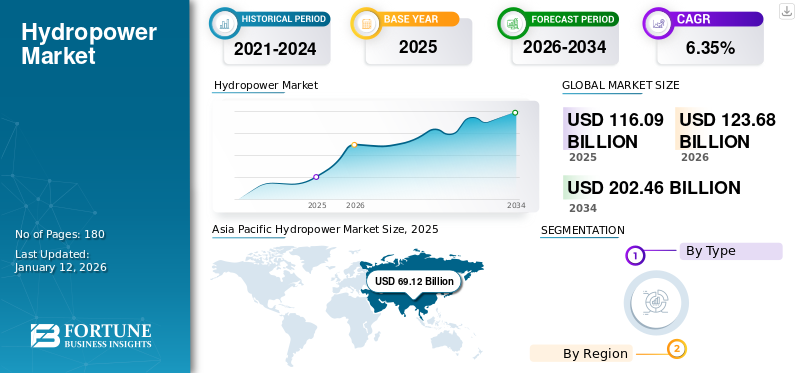

Hydropower Market Size, Share & Industry Analysis, By Type (Small Hydropower and Large Hydropower), and Regional Forecast, 2026-2034

HYDROPOWER MARKET SIZE AND FUTURE OUTLOOK

The global hydropower market size was valued at USD 116.09 billion in 2025 & is projected to be worth USD 123.68 billion in 2026 and reach USD 202.46 billion by 2034, exhibiting a CAGR of 6.35% during the forecast period. Asia Pacific dominated the global market with a share of 59.54% 2025.

Hydropower, often referred to as hydroelectric power, is a renewable energy source that harnesses the energy of moving water to create electricity. It utilizes the continuous and self-renewing process of the water cycle to generate power, utilizing water as a fuel that is neither diminished nor depleted in the process. Rising electricity demand and export opportunities are driving the need for hydropower. For instance, Nepal and the Lao People’s Democratic Republic are developing projects to export electricity.

In 2022, GE Renewable Energy Commission’s 180-MW Bajoli hydro project, a run-of-the-river power plant, was built on the river Ravi in Himachal Pradesh with a head race tunnel of approximately 16 km.

MARKET DYNAMICS

MARKET DRIVERS

Hydropower Plant’s Flexibility and Security of Electricity Systems to Drive Market Growth

Several hydropower plants can ramp up and down their electricity production swiftly compared to other power plants, such as coal, natural gas, and nuclear. These plants can also be stopped and resumed more effortlessly as compared to their non-renewable counterparts. This high level of flexibility allows plant operators to regulate quick shifts in demand and compensate for variations in supply from other electricity sources. This makes hydropower a compelling alternative to support the rapid deployment of and secure incorporation into wind and solar PV electricity systems, whose electricity production can differ depending on factors, such as the weather and time of day. With its capacity to supply large amounts of low-carbon electricity on demand, hydropower is a major asset for building stable and clean electricity systems.

Increasing Government Funding for Renewable Energy and Supportive Policies to Enhance Market Growth

Governments around the world have executed laws to endorse the development and utilization of renewable energy sources, including mandates, tax incentives, and subsidies. In August 2024, the Union Cabinet, led by the Prime Minister of India, sanctioned the Ministry of Power's proposal to grant Central Financial Assistance (CFA) to the state governments of the North Eastern Region (NER). The CFA was granted to ensure their equity involvement in the development of Hydro Electric Projects through a Joint Venture (JV) partnership between state entities and Central Public Sector Undertakings (PSUs). Approximately 15,000 MW of cumulative hydro capacity will be facilitated under this program. The funding for this scheme will come from a 10% Gross Budgetary Support (GBS) allocated to the North Eastern Region from the Ministry of Power’s budget.

MARKET RESTRAINTS

High Capital and Operational Costs to Impede Market Growth

In contrast to a traditional power station, the establishment of a new hydropower facility necessitates a considerable financial commitment and a longer development period. Furthermore, operating costs are significantly elevated due to the remote locations of these facilities, which necessitate regular maintenance. Hence, the substantial capital investment and high operational costs are anticipated to limit the hydropower market growth.

According to the National Renewable Energy Laboratory, the overnight capital cost of New Stream-Reach Developments Projects was around approximately USD 6,574/kW to USD 8,611/kW in 2022. New Stream-Reach Development (NSD) is a greenfield hydropower development in previously undeveloped waterways.

MARKET OPPORTUNITIES

Novel Small-Scale Hydropower Technologies Might Create Lucrative Market Opportunities

Small-scale hydropower technologies are emerging as promising solutions in the renewable energy sector. They could create lucrative market opportunities during the forecast period, especially due to their adaptability in several environments and minimal environmental impact compared to large-scale hydropower projects. Small-scale hydropower systems can be deployed in diverse locations, including rivers, streams, and even irrigation channels, making them feasible for both remote rural areas and urban settings. Gathering and analyzing real-world data to optimize the operational parameters of hydropower turbines enhances grid stabilization services while maintaining the stations' reliability and safety. It is anticipated that an additional 42 TWh could be contributed to the current hydropower energy output through the utilization of digitized hydropower technologies. This rise has the potential to result in yearly operational cost savings of USD 5 billion and a notable decrease in greenhouse gas emissions.

MARKET CHALLENGES

Competition from other Renewables to Challenge market Growth

As the landscape of renewable energy changes, hydropower is progressively facing competition from swiftly expanding sectors such as solar and wind energy. These alternatives frequently offer reduced expenses and quicker development schedules, which may redirect investment from hydropower initiatives. New hydropower projects generally face long lead times, time-consuming clearing procedures, high costs & risks from ecological assessments, and resistance from local communities. These pressures result in higher financing costs and investment risks compared to other storage technologies and power generation, thus discouraging investors. In developing countries, which is the largest untapped market for new hydropower, the desire of hydropower investments is impacted by economic risks, worries regarding the financial health of utilities, and policy hesitations. In developed countries, there is a lack of incentives to modernize old fleets.

HYDROPOWER MARKET TRENDS

Pumped Storage Hydropower (PSH) Becomes Leading Technology in Energy Storage, Driving Market Expansion

This clean energy storage method harnesses gravity to produce electricity. It is the most prevalent type of energy storage on the power grid, with significant growth expected in the coming years. In a PSH system, water can be recycled numerous times, functioning like a rechargeable water battery.

Typically, PSH systems possess large storage capacities and can operate for extended periods. This is vital as they provide reliable power during peak demand. Additionally, their flexibility allows for quick adjustments in power generation levels. As renewable energy sources, such as solar and wind become more integrated into the grid, PSH systems play a crucial role in stabilizing the grid by responding to variations in power supply as electricity generated from solar/wind energy can fluctuate unpredictably.

- In the U.S., the 3 GW Bath County PSH can store energy for 11 hours, supplying power to 750,000 households. However, many PSH systems are designed to store energy for more than 11 hours, with some offering 20 hours or more of capacity.

- According to the International Hydropower Association (IHA), PSH projects around the globe can store as much as 9,000 gigawatt hours (GWh) of electricity.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The economic and health challenges presented by the COVID-19 pandemic highlighted the importance of renewable energy sources like hydropower in delivering clean, sustainable, dependable, and cost-effective electricity. In the short term, widespread uncertainty, fluctuations in currency, and liquidity shortages jeopardized the financing and refinancing of numerous hydropower initiatives. The development of new projects and essential modernization efforts were also stalled due to social distancing regulations and supply chain disruptions.

In certain markets, both demand and prices decreased by over 20% and continued to be highly unstable, with instances of negative pricing reported. However, it is important to note that projects backed by long-term power purchase agreements largely remained unaffected by these challenges.

These factors led to diminishing confidence throughout the hydropower sector, as indicated by the International Hydropower Association’s (IHA) recent member survey after the onset of the crisis. The survey revealed that confidence among respondents dropped by more than 20% (from 77% in the 2018 survey to 56%) regarding its organization’s hydropower revenues over the next 1-3 years.

SEGMENTATION ANALYSIS

By Type

To know how our report can help streamline your business, Speak to Analyst

Large Hydropower Plants Dominate Market Due to Ongoing Construction of Huge-Scale Hydropower Project in Various Regions

Based on type, the market is divided into small and large hydropower plants.

The large type segment is dominating the market. An anticipated rise in investment and government backing for the construction of hydropower plants in India is expected to strengthen the segment’s growth in the coming years. Financial assistance, including grants for infrastructure development, flood protection, and policies facilitating cross-border trade, is being implemented. Indian states, such as Uttarakhand, Punjab, and West Bengal are also endorsing hydropower projects. Additionally, regulations are in place to ensure the timely resolution of disputes related to land access and permissions from relevant authorities. The segment dominated the market in 2024 with a share of 56.96%.

- In May 2023, the National Development and Reform Commission (NDRC) of China announced its approval for the construction of a new hydropower facility in the Xizang Autonomous region, backed by financial assistance of approximately USD 8.43 billion. The plant is expected to generate an annual average electricity output exceeding 11.28 billion kilowatt-hours.

HYDROPOWER MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

North America

Asia Pacific Hydropower Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Increasing Share of Hydroelectric Power in Electricity Generation Boosts U.S. Market

North America is the third largest market anticipated to hit USD 14.75 billion in 2026. In 2023, approximately 6% of electricity in the U.S. came from conventional hydropower, accounting for 31.5% of the total renewable electricity sourced from hydropower. The country has 2,252 hydropower facilities with a combined generation capacity of 80.92 GW. The Grand Coulee Dam, located on the Columbia River in Washington, is the biggest hydropower facility in the U.S., boasting a power generation capacity of 6,765 MW. Furthermore, Canada’s national trade organization, WaterPower Canada (Hydroélectricité Canada), released a series of reports aimed at policymakers to emphasize the vital role of hydropower in meeting the nation’s net-zero objectives. The reports detail the technical requirements of the electricity system and demonstrate how hydropower fulfills these requirements. This included Pumped Storage Hydropower (PSH), the potential to enhance capacity & efficiency at current hydropower installations through upgrades, and an equal comparison of electricity generation costs by source. Meanwhile, the U.S. energy sector is witnessing a significant influx of federal funding due to the passing of landmark legislations, such as the Inflation Reduction Act and the Bipartisan Infrastructure Law.

U.S.

Growing Demand for Clean Energy to Drive Market Growth

Hydropower facilities deliver important grid stability and adaptability by supplying energy generation as needed. They can swiftly increase or decrease output to accommodate changing electricity demands, positioning them as a vital part of the energy mix as more intermittent renewable resources such as solar and wind are incorporated into the grid. This capability boosts the attractiveness of hydropower in light of the growing dependence on renewable energy. The hydropower market in the U. S. is ready for expansion fueled by favorable legislation, a rise in clean energy installations, hydropower's essential contribution to grid stability, modernization initiatives, ecological advantages, and regional prospects. As these elements come together, hydropower is expected to assume an even more crucial role in meeting national clean energy goals and securing a sustainable energy future. The U.S. market is poised to grow with a value of USD 7.66 billion in 2026.

Europe

Growth of PSH is Creating New Demand for Hydropower Solutions

Europe is the second leading region set to grow with a value of USD 24.68 billion in 2026, exhibiting a CAGR of 4.14% during the forecast period (2025-2032). In 2023, Europe experienced minimal progress in launching new greenfield hydropower projects. The demand for system flexibility across the region is creating opportunities for Pumped Storage Hydropower (PSH) while modernizing the current hydropower infrastructure. Spain market is expanding and is projected to reach a market value of USD 16.20 billion in 2025. This will also offer a key chance to boost capacity and improve efficiency. The droughts that affected Europe during the first three quarters of 2022 led to a decrease in hydropower energy output. However, in 2023, hydropower generation rebounded, achieving 637.23 TWh, which is nearly comparable to the average of 666.5 TWh recorded in 2020 and 2021. The updated Renewable Energy Directive from the European Union (EU) at the end of 2023 represented a key step in Europe’s push to decarbonize its energy systems, thereby setting ambitious goals for renewable energy to account for at least 42.5% of the total energy consumption by 2030. Germany is set to be worth USD 1.05 billion in 2026, while Italy is foreseen to gain USD 1.52 billion in the same year.

- In 2023, Norway installed the largest hydropower capacity in Europe, exceeding 33.9 gigawatts. Turkey was a close second, with approximately 32.5 gigawatts installed. The total hydropower capacity in Europe approached 259 gigawatts that year.

Asia Pacific

Developing Asian Countries are Creating Opportunities for Market Growth

Asia Pacific held the largest revenue share valued at USD 69.12 billion in 2025 and USD 74.61 billion in 2026. In addition to the leading hydropower nations, smaller countries in Southeast Asia are progressing swiftly with the development of large hydropower plants. The increasing energy demand to fuel the Mekong economy has piqued the interest of riparian nations in hydropower initiatives. Significant investments in hydropower projects throughout the region in recent decades demonstrate this trend. Japan is set to reach USD 22.79 billion in 2026, while India is expected to stand at USD 4.51 billion in the same year.

Asia boasts a total installed capacity of approximately 519 GW, with around 74 GW coming from pumped storage, making it home to over a third of the global hydropower output. The Indonesian government has acknowledged the importance of hydropower in achieving its net zero emissions goal by 2060. The country is actively harnessing its hydropower resources, with the Mentarang Induk hydropower plant expected to be Indonesia's largest, featuring a capacity of 1,375 MW. Additionally, it plans to resume the development of the 9,000 MW Kayan hydropower project in North Kalimantan, which had previously been halted.

- Moreover, in February 2023, India sanctioned a USD 3.9 billion investment for the 2,880 megawatt (MW) Dibang hydropower project in Arunachal Pradesh by the National Hydroelectric Power Corporation (NHPC), with an estimated construction period of nine years.

China

Rapid Infrastructure Facilities to Boost Growth of Hydropower Industry in China

China remains a global frontrunner in the development of new hydropower projects. In 2023, the nation commissioned 6.7 GW of additional capacity, which included over 6.2 GW of Pumped Storage Hydropower (PSH). This is part of China's broader goal to add as much as 80GW of new PSH capacity by 2027. Other countries in the region also have various projects underway.

In 2022, China's hydropower production reached 1.3 petawatt hours. The country's hydroelectric output hit its highest point in 2020, nearing 1.4 petawatt hours, marking an increase of approximately 51 terawatt hours from the year before. Benefiting from significant spring rains, China has been able to capitalize on its extensive cascade dams, resulting in a sharp increase in hydroelectricity production and a decrease in reliance on coal-fired power in May.

In May 2024, hydropower generation soared to 115 billion kilowatt-hours (kWh), a rise from 82 billion kWh during the same month the previous year, when river levels were adversely affected by a prolonged drought. This was the second-highest level of hydro generation recorded for this time of the year in the past decade and a record 122 billion kWh was achieved following heavy spring rainfall in 2022. China is projected to reach a market value of USD 32.63 billion in 2026.

Latin America

Hydropower Serves as Significant Source of Electricity in Latin America

Latin America is the fourth largest market expected to hold USD 6.46 billion in 2026. Hydropower plays a significant role in electricity generation across Latin America, representing 45% of the region's overall electricity supply. As of 2019, the aggregate installed hydropower capacity in the region reached 196 gigawatts (GW), with South America contributing 176 GW. Brazil leads the region in hydropower capacity, boasting over 109.9 GW of installed capacity as of 2023. To bolster the resilience of hydropower in Latin America against climate change, governments are exploring the development and enhancement of climate risk insurance, simplification of regulatory approval processes, and planning & execution of national and regional transmission.

Middle East & Africa

Global Warming Impacts Growth of Hydropower Market in MEA

Severe drought and lack of water are affecting communities across Africa, South America, and the Middle East, with experts attributing the situation to both human-induced climate change and the El Nino weather phenomenon.

As water scarcity is forecasted to increase in a warming environment, the resulting pressure on irrigation and freshwater resources also impacts hydroelectric power production, an essential low-carbon energy source dependent on flowing rivers.

In the Middle East, hydropower capacity is declining over the years, particularly in the once-lush Euphrates-Tigris river basin, which was noted by Benjamin Pohl, head of program climate diplomacy and security at the German think tank Adelphi, as one of the fastest-drying regions on earth. Oman market is forecasted to be valued at USD 0.78 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Industrial Participants are reinforcing their Market Position by Holding Expertise from Initial Studies to Installation

The global hydropower market share is mostly fragmented, with key players operating in the industry. Globally, GE Renewable Energy (Vernova), Tata Power, Toshiba are dominating the market. GE Vernova has abilities in all aspects of the hydropower sector, i.e., from initial studies to design, construction & management, installation & maintenance, operation, etc.

GE Renewable Energy (Vernova) was a manufacturing and services division of the American company General Electric. It is an American multinational conglomerate that was established in 1892, incorporated in New York, and headquartered in Boston.

GE's portfolio includes a diverse range of hydropower plants, encompassing both high and low head, storage, and run-of-river systems. It ensures that hydro plants achieve optimal performance and reliability, with one focused point of contact to facilitate effective collaboration with all parties involved during the development and after.

List of the Key Companies Profiled in the Report:

- Toshiba (Japan)

- Centrais Eletricas Brasileiras (Brazil)

- RusHydro (Russia)

- Statkraft (Norway)

- ANDRITZ AG (Austria)

- Siemens Energy AG (Germany)

- GE Renewable Energy (France)

- Voith GmbH (Germany)

- KONČAR (Croatia)

- Iberdrola SA (Spain)

- China Yangtze Power Co Ltd (China)

- Alstom Hydro (France)

- Tata Power Company (India)

- American Hydro Corp (U.S.)

- ABB Ltd (Switzerland)

- Veolia (France)

KEY INDUSTRY DEVELOPMENTS:

- In September 2024, Toshiba announced plans to intensify its efforts in Bulgaria to restore the functionality of the Chaira pumped-storage hydropower plant (PSHPP) and have it operational again as soon as possible, as stated by the Bulgarian government in Sofia. This collaboration was established during a meeting between Minister of Energy Vladimir Malinov and Takehiko Matsushita, Vice President of the Power Systems Division at Toshiba Energy Systems & Solutions Corporation.

- In November 2023, GE Vernova’s Hydro Power division was chosen by Tacoma Power to renovate two turbine and generator units, each rated at 27 MW/33 MVA, at the Cushman II hydropower facility, which has a total of three units on site. The project covered the design, production, renovation, installation, and commissioning of two new generator stators, refurbishment of the generator rotor poles shaft thrust bearing, installation of two new turbine distributors, and renovation of the turbine runner and draft tube.

- In July 2022, GE commissioned the 180 MW Bajoli hydroelectric project in Himachal Pradesh. The project was eventually connected to the grid, with each of the three 60 MW units producing electricity. This facility provides hydropower to the Indira Gandhi International Airport in Delhi, which has recently become the first airport in India to operate entirely on hydro and solar energy.

- In March 2022, ANDRITZ and the Electricity Generating Authority of Thailand (EGAT) entered a Memorandum of Understanding (MoU) to collaboratively investigate and enhance business prospects for hydropower initiatives in Thailand and neighboring Southeast Asian nations.

- In July 2021, KONČAR, a Croatian company specializing in transport, electrical, and energy sectors, announced its inaugural contract in Japan to produce, oversee, and design three generator assemblies for two small hydropower plants (SHPPs). The initial phase of the project will be completed upon the commissioning of the synchronous generator with a nominal power of 5.2 MVA. In comparison, the second phase will conclude once the designation of the synchronous generator with a nominal power of 5.2 MVA is finalized, as stated by the company.

INVESTMENT ANALYSIS AND OPPORTUNITIES

As the transition to clean energy progresses, there are number of exciting developments in the consumption of renewable energy sources, such as hydropower. However, with the increasing connection of variable renewables to the grid, there's a greater demand for stable, adaptable, and renewable power, along with storage solutions to balance supply and demand.

The hydropower's long-standing reputation as a dependable energy and storage provider might paradoxically contribute to the perception that investment opportunities in it are exhausted. On the contrary, hydropower, which includes Pumped Storage Hydropower (PSH), still possesses significant potential for expansion, especially in the realm of small- to medium-sized projects that generate up to 30 megawatts of power.

- Nepal and Bhutan are inviting Indian investments to enhance their hydroelectric production and sell excess electricity to New Delhi, according to officials from both the nations during an industry event. India, with a target of achieving net zero emissions by 2070, is in search of renewable energy sources to support its economic growth. Nepal and Bhutan currently export 2,070 megawatts and 700 megawatts of surplus power to India, respectively.

REPORT COVERAGE

The market analysis provides an in-depth perspective of the market’s size. It emphasizes important elements, such as prominent companies and their activities in hydropower, as well as hydroelectric power generation. Furthermore, the analysis presents information on market trends and technologies while showcasing significant industry advancements. Alongside these factors, the report includes various challenges and factors that have played a role in the market's decline and growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.35% from 2026 to 2034 |

|

Unit |

Value (USD Billion), Volume (MW) |

|

Segmentation |

By Type

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 116.09 billion in 2025.

The market is likely to record a CAGR of 6.35% over the forecast period of 2026-2034.

Based on type, the large hydropower segment is expected to lead the market during the forecast period.

The market size of Asia Pacific was valued at USD 69.12 billion in 2025.

Hydropower plant’s flexibility and security of electricity systems will drive the market’s growth.

Some of the top players in the market are Siemens Energy AG, Tata Power, Toshiba, GE Renewable Energy, and others.

The global market size is expected to reach a valuation of USD 202.46 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us