Green Methanol Ships Market Size, Share & Industry Analysis, By Ship Type (Cruise Ships, Container Vessels, Bulk Carrier, Tankers, Cargo Ships, Tugs, and Others), By Fuel Type (Single Fuel and Dual Fuel), By Sales Channel (Line Fit and Retro Fit), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

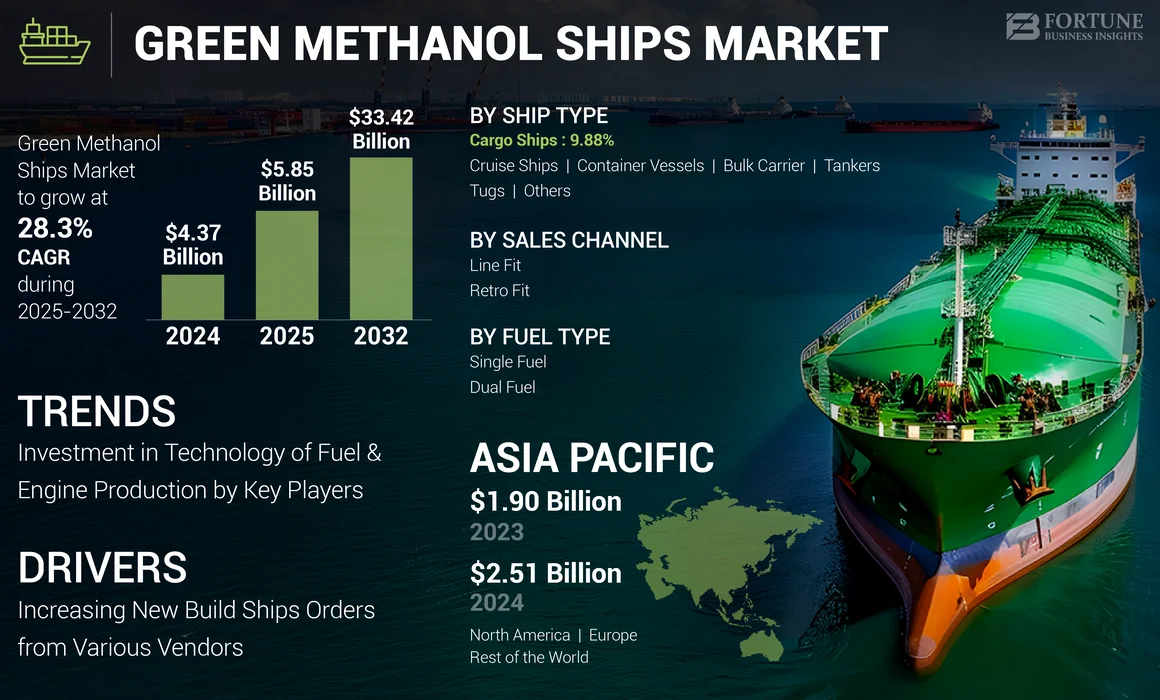

The global green methanol ships market size was valued at USD 4.37 billion in 2024. The market is projected to grow from USD 5.85 billion in 2025 to USD 33.42 billion by 2032, exhibiting a CAGR of 28.3% from 2025 to 2032. Asia Pacific dominated the green methanol ships market with a market share of 57.44% in 2024.

Methanol is a transparent liquid that can serve as a fuel for engines. When produced from low-carbon materials such as hydrogen or biomass, it is referred to as green methanol. In comparison to traditional fuels such as gasoline or diesel, green methanol has the potential to reduce CO2 emissions by 60-95%, according to the Methanol Institute. Additionally, it contains less sulfur, which helps lower emissions of sulfur oxides that lead to air pollution and acid rain.

The market is highly consolidated due to the adoption of green methanol technology being very less among the shipbuilding industry and the shipping industry. A few major key players are adopting the green methanol technology such as HD Hyundai Heavy Industries, Samsung Heavy Industries.

The growth of green methanol as a substitute for fossil fuels is especially appealing to the maritime sector since it remains liquid at ambient temperatures, making it more economical to store and transport compared to gaseous fuels, and it boasts the smallest carbon footprint among all liquid fuels. Furthermore, it can be utilized in both internal combustion engines and fuel cells, offering adaptability based on specific requirements.

Green Methanol Ships Market Overview & Key Metrics

Market Size & Forecast

- 2024 Market Size: USD 4.37 billion

- 2025 Market Size: USD 5.85 billion

- 2032 Forecast Market Size: USD 33.42 billion

- CAGR: 28.3% from 2025–2032

Market Share

- Asia Pacific dominated the green methanol ships market with a 57.44% share in 2024, supported by its robust shipbuilding sector, significant investments in sustainable maritime technologies, and national initiatives for decarbonizing shipping. Major shipbuilding hubs like China, South Korea, and Japan are driving adoption through dual-fuel and methanol-powered vessels.

- By ship type, the container vessels segment led the market in 2024, driven by the rapid transition of global fleet operators like Maersk and Evergreen toward methanol-fueled long-haul container ships. The dual fuel segment also held the largest share by fuel type, owing to its operational flexibility and ability to comply with evolving environmental regulations.

Key Regional Insights

- Asia Pacific: Largest and fastest-growing market; fueled by government-backed decarbonization programs, rapid adoption of dual-fuel technologies, and strategic investments in methanol bunkering infrastructure by major ports like Shanghai and Busan.

- Europe: Strong growth due to EU ETS regulations, sustainability goals, and leading adoption of green fuels by European shipping companies such as Maersk, MSC, and CMA CGM.

- North America: Growing demand supported by renewable methanol production projects and port infrastructure development in the U.S. and Canada; key ports like Houston and Vancouver are expanding methanol bunkering facilities.

- Rest of the World: Emerging opportunities in the Middle East, Africa, and Latin America; driven by renewable energy initiatives and investments in green maritime corridors and port infrastructure.

Market Dynamics

Market Drivers

Increasing New Build Ship Orders from Various Vendors, Accelerating Market Growth

The increasing orders for new build ships from various vendors are significantly accelerating the green methanol vessels market, driven by regulatory pressures, environmental goals, and technological advancements. IMO decarburization goals and regional regulations such as the EU ETS are driving shipping companies to adopt low-emission fuels such as green methanol.

Companies such as Maersk, Evergreen, and COSCO are investing heavily in green methanol ships to align with their sustainability goals and reduce their carbon footprints. For instance, in July 2023, Evergreen has ordered 24 methanol-fueled containerships at a cost of nearly USD 5 billion, split between Samsung Heavy Industries (16 ships) and Nihon Shipyard Co. (8 ships). Each ship has a capacity of 16,000 TEU, with deliveries expected to start in 2026. This move aligns with Evergreen's strategy to comply with emerging EU ETS regulations and environmental requirements for European ports

In addition, the surge in new build orders demonstrates a shift toward modernizing fleets with sustainable technologies to meet future emissions standards. There is an increasing appetite from ship-owners for methanol-fueled vessels as they seek solutions that align with both regulatory requirements and their global sustainability goals. This sentiment is reflected in the growing number of orders and investments in new builds.

Market Restraints

High Production Costs of Green Methanol Significantly Affect Market Growth and Adoption

Green methanol production costs per ton are much higher compared to fossil methanol. The price gap makes green methanol less competitive, especially in industries where cost efficiency is critical, such as shipping and manufacturing. Due to the higher costs of renewable feedstocks (e.g., biomass, captured CO₂) and advanced technologies, green methanol carries a premium over conventional methanol. This pricing limits its adoption in cost-sensitive markets such as bunker fuels.

Establishing infrastructure for green methanol production, storage, and bunkering requires substantial investment. The underdeveloped infrastructure compared to fossil fuels slows down scalability and market expansion. Renewable feedstocks such as biomass or CO₂ capture require specialized processes and equipment, increasing operational costs.

Green methanol production relies on technologies such as electrolysis for renewable hydrogen and carbon capture systems. These technologies are expensive and require significant upfront investment, which acts as a barrier for smaller market players. In addition, green methanol faces competition from biofuels, hydrogen, and LNG, which often have established supply chains and lower costs. This competition diverts investments away from green methanol can hamper the market growth.

Market Opportunities

Growing Partnerships, Investments Between Governments, Ports, and Major Entities to Adopt Sustainable Maritime Industry Create Lucrative Opportunities

Governments, shipping companies, ports, and technology providers are forming long-term partnerships to establish sustainable maritime practices. The Green Coastal Shipping Program in Norway involves key stakeholders across the value chain, including ship-owners, cargo owners, ports, and fuel suppliers, to develop infrastructure and adopt green technologies collectively. These partnerships ensure that infrastructure (e.g., bunkering facilities) and market demand for green fuels such as methanol grow simultaneously.

The global green methanol ships market growth is accelerating as the key players invest in methanol manufacturing facilities to increase the manufacturing capacity of green methanol to achieve carbon neutrality by 2050. For instance, in 2023, The Maritime and Port Authority of Singapore (MPA) along with Enterprise Singapore (EnterprisesSG), via the Singapore Standards Council (SSC), released a new Technical Reference (TR) 129 concerning Methanol Bunkering to establish a detailed framework for the safe and effective utilization of methanol as an alternative fuel in bunkering operations.

Furthermore, in September 2024, OCI Global, a prominent global manufacturer and supplier of hydrogen products, announced a deal to buy back the 11% and 4% shares in its Global Methanol Business from Alpha Dhabi Holding PJSC and ADQ, respectively. This comes after the prior announcement of the sale of OCI Methanol to Methanex Corporation.

Market Challenges

Several Significant Challenges Hinder Its Widespread Adoption and Sustainable Growth

Limited Green Methanol Supply and Feedstock Constraints: The production of green methanol depends on renewable energy and sustainable feedstocks, such as biomass and captured CO₂, which are currently limited in availability. The lack of biological feedstock, affordable renewable energy, and electrolytes for methanol synthesis is causing delays in project timelines and diminishing trust among ship-owners and operators. Numerous green methanol initiatives, particularly in key production areas such as China, have encountered technological challenges in production, resulting in missed deadlines and disruptions in the supply chain.

High Production and Fuel Costs: Green methanol is considerably more costly than traditional marine fuels and even other alternative options, primarily due to the elevated expenses associated with renewable energy, feedstock, and production technology. The difference in price, known as the "green premium," represents an obstacle to widespread acceptance, particularly in a cost-sensitive sector such as shipping.

Vessel Retrofitting and Technical Challenges: Modifying existing vessels to utilize methanol is a technically challenging and expensive process, involving the installation of new storage tanks, pipelines, and fuel-handling systems designed to accommodate methanol’s specific characteristics. The increased flammability of methanol and its distinct combustion traits demand rigorous safety precautions and engineering adjustments, which elevate both retrofit expenses and operational hazards.

The market for green methanol ships contends with a complex set of challenges, including supply limitations, elevated costs, insufficient infrastructure, technical and retrofitting obstacles, issues related to energy density, regulatory unpredictability, and reliability within the supply chain.

Green Methanol Ships Market Trends

Growing Investments in Technology of Fuel & Engine Production by Key Players and Private and Government Port Organizations

Green methanol is increasingly produced via renewable hydrogen (from water electrolysis) combined with captured CO₂. For example, the EU-funded HyMethShip project achieves a 97% CO₂ reduction by using onboard carbon capture and integrating renewable hydrogen into methanol synthesis. The green methanol fuel production landscape for the maritime industry is undergoing rapid transformation, driven by technological innovation and regulatory pressures.

Moreover, companies such as Wärtsilä and MAN Energy Solutions have developed methanol-compatible engines that reduce NOx emissions by >80% and eliminate SOx. In addition, over 100 ports worldwide, including Rotterdam and Singapore, now offer methanol bunkering.

For instance, in March 2025, Wah Kwong, a shipowner based in Hong Kong, established a strategic partnership with CIMC ENRIC, a provider of clean energy equipment and services. The two companies signed an agreement to collaborate on renewable fuel projects and explore joint investment opportunities. Their focus will be specifically on green methanol bunkering applications, logistics, and bunkering services.

The development of dual-fuel engines capable of operating on both conventional fuels and green methanol allows for greater flexibility and smoother transitions for shipping companies. Innovations such as battery power systems and shore power connections are being integrated into new builds to enhance efficiency and reduce environmental impact.

- Asia Pacific witnessed green methanol ships market growth from USD 1.90 Billion in 2023 to USD 2.51 Billion in 2024.

For instance, in March 2025, AAL Shipping, a shipping firm based in Singapore, named its fifth Super B-class vessel, which is capable of using methanol as fuel, after the maritime center of the Middle East. The AAL Dubai, a multipurpose heavy lift vessel with a deadweight tonnage of 32,000, was launched at the CSSC Huangpu-Wenchong Shipyard located in Guangzhou, China.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Ship Type

Increased Demand for Cleaner Long-Haul Shipping Solutions Boosted Container Vessels Segment Growth

The market is classified by ship type into cruise ships, container vessels, bulk carrier, tankers, cargo ships, tugs, and others.

Container vessels are estimated to be the fastest-growing segment during the forecast period of 2025-2032 and accounted for the largest market share in 2024. The adoption of green methanol as a sustainable fuel for container vessels is driving significant growth in the maritime industry. The segment dominance is attributed to their high fuel consumption and demand for cleaner long-haul shipping solutions. Major shipping companies such as Maersk aim to achieve carbon neutrality by 2050, with all new container vessels equipped with dual-fuel engines capable of running on green methanol.

For instance, in January 2024, A.P. Moller-Maersk A/S’s latest vessel powered by methanol is set to depart from South Korea as the shipping industry leader aims to lower emissions in one of the most environmentally damaging sectors globally. The Copenhagen-based company introduced the 350-meter-long container ship named Ane Maersk at the shipyard of Korean shipbuilder HD Hyundai Heavy Industries Co. It is scheduled to be operational by February and is recognized as the world’s first large container ship being powered by green methanol for long-distance ocean travel.

The cargo ships segment accounted for the second-largest share in 2024. The adoption of green methanol as a sustainable fuel for cargo ships is driving significant growth in the maritime industry. Green methanol-powered cargo ships are set to play a pivotal role in achieving decarburization goals within the maritime industry. With increasing investments from shipping companies, advancements in fuel technologies, and expanding bunkering infrastructure, cargo vessels will remain central to the growth of the market.

- The cargo ships segment is expected to hold a 9.88% share in 2024.

For instance, in June 2024, Mitsubishi Shipbuilding Co., Ltd. has secured contracts from Toyofuji Shipping Co., Ltd. (located in Aichi Prefecture) and Fukuju Shipping Co., Ltd. (based in Shizuoka Prefecture) for the construction of Japan's inaugural methanol-fueled roll-on/roll-off (RORO) cargo vessels. The two vessels are set to be constructed at the Enoura Plant of MHI's Shimonoseki Shipyard & Machinery Works in Yamaguchi Prefecture, with an expected completion and delivery date by the conclusion of fiscal 2027.

To know how our report can help streamline your business, Speak to Analyst

By Fuel Type

Dual Fuel Segment Led the Market Due to Its Operational Flexibility

The market is segregated by fuel type into single fuel and dual fuel.

The dual fuel segment accounted for the largest market share in 2024, and it is estimated to be the fastest-growing segment during the forecast period of 2025-2032. The segment is driving significant growth in the shipping industry due to its operational flexibility, alignment with global decarburization goals, and ability to run on both methanol and conventional fuels. In addition, it can meet short-term regulatory body requirements while allowing for the gradual adoption of cleaner fuels.

For instance, in May 2024, Singapore-based independent common carrier X-Press Feeders received its inaugural green methanol-powered containership, constructed by the Chinese shipbuilder Yangzijiang Shipbuilding Group. The delivery of the 1,260 TEU boxship occurred on May 16, 2024. This vessel is equipped with a dual-fuel engine capable of operating on green methanol, leading the way for Europe’s first feeder network utilizing green methanol.

The single fuel segment is set to register significant growth during the forecast period. The shift toward green methanol as the sole fuel choice in the shipping sector is being embraced due to its ecological advantages and support for worldwide decarburization initiatives. Vessels utilizing a single fuel are anticipated to become a major category, especially among newly constructed ships designed solely for propulsion with green methanol. Single-fuel systems are preferred for their straightforwardness and complete commitment to sustainable practices. Advances in research focused on propulsion systems that run exclusively on green methanol are enhancing the efficiency and dependability of single-fuel vessels.

By Sales Channel

Line Fit Segment Led the Market Due to Its Long-term Operational and Environmental Benefits

The market is divided by sales channel into line fit and retro fit.

The line fit segment accounted for the largest market share in 2024, and it is estimated to be the fastest-growing segment during the forecast period of 2025-2032. This growth reflects strong demand for purpose-built green methanol ships designed to meet environmental regulations and operational needs. In addition, advancements in dual-fuel and single-fuel engine technologies allow for seamless integration of green methanol propulsion systems during ship construction. Moreover, line-fit vessels represent the future of sustainable shipping, offering long-term operational and environmental benefits and anticipating the segmental growth.

For instance, in January 2025, Norwegian shipping firm Höegh Autoliners finished one-third of its multi-fuel Aurora-class pure car and truck carrier (PCTC). Similar to its sister vessels, Höegh Sunlight measures 200 meters in length and can transport 9,100 vehicles. These ships will also be the first in the PCTC sector to achieve DNV’s ammonia-ready and methanol-ready notations.

The retro fit segment is set to register considerable growth during the forecast period. The retrofit segment offers a pathway for existing fleets to transition to more sustainable operations. As technology advances and costs decrease, retrofitting is likely to become an increasingly viable option for ship-owners looking to comply with emissions regulations and meet sustainability goals to catalyze the market growth.

Green Methanol Ships Market Regional Outlook

The market is classified by region into North America, Europe, Asia Pacific, and the Rest of the World.

Asia Pacific

Asia Pacific Green Methanol Ships Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the largest green methanol ships market share in 2024 and is estimated to be the fastest-growing during the forecast period. The market is poised for significant growth in the Asia Pacific region, driven by regulatory support, technological advancements, and increasing investments in sustainable maritime solutions. The region is anticipated to account for the largest share of the market due to its robust shipbuilding industry and commitment to decarburization. Moreover, national initiatives in countries such as China, Japan, and South Korea are aligning with these international standards, facilitating the transition to sustainable maritime fuels. Asia Pacific houses some of the world’s largest shipbuilding nations, including China and South Korea, which are investing heavily in dual-fuel and methanol-powered vessels, aiding the market growth.

Europe

The European market is positioned for robust growth, driven by stringent regulatory frameworks, corporate sustainability commitments, and significant investments in renewable energy infrastructure. The inclusion of maritime transport in the EU ETS by 2024 creates a financial incentive for shipping companies to adopt low-carbon fuels such as green methanol. These initiatives prioritize renewable energy adoption, with green methanol emerging as a key component for decarbonizing maritime operations. For instance, from 2022, major European shipping companies such as Maersk, MSC, CMA CGM, and Hapag-Lloyd have ordered over 200 methanol-powered vessels to meet net-zero targets by 2050.

North America

North America is poised for substantial growth, driven by investments in renewable energy and advancements in methanol production technologies. Emerging producers such as SunGas Renewables, Carbon Sink, and WasteFuel are ramping up production capacity to meet rising demand from the shipping sector. Major ports across North America, including Houston and Vancouver, are expanding bunkering facilities for methanol storage and refueling, ensuring operational feasibility for green methanol-powered ships. For instance, in September 2023, OCI Global, recognized as the largest producer of green methanol worldwide, revealed its intention to increase its production capacity to around 400,000 metric tons annually due to the rising demand for green methanol in various high-emission sectors such as road transport, shipping, and industry. The plans for expansion involve entering into agreements for the supply of renewable natural gas (RNG) that will exceed 15,000 mmbtu per day, as well as obtaining waste and development rights from the City of Beaumont, Texas, U.S.

Rest of the World

The rest of the World includes the Middle East & Africa, and Latin America. The Middle East & Africa region has seen notable growth. The emerging countries, such as Saudi Arabia, Turkey, Egypt, Israel, and so on, are heavily investing in green energy to fuel the shipping industry, new port technologies, and so on, to meet the decarbonization goals. Latin America is emerging as a promising region for the adoption of green methanol-powered ships, driven by its abundant renewable energy resources, supportive environmental policies, and increasing investments in sustainable shipping infrastructure.

Competitive Landscape

Key Market Players

Key Participants Are Concentrating On Incorporating Cutting-Edge Technologies to Establish a Solid Presence

The competitive landscape of the green methanol ships market is characterized by rapid growth driven by regulatory pressures, technological advancements, and a shift toward sustainable maritime fuels. The competitive landscape features several prominent players in green methanol ships actively engaged in the development and manufacturing of green methanol ships. These companies are focusing on innovation through acquisitions, mergers, collaborations, and new product launches to strengthen their market positions. Major shipping companies are playing pivotal roles in advancing the adoption of green methanol as a sustainable maritime fuel. For instance, in September 2023, Maersk partnered with its primary shareholder to establish a new company focused on creating "green methanol." This type of green methanol, generated from either biomass or captured carbon combined with hydrogen from renewable energy, has the potential to cut carbon dioxide emissions from container vessels by 60% to 95% compared to traditional fossil fuels.

LIST OF KEY GREEN METHANOL SHIP COMPANIES PROFILED

- HD Hyundai Heavy Industries (South Korea)

- Samsung Heavy Industries (South Korea)

- COSCO Shipping Lines (China)

- Damen Shipyards Group (Netherlands)

- VARD AS (Norway)

- Kawasaki Heavy Industries (Japan)

- Hanwha Engine Co. Ltd. (South Korea)

- Methanex Corporation (Canada)

- Shanghai Waigaoqiao Shipbuilding Co., Ltd. (China)

- Yangzijiang Shipbuilding Group (China)

- Huangpu Wenchong Shipbuilding Company Limited (China)

- COSCO Shipping Industries (China)

KEY INDUSTRY DEVELOPMENTS

- March 2025 - WasteFuel, a bioenergy company based in the U.S., has teamed up with ITC, a Turkish company specializing in integrated waste management, to initiate the front-end engineering design (FEED) for a green methanol biorefinery in Ankara, Türkiye. According to WasteFuel, the biorefinery will be located adjacent to ITC’s current integrated waste management facility and will make use of biogas generated from anaerobic digestion and landfill gas collection. When it becomes operational, the green methanol produced will serve as a low-carbon fuel intended for the maritime sector. A final investment decision (FID) is anticipated in early 2026.

- March 2025 - Singapore has introduced a new standard for methanol bunkering, representing a significant advancement in facilitating large-scale methanol bunkering and reinforcing its role as a sustainable, multi-fuel bunkering hub.

- February 2025 - Algoma, in partnership with the Swedish company Furetank, has received its fifth new product tanker, the Fure Vesborg, from China Merchants Jinling Shipyard located in Yangzhou. After being delivered, the 17,999 dwt environmentally friendly dual-fuel methanol tanker commenced operations by loading its initial cargo in China. The ship is anticipated to start trading in Northern Europe during the second quarter of 2025.

- February 2025 - Valmet, a provider of process technologies, automation, and services based in Finland, has secured a contract for a marine methanol fuel automation control system intended for two cable-laying vessels (CLV) currently under construction in China for Jan De Nul.

- February 2025 – Swiss marine power firm WinGD is preparing to deliver its inaugural methanol-fueled engine following the successful completion of factory and type approval assessments. The ten-cylinder, 92-bore X-DF-M engine, touted as “the largest” methanol-fueled engine constructed to date, was unveiled during a ceremony at engine manufacturer CMD in Shanghai, China.

REPORT COVERAGE

The research report provides a detailed analysis of the market insights. It focuses on important aspects, such as key players, ship type, fuel type, and sales channel, depending on various regions and countries. Moreover, it offers insights into the green methanol ships market trends, competitive landscape, market competition, comparative analysis, and highlights key industry developments. Additionally, it encompasses several factors that have contributed to the expansion of the global market in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 28.3% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Ship Type

|

|

By Fuel Type

|

|

|

By Sales Channel

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 4.37 billion in 2024 and is anticipated to reach USD 33.42 billion by 2032.

The market is likely to grow at a CAGR of 28.3% during the forecast period (2025-2032).

The top players in the industry are Damen Shipyards Group (Netherlands), HD Hyundai Heavy Industries (South Korea), Shanghai Waigaoqiao Shipbuilding Co., Ltd. (China), and so on.

Asia Pacific dominated the market in 2024.

The Asia Pacific region is estimated to be the fastest-growing during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us