in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us