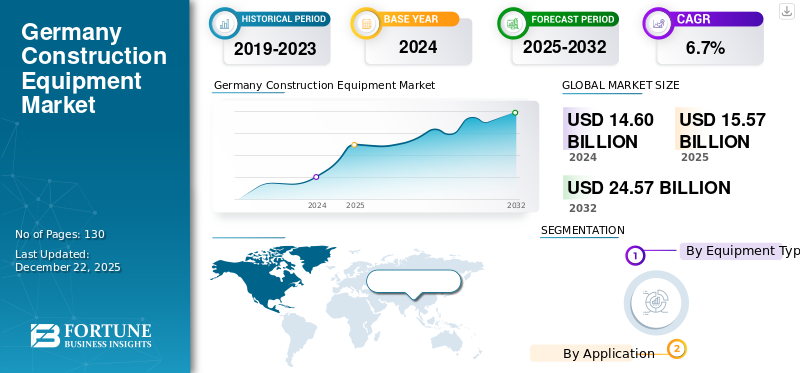

Germany Construction Equipment Market Size, Share & Analysis, By Equipment Type (Earthmoving Equipment, Material Handling Equipment & Cranes, Concrete Equipment, Road Building Equipment, Civil Engineering Equipment, Crushing And Screening Equipment, and Other Equipment), By Application (Residential, Commercial, and Industrial), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

The Germany construction equipment market size was worth USD 14.60 billion in 2024 and is projected to grow from USD 15.57 billion in 2025 to USD 24.57 billion by 2032, exhibiting a CAGR of 6.7% during the forecast period.

Increased investment in infrastructure, growing urbanization and housing demand, upgradation and maintenance of port infrastructures, supported by regulatory policies is set to meet the market demand for construction equipment. Although, the market witnessed slow growth in 2024, owing to several factors such as increased competition and unprecedented geopolitical scenarios. However, the market is expected to gain its momentum in the coming years, owing to government-backed incenti=ve programs that are boosting the unit sales of technology-integrated and energy-efficient equipment in the country.

- For instance, in May 2025, LEAG Holding's Solar PV Park, a 1 GW solar energy project, is about to begin its operation in 2026.

Download Free sample to learn more about this report.

Renewable energy plants witnessed significant investment in 2023, with more than 70% year-on-year growth in comparison to 2022. Construction of solar plants, onshore and offshore wind power plants, to increase the volume sales of earthmoving and other construction equipment market share.

Germany Construction Equipment Market Trends

Compact Machinery with Integrated Technology is Gaining Significant Market Traction

Demand for smart equipment is rising across the country as a result of sustainability targets, stringent emissions policies, and an incentivized structure for battery-operated construction equipment. Growing urban density and increasing residential and road construction are driving the market demand for compact machines with telematics integration. Furthermore, predictive maintenance tools and fleet management systems provided by construction equipment manufacturers are also accelerating the construction equipment market growth.

- For instance, in April 2024, Schwing Group, in partnership with Tranckunit, to provide IoT solutions for its truck-mounted concrete pumps.

Download Free sample to learn more about this report.

Year-over-Year growth of residential units in the country to drive the market demand for construction machinery, including concrete mixers, wheeled loaders, etc. The stock of dwellings rose by 5.7% in 2020 in comparison to 2010.

Key takeaways

- In the type segmentation, earthmoving equipment accounted for more than 57% of the market in 2024.

- In the application segment, the industrial sector is projected to grow at a CAGR of 7.3% in the forecast period.

Germany Construction Equipment Market Growth Factors

Investment in Renewable Energy and Infrastructure Development to Drive the Market Demand

Expansion of existing public infrastructure, investment in transit solutions such as highway networks, and increasing renewable energy projects to significantly bolster the Germany construction equipment market growth . Projects such as Fehmarn Belt link, Autobahn A1, A7, A100 Upgrades, Cuxhaven Offshore Terminal Expansion, Stuttgart 21 Railway Overhaul, etc., are all aimed at boosting the market growth for construction sites preparation, tunneling, and material handling machines.

- For instance, in November 2024, DEME, a marine engineering firm has obtained the expansion project for the Cuxhaven Port of Germany.

Germany Construction Equipment Market Restraints

Limited Skilled Workforce and Slow Economic Growth Might Pose a Challenge to Market Growth

Germany’s market demand for construction equipment might pose a challenge in coming years owing to volatile political scenarios, unprecedented trade tariffs, and sourcing challenges. Limited skilled workforce further hinders the overall productivity and adoption of new machinery and equipment across the country.

Germany Construction Equipment Market Segmentation Analysis

By Equipment Type

Based on equipment type, the market is divided into earthmoving equipment, material handling equipment & cranes, concrete equipment, road building equipment, civil engineering equipment, crushing and screening equipment, and other equipment.

Expansion of manufacturing facilities, renewable energy megaprojects, investment in transit infrastructure, and urban redevelopment projects are significantly driving the market demand for earthmoving equipment owing to its wide array of applications. Earthmoving equipment dominates the market as a result of site preparation, excavation, highway construction, energy, and utility projects.

- For instance, the government has proposed the target to expand its offshore wind power capacity to 70GW by 2045.

Expansion of logistics and industrial facilities, ports, and offshore logistics facilities are significantly expected to drive the growth of material handling equipment segment, including forklifts, reach trucks, cranes, etc. European players in the market are collaborating with rental companies to expand their product offerings across the country.

By Application

Based on the application, the market is categorized into residential, commercial, and industrial.

Residential application to dominate Germany construction equipment market share due to growing demand for houses and apartments, high demand for affordable housing, and government-funded residential projects.

- For instance, according to the Federal Ministry for Housing, Urban Development, and Building Germany, the funding for the construction of new and existing rental apartments rose by 51% in 2024 in comparison to 2022.

The industrial sector is expected to witness the highest growth rate during the forecast period, owing to investments in energy and renewable projects, and rising demand for warehouses driven by e-commerce.

List of Key Companies in the German Construction Equipment Market

Wirtgen Group, John Deere, and Liebherr are a few of the top players, making the German market moderately fragmented in nature. They are introducing technology-integrated equipment, establishing brand presence, a strong dealer and distributor network, and a collaboration strategy to drive the growth of the construction equipment market.

- For instance, Develon in May 2024 introduced its excavator models, such as DX100W-7 and DX27Z-7, for the gardening and landscaping sectors.

LIST OF KEY COMPANIES PROFILED

- Volvo Construction Equipment (Sweden)

- Wirtgen Group (Germany)

- JCB (U.K.)

- Komatsu (Japan)

- Liebherr Group(Switzerland)

- Kion Group AG (Germany)

- Wacker Neuson (Germany)

- Jungheinrich AG (Germany)

- CNH Industrial (U.K.)

- Caterpillar (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Liebherr Group unveiled its RE 25 M railroad excavator machine at the 29th International Exhibition for Track Technology (IAF) in Germany.

- April 2025: Caterpillar Inc. showcased over 48 machines that included demolition, waste handling, and recycling product portfolios at the BAUMA trade exhibition held in Munich, Germany.

REPORT COVERAGE

The Germany construction equipment market report provides a detailed analysis of the market. It focuses on market dynamics and key industry developments, such as mergers and acquisitions. Additionally, it includes information about the growth in earthmoving equipment, concrete and material handling equipment, and applications. Besides this, the report also offers insights into the latest industry trends and the impact of various factors on the demand for construction equipment.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.7% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type · Earthmoving Equipment · Material Handling Equipment and Cranes · Concrete Equipment · Road Building Equipment · Civil Engineering Equipment · Crushing and Screening Equipment · Other Equipment |

|

By Application · Residential · Commercial · Industrial |

Frequently Asked Questions

Fortune Business Insights says that the U.S. market was worth USD 14.60 billion in 2024.

The market is expected to exhibit a CAGR of 6.7% during the forecast period.

By equipment type, the earthmoving equipment segment is set to lead the market.

Wirtgen Group, John Deere, and Liebherr are the leading players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us