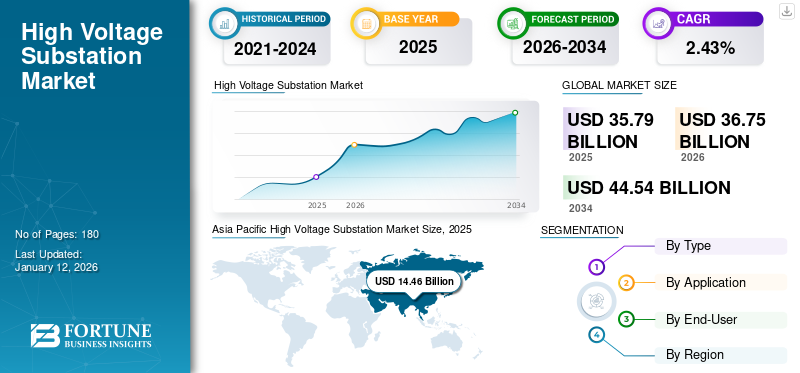

High Voltage Substation Market Size, Share & Industry Analysis, By Type (Gas-Insulated Substations (GIS), Air-Insulated Substations (AIS), and Hybrid Substations), By Application (Transmission and Distribution), By End-User (Utilities and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global high voltage substation market size was valued at USD 35.79 billion in 2025. The market is projected to grow from USD 36.75 billion in 2026 to USD 44.54 billion by 2034, exhibiting a CAGR of 2.43% during the forecast period. Asia Pacific dominated the high voltage substation market with a share of 40.41% in 2025.

The high-voltage substation market is driven by rising electricity demand, increasing utility integration, and growing urbanization, leading to a need for efficient and reliable power infrastructure. As populations and economies grow, so does the demand for electricity, necessitating the expansion and modernization of power grids. Substations are crucial for transforming and regulating voltage levels to ensure efficient transmission and distribution of electricity to meet this growing demand. These factors are anticipated to boost the market share in the coming years.

The global shift toward utility sources such as solar and wind power requires substations to handle the intermittent nature of these sources and integrate them into the grid. Traditional substations are being replaced with distribution substations that offer real-time monitoring, enhanced reliability, and improved operational efficiency. Technological advancements in IoT, AI, and communication systems are enhancing the capabilities of distribution substations.

ABB is a prominent player in the high-voltage substation market, offering a wide range of products and services, including transformers, switchgear, and control systems, with a strong global presence and a history of innovation in the industry. The presence of large players with a wide variety of substation components is expected to drive market growth during the forecast period.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Energy Demand to Drive Market Growth

The market is experiencing growth primarily due to rising global energy demand and the increasing integration of utility sources, which necessitates efficient and reliable power transmission and distribution. The transition to utility sources such as solar and wind power, often located in remote areas, necessitates the development of high-voltage substations to transmit power efficiently over long distances.

- According to the International Energy Association, energy demand increased by 2.2% in 2024. The emerging and developing economies accounted for 80% of the increase in global energy demand.

As cities expand and industries grow, the demand for electricity in urban and industrial areas increases significantly, requiring efficient and reliable power distribution systems, including high-voltage substations. Many existing power grids and substations are aging, requiring upgrades or replacements, creating a need for new high-voltage substations and technologies.

MARKET RESTRAINTS

Increased Adoption of Microgrids to Limit Market Expansion

The growing popularity of utility sources such as solar and wind, coupled with technologies such as microgrids, allows for power generation closer to the point of consumption. This decentralization reduces the need for large, centralized substations to transmit power over long distances. In areas with limited or no grid access, off-grid power systems (like solar-powered systems with battery storage) are becoming increasingly common. These systems further reduce the reliance on traditional substations and transmission infrastructure. The shift toward distributed and off-grid power generation is a key factor influencing the high-voltage substation market, potentially leading to a slower growth rate in the traditional substation segment.

MARKET OPPORTUNITIES

Integrating Renewable Energy into Power Generation to Create Lucrative Opportunities in the Market

The high-voltage substation market is poised for growth due to factors such as increasing utility integration, grid modernization, and the need for a reliable and efficient power supply, creating lucrative opportunities for companies in this sector. The global shift toward utility sources such as solar and wind is driving the need for high-voltage substations to facilitate grid integration. Utility generation often occurs in remote areas, requiring substations to transmit power efficiently over long distances. The integration of utility sources necessitates the development of smart grids and advanced substation technologies for real-time monitoring and control. These factors are anticipated to boost the high voltage substation market growth in the coming years.

- In January 2025, National Utilities Laboratories partnered with Indian state governments to evaluate strategies to integrate utilities into India’s power grid system across the country.

HUGH VOLTAGE SUBSTATION MARKET TRENDS

Long Distance Power Transmission Ability is the Recent Market Trend

The high voltage substations are majorly used for long distance power transmission as they reduce the power losses in the transmission lines and can carry more power than the low voltage lines, especially in the densely populated areas or industrial centers. Also, the these substations lowers the energy cost by reducing the need for larger conductors that improve the overall efficiency of the electrical grid. The countries, namely China, Brazil, and others, have heavily invested in long-distance power transmission for renewable energy integration and the development of cross-border power grids.

- For instance, in January 2025, Adani Energy Solutions Ltd (AESL) formally acquired “Rajasthan Part I Power Transmission Ltd” from bid process coordinator REC Power Development & Consultancy Ltd (RECPDCL).

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Cost-Effectiveness Offered To Augment The Air-Insulated Substations (AIS) Segment Growth

Based on type, the market is classified into Gas-Insulated Substations (GIS), hybrid substations, and Air-Insulated Substations (AIS).

The Air-Insulated Substations (AIS) accounted for the dominant market share as they offer advantages such as cost-effectiveness and easier to expand but require more space and are more susceptible to environmental conditions. The components of AIS are typically more accessible for inspection and maintenance. Also, AIS performs well in areas with moderate climates and where land is readily available, such as rural areas or locations with favorable offsite terrain.

- In August 2023, General Electric signed a contract with Casa dos Ventos, a Brazilian utility company, to develop two 500 kV Air Insulated Substations (AIS) for Serra do Tigre Wind Complex in the municipalities of Currais Novos and Sao Tome in the state of Rio Grande do Norte in Brazil.

By Application

Growing Need for Efficient Energy Distribution Drives the Distribution Segment Growth

Based on application, the market is classified into transmission and distribution.

Distribution emerged as the largest segment owing to the increasing demand for high-voltage power distribution lines for long-distance power transfer with minimal loss. The demand for distribution high-voltage substations is driven by factors such as grid modernization, utility integration, and the need for efficient and reliable energy distribution. Distribution substations are gaining traction due to their enhanced capabilities and cost-effectiveness.

Moreover, industries are increasingly looking for ways to optimize their energy consumption and reduce waste, and distribution substations provide integrated solutions that cater to these demands. Distribution substations offer advantages in power distribution, including reduced physical space, improved safety, and enhanced system reliability.

By End-User

Development of Utility-Scale Grid infrastructure to Boost Segment Growth

Based on end-user, the market is segmented into utilities and industrial.

The utilities segment is expected to dominate the market owing to the high demand for high-voltage substations due to the increasing integration of utility sources and the need for grid modernization. The segment’s market is expected to grow significantly in the coming years.

- In April 2024, Hitachi Energy received a contract to develop a 950 km HVDC transmission system to distribute 6 GW of utilities in India.

High-voltage substations play a crucial role in integrating utility sources such as solar and wind into the grid, enabling efficient transmission of electricity from remote generation sites to demand centers. Utilities projects, often located in remote areas, require substations to connect to the grid and transmit the generated power to consumers.

High Voltage Substation Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Asia Pacific High Voltage Substation Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In North America, the market growth is driven by factors such as increased electricity demand due to urbanization and industrialization, the integration of utility sources, and grid modernization initiatives, leading to a growing market for substation equipment. Moreover, factors such as rising investments in grid modernization, the integration of utilities sources, and the expansion of industrial and commercial sectors are expected to contribute to the growth of the market in the region.

In the U.S., the demand for high voltage substations is driven by the rapid expansion of data centers that are equipped with advanced technologies such as cloud computing, artificial intelligence (AI), big data analytics, and others that require robust & reliable power infrastructure. Also, the power infrastructure in this country is aging, which requires significant upgrades and modernization to the grid which has led to increased investments in the high voltage substations.

- In May 2024, the government of the U.S. launched a joint grid modernization initiative with 21 states for the extension of 100,000 miles of transmission lines in the next five years.

Europe

The European market is expected to grow due to rising electricity demand, increasing utility integration, and the need for grid modernization and replacement of aging infrastructure. As European cities and economies continue to grow, so does the demand for electricity, necessitating investments in robust and efficient power infrastructure, including substations. The development of smart grids, which use advanced technologies to improve efficiency and reliability, also necessitates the deployment of new substations and upgrades.

- In April 2024, the European Commission announced plans to modernize Europe’s electricity grid and renewable-based electrification of energy systems through large-scale investments by 2030.

Asia Pacific

Asia Pacific's market is expected to grow due to increasing electricity consumption, expansion of utility projects, and the need for reliable power transmission and distribution, particularly with the rise of smart grid technologies. Governments in the region are investing heavily in power infrastructure projects, including the development of new substations and the modernization of existing ones.

- In January 2023, China’s state grid corporation announced an investment of USD 77 billion in electricity transmission. Moreover, the organization also announced plans to invest a total of USD 329 billion through the 2021-2025.

Latin America

In Latin America, the market is experiencing growth, driven by increasing energy demand, utility integration, and government initiatives to modernize grids and achieve energy transition goals. The region has abundant utility resources (solar, wind, and hydropower), and the increasing integration of these sources into the grid requires robust high-voltage substations to facilitate long-distance transmission from remote locations. The need to modernize existing grids and strengthen transmission networks for improved reliability and efficiency is also a key driver.

Middle East & Africa

The Middle East & Africa (MEA) region is experiencing a surge in demand for high-voltage substations, driven by rapid urbanization, industrialization, and increasing investments in utilities and power infrastructure. The region’s market is expected to grow significantly in the coming years. Rapid population growth and urbanization in the region are causing a surge in electricity demand, necessitating efficient transmission and distribution infrastructure. Countries such as Saudi Arabia, the UAE, Nigeria, and South Africa are experiencing significant growth in electricity consumption, making high-voltage substations crucial for meeting their energy needs.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies are Focused on Strategic Contracts with Governments Across the Globe to Expand Market Share

The global high voltage substation market share is concentrated with companies such as ABB, Mitsubishi Electric, Netcontrol Group, Rockwell Automation, and others, which account for a significant share. For instance, in June 2023, Senelec announced the commissioning of the first high voltage substation covering an area of six hectares located in the municipality of Sandiara, Africa. The substation will foster a transmission network at high voltage (90 and 225 kV) from power plants. Focusing on significant investments in the enhancement of power transmission has supported the companies’ share in the market.

LIST OF KEY HIGH VOLTAGE SUBSTATION COMPANIES PROFILED

- ABB (Switzerland)

- Mitsubishi Electric (Japan)

- Netcontrol Group (Finland)

- Rockwell Automation (U.S.)

- Schneider Electric (France)

- Siemens (Germany)

- SIFANG (China)

- Tesco Automation (Canada)

- Cisco Systems (U.S.)

- Eaton (U.S.)

- Efacec (Portugal)

- Hitachi Energy (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- February 2025: The Government of Belgium approved the launch of high voltage line substation between Massenhoven and Van Eyck. The high-voltage substation will be constructed in the Lommel region.

- January 2025: Transgrid announced the expansion of utility transmission for HumeLink with Hitachi Energy for the supply of high voltage substation equipment for HumeLink West and East.

- December 2024: MTU collaborated with H&MV Engineering and ABB to launch a distribution substation to support Ireland’s energy transition and power engineering innovations with a major focus on renewables, commercial, utility, data centers, and industrial sectors.

- August 2024: Maharashtra State Electricity Distribution Co. Ltd approved and announced plans to develop ultra-high voltage substation with capacity of 132/22 kV and 220/22 kV in Pune region, India.

- July 2020: Ende Transmisión, a Bolivian state power transmission company, announced plans to construct 500/230 kV Las Brechas high voltage substation. The country’s transmission network mainly consists of 115 kV and 230 kV infrastructure with minimal contribution to grid capacity at 69 kV.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 2.43% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 36.75 billion in 2026 and is projected to record a valuation of USD 44.54 billion by 2034.

In 2025, the market value stood at USD 14.46 billion.

The market is expected to exhibit a CAGR of 2.43% during the forecast period.

The utilities segment led the market by end-users.

The key factor driving the market is increasing energy demand.

ABB, Mitsubishi Electric, Netcontrol Group, Rockwell Automation, and others are the top players in the market.

Asia Pacific dominated the high voltage substation market with a share of 40.41% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us