Food Vacuum Machine Market Size, Share & Industry Analysis, By Product Type (Chamber Vacuum Machine, External Vacuum Machine, Tray Sealing Machine, and Handheld Vacuum Sealers, and Others), By Packaging Type (Flexible, Rigid Packaging, and Semi-Rigid Packaging), By End User (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

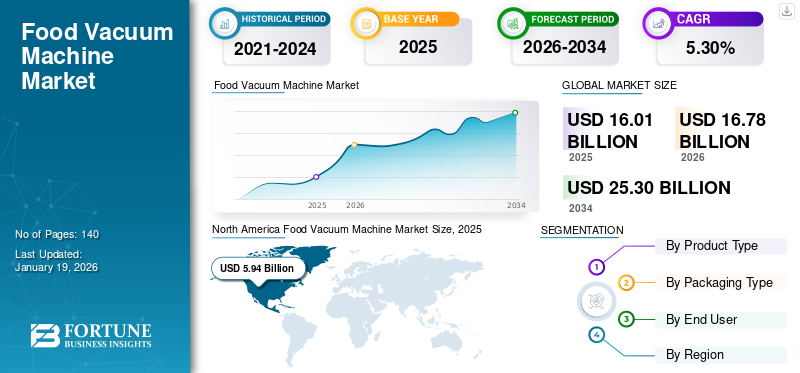

The global food vacuum machine market size was valued at USD 16.01 billion in 2025 and is projected to grow from USD 16.78 billion in 2026 to USD 25.30 billion by 2034, exhibiting a CAGR of 5.30% during the forecast period. North America dominated the global market with a share of 37.10% in 2025.

Food vacuum machines are recognized as a tool for food protection, expanding the shelf life and quality of the food products. The market is experiencing continuous development, as homes and commercial food sectors are adopting more and more advanced packaging solutions.

The market is growing rapidly due to an increase in consumer preference for convenient and stable food options, as well as rising concerns about reducing food waste. Urbanization and lifestyle changes are driving demand for packaged food, which is boosting the adoption of vacuum sealing solutions.

A few prominent players operating in the market are MULTIVAC Group, ULMA Packaging, S. Coop., Sealed Air Corporation, Syntegon Technology GmbH, I.M.A., Industria Macchine Automatiche S.p.A., and others.

MARKET DYNAMICS

Market Drivers

Rising Demand for Packaged & Processed Foods Drives the Market Development

The growing demand for packaged and processed foods is driving the global food vacuum machine market growth. The market is experiencing a period of rapid growth and change, which is inspired by heavy global demand for packaged and processed foods. This market is directly associated with changes in modern consumer lifestyles, which makes vacuum sealing techniques an important component in the food supply chain. Rising global consumption of ready-to-eat, meat, shellfish, and dairy products is driving strong demand for vacuum packaging solutions. This growing demand is contributing to revenue growth across industries.

For example, a major driver for the global market is the rise of packaged food, which was valued at over USD 2 billion in 2021 and is expected to grow continuously. This trend is particularly evident in the Asia Pacific region, where a rapidly growing food market, which costs more than USD 1 billion, and an increase in disposable income are promoting the adoption of vacuum sealing techniques in the domestic and commercial environments.

Market Restraints

High Initial Costs and Operational Barriers Hampers the Market Growth

The high initial costs and operational barriers act as significant restriction factors for the market. Many advanced vacuum systems require adequate initial investment, making them less accessible to food processors, retailers, and domestic users. In addition, installation, maintenance, and special training costs can discourage users from adopting these machines, especially in developing economies. Operating challenges include a continuous energy supply, the requirement of compatibility with various packaging materials, and ensuring that hygiene standards are met.

Market Opportunities

Sustainability & Eco-Friendly Packaging Offers Lucrative Growth Opportunities

The market is witnessing major opportunities driven by the shift towards sustainable and eco-friendly packaging. It is an important driver, as demand for long-term solutions is encouraging manufacturers to design equipment compatible with the new generation of materials.

Increasing customers' demand for sustainable solutions is inspiring vacuum machine producers to create goods suitable for recycled, biodegradable, and thin-film materials, therefore supporting food businesses in improving their ESG performance by cutting plastic consumption.

For instance, IMA Group, a leader in packaging machinery, is focusing on solutions that allow the use of recyclable and biodegradable laminates. Similarly, Greendot Biopak is making compostable vacuum films from plant-based materials. These developments allow food companies to reduce the use of plastic and improve their ESG position (environmental, social and governance).

FOOD VACUUM MACHINE MARKET TRENDS

Automation and Smart Packaging Integration Has Emerged as a Prominent Market Trend

A dominant trend is the deep integration of automation and intelligent packaging technologies. As the food industry faces increasing pressure to improve operational efficiency and food safety, manufacturers are adopting automated vacuum packaging. This is particularly evident in the totally automatic segment, which is expected to account for a significant amount of revenue in the flexible packaging machines market by 2025.

In addition, the market is witnessing the integration of smart packaging solutions, such as those with RFID labels and sensors. These innovative products enhance traditional monitoring and safety by providing real-time data on freshness, temperature, and traceability. For example, in May 2025, Paulig, a coffee brand announced the launch of recyclable coffee package, which showcases a combination of advanced technology and stability.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product Type

Growth of Chamber Vacuum Machines Due to Its Application in Industrial-Scale Operations

Based on the product type, the market is segmented into chamber vacuum machine, external vacuum machine, tray sealing machine, handheld vacuum sealers, and others.

In 2026, the chamber vacuum machine segment held the largest food vacuum machine market share 33.37% with a valuation of USD 5.14 billion. The chamber vacuum machine is responsible for the ability of industrial-scale, regulatory compliance and its ability to maintain unmatched shelf-life performance, which makes it the backbone of commercial food packaging operations.

The handheld vacuum sealers segment is expected to grow with the highest CAGR with a growth rate of 6.3% over the forecast period. This growth is due to consumer lifestyle trends, such as convenience and stability, as well as the compatibility of these sealers with e-commerce platforms and the increasing adoption by small businesses.

By Packaging Type

Dominance of Flexible Packaging Leads to Increased Segment Growth

The market is divided into flexible, rigid packaging, and semi-rigid packaging.

In 2026, the flexible packaging segment had the highest market share 64.42% with a revenue of 9.9 billion USD. It is due to its better barrier properties, light structure, and cost-effectiveness, which make it suitable for a wide range of food categories such as meat, seafood, and dairy. Flexible packaging is also the most widely adopted format in both industrial and retail applications.

The rigid packaging segment is expected to grow over the forecast period with the highest CAGR of 6.6%. Rigid packaging is estimated to have the highest growth rate due to the increasing demand for premium food products, case-ready meat, and high-value proteins, requiring increased safety, durability, and premium presentation.

By End User

To know how our report can help streamline your business, Speak to Analyst

Extensive Application in the Food Industry Propels the Industrial Segment to Lead

Based on the end user, the market is segmented into residential, commercial, and industrial. Commercial is further sub-segmented into retail stores and supermarkets, HoReCa, QSRs, food service providers, and others. Industrial end-user is sub-segmented into food, beverages, and others.

In 2026, the industrial end-user held the highest market share 57.27% with a revenue of USD 8.86 billion. The dominance is due to the increasing use of vacuum technology in the food industry, which is used to preserve food by increasing its shelf life. Additionally large-scale food processors, meat packers, seafood exporters and high-capacity dairy plants require such machines, further supporting market growth.

The commercial segment is expected to witness the highest CAGR of 6.3% during the forecast period. This growth is inspired by the rapid expansion of restaurants, hotels and cloud kitchens globally, and the increasing consumption of packaged food, which is driving a strong growth in this segment.

FOOD VACUUM MACHINE MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America, and Middle East & Africa.

North America

North America Food Vacuum Machine Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The market in North America is a significant segment,dominated the market with a valuation of USD 5.94 billion in 2025 and USD 6.24 billion in 2026. driven by the high consumer awareness and a strong retail food network. In 2026, the U.S. is expected to have a substantial market share with an estimated valuation of USD 4.76 billion. The growth of the U.S. market is driven by a strong culture of preservation of widespread adoption of advanced kitchen appliances.

A major driver is the growing demand for fresh and organic food products and organic food sales. The United States Food and Drug Administration (FDA) controls food packaging material and ensures that human health is not in danger, which in turn affects the design and use of food vacuum machines. For example, the FDA requires any packaging material that enters direct contact with food to be approved and proven for safety.

Europe

The European market is growing and is expected to reach USD 3.32 billion in 2025. This is attributed to a strong approach to stability and environmental rules. The legal structure of the European Union for food packaging, such as regulation (CE) number 1935/2004, ensures that the material does not endanger human health or replace the food structure. The U.K., Germany, and Italy are some of the key contributors to market growth, with projected revenues of USD 0.55 billion, USD 0.84 billion, and USD 0.35 billion by 2026, respectively.

Asia Pacific

The Asia Pacific region is a major contributor to the food vacuum machines market, with an expected income of USD 5.35 billion in 2025. It is also predicted that the area during the forecast period will expand with the highest CAGR. China and India are expected to contribute to the income of USD 2.28 billion and 0.75 billion, respectively, in 2026. There is an E-C expansion in food. The region facilitates easy access to a wide range of products, thus improving entry into the market.

South America and Middle East & Africa

The markets of the South America and Middle East and Africa are experiencing development in 2025, respectively, with the expected participation of USD 1.59 billion and USD 0.48 billion, respectively. It is predicted that by 2025, in GCC countries, will have a market share of USD 0.22 billion. This expansion is inspired by urbanization and the development of food processing and packaging infrastructure.

COMPETITIVE LANDSCAPE

Key Industry Players

Growing Focus of Key Players on Innovation and New Product Launches Lead to their Dominating Market Positions

The global food vacuum machine market is highly fragmented, with several key players actively competing across regions. Prominent companies include MULTIVAC Group, ULMA Packaging S. Coop., Sealed Air Corporation (Cryovac) Syntegon Technology GmbH, and I.M.A. Industria Macchine Automatiche S.p.A. These players will adopt a variety of strategic initiatives such as new product launches, mergers and acquisitions, technological advancements, and investments in automation to strengthen their market presence and maintain competitiveness in the global landscape.

LIST OF KEY FOOD VACUUM MACHINE COMPANIES PROFILED

- MULTIVAC Group (Germany)

- ULMA Packaging, S. Coop. (Spain)

- Sealed Air Corporation (Cryovac) (U.S.)

- Syntegon Technology GmbH (Germany)

- M.A. Industria Macchine Automatiche S.p.A (Italy)

- ORVED S.r.l. (Italy)

- Allpack (China)

- Shandong Kangbeite Packaging Machinery CO., LTD. (China)

- Supervac (Austria)

- Hawo Verarbeitungsmaschinen GmbH (Germany)

- Webomatic (Germany)

- Boss Vakuum (Germany)

KEY INDUSTRY DEVELOPMENTS

- August 2025- Paxiom Group introduced the PKR-Dual Delta Robot, a pick-and-place case-packing cell specifically designed for pouches. This launch outlines market focus on automation and operational efficiency, enabling high-speed packing, which is required for rapidly growing e-commerce and retail sectors.

- July 2025- Zzleepandgo S.R.L., a major provider of smart sleeping pods, announced new establishments at several European airports. This growth mirrors a larger trend in catering to contemporary tourists, therefore emphasizing the increasing demand for it. Among them, suitably wrapped food helps the market indirectly.

- June 2025- A global packaging solutions leader, Multivac, participated with a major food retailer to increase its packaging operation. This partnership has made a significant improvement in operational efficiency of their processes, highlighting the importance of strategic partnership and technological innovation in driving market growth.

- May 2025- Piplife, an international piping system company, launched Stormbox E and Stormbox II E Attenuation and Sokwee Crates made completely from Polypropylene.

- April 2025- Toppan Packaging Service Company Limited, a subsidiary of Toppan Holdings Inc., in collaboration with India's Toppan Speciality Films Private Limited (TSF), unveiled GL-SP, an advanced barrier film based on Biaxially Oriented Polypropylene (BOPP). While mainly a film product, this barrier technology has direct applications in the market, especially for moisture and gas conservation in food and drug packaging.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, product types, packaging types and end users of the product. Besides this, it offers insights into the food vacuum machine market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Growth Rate |

CAGR of 5.30% from 2026-2034 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type · Chamber Vacuum Machine · External Vacuum Machine · Tray Sealing Machine · Handheld Vacuum Sealers · Others |

|

By Packaging Type · Flexible · Rigid Packaging · Semi-rigid Packaging |

|

|

By End User · Residential · Commercial o Retail Stores and Supermarkets o HoReCa o QSRs and Food Service Providers o Others · Industrial o Food o Beverages o Others (Specialty, etc.) |

|

|

By Region · North America (By Product Type, Packaging Type, End User and Country/Sub-region) o U.S. (By Packaging Type) o Canada (By Packaging Type) o Mexico (By Packaging Type) · Europe (By Product Type, Packaging Type, End User and Country/Sub-region) o U.K. (By Packaging Type) o Germany (By Packaging Type) o France (By Packaging Type) o Italy (By Packaging Type) o Spain (By Packaging Type) o BENELUX (By Packaging Type) o Nordics (By Packaging Type) o Russia (By Packaging Type) o Rest of Europe · Asia Pacific (By Product Type, Packaging Type, End User and Country/Sub-region) o China (By Packaging Type) o Japan (By Packaging Type) o India (By Packaging Type) o South Korea (By Packaging Type) o ASEAN (By Packaging Type) o Oceania (By Packaging Type) o Rest of Asia Pacific o South America (By Product Type, Packaging Type, End User and Country/Sub-region) o Argentina (By Packaging Type) o Brazil (By Packaging Type) o Rest of South America · Middle East & Africa (By Product Type, Packaging Type, End User and Country/Sub-region) o GCC (By Packaging Type) o South Africa (By Packaging Type) o Rest of the Middle East & Africa |

Frequently Asked Questions

The global food vacuum machine market size was valued at USD 16.01 billion in 2025 and is projected to grow from USD 16.78 billion in 2026 to USD 25.30 billion by 2034, exhibiting a CAGR of 5.30% during the forecast period.

The market is expected to exhibit steady growth at a CAGR of 5.30% during the forecast period.

Rising demand for packaged & processed foods drives the market growth.

MULTIVAC Group, ULMA Packaging, S. Coop., Sealed Air Corporation, Syntegon Technology GmbH, I.M.A, and Industria Macchine Automatiche S.p.A are the top players in the market.

The North America region held the largest market share.

North America was valued at USD 5.94 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us