Head Mounted Display Market Size, Share & Industry Analysis, By Platform (Airborne Platforms, Dismounted Soldier Systems, Armored Vehicle & Crew HMDs, Naval & Maritime HMDs, and Others), By Product Type (VR, HMDs, AR, HMDs / Smart Glasses, Mixed Reality (MR) HMDs, and Helmet-Mounted Displays (Aviation & Defense)), By Application (Situational Awareness & Targeting, Pilotage & Flight Operations, and Others), By Integration (Fully Integrated Platform-Coupled HMDs, Semi-Integrated HMDs with External Sensors, Standalone & Others), By End User, and Regional Forecast, 2026-2034

Head-Mounted Display Market Size and Future Outlook

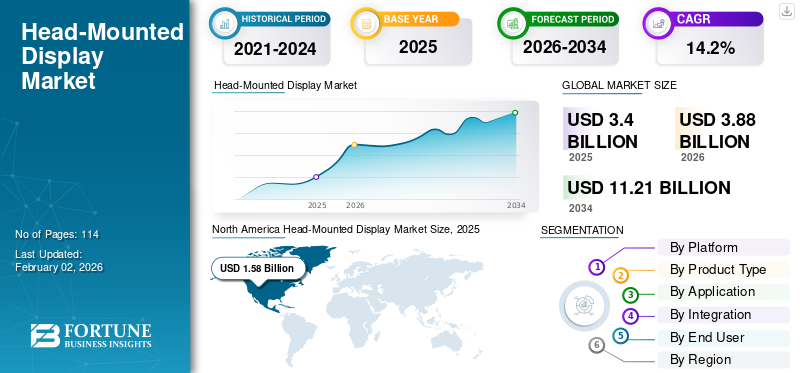

The global head-mounted display market size was valued at USD 3.40 billion in 2025 and is projected to grow from USD 3.88 billion in 2026 to USD 11.21 billion by 2034, exhibiting a CAGR during the forecast period of 14.2%. North America dominated the global head-mounted display market with a market share of 46.47% in 2025. The industry growth is driven by immersive training adoption, defense modernization programs, augmented reality integration, pilot helmet display upgrades, and expanding enterprise wearable visualization applications.

Head mounted displays (HMDs) are wearable visual systems that place essential information right in front of the user’s eyes, usually through a visor, helmet, or smart glasses. In defense, this means pilots see flight and targeting displays on their helmets. Vehicle crews gain 360-degree vision from external cameras. Soldiers can view navigation, blue-force tracking, and targeting cues without looking down at a tablet. The market is being driven by several major factors, such as the fact that militaries are digitizing quickly, they want improved situational awareness without overwhelming operators, AR/MR technology and sensors have become lighter and cheaper, and there is a strong push to connect every platform and soldier into the tactical network.

On the supplier side, the market is led by a mix of large defense companies and specialized optics and electronics providers. Key players include Elbit Systems, BAE Systems, Thales, Collins Aerospace (Raytheon Technologies), L3Harris Technologies, Saab, Leonardo, Honeywell Aerospace, and an expanding network of AR/MR and night-vision specialists supplying sensors, waveguides, and computing modules that fit into larger helmet and soldier-system programs.

Head mounted display market size expansion is supported by defense modernization initiatives, pilot helmet upgrade programs, and growing deployment of wearable display systems for dismounted soldiers. Aviation and military applications continue to represent high-value segments due to integration complexity, certification requirements, and advanced sensor fusion capabilities. Simultaneously, enterprise and industrial use cases are broadening adoption beyond traditional defense markets.

Head mounted display market share remains concentrated among established aerospace and defense electronics manufacturers, complemented by emerging augmented reality and wearable technology firms. Competitive positioning increasingly depends on display resolution, latency reduction, ergonomic optimization, and integration with secure communication networks.

Head mounted display market trends indicate rapid advancement in lightweight optics, waveguide displays, artificial intelligence-enabled targeting overlays, and sensor integration. Helmet-mounted displays for fighter aircraft and rotary platforms continue to evolve toward full digital architectures. Meanwhile, augmented reality smart glasses are gaining traction for battlefield awareness and industrial task support.

Head mounted display market growth is expected to remain sustained through the forecast period, supported by multi-domain operational doctrines and increased investment in immersive training systems. Regional demand patterns vary according to defense budgets and technology readiness, but wearable visualization platforms are becoming central to digital transformation strategies across aviation and defense ecosystems worldwide.

HEAD MOUNTED DISPLAY MARKET TRENDS

Surge in Global Military Spending & Cross-Sector XR Expansion Fuel HMD Market Trends

Global defense budgets reached record highs in 2024, with spending rising to about USD 2.72 trillion according to the Stockholm International Peace Research Institute (SIPRI). Militaries globally are prioritizing modernization, networked systems, and improved situational awareness. This trend is creating a growing base of combat aircraft, armored vehicles, naval platforms, and infantry programs that increasingly adopt head-mounted display (HMD) solutions for real-time data overlays, night-vision integration, and mixed reality navigation. At the same time, the wider use of augmented reality (AR) and virtual reality (VR), and mixed reality in business, training, and entertainment is expanding the global supply chain for optics, sensors, processors, and display waveguides. This change makes it cheaper and faster to increase HMD production for both civilian and defense uses.

The International Data Corporation (IDC) projects that shipments of AR/VR headsets, which form the technology backbone of many HMDs, will rise from 8.1 million units in 2023 to 14.3 million units in 2025. This reflects steady consumer demand and renewed investment in XR-based devices.

Lightweight optical architectures define current Head mounted display market trends. Manufacturers invest in waveguide displays and micro-projection systems to reduce bulk while enhancing clarity. Improved ergonomics support longer operational use. Artificial intelligence integration is expanding. AI-enabled overlays assist with target recognition, navigation cues, and predictive threat analysis. These capabilities enhance decision-making speed. Mixed reality adoption is increasing across defense and industrial segments. Blending digital and physical environments supports training realism and operational effectiveness.

Fully digital helmet-mounted displays are replacing analog systems in advanced aircraft. Digital architectures allow rapid software upgrades and enhanced sensor fusion. Edge computing capability is being integrated directly into head mounted display platforms. On-device processing reduces latency and improves responsiveness in contested environments.

MARKET DYNAMICS

MARKET DRIVERS

Demand for Heads-Up and Data-Rich Warfighters Drives Defense HMD Market Growth

Militaries are working hard to get important data from cockpit and vehicle displays into the operator’s direct line of sight. Helmet- and head mounted displays allow pilots, AFV crews, and dismounted soldiers to see targeting, navigation, threat cues, and blue-force positions without looking down or away from the fight. As forces move toward network-focused, sensor-heavy operations, HMDs become essential tools for air, land, and special operations units. This is why they are now integrated into flagship aircraft, soldier systems, and next-gen vehicle programs instead of being treated as separate gadgets.

In February 2024, Collins Elbit Vision Systems announced the delivery of the 3,000th F-35 Gen III Helmet Mounted Display System, the main display for the Joint Strike Fighter. This highlights how front-line combat aircraft now see HMDs as standard equipment instead of optional upgrades.

Defense modernization programs represent the primary driver of the Head mounted display market. Armed forces prioritize advanced visualization systems that enhance situational awareness, reduce cognitive load, and support precision engagement. Helmet-mounted displays integrated with targeting systems enable real-time battlefield information delivery.

Growth in immersive training environments further supports demand. Military and aviation organizations increasingly deploy virtual reality and mixed reality head mounted display systems for simulation-based training. These platforms reduce operational costs while improving readiness. Technological advancement reinforces market expansion. Improvements in micro-displays, waveguide optics, and sensor fusion enable lighter and more capable systems. Reduced latency and enhanced resolution improve usability across high-performance aviation and tactical environments.

MARKET RESTRAINTS

High Hardware Costs and Lifecycle Spend Restrain Market Growth

Even as demand for immersive, real-time data grows, the global head-mounted display market faces an affordability issue. High-end AR/VR and mixed reality HMDs, especially those designed for enterprise and defense, are priced at the top end of the scale. When you include compute packs, accessories, integration, support, and training, the actual market size for mounted displays that can justify deployment is smaller than the hype suggests. This slows down roll-out beyond well-funded programs in North America and a few other key markets, leaving many buyers stuck in pilot mode instead of expanding their fleets of devices.

In 2024, the average price of a high-end VR headset is expected to be around USD 500 to 1,000. Devices including the Valve Index, HTC Vive Pro 2, and top-end Meta bundles all fall within this range. This positions serious immersive hardware in the “premium electronics” category instead of mass-market pricing.

High development and integration costs constrain the Head mounted display market. Advanced systems require specialized optics, secure processors, and extensive testing. Certification for aviation and defense platforms increases time to market and capital requirements. Ergonomic challenges also affect adoption. Weight distribution, heat management, and prolonged wear comfort influence user acceptance. In high-performance aviation environments, even minor discomfort can impact operational effectiveness.

Power consumption and battery limitations present additional technical barriers. Standalone augmented reality systems must balance display brightness, processing capability, and operational endurance. Integration complexity further restricts deployment speed. Head mounted display systems must interface seamlessly with sensors, weapons systems, communication networks, and avionics. Compatibility challenges can delay large-scale adoption.

MARKET OPPORTUNITIES

Enterprise and Training Use Cases Unlock New Market Opportunities

Beyond gaming and entertainment sectors, there is significant potential for the global head mounted display market growth in enterprise, training, and simulation. Organizations are increasingly adopting AR, VR, and mixed reality HMDs to provide hands-on training, remote assistance, and digital twins, putting real-time data, work instructions, and safety cues directly in workers’ fields of view. This is particularly beneficial in defense, aerospace, automotive, and industrial sectors, where mistakes can be costly, and downtime is detrimental. As these use cases develop, they create an increasing demand for head mounted display solutions in both civilian and defense settings. This supports market growth over the forecast period and reduces reliance on the demand for consumer VR headsets.

Emerging defense programs present a substantial opportunity within the head-mounted display market. Modern combat aircraft, unmanned platforms, and next-generation soldier systems require advanced visualization integration.

Retrofit and upgrade programs offer recurring revenue potential. Many legacy aircraft and armored platforms require helmet-mounted display modernization to maintain operational relevance. Enterprise digital transformation creates additional growth pathways. Industrial sectors adopt augmented reality head mounted display systems to enhance productivity and reduce training time.

Space and unmanned system integration represent an expanding frontier. Head mounted display platforms supporting remote piloting and mission monitoring create new demand segments. Development of lighter materials and energy-efficient displays provides an opportunity for differentiation. Vendors that achieve improved endurance and comfort gain a competitive advantage.

MARKET CHALLENGES

Integration Complexity and Legacy Systems Challenge Market Growth

One of the major challenges in the global head mounted display (HMD) market is making all the components work together in real units, not just in demos. Defense customers want HMD solutions that connect to existing aircraft mission computers, vehicle vetronics, soldier radios, and battle management systems. Meanwhile, commercial users need AR/VR devices that communicate effectively with enterprise applications and IT networks. In practice, integrating real-time data feeds, tracking, sensors, and mixed reality visuals into outdated platforms is complicated and costly. This delays deployments, even though there is an increasing demand for immersive experiences and improved AR/VR.

Impact of the Russia-Ukraine War

Russia-Ukraine War Accelerates Demand for Situational Awareness and Shifts toward AR/VR-Enabled HMDs

The Russia-Ukraine conflict has changed battlefield expectations, and global head-mounted display (HMD) needs. The war has demonstrated that survival now relies on real-time data, quick target acquisition, and maintaining situational awareness in complex environments filled with electronic warfare. Drones, FPV strikes, loitering munitions, and dispersed infantry tactics show that soldiers and vehicle crews require better visualization tools that allow them to keep their heads up and focused, rather than looking down at screens or handheld devices. Consequently, countries in Europe and North America are quickly modernizing their forces with AR, VR, and mixed reality HMDs for operations and training; nations in Asia and the Middle East are also speeding up similar upgrades to avoid falling behind.

SIPRI reported that European defense spending rose by over 30% between 2021 and 2024, making it the fastest regional increase globally. This surge is driven largely by urgent modernization and the need to address lessons learned from Ukraine, particularly in areas such as sensor fusion, soldier systems, and targeting aids. All these factors directly contribute to the growing demand for military HMD solutions.

Download Free sample to learn more about this report.

Segmentation Analysis

By Platform

Central Role of Combat Aircraft in Networked Warfare, Airborne Platforms Dominate Head-Mounted Display Market

In terms of by platform, the market is categorized into airborne platforms, dismounted soldier systems, armored vehicle & crew HMDS, naval & maritime HMDS, and others.

Airborne Platforms

Airborne platforms dominate the head-mounted display (HMD) market due to the critical need for enhanced pilot safety and operational efficiency in high-stakes environments, coupled with substantial defense budgets and ongoing aircraft modernization programs. These factors have driven significant investment and rapid technological advancement specifically for aviation applications.

Airborne platforms represent the highest-value segment within the Head mounted display market. Fighter aircraft, rotary-wing platforms, and special mission aircraft deploy helmet-mounted displays tightly integrated with avionics, radar, and targeting systems. These systems support beyond-visual-range targeting, threat cueing, and navigation overlays. Certification complexity and sensor fusion integration elevate system cost and technological intensity. Modernization cycles tied to aircraft upgrade programs sustain recurring procurement demand. This segment commands a substantial share of the overall market value.

Dismounted Soldier Systems

Dismounted soldier systems in the market are expected to show the fastest CAGR of 17.5% over the forecast period. Dismounted soldier head mounted display systems focus on tactical situational awareness, navigation, and data sharing. Augmented reality overlays provide mapping, target identification, and communication integration. Adoption is driven by soldier modernization programs and digital battlefield transformation initiatives. Weight reduction, durability, and battery life remain key design priorities. While unit costs are lower than airborne systems, deployment scale across infantry units supports significant Head mounted display market size growth.

Armored Vehicle & Crew HMDs

Armored vehicle crews increasingly use head mounted display systems linked to external sensors and panoramic cameras. These systems enhance situational awareness without direct line-of-sight exposure. Integration complexity centers on vehicle electronics and secure communication networks. Demand aligns with armored modernization initiatives and multi-domain operational concepts.

Naval & Maritime HMDs

Naval head mounted display systems support bridge navigation, targeting, and maritime surveillance integration. Adoption remains selective but is expanding as naval digitization accelerates. Marine-specific environmental durability requirements influence product design.

To know how our report can help streamline your business, Speak to Analyst

By Product Type

Their Role as Primary Combat Interface, Helmet-Mounted Displays Dominate Product Mix in Defense HMDs

On the basis of by-product type, the market is classified into Virtual Reality (VR) HMDs, Augmented Reality (AR) HMDs / Smart Glasses, Mixed Reality (MR) HMDs, and Helmet-Mounted Displays (Aviation & Defense).

Helmet-Mounted Displays (Aviation & Defense)

Helmet-Mounted Displays (HMDs) in aviation and defense are the leaders in the head-mounted display market. In fast jets and combat helicopters, the helmet has become the main screen for pilots. Instead of looking down at cockpit instruments, aircrew now depend on helmet-mounted displays for symbology, cueing, and sensor fusion to find, track, and engage targets. They can also fly safely at low altitudes and coordinate with other platforms. This makes aviation and defense HMDs the most important and best-funded product type in the head mounted display market.

Helmet-mounted displays integrated directly into pilot helmets remain the most technologically complex product segment. These systems fuse targeting, navigation, and threat data. High integration requirements sustain premium pricing and strong Head mounted display market share concentration.

Mixed Reality (MR) HMDs

The mixed Reality (MR) HMDs segment is expected to show the fastest CAGR of 19.4% over the forecast period. Mixed reality systems blend virtual and physical interaction layers. Adoption is strongest in advanced simulation and mission rehearsal contexts. MR platforms support interactive overlays and collaborative training environments.

VR HMDs

Virtual reality head mounted display systems are widely used in immersive training environments. Military flight simulators and tactical training centers rely on VR systems to replicate complex operational scenarios. Growth is driven by cost-effective training transformation and readiness enhancement.

AR HMDs / Smart Glasses

Augmented reality head mounted display platforms project contextual data into the user’s real-world view. Defense and industrial sectors adopt these systems for situational awareness and maintenance support. Lightweight optics and wireless connectivity are key adoption drivers.

By Application

Need for Real-Time Threat Visibility, Situational Awareness and Targeting Dominates HMD Applications

Based on the application, the market is segmented into situational awareness & targeting, pilotage & flight operations, dismounted infantry combat & urban operations, training & simulation, and others.

Situational Awareness & Targeting

Situational awareness & targeting dominate the application segment in the market for head-mounted displays. In combat, the top priority is knowing where threats, friendlies, and objectives are located. This needs to happen without taking eyes off the fight. Head-mounted display (HMD) systems allow pilots, vehicle crews, and dismounted soldiers to overlay real-time data, such as sensor tracks, targeting cues, navigation, and blue-force positions, directly in their line of sight. This combination of seeing first, deciding faster, and shooting sooner makes Situational Awareness and targeting the main reasons for most AR/VR and mixed reality deployments in defense.

Pilotage & Flight Operations

Pilot-focused applications include navigation, instrument display, and night operations support. Digital overlays reduce head-down time and improve operational safety. Aviation certification requirements influence system design and procurement cycles.

The dismounted infantry combat & urban operations segment is the fastest CAGR of 19.2% in the forecast period.

By Integration

Deeper Sensor and Mission-System Fusion, Fully Integrated Platform-Coupled HMDs Dominate Defense Deployments

Based on integration, the market is segmented into fully integrated platform-coupled HMDs, semi-integrated HMDs with external sensors, standalone night-vision / low-light HMDs, HMDs with tactical network integration, and MR/XR enhanced integrated systems.

Fully integrated platform-coupled HMDs lead the integration landscape as they connect directly to an aircraft’s or vehicle’s core mission systems. In this integration, the head mounted display (HMD) serves as the main interface for fused sensors, weapons, flight data, and tactical networks. This gives pilots and crews a single, clear mixed reality view, rather than forcing them to manage multiple screens. As a result, major air forces and advanced land programs continue to prioritize fully integrated HMDs over external sensor setups.

The MR/XR enhanced integrated systems segment is expected to show the fastest CAGR of 20.2% across the forecast period.

By End User

High Adoption of Modern Avionics and Sensor-Fused Helmets, Air Forces Lead HMD End-User Demand.

Further, the market is segmented by end user, into air forces, land forces, special operations forces, navies & marine corps, and others.

Air Forces dominate the market for head mounted displays. Fast jets, trainers, and rotary-wing aircraft were the first to widely adopt helmet-mounted cueing, night vision integration, and real-time data overlays. In today’s air combat, the helmet is not just protective gear; it serves as the pilot’s main mixed-reality interface for targeting, navigation, threat warnings, and off-boresight engagement. As nations upgrade their fighter fleets and enhance training programs, Air Forces will continue to account for the largest share of spending on head mounted display (HMD) systems.

The special operations forces segment is expected to show the fastest CAGR of 16.8% across the forecast period.

Head Mounted Display Market Regional Insights

By geography, the market is categorized into Europe, North America, Asia Pacific, and the Rest of the World (Middle East & Africa, and Latin America).

North America Head Mounted Display Market Analysis:

North America held the dominant head-mounted display market share in 2024, valued at USD 1.40 billion, and also took the leading share in 2025, with USD 1.58 billion, led primarily by the U.S., which alone contributed over 94.11% share in 2025 of the regional share. U.S. Air Force and naval aviation have been quick to adopt helmet-mounted display (HMD) systems for fighters, bombers, transport aircraft, and rotorcraft. The Army and Marine Corps are now pushing Augmented Reality (AR), Virtual Reality (VR), and mixed reality into soldier and training use cases. The combination of large research and development budgets, a vast installed fleet, and home-grown major players in AR/VR, optics, and semiconductors means that North America sets many trends in the mounted display market that other regions follow during the forecast period.

North America represents the largest head-mounted display market, driven by sustained defense modernization, advanced aviation programs, and immersive training investment. Strong research funding and established aerospace manufacturers support technological leadership. Adoption spans helmet-mounted aviation systems and augmented reality soldier platforms. These factors sustain dominant Head mounted display market share and consistent regional growth.

North America Head-Mounted Display Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

United States Head mounted display Market:

The United States leads the Head mounted display market through extensive defense procurement and next-generation aircraft programs. Fighter pilot helmet upgrades, immersive simulation systems, and soldier modernization initiatives drive demand. Strong integration of augmented reality and networked communication platforms supports steady Head mounted display market size expansion nationwide.

In 2024, the U.S. spent about USD 997 billion on defense, which is nearly 40% of all military spending globally and more than the next nine countries combined, according to SIPRI-based analysis. This spending highlights why U.S.-driven programs significantly influence the global market for head-mounted displays.

Europe Head mounted display Market Analysis:

Europe is expected to see significant growth in the Head Mounted Display (HMD) Market in the coming years. During the forecast period, the European region is projected to have a growth rate of 13.8%. The market in Europe is estimated to be USD 0.80 billion in 2025, driven directly by the Russia-Ukraine war. In this region, both the U.K. and France are expected to reach USD 0.17 billion and USD 0.14 billion, respectively, in 2026. Major air forces in the U.K., France, Germany, Italy, and Spain are pushing upgrades, including the Striker II and other helmet-mounted displays across Eurofighter, Rafale, Typhoon, and rotary fleets. As a result, airborne HMDs still account for the largest portion of spending, driving the market growth in the region.

Europe’s Head mounted display market is shaped by multinational defense collaboration and aviation modernization programs. Countries prioritize interoperable helmet-mounted display systems and advanced training simulators. Investment in lightweight optics and sensor integration strengthens competitive positioning. These initiatives sustain moderate yet stable Head mounted display market growth.

Germany Head mounted display Market:

Germany’s Head mounted display market emphasizes precision engineering, aviation integration, and soldier modernization programs. Defense forces invest in secure, lightweight augmented reality systems. Collaboration with aerospace manufacturers supports continuous capability enhancement. These factors contribute to steady Head mounted display market growth aligned with national defense priorities.

United Kingdom Head mounted display Market:

The United Kingdom Head mounted display market prioritizes advanced helmet systems and immersive simulation technologies. Defense modernization and pilot upgrade programs drive demand. Emphasis on interoperability within allied frameworks strengthens procurement alignment. Continued investment supports consistent Head mounted display market growth.

Asia-Pacific Head mounted display Market Analysis:

Asia Pacific is anticipated to be the fastest growing region in the global market with a CAGR of 16.1%. China, India, Japan, Australia, and South Korea are pushing hard on networked warfare. This focus keeps airborne platforms, including the fighters and attack or utility helicopters, as the largest category for helmet-mounted displays in the area. At the same time, there is a clear increase in dismounted soldier systems and vehicle crew HMDs. Based on these factors, countries including China expect to reach a valuation of USD 0.32 billion, and India is set to reach USD 0.13 billion by 2026.

Asia-Pacific represents a high-growth Head mounted display market driven by rising defense budgets and aviation expansion. Countries invest in advanced pilot helmets, augmented reality soldier systems, and simulation training. Rapid modernization initiatives contribute to increasing the head-mounted display market size across tactical and strategic domains.

Japan Head mounted display Market:

Japan’s Head mounted display market focuses on aviation safety, advanced pilot systems, and secure communication integration. Defense investment supports the modernization of airborne helmet-mounted displays and augmented reality platforms. Technological precision and reliability requirements sustain measured Head mounted display market growth.

China Head mounted display Market:

China’s Head mounted display market expands through indigenous aerospace development and defense digitization initiatives. Integration of helmet-mounted targeting systems and augmented reality soldier platforms supports modernization. Significant research investment strengthens domestic capability, contributing to rising Head mounted display market share.

Latin America Head mounted display Market Analysis:

Latin America shows gradual development within the Head mounted display market. Defense modernization and aviation training upgrades drive selective procurement. Budget limitations moderate large-scale deployment, but incremental adoption supports steady Head mounted display market growth across regional security forces.

Middle East & Africa Head mounted display Market Analysis:

The Middle East and Africa Head mounted display market is influenced by defense procurement and aviation capability enhancement. Governments invest in advanced pilot helmet systems and tactical visualization tools. Strategic partnerships support technology acquisition. Market growth depends on defense budgets and regional security dynamics.

Head Mounted Display Industry Competitive Landscape

Key Industry Players

Race for Mixed-Reality Superiority Makes Global Market Competitive, Layered, and in Flux

The market for head mounted display in defense relies on a few major players, but power dynamics are changing as AR, VR, and mixed reality transition from consumer tech into military systems. Key companies such as Elbit Systems, BAE Systems, Thales, Collins Aerospace, L3Harris Technologies, Leonardo, Honeywell, and Saab dominate helmet-mounted displays for fighters, helicopters, armored vehicles, and rotary/naval aviation. They control critical integration, which includes sensor fusion, weapon cueing, low-latency real-time data, and certification on frontline platforms. Their approach is to offer fully integrated, platform-linked HMD suites with upgrade options. This allows air forces and ground forces to start with basic symbology and night vision, then add augmented reality (AR) overlays, 360° vision, and mixed reality features over time. This strategy keeps them central to the mounted display market in aviation and high-end ground platforms.

At the same time, a second layer of competition is emerging from AR, VR, and XR specialists who started in the gaming and entertainment sectors. These companies are increasingly used for training, simulation, and enterprise applications. Firms including Microsoft (HoloLens/IVAS ecosystem), Varjo, and HTC provide high-end VR headsets and AR devices that militaries are testing for immersive mission rehearsal, remote maintenance, and digital twins. Beneath them is an ecosystem of optics, waveguides, sensors, and silicon vendors that create lighter HMD hardware and enhance mixed reality performance.

The Head mounted display industry competitive landscape is characterized by a combination of established aerospace defense contractors and emerging wearable technology innovators. Competition centers on optical clarity, system integration depth, latency reduction, and ergonomic performance. Vendors differentiate through proprietary display technologies and sensor fusion capabilities. Leading defense electronics manufacturers hold significant Head mounted display market share through long-term aviation and military contracts. Their portfolios include fully integrated helmet-mounted display systems and advanced augmented reality solutions. These firms leverage certification expertise and deep integration capability.

Mid-tier and emerging firms focus on augmented and mixed reality smart glasses. These companies influence the head-mounted display market trends by advancing waveguide optics, lightweight materials, and edge computing integration. Partnerships with defense agencies and industrial enterprises support market expansion. Strategic alliances play a central role. Vendors collaborate with aircraft manufacturers, system integrators, and software developers to deliver interoperable solutions. Open architecture approaches enhance upgrade flexibility and customer retention.

Top Players Analyzed:

- Elbit Systems Ltd (Israel)

- RTX Corporation (U.S.)

- BAE Systems plc. (U.K.)

- Thales Group (France)

- L3Harris Technologies, Inc. (U.S.)

- Leonardo S.p.A. (Italy)

- Saab AB (Sweden)

- Honeywell International Inc. (U.S.)

- Rheinmetall AG (Germany)

- Kopin Corporation (U.S.)

- Sony Group Corporation (Japan)

- Microsoft Corporation (U.S.)

- Varjo Technologies Oy (Finland)

- HTC Corporation (Taiwan)

KEY INDUSTRY DEVELOPMENTS

- April 2025: The U.S. Air Force, through the NATO Support and Procurement Agency, awarded Thales Defense & Security Inc. a contract for Scorpion Helmet Mounted Display retrofit kits. These kits will update active-duty and Air National Guard F-16 Block 40/50 aircraft, replacing old JHMCS units with a full-color, day/night digital HMD platform.

- September 2023: Collins Elbit Vision Systems, a joint venture between RTX’s Collins Aerospace and Elbit Systems of America, received a USD 16 million contract from the U.S. Navy. This contract is for development, engineering, logistics, and test support of the Improved Joint Helmet Mounted Cueing System on Block III F/A-18E/F and EA-18G aircraft. This agreement officially launched the new Zero-G Helmet Mounted Display System+ (HMDS+).

- April 2023: Elbit Systems showcased its IronVision head-mounted display technology for armored fighting vehicles. This technology offers 360° “see-through armor” situational awareness and AR symbology to crews under closed hatches. This signals that HMD concepts are now transitioning from fighters and helicopters into main battle tanks and infantry fighting vehicles as a new trend in armor.

- November 2022: Raytheon received a USD 34 million order to support the development and integration of the MV-22 Helmet Mounted Display / Degraded Visual Environment program. This work will add new Ethernet and data-server capabilities across V-22 variants and create a common baseline for future HMD upgrades.

- July 2022: The U.S. Army began testing Elbit America’s X-Sight augmented reality helmet mounted display for helicopter pilots. The Army is exploring this technology as a potential replacement for existing monocle-based systems on AH-64 Apache and other platforms. This demonstrates growing interest in wide-FOV AR HMDs for low-level, degraded-visual-environment flight.

REPORT COVERAGE

The global head mounted display market analysis provides an in-depth study of market size, company profiling & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market during the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on strategic partnerships, mergers & acquisitions. The market research report also encompasses a detailed competitive landscape with information on the market share and profiles of the market key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| Attribute | Details |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Period | 2021-2024 |

| Growth Rate | CAGR of 14.2% from 2026 to 2034 |

| Unit | Value (USD Billion) |

|

Segmentation |

Platform, Product Type, Application, Integration, End User, and Region |

|

By Platform

|

|

|

By Product Type

|

|

|

By Application

|

|

|

By Integration

|

|

|

By End User

|

|

| By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.88 billion in 2026 and is projected to reach USD 11.21 billion by 2034.

In 2025, the market value stood at USD 1.58 billion.

The market is expected to exhibit a CAGR of 14.2% during the forecast period of 2026-2034.

The airborne platforms segment led the market by platform.

Demand for Heads-Up, Data-Rich Warfighters Drives Defense HMD Market Growth

Elbit Systems Ltd, RTX Corporation, BAE Systems plc., Thales Group, L3Harris Technologies, Inc., Leonardo S.p.A., Saab AB, Honeywell International Inc., Rheinmetall AG, Kopin Corporation, Sony Group Corporation, Microsoft Corporation, Varjo Technologies Oy, HTC Corporation, and among others are the top companies in the head-mounted display market.

North America dominated the market in 2024

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us