High Voltage Protective Relay Market Size, Share & Industry Analysis, By Product Type (Electromechanical Relays, Digital Relays, and Static Relays), By Application (Generator Protection, Feeder Protection, Transmission Line Protection, Motor Protection, and Transformer Protection), By End-User (Utilities and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

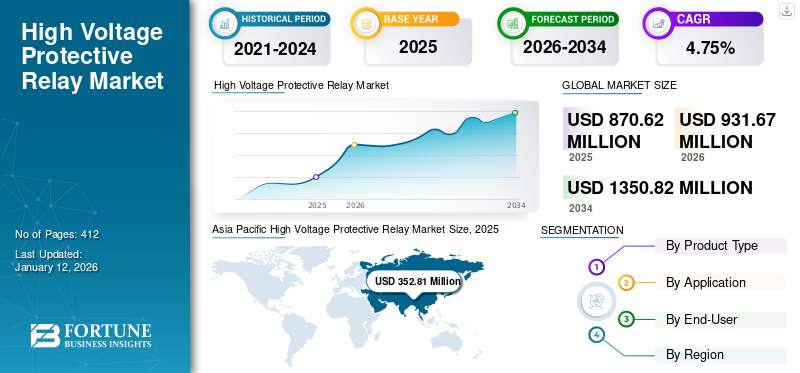

The global high voltage protective relay market size was valued at USD 870.62 million in 2025 and is projected to grow from USD 931.67 million in 2026 to USD 1,350.82 million by 2034, exhibiting a CAGR of 4.75% during the forecast period. Furthermore, Asia Pacific dominated the high voltage protective relay market with a share of 40.52% in 2025 and increasing demand for electricity.

Rapid urbanization, an increase in population, and industrial growth are leading to a rise in electricity usage worldwide. In order to fulfill this demand, major investments are being directed toward power generation, transmission, and distribution systems, which need protective relays to protect equipment and guarantee dependable power supply.

Global High Voltage Protective Relay Market Overview

Market Size

- 2025 Value: USD 870.62 million

- 2026 Value: USD 931.67 million

- 2034 Forecast Value: USD 1,350.82 million, with a CAGR of 4.75% from 2026–2034

Market Share

- Regional Leader: Asia Pacific held the largest market share in 2025, driven by rapid industrialization, electrification, and growing energy demand across nations such as China, India, and Japan.

- Fastest-Growing Region: Asia Pacific, due to large-scale infrastructure development, grid expansion, and rising renewable energy integration.

- End-User Leader: Utilities segment led the market in 2024, fueled by grid modernization, substation expansion, and increasing electricity demand.

Industry Trends

- Smart Grid Adoption: Rising investment in grid modernization and digitization boosts demand for intelligent protective relays.

- 5G & EV Charging Integration: Growing adoption in electric vehicles and smart substations enhances demand for high-speed, secure relays.

- IoT & Remote Monitoring: Use of relays with remote access and real-time monitoring aligns with smart utility operations.

- Digital Relay Advancement: Shift from electromechanical to digital relays driven by enhanced precision, response time, and reliability.

Driving Factors

- Industrial & Infrastructure Expansion: Increased electrification and industrial activities, including EV infrastructure and heavy industries, raise the need for robust protection systems.

- Investment in T&D Networks: Growing investments in transmission & distribution (T&D) systems, HVDC, and UHV technologies propel relay adoption.

- Rising Renewable Integration: Variable power from solar and wind requires advanced protection to manage bi-directional flow and grid stability.

- Technological Evolution: Innovations like arc suppression, high-speed switching, and predictive maintenance are becoming standard.

- Government Initiatives: Supportive energy policies and investment incentives drive market growth globally.

The upgrade of aging electrical grids and the implementation of smart grid technologies are increasing the need for advanced protective relays. These relays improve grid resilience by identifying faults, isolating damaged sections, and facilitating automated power rerouting, thereby enhancing system reliability.

ABB, Siemens, Eaton, and GE Vernova are the major market players in the high voltage protective relay market. These firms are recognized for their groundbreaking digital and software-based protective relay solutions, which provide improved accuracy, dependability, and scalability. Their advanced products facilitate smart grid technologies, IoT connectivity, and data-informed decision-making, aligning with the sector's transition toward updated electrical frameworks.

MARKET DYNAMICS

MARKET DRIVERS

Electrification and Industrial Expansion to Drive Market Growth

The expansion of industry activities and infrastructure projects increasingly requires robust power protection systems. The rapid growth of Electric Vehicle (EV) charging infrastructure, including ultra-fast and high-power charging stations, necessitates reliable grid protection to manage voltage fluctuations and prevent system overloads. Similarly, the expansion of heavy industries such as mining, steel, oil & gas, and manufacturing, all of which rely on high-voltage power networks, requires advanced protective relay solutions to mitigate faults, enhance system stability, and ensure operational safety. According to the United Nations Industrial Development Organization, the 29th edition of the International Yearbook of Industrial Statistics (2023) highlights a 2.3% global growth across industrial sectors, including manufacturing, mining, utilities, and waste management, reflecting ongoing post-pandemic recovery.

Additionally, HVDC (High Voltage Direct Current) transmission networks, which are being deployed for long-distance electricity transmission and interconnection of regional grids, depend on precise relay protection to detect and isolate faults quickly, minimizing disruptions. As more industrial facilities and transportation networks shift toward electrification, the need for intelligent protective relays with fast fault detection, remote monitoring, and predictive maintenance capabilities continues to grow.

Rising Investment in Transmission and Distribution Networks to Boost Market Expansion

Rising investment in transmission and distribution due to utilities and governments prioritizing grid expansion, modernization, and reliability, are fueling the demand for higher voltage protective relays. With increasing electricity demand and the shift toward renewable energy sources, countries are investing in high-voltage transmission infrastructure, including HVDC (High Voltage Direct Current) and UHV (Ultra-High Voltage) systems, to facilitate efficient long-distance power transfer. As per the International Energy Agency (IEA), global power transmission investment rose by 10% in 2023, reaching USD 140 billion. Europe, the U.S., China, India, and Latin America led this growth. However, investment remains uneven, with advanced economies and China, contributing around 80% of the total. These high-capacity networks require advanced protective relays to detect and isolate faults rapidly, ensuring system stability and preventing cascading failures. Moreover, the expansion of substations and distribution networks, driven by growing urbanization and industrialization necessitates intelligent relay protection to manage complex power flows and grid interconnections.

MARKET RESTRAINTS

Cybersecurity Vulnerabilities to Constrain High Voltage Protective Relay Market Expansion

The increasing need for remote access to protective relays and other substation monitoring devices poses significant cybersecurity risks. Utility personnel need real-time access to protection, control, and monitoring systems to diagnose faults, assess grid health, and coordinate system operations. However, this expanded access, especially through the internet and corporate networks, increases the vulnerability of microprocessor-based protective relays to cyber threats, unauthorized access, and configuration errors.

Relay settings and access control are critical in preventing accidental or malicious alterations that could disrupt grid operations. The multifunctional nature of modern relays extends their usage beyond protection engineers to automation engineers, system operators, and maintenance personnel. This diversification creates an added challenge in managing access rights and enforcing security protocols. To mitigate these risks, utilities are implementing password protection, multi-tiered access levels, setting-change logs, and automated alerts for unauthorized modifications.

MARKET OPPORTUNITIES

Increasing Renewable Energy Share in Energy Mix to add Market Growth

Rising inclination toward renewable energy in power infrastructure is playing a key role in developing the high voltage protective relay market. According to the International Renewable Energy Agency, (IRENA), in 2022, renewable energy contributed 29.1% of global electricity generation, totaling 8,440 TWh. Renewable capacity surged over the past two decades, reaching a record 473 GW in 2023, representing 85.5% of all new capacity additions. Meanwhile, non-renewable capacity growth has remained below 80 GW annually since 2019. The shift toward solar, wind, and hydropower introduces new challenges in grid stability, fault management, and bidirectional power flow. Unlike traditional power plants, renewable energy sources generate variable and intermittent power, requiring adaptive protection systems to ensure reliable grid operation. High voltage protective relays play a critical role in managing these fluctuations by enabling real-time fault detection, isolation, and system restoration to prevent outages and equipment damage.

Furthermore, the decentralized nature of Distributed Energy Resources (DERs), such as rooftop solar and battery energy storage systems, increases the complexity of grid operations, necessitating smart digital relays with advanced communication protocols (IEC 61850, DNP3, Modbus) for seamless coordination. Hence, the rising renewable energy share in the energy mix is expected to drive the global high voltage protective relay market share.

MARKET CHALLENGES

Complexity in Integration and Maintenance to Restrain Market Growth

Integrating high voltage protective relays into older systems often poses significant challenges due to variations in technology, communication protocols, and compatibility. Conventional grid architectures struggle to satisfy the requirements of contemporary power networks, which are increasingly defined by distributed generation and the integration of renewable energy sources.

Protective relay systems demand precise calibration and regular testing to ensure reliability. Practical issues such as current transformer errors lead to false differential currents, causing incorrect relay trips and compromising system security.

HIGH VOLTAGE PROTECTIVE RELAY MARKET TRENDS

Rising Usage of Product in Electric Vehicles to Drive Market Demand

High-voltage protective relays are crucial for handling the connection and disconnection of EV battery packs that function at high voltages (up to 450VDC or greater). These relays ensure safe operation by stopping hazardous voltage spikes during precharge procedures and separating the battery under fault conditions. Features such as arc suppression and rapid disconnection intervals (e.g., under 20 milliseconds) reduce hazards such as contact welding and high-voltage surges, thereby safeguarding the safety of both the vehicle and the operator.

In March 2023, Panasonic Industrial unveiled its latest HE relays, HE-R and HE-S, which have been subjected to improved short-circuit testing. The HE-R relay successfully completed IEC62955, a 10kA short circuit test, which is among the industry’s most stringent safety evaluations. As a result, clients can specify their 22kW wallbox units up to 32A at 10kA short circuit current, ensuring a robust level of protection for EV charging infrastructure.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic had a negative impact on several sectors, including the power sector. The primary reason for the decline in the global market was the disruption in the supply chains. Several manufacturers and service providers faced issues due to the government’s strict regulation which paused the overall operations in multiple countries, including import and export of goods and raw materials. For instance, the Saudi Arabia-Egypt power line project experienced delays due to the pandemic. Egypt’s electricity interconnection project with Saudi Arabia was a result of COVID-19-related restrictions. The Egyptian Electricity Transmission Company postponed the deadline for bid submissions by up to 60 days and all contracts, which were initially scheduled to be signed by the end of May 2020, were deferred.

SEGMENTATION ANALYSIS

By Product Type

Integration of Advanced Technologies Boosts Digital Relays Segment Growth

Based on product type, the market is segmented into electromechanical relays, digital relays, and static relays. Digital relays hold the largest market share of 72.00% in 2026 due to their integration of advanced digital technology, providing enhanced performance, dependability, and precision in comparison to conventional electromechanical relays. These relays facilitate quicker and more comprehensive examination of waveforms, which is essential for contemporary electrical systems that demand high accuracy and reliability.

Static relay is the second dominating segment in the market. Static relays, which depend on electronic components instead of mechanical elements, provide greater reliability, accuracy, and quicker response times. These characteristics render them suitable for contemporary high-voltage systems where rapid fault detection and isolation are essential.

By Application

Rising Electricity Demand Globally Drives Motor Protection Segment Growth

Based on application, the market is divided into generator protection, feeder protection, transmission line protection, motor protection, and transformer protection. Motor protection is leading the market with holding 31.04% share in 2026 due to the rise in industrial automation, the global push for increased power generation worldwide, and the demand for energy-efficient manufacturing. Industries are deploying intelligent relays to protect motors from voltage imbalances, overloads, and phase failures.

Generator protection also holds a considerable market share. Generator protection relays are vital for identifying faults and safeguarding generators, which are critical elements in power plants and industrial environments. These relays make certain that generators function safely and effectively, reducing downtime and economic losses.

By End-User

To know how our report can help streamline your business, Speak to Analyst

Heavy Investments in Infrastructure Upgrades Boost Utilities Segment Growth

Based on end-user, the global market is segmented into utilities and industrial. The utilities segment dominates the market share with 62.58% in 2026 due to the wide use of high voltage protective relays in utility operations. In addition, heavy investments in infrastructure upgrades and grid expansions are driving market growth. As energy electricity demands increase, the utility sector is expanding, which increases the demand for high voltage protective relays.

Industrial is the fastest-growing segment globally owing to the growing operation and R&D on an industrial level. Moreover, the adaptation of energy-efficient equipment in industrial activities is influencing the product demand such as high voltage protective relays. In addition, the rising investments, coupled with the growing population are driving industrial expansion, which in turn creates a need for high voltage protective relays to ensure the efficient operation of equipment.

HIGH VOLTAGE PROTECTIVE RELAY MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Rising Investment in Power Infrastructure Boosts Market Expansion

North America holds a notable share of the market due to the rising deployment of substations and the expansion of transmission and distribution infrastructures. Substations are widely used in industrial machinery and equipment to ensure flawless power delivery, further necessitating protective relays for safeguarding equipment within substations. Government and business initiatives play a vital role in driving the demand for protection relays worldwide, particularly in the U.S. Countries in this region have implemented policies and regulations to promote energy efficiency, reduce carbon emissions, and transition toward cleaner technologies.

Over the past two decades, capital spending on the U.S. distribution system surged by 160% increasing by USD 31.4 billion from 2003 to 2023, primarily due to grid modernization and infrastructure upgrades. Thus, rising investment in power infrastructure in the region is expected to necessitate the demand for high voltage protective relays in the forthcoming years.

U.S.

Shift Toward Renewable Energy Sources to Fuel Market Growth

The U.S. market is projected to reach USD 165.15 million by 2026. The transition to renewable energy sources such as solar and wind is a major catalyst for the expansion of the U. S. high-voltage protective relay market. This movement is transforming the energy sector, leading to decentralized systems and dynamic power grids that necessitate sophisticated relay technologies to guarantee secure integration and grid reliability. Protective relays are essential for identifying faults, isolating problems, and maintaining a stable power supply despite the fluctuations caused by renewable energy sources.

Europe

Rising Demand for Smart Grid Technologies and Grid Connectivity to Fuel Market Growth

Europe's high voltage protective relays market is growing owing to industrial expansion in Germany, France, the U.K., and Italy. Moreover, increasing demand for smart grid technologies, grid connectivity, and utility operations are also key factors influencing the European market. For instance, Germany's Federal Network Agency planned to accelerate power grid expansion, aiming to double completed high-voltage line projects from 440 km to 900 km in 2023. It targets approvals for 2,800 km by 2024 and 4,400 km by 2025. The market is forecast to grow in upcoming years as the demand for renewable sources is increasing. This trend positively impacts the global high voltage protective relay market, driven in part by Europe’s protective developments. The UK market is projected to reach USD 23.84 million by 2026, while the Germany market is projected to reach USD 39.52 million by 2026.

Asia Pacific

Asia Pacific High Voltage Protective Relay Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Growing Industrialization and Urbanization to Propel Market Growth

High voltage protective relay market in Asia Pacific is dominant owing to the availability of manufacturers in India, China, and Japan. In addition, growing urbanization and industrialization in developing countries are influencing the electricity demand. For instance, in February 2025, the Indian government announced at the Madhya Pradesh Global Investors Summit 2025 that Indian Railways is on track to achieve full electrification by FY26, with over 97% already completed. This effort aligns with the goal of making Indian Railways a net-zero carbon emitter by 2030. Similar electrification initiatives in other countries in the region are expected to drive the demand for high voltage protective relays in the coming years. The Japan market is projected to reach USD 62.42 million by 2026, and the India market is projected to reach USD 82.76 million by 2026.

China

Rising Industrialization to Support Market Growth

China market is projected to reach USD 135.52 million by 2026. China dominates the high voltage protective relay market in Asia Pacific due to the rapid expansion of its utilities and industrial sector to meet the rising power demands across allied industries. In 2023, The State Grid Corporation of China initiated the construction of an ultra-high voltage (UHV) power transmission project in the Sichuan Province and Chongqing Municipality, located in southwestern China. The project costs around USD 4 billion and involves the development of 658 km of 1,000 kV double-circuit lines, with some sections being built at elevations above 4,000 meters. In addition, the country's developing manufacturing infrastructure supports efficient mass production of electrical components, meeting both domestic and international demand.

Latin America

Modernization and Expanding Transmission and Distribution Network to Push Market Growth

Latin America is slowly but efficiently working on technologies to deliver reliable power supply to developing countries. The growing demand for electricity in Mexico and Brazil is influencing the growth of electrical components such as high voltage protective relays. The demand for advanced electrical equipment such as protective relays, substations, grid technology, STATCOM, and clean sources is closely associated with utility-scale projects. As modern electrical grids become more complex to meet the rising energy demand of industries and communities, maintaining a proper balance between power demand and supply is essential. Hence, the modernization of power grids, and expansion or replacement of transmission & distribution lines is anticipated to play a key role in driving the high voltage protective relay market growth.

Middle East & Africa

Rising Energy Consumption Coupled by Increasing Population to Fuel Market Growth

The Middle East & Africa has been experiencing rapid expatriate population growth and urbanization, leading to increased energy demand. According to the International Energy Agency (IEA), the per capita electricity consumption in the Middle East reached 5.072MWh/Capita in 2022, around 48% higher than the global average. This has driven the need for more efficient and reliable electrical grid systems and transmission & distribution systems, where high voltage protective relays play a vital role in maintaining grid protection.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Players Focus on Launching New Products to Maximize Asset Utilization

The global market is mostly fragmented, with key players operating in the industry. Globally, ABB is dominating the market. In January 2023, ABB launched the world’s first virtualized protection and control solution to help its customers maximize asset utilization. This innovative solution, named Smart Substation Control and Protection SSC600 SW, enables customers to deploy the hardware of their choice while accessing the same proven protection and control functionality available in ABB’s turnkey solution.

List of Key High Voltage Relay Companies Profiled

- ABB (Switzerland)

- Siemens (Germany)

- Eaton (Ireland)

- GE Vernova (U.S.)

- Toshiba Corporation (Japan)

- Rockwell Automation (U.S.)

- Schneider Electric (France)

- Mitsubishi Electric Corporation (Japan)

- NR Electric Co (China)

- Fanox (Spain)

KEY INDUSTRY DEVELOPMENTS

- June 2024 – Schneider unveiled PowerLogic P7, the latest addition to its PowerLogic product line. Designed for complex and high-demand applications, the PowerLogic P7 is equipped with advanced features and is based on a next-generation platform that is visualization-ready and powered by a single configuration tool, the PowerLogic Engineering Suite.

- April 2024 – GE hosted a seminar at its advanced R&D and manufacturing center in Markham, Ontario, Canada. This event offers an in-depth look at the new Multilin 8 Series- GE’s latest protection relay platform designed for feeders, motors, transformers, and generators.

- February 2023 – ABB’s pioneering all-in-one protection relay REX640, widely used for advanced power generation & distribution applications, is equipped with a third functionality upgrade, which includes technological innovations, fosters safety in the modern grid, and enhances the user experience and safety. These technological advancements are aimed at enhancing safety, improving user experience, and supporting stability in the modern grid.

- December 2022 – Siemens delivered the new protection relays for distribution grids by expanding its family of Reyrolle protection devices with the launch of the 7SR46. The key application for the Reyrolle 7SR46 is to offer overcurrent and earth fault protection in medium voltage distribution transformer stations.

- June 2021 – Toshiba launched the GRW200, an advanced numerical feeder differential protection relay designed for metallic pilot-wire and fiber optic communication channels. It features a unique pilot-wire interface for direct connection to existing protection pilots, along with an upgrade option to fiber optic communication. The GRW200 provides phase-segregated line differential protection, integrated channel monitoring, overcurrent guard schemes, inrush restraint, and backup protection, all within a compact 4U design.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Investments in upgrading and expanding power grids, including transmission and distribution networks, are driving the demand for high voltage protective relays. Moreover, the growth of renewable energy sources, such as solar and wind, necessitates advanced protective relay systems to ensure grid stability and reliability.

- November 2024: Sterling Tech-Mobility Ltd established a manufacturing plant in partnership with Chinese company Kunshan GLVAC Yuantong New Energy Technology for advanced high-voltage DC contactors and relays for electric and hybrid vehicles in Bengaluru, with an investment of USD 46,874.81 million.

This partnership, which focuses on the local production of these automotive components, is projected to create USD 2,929 million in business by FY30, and Sterling Tools will introduce the specialized technology to manufacture and assemble HVDC contactors and relays domestically at a new facility in Bengaluru.

REPORT COVERAGE

The global high voltage protective relay market research report delivers a detailed insight into the market and focuses on key aspects such as leading companies and their operations. Besides, the report offers insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.75% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market was valued at USD 870.62 million in 2025.

The market is likely to grow at a CAGR of 4.75% over the forecast period (2026-2034).

By product type, the digital relays segment leads the market during the forecast period.

The market size of Asia Pacific stood at USD 352.81 million in 2025.

Electrification and industrial expansion a key factors driving market growth.

ABB, Siemens, Eaton, and others are some of the markets top players.

The global market size is expected to reach USD 1,350.82 million by 2034.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us