Gas Hydrates Market Size, Share & Industry Analysis, By Type (Onshore Gas Hydrates and Offshore/Marine Gas Hydrates), By Origin (Seabed and Permafrost), and Country Forecast, 2026-2034

Gas Hydrates Market Overview

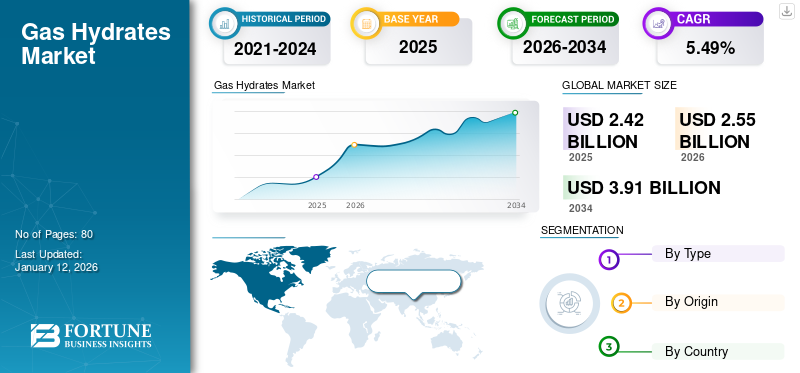

The global gas hydrates market size was valued at USD 2.42 billion in 2025 and is projected to grow from USD 2.55 billion in 2026 and reach USD 3.91 billion by 2034, exhibiting a CAGR of 5.49% during the forecast period. China dominated the gas hydrates market with a market share of 68.39% in 2024.

Gas hydrates are crystalline solids composed of water and gas. It looks and acts similar to ice but contains huge amounts of methane. It is known to occur on all continents and is found as a several hundred meters thick layer in huge quantities in marine sediments just below the seabed and with permafrost in the arctic region.

Moreover, gas hydrate deposits are found wherever methane occurs in the presence of water at high pressures and relatively low temperatures, such as under permafrost or in shallow sediments at the edges of continental deep seas. Hydrated methane can be a key product that includes both biogenic, produced as a result of biological activity in sediments, and thermogenic, produced as a result of geological processes occurring deeper in the earth.

The global gas hydrates industry is being reshaped by ongoing advancements in subsea exploration technologies and increased R&D investments by both the government and private entities. The growing emphasis on sustainable offshore drilling, combined with advances in carbon sequestration and methane recovery methods, is expected to accelerate commercialization and grow the long-term gas hydrates market size in both developed and emerging regions.

GLOBAL GAS HYDRATES MARKET OVERVIEW

Market Size:

- 2025 Maket Size: USD 2.42 billion

- 2026 Market Size: USD 2.55 billion

- 2034 Forecast Market Size: USD 3.91 billion, with a CAGR of 5.49% (2026–2034)

Market Share:

- Regional Leader: China held a 68.39% share in 2024, driven by large-scale offshore gas hydrate production tests in the South China Sea and continued government-backed exploration programs.

- Fastest-Growing Country: United States market driven by extensive R&D projects led by the U.S. Geological Survey (USGS) and the Department of Energy (DOE) focused on methane recovery and clean energy transition.

- Dominant Resource Type: Offshore/Marine Gas Hydrates dominate due to vast reserves along continental margins and advancements in subsea extraction technologies.

Industry Trends:

- Technological Advancement: Growth in thermal stimulation, depressurization, and CO₂-injection techniques is enhancing extraction efficiency and cost optimization.

- Sustainability & Carbon Capture: Integration of CCS (Carbon Capture and Storage) technologies with methane recovery projects to ensure environmentally responsible production.

- AI & Data Integration: Use of digital twin modeling, AI-driven reservoir simulations, and real-time monitoring improves exploration precision and safety.

- Public-Private Collaboration: Strategic partnerships between national energy agencies, research bodies, and private operators are expediting commercialization trials.

Driving Factors:

- Rising Clean Energy Demand: Increasing global need for low-carbon and sustainable energy sources is propelling investment in methane hydrate exploration.

- Government Support & R&D Investment: Strong national programs in China, Japan, the U.S., and India to develop large-scale hydrate extraction facilities.

- Depleting Fossil Fuel Reserves: Growing emphasis on alternative energy diversification amid global fossil fuel decline.

- Offshore Resource Potential: Expanding subsea drilling capacity is unlocking high-yield hydrate reservoirs across deep-sea continental slopes.

The global impact of the COVID-19 pandemic on the market was moderate. A great economic shock was felt throughout this period and continued until the end of the year and even during the next year, but the extent of the damage is still uncertain, as is the speed and scale of recovery.

Owing to the global lockdowns that resulted from the pandemic, gas consumption and production plummeted, and the prices reached a new record low. As the pandemic started to spread in Europe, gas production went below the 2015- 2019 range, reflecting the decreasing trend of gas production in Europe.

Gas Hydrates Market Trends

Development of Advanced Extraction Technologies for the Product is Surging Market Growth

The development of innovative extraction techniques for the product is an important trend in the market. Ongoing research and technology development aims to improve the efficiency and cost-effectiveness of gas hydrate extraction, including methods such as decompression, thermal stimulation, and CO2 injection. These advances are critical to realizing the commercial potential of gas hydrate reserves.

Furthermore, environmental sustainability is the main trend in the market. As concerns about climate change and greenhouse gases increase, there is an increasing emphasis on environmentally sustainable practices in gas hydrate exploration and production. In line with this trend, the goal is to minimize methane emissions from mining, promote carbon capture and storage (CCS) technologies, and implement ecological production processes.

The growing collaborations between global energy agencies and private sector players are facilitating the exchange of advanced technologies, thereby accelerating large-scale testing and deployment of hydrate recovery systems. Strategic public-private partnerships are also expected to improve data integration, operational safety, and economic viability, thereby increasing the long-term potential of the gas hydrates market.

Download Free sample to learn more about this report.

Gas Hydrates Market Growth Factors

Increasing Government Support for Gas Hydrate Projects to Drive the Market Growth

The gas hydrate project will analyze solid, liquid, and gas samples to determine their chemical composition, stable carbon isotopes, and radiocarbon ages. Fluid samples include seawater containing dissolved compounds or gases and pore water extracted from sediments near gas flows or gas hydrate deposits. T

he USGS Gas Hydrates Project has contributed to the understanding of the U.S. and international gas hydrate science for at least three decades. The USGS Gas Hydrate Research Group is one of the largest in the U.S. The USGS Gas Hydrates Project focuses on the study of natural gas hydrates in deep-sea systems and permafrost. As part of the ongoing Alaska North Slope study, DOE, in collaboration with the Japan Metals and Energy Safety Organization (JOGMEC); Ministry of Economy, Trade and Industry; U.S. Geological Survey; and Arctic Slope Regional Corporation Energy Services (AES), conducts scientific production trials of gas hydrate-rich sands.

Testing is being done under a drilling agreement between AES and Hilcorp Alaska on behalf of the Prudhoe Bay Working Interest Owners and approved by the Alaska Department of Natural Resources. The purpose of this test is to monitor the long-term behaviour of production, assess potential environmental impacts, and develop concepts for efficient gas hydrate well design. The Alaska site offers a unique opportunity to conduct experiments over several months, as the established infrastructure allows continuous access to the site.

Rising global energy demand and the depletion of traditional fossil fuel reserves have made gas hydrates a promising alternative in future energy systems. The diversification of national energy portfolios through hydrate resource exploration is expected to open up new investment opportunities and support sustainable energy transitions in the global gas hydrates market.

Rising Demand for Clean and Renewable Energy to Fuel the Market Growth

Gas hydrates are part of the global carbon cycle. Methane is the third most common greenhouse gas in the atmosphere after water. Clean energy is one of the most important global needs to meet global energy source demand. Natural gas hydrates (NGH) are one proposed way to release methane as clean energy and sequester carbon dioxide.

As a new alternative energy source, gas hydrate has attracted widespread attention worldwide. Because gas hydrate is always associated with free gas, evaluation of the gas hydrate and free gas system is an important consideration in hydrate reservoir research and development.

Furthermore, gas hydrate is considered one of the most potential new clean energies to replace coal, oil, and gas in the 21st century, and it is also a new energy with abundant reserves that have not yet been fully exploited. Because natural gas hydrate is a type of clean energy with great potential and positive impact on the greenhouse effect and marine ecosystem, the U.S., Canada, Japan, South Korea, and India are dedicated to its research and development, bolstering the gas hydrate market growth.

In addition, advances in gas hydrate modeling, data analytics, and real-time reservoir monitoring improve exploration accuracy and operational safety. The combination of digital twin technologies and AI-driven geophysical simulations is predicted to increase production efficiency and resource management, propelling progress in the worldwide gas hydrates market report.

RESTRAINING FACTORS

High Production Costs and Complex Processing Techniques May Hamper the Market Growth

Gas hydrate extraction faces several challenges. The complex process of producing gas from hydrate-bearing sediments involves a combination of thermal, hydraulic, chemical, and mechanical factors, making it different from traditional fossil resource extraction. Avoiding the formation of hydrates during production is crucial because removing hydrate plugs is difficult and expensive.

However, current solutions for hydrate formation in natural gas pipelines are not sustainable, and sustainable solutions and new technologies must be explored. The development of natural products also requires addressing key issues such as diagenesis, rock structural stability, particle size, and mode of cementation. In addition, the description and quantification of hydrate abundance and the creation of dynamic factors must be improved. Another challenge is methane leakage, especially in oceanic gas hydrate reservoirs with low permeability and permeable boundary layers.

Despite the progress, there are still challenges in basic theoretical research, production methods, and equipment and operation methods. In general, gas hydrate extraction requires addressing these challenges to achieve long-term commercial exploitation.

Furthermore, limited field-scale demonstration projects and uncertain economic feasibility continue to limit the global gas hydrates market expansion. The absence of standardized regulatory frameworks, combined with high environmental risk concerns, complicates project financing and private investment. Addressing these barriers is critical to unlocking the gas hydrates industry's commercial potential and achieving long-term growth in the global gas hydrates market.

Gas Hydrates Market Segmentation Analysis

By Type Analysis

Offshore/Marine Gas Hydrates Hold a Dominant Share Due to the Growing Development and Production for Future Energy Source

Based on type, the global gas hydrates market is segmented into onshore gas hydrates and offshore/marine gas hydrates.

Offshore/ marine gas hydrates holds majority of market share 72.62% in 2026 and considered to be the fastest growing segment for global gas hydrate market. Large amounts of natural gas are stored in marine gas hydrates that are deposited at the edges of continents. Marine gas hydrates are considered a new energy and are characterized by high energy density, huge amounts of resources, and purification. It is important for resource development, environmental protection, and global climate change. This large marine gas hydrate reservoir is still considered an important part of the global carbon cycle and a future source of energy.

Onshore gas hydrates is expected to grow during the forecast period as gas hydrates occur naturally on land in some permafrost regions and in sediments on or under the seabed, where water and gas combine at low temperatures and high pressures to form an icy solid. Methane, an important component of natural gas, is usually the dominant gas in the hydrated structure.

The offshore segment's dominance is reinforced by increased government-led exploration programs and advances in subsea drilling technologies. Strategic initiatives in China, Japan, and India are bolstering the gas hydrates industry through large-scale production tests and feasibility studies, which are expected to shape the long-term trajectory of the global gas hydrates market.

To know how our report can help streamline your business, Speak to Analyst

By Origin Analysis

Permafrost holds the Dominant Market Share Due to Larger Occurrences of Natural Gas Hydrates

Based on origin, the global market is segmented into seabed and permafrost.

Permafrost is dominating the gas hydrate market contributing 69.09% globally in 2026 and is considered to be the fastest growing segment among others as gas hydrates are widespread in the sediments of continental ocean margins and permafrost places where ocean and atmospheric warming can disrupt the hydrate stability field and lead to the release of bound methane into surface sediments and soils.

The seabed is expected to dominate the methane hydrate extraction market. Most of the world's methane hydrate occurs on the continental slopes of the sea, where enough organic matter accumulates at the bottom. This provides an opportunity for governments and companies to explore and scale up methane capture widely. Many countries are taking active steps to remove methane hydrate from the seabed.

Ongoing research into permafrost hydrate behavior under climate change conditions is yielding new insights into methane fluxes and storage stability. These developments are expected to improve global gas hydrates market analysis and support policy frameworks that promote safe extraction, carbon management, and ecosystem preservation—all of which are critical priorities in shaping the evolution of the modern gas hydrates industry.

Regional Insights

The market has been studied geographically across four main countries: China, the U.S., Japan, and others, with other countries including Germany, Canada, and South Korea. The U.S. gas hydrates market is projected to grow significantly, reaching an estimated value of USD 392.81 billion by 2026, and is further expected to reach USD 0.54 billion by 2032, supported by long-term research initiatives led by the USGS Gas Hydrate Project, which has contributed to advancements in gas hydrate science for over three decades.

Based on country, China dominates the gas hydrates market due to the increase in gas hydrate production trials, with the China market projected to reach USD 1.76 billion by 2026. Over the past years, the country has been preparing for the third round of offshore gas hydrate production tests and has completed seismic and environmental surveys in targeted waters of the South China Sea, along with geological design activities for new gas hydrate wells.

Japan represents a key market for gas hydrates, with the Japan market projected to reach USD 0.31 billion by 2026. In January 2024, a long-term onshore methane hydrate production trial began in Prudhoe Bay on Alaska’s North Slope on behalf of the Japan Metals and Energy Security Organization (JOGMEC), supported by Toyo Engineering Corporation. This initiative is part of Japan’s broader strategy to advance methane hydrate technology, including a planned five-year pilot project scheduled to begin in fiscal year 2027–2028 under the current government framework.

Furthermore, emerging economies such as India and South Korea are expanding the global gas hydrates market footprint through government-backed exploration initiatives, technological collaborations, and environmental monitoring programs. This increasing regional diversification in exploration and investment is expected to support overall market expansion and create new strategic opportunities in the global gas hydrates industry.

Key Industry Players

Several Players are Launching Pilot Projects to Gain a Competitive Edge

The global gas hydrates market is highly fragmented, with large and medium-sized country players supplying a wide range of products across the value chain at local and national levels. Many companies are actively implementing pilot projects for the production of the product. These players focus on strategic partnerships, new product launches, and commercialization to expand in the market. Moreover, these players invest heavily in research projects that enable them to launch innovative products and gain maximum revenue in the market.

The strategic alliances between national research agencies and private exploration firms are reshaping the competitive landscape of the gas hydrates sector. Companies are prioritizing environmentally responsible extraction practices, digital monitoring systems, and advanced simulation models to increase yield efficiency. This collaborative shift represents a shift toward data-driven innovation and sustainability in the evolving global gas hydrates market analysis.

List of Top Gas Hydrates Companies:

- Petro China Company Limited (China)

- Japan Petroleum Exploration Company Limited (Japan)

- Oil and Natural Gas Corporation (India)

- Gail Limited (India)

- Chevron Corporation (U.S.)

- Japan Drilling Co., Ltd. (Japan)

- Schlumberger Limited (U.S.)

- ConocoPhillips (U.S.)

- Korea Gas Corporation (KOGAS) (South Korea)

- ExxonMobil Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024- A scientific drilling mission in the Gulf of Mexico returned 44 cores from a methane hydrate reservoir deep beneath the ocean floor. Globally, energy-rich methane hydrates contain about 15% of the world's organic carbon but are poorly understood by the scientific community. The successful mission, led by The University of Texas at Austin, will now allow universities and scientific institutions around the country to study the methane hydrates.

- October 2023- As part of an international partnership, the National Energy Technology Laboratory (NETL) of the U.S. Department of Energy (DOE) announced that it is investigating the gas hydrate resource potential of the Prudhoe Bay Unit on Alaska's North Slope.

- January 2023- China unveiled that it is ready to spud a third gas hydrate well in the South China Sea. More exploration and evaluation activities are needed before commercial development in 2030.

- December 2022- An expedition funded by the National Energy Engineering Laboratory of the U.S. Department of Energy (DOE) and the Japan Organization for Metals and Energy Security (JOGMEC) drilled more than 600 meters (2,000 feet) of permafrost to remove hydrate-bearing sediments from deep below the tundra surface.

- March 2021- Offshore oil rig manufacturer Modec announced its plans to develop a system designed to extract methane hydrate, also known as fire ice, from the ocean floor and turn it into a source of clean-burning hydrogen. Modec will pilot the technology during the next fiscal year starting April. The technology will be used in a novel floating unit that will retrieve the methane hydrate. The technology is used in a new floating unit that produces methane hydrate.

REPORT COVERAGE

The report provides a detailed value chain analysis of the market and focuses on key aspects such as competitive landscape and gas hydrates market share by type and by origin. Besides this, it offers insights into the market trends and highlights key industry developments and key players. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.49% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By Origin, and By Country |

|

Segmentation |

By Type

|

|

By Origin

|

|

|

By Country

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 2.42 billion in 2025.

The market is likely to grow at a CAGR of 5.49% over the forecast period.

The offshore/marine gas hydrates segment leads the market due to the ongoing pilot projects in different countries.

The market size of China stood at USD 1.58 billion in 2024.

The rising demand for clean and renewable energy is set to spur the market growth.

Some of the top players in the market are Japan Petroleum Exploration Company Limited, Oil and Natural Gas Corporation, Gail Limited, and ConocoPhillips.

The global market size is expected to reach USD 3.91 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us