Advanced Energy Storage System Market Size, Share & Industry Analysis, By Technology (Lithium-ion Battery, Solid State Battery, Flow Battery, Thermal Energy Storage, Pump Hydro Storage, and Others), By Application (Residential, Commercial, Industrial, and Utility), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

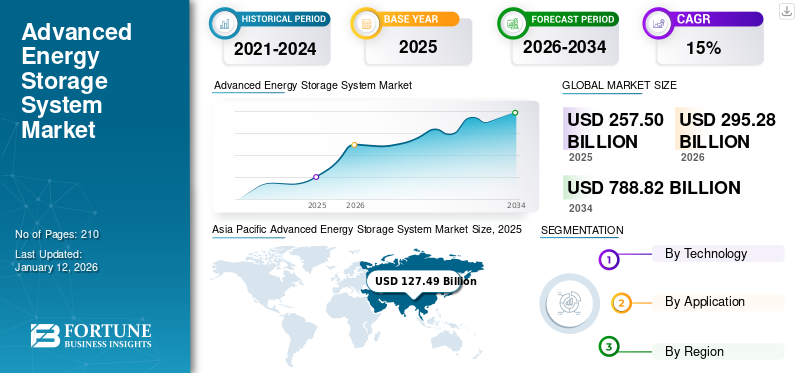

The global advanced energy storage system market was valued at USD 257.50 billion in 2025 and increased to USD 295.28 billion in 2026, reaching USD 788.82 billion by 2034, registering a CAGR of 15.07% during 2026–2034. Asia Pacific dominated the advanced energy storage system market with a market share of 49.51% in 2025.

Advanced Energy Storage System (ESS) are sophisticated technologies designed to store and manage electrical energy efficiently. These systems encompass various technologies such as batteries, pumped hydro, and thermal storage, enabling better grid stability and renewable energy integration. Key applications in the storage systems market include electric vehicles, grid storage, and smart infrastructure. ESS technologies are critical for addressing energy challenges, supporting sustainable development and optimizing energy consumption across multiple sectors.

ABB is one of the leading players in the advanced energy storage system market, offering fully digitalized energy storage solutions that enhance grid efficiency. Their energy storage portfolio includes factory-built, pre-tested solutions that can be deployed directly to customer sites, providing faster installation and higher savings. The company has been a key contributor to the development of grid-scale Battery Energy Storage Systems (BESS), which is a significant project in the Philippines aimed at stabilizing the grid and facilitating the integration of renewable energy sources.

MARKET DYNAMICS

MARKET DRIVERS

Rising Peak Energy Demand Coupled with Favorable Policy Framework to Aid Market Growth

The growing population across the world, coupled with growing initiatives to boost rural electrification, has led to higher peak energy demand. Besides, the increased rate of urbanization and the emergence of new infrastructure projects have further increased power supply demands from utilities.

For example, as per the Italian Transmission System Operator (TSO), Terna S.p.A., the total peak load in the country reached a maximum of around 55.16 GW in 2020. The company further stated that the lowest value of the national peak load was around 37.44 GW in the same year, observing a steep change of over 47.3% between the lowest and highest demands.

Furthermore, regulatory policies introduced by different authorities to promote low-carbon technologies have positively propelled the battery energy storage market. Energy storage systems are increasingly integrated with renewable technologies such as solar & wind power. Consequently, substantial targets to cut the carbon footprint coupled with efforts to boost the use of green technologies in the primary energy generation mix are likely to contribute to the advanced energy storage system market growth.

Increase in Demand for Energy-efficient Batteries to Drive Energy Storage System Market

The growth of renewable energy sources, such as solar and wind, has created a need for effective energy storage to address the intermittent nature of these power sources. Battery storage systems can store excess energy generated during peak production periods and discharge it when demand is high or when renewable sources are not generating enough power.

Governments around the world are implementing policies and regulations to support the adoption of renewable energy and Advanced Energy Storage System technologies. For example, the Inflation Reduction Act (IRA) passed in the U.S. in 2022 provides over USD 369 billion in funding for clean energy technologies, including significant tax credits for energy storage projects. Similarly, China has announced plans to install over 30 GW of energy storage capacity by 2025. India has set ambitious targets for Advanced Energy Storage System development in its draft National Electricity Plan. These policy initiatives are expected to drive significant growth in the energy storage and lead acid battery market, with global installations projected to reach 411 GW by the end of 2030.

MARKET RESTRAINTS

High Initial Investment Cost to Restrain Market Growth

The major factor that can restrain the advanced energy storage system market share is the requirement for substantial capital investments. These systems are mainly deployed in large ESS and BESS plants to meet energy demand, mainly at peak loads. For instance, the Energy Sector Management Assistance Program (ESMAP), a special unit administered by the World Bank, reported that the total installed cost of various energy storage technologies can vary substantially, ranging from USD 2,000 per kW to around USD 3,300 kW, which affects initial capital expenditures.

However, continuous research and development aimed at improving the performance features of batteries is likely to mitigate this challenge and support market growth during the forecast period.

Furthermore, the growing commercialization of other low-carbon power generation and propulsion technologies, such as fuel cell systems powered by hydrogen fuel cells and energy storage carbon fiber, may divert the investments away from energy storage projects, potentially slowing market growth.

MARKET OPPORTUNITIES

Rapidly Expanding Grid Infrastructure across the Globe Presents New Market Opportunities

The increase in demand for energy with fewer carbon emissions has resulted in increasing investments in the renewable energy sector. This has led to the construction of new grids and the required infrastructure for the transmission of power.

For instance, in October 2024, the U.S. Department of Energy (DOE) announced a significant investment of USD 1.5 billion aimed at enhancing the national electricity grid infrastructure. This funding would support four major transmission projects across various states, adding approximately 1,000 miles of new development and increasing capacity by 7.1 GW. Key projects include the Aroostook Renewable Project in Maine, which will construct a new substation and a 111-mile transmission line, and the Cimarron Link in Oklahoma, which will establish a 400-mile HVDC line for renewable energy transmission.

MARKET CHALLENGES

Dependency of Raw Material May Challenges Industry Development

The advanced energy storage system market faces a critical challenge due to material scarcity, with limited global reserves of rare earth metals such as lithium, cobalt, and nickel, creating significant supply chain vulnerabilities. Geographically concentrated mineral resources, high extraction costs, and geopolitical dependencies threaten the scalability and affordability of battery technologies. This challenge demands urgent innovation in alternative material development, recycling strategies, and diversified sourcing to sustain the continuous growth of advanced energy storage systems.

According to IEA, global rare earth reserves are estimated at 110-130 million metric tons, with China controlling the majority of global reserves, creating significant supply vulnerabilities. Moreover, global rare earth production reached 350,000 metric tons in 2023, with China producing around 240,000 tons, representing almost 70% of worldwide output.

ADVANCED ENERGY STORAGE SYSTEM MARKET TRENDS

Rising Demand for Electric Vehicle (EV) Battery Storage Systems to Amplify Product Demand

The advanced energy storage system market is experiencing a significant trend driven by the exponential growth of electric vehicles. Global EV battery demand is accelerating, with market projections indicating substantial expansion in energy storage technologies tailored for automotive applications. The market is witnessing increased investments in high-capacity, efficient battery technologies that power vehicles and enable bidirectional energy flow between electric vehicles and power grids.

For instance, according to IEA, the global Electric Vehicle (EV) market is experiencing significant growth, with nearly 14 million electric cars sold in 2023, representing a 35% year-on-year increase. China dominates the market with 60% of global EV sales, followed by Europe and the U.S.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic severely disrupted the energy storage systems market by halting production and supply chains. Manufacturing of battery systems and electric vehicles experienced significant slowdowns, temporarily reducing market growth and investments. However, the sector quickly adapted, with an accelerated digital transformation and a renewed focus on renewable energy technologies. Market recovery is now underway, driven by increasing production of electric vehicles and rising demand for sustainable energy.

SEGMENTATION ANALYSIS

By Technology

Pump Hydro Storage System Segment Dominates Due to its High Energy Storage Requirements

Based on technology, the market is segmented into lithium-ion battery, solid state battery, flow battery, thermal energy storage, pump hydro storage, and others.

The pump hydro storage system holds the largest market share of 75.06% in 2026, as it can store excess energy generated during low-demand periods by pumping water to an elevated reservoir and releasing it during peak demand, thereby stabilizing the grid and ensuring a reliable power supply. This capability makes pump hydro an essential component for utilities aiming to enhance grid stability while transitioning to cleaner energy sources.

The lithium-ion battery exhibits the highest growth rate as demand for lithium-ion energy storage systems has witnessed considerable growth owing to their long-standing presence and operational characteristics. Additionally, the flexibility of these systems, which are easily integrated across various applications and growing measures to combat power outage situations in countries, are likely to augment the segment growth.

By Application

To know how our report can help streamline your business, Speak to Analyst

Utility Segment Accounts for Major Share Due to Increasing Electrification Initiatives

Based on application, the market is sub-divided into residential, commercial, industrial, and utility.

The utility segment accounts for a major share in the industry due to increasing electrification initiatives to power distant and remote locations. Furthermore, developing hybrid energy storage systems and the potential to respond to a variety of needs is expected to be a key factor driving segment growth.

The residential sector is more sensitive to power outages than the residential sector. The increasing reliability of Battery Energy Storage Systems (BESS) and the decrease in the cost of these systems are major drivers that are expected to propel the adoption of BESS in the commercial and industrial sectors, creating an opportunity for growth in the market during the forecast period.

ADVANCED ENERGY STORAGE SYSTEM MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Asia Pacific Advanced Energy Storage System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Renewable Energy Integration and Battery Deployment Driving North America Market

Governments in North America, particularly in the U.S. and Canada, have implemented stringent regulations regarding the disposal and recycling of lead-acid batteries. The North America market is valued at USD 43.69 billion by 2026. For instance, the shift toward renewable energy sources such as solar and wind is a significant driver of ESS demand. As these sources are inherently intermittent, energy storage systems are essential for balancing supply and demand. The U.S. energy storage systems market is projected to reach over USD 240 billion by 2032, largely due to the increasing integration of renewables into the grid.

Investments in renewable energy projects are accelerating. For instance, California and Texas are leading states in large-scale battery storage installations, with California Independent System Operator (CAISO) accounting for about 34% of the country's installed capacity. These investments create a robust market for ESS as they help mitigate the intermittency of renewable generation.

U.S.

Increasing Investment in Developing Large-Scale Projects to Drive Industry Development

The U.S. is the leader in the North American energy storage system market due to the increasing investments in developing large-scale projects, establishing a robust policy framework, and availability of colossal infrastructure. The U.S. market is valued at USD 41.62 billion by 2026. Most of the largest ESSs in the U.S. use the electric power grid as their charging source. An increasing number of battery ESSs are paired or co-located with a renewable energy facility, which in some cases may be used directly as a charging source. The advanced energy storage market in the U.S. is projected to grow significantly, reaching an estimated value of USD 86.75 billion by 2032.

Europe

Supportive Regulatory Landscape and Infrastructure Investment to Drive Market Growth

The increase in demand for energy storage systems in Europe is driven by the urgent need for renewable energy integration, supportive regulatory frameworks, and substantial investments in infrastructure. As Europe continues its journey toward a carbon-neutral future, ESS will play an increasingly pivotal role in balancing supply and demand across various sectors. The UK market is valued at USD 10.35 billion by 2026, and the Germany market is valued at USD 19.81 billion by 2026.

For instance, the European Union Clean Energy Package and the revised Renewable Energy Directive (RED II) create a favorable regulatory environment for BESS deployment. These policies aim to increase renewable energy consumption and enhance flexibility in the electricity system, thereby driving demand for storage technologies. Furthermore, initiatives such as REPowerEU aim to reduce energy dependence and advance decarbonization efforts, highlighting the importance of energy storage in achieving these goals.

Asia Pacific

Growing Demand for Energy Drive Market Growth in Asia Pacific

The Energy Storage System market is experiencing significant growth across the Asia Pacific region due to increasing energy demand, rising renewable energy deployment, and a desire for grid stability. In this region, China is a dominant player in advanced energy storage systems. For instance, in India, the National Monetization Pipeline and the National Energy Storage Mission aim to outline a long-term strategy for energy storage deployment. The government has also proposed incentives for manufacturers and consumers to adopt ESS solutions, helping to drive the market forward. India aims to reach 450 GW of renewable energy capacity by 2030.

China

Lithium-Ion Dominance and Technological Diversification Drive Chinese Market

The Chinese energy storage landscape is predominantly characterized by lithium-ion battery technologies, which currently account for around 90% of electrochemical storage capacity. However, the market is rapidly diversifying, with emerging technologies such as flywheel storage, supercapacitor systems, and compressed-air facilities gaining traction. Industry projections suggest that China's cumulative new energy storage capacity could increase significantly, reaching between 221 GW and 300 GW by 2030. This shift signals a transformative change from policy-driven to demand-driven market dynamics. The China market is valued at USD 66.8 billion by 2026, and the India market is valued at USD 39.82 billion by 2026.

Latin America

Rising Electricity Demand to Fuel Market Growth in Latin America

The advanced energy storage system market in Latin America is poised for substantial growth, primarily driven by the utility sector, which is responding to increasing electricity demand, a focus on behind-the-meter projects, renewable energy integration, and emerging regulatory frameworks. Chile is emerging as a leader in energy storage within the region, with significant projects such as ENGIE's BESS Coya, which began commercial operations in March 2024. This facility has a capacity of 638 MWh and is designed to store renewable energy generated from a co-located solar plant. It can deliver an average of 200 GWh annually, enough to power around 100,000 homes while reducing CO2 emissions by approximately 65,000 tons per year. The Latin America market is valued at USD 7.26 billion by 2026.

Middle East & Africa

Rapid Electrification and Large-Scale Renewable Projects to Support Market Expansion

The advanced energy storage market in the Middle East & Africa (MEA) is undergoing a remarkable transformation driven by ambitious renewable energy targets, rapid electrification, and decarbonization strategies. The United Arab Emirates (UAE) and Saudi Arabia are leading the transition by investing in large-scale renewable projects supported by ESS. The UAE's Masdar has initiated projects combining solar power with lithium-ion battery storage to stabilize the grid and manage peak demand. In Saudi Arabia, the government launched the NEOM project, an advanced city powered entirely by renewables, integrating ESS to support 100% renewable energy usage. Additionally, the Red Sea Project is another initiative where ESS will be used to enable off-grid renewable power solutions. The Middle East & Africa market is valued at USD 5.67 billion by 2026.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on Providing Products and Solutions to Strengthen their Market Position

The global advanced energy storage system market has observed a significant number of key market players delivering a wide range of products and solutions to fortify their market position. The industry has also experienced steady involvement from global and regional players, along with several small & medium scale system integrators.

ABB is projected to hold a substantial market share owing to its ability to deliver cost-effective energy storage solutions that can be integrated with various renewable technologies for better applicability. Furthermore, collaborative operations such as the setup of Fluence as a joint venture is expected to enhance its reach across utility, industrial, and infrastructure sectors, offering the company an added advantage.

List of Key Advanced Energy Storage System Companies:

- ABB Ltd (Switzerland)

- AES Corporation (U.S.)

- Ecoult (Australia)

- LG Chem Ltd. (South Korea)

- Tesla, Inc. (U.S.)

- GS Yuasa Corporation (Japan)

- Samsung SDI (South Korea)

- General Electric (U.S.)

- Mitsubishi Heavy Industries (Japan)

- Toshiba Corporation (Japan)

- Panasonic Corporation (Japan)

- Saft Groupe S.A. (France)

- Hitachi (Japan)

- Sonnen Gmbh (Germany)

- Lockheed Martin (U.S.)

KEY INDUSTRY DEVELOPMENTS

- July 2024: Tesla Energy signed an agreement to supply its Megapack batteries to Intersect Power in a multi-billion dollar deal that will extend through 2030. Under this agreement, Tesla would supply 15.3 GWh of Megapacks over the coming 6-7 years, which would support large-scale solar and Battery Energy Storage Systems (BESS) in California and Texas.

- June 2024: ABB and Cleanwatts Digital s.a. (Cleanwatts), which is a software solutions provider for Artificial Intelligence (AI)-driven energy-sharing in connected, sustainable communities, signed a MoU to build enhanced energy management. This collaboration would combine Cleanwatts' advanced energy-sharing platform with ABB's high-quality energy management technology, such as the InSite energy management system, energy meters, sensors, and electric vehicle chargers.

- September 2024: Eaton collaborated with Tesla to design and boost the functionality of home energy storage and solar installations in North America by 2025. Tesla's Powerwall is aimed at supporting Eaton's new AbleEdgeTM smart breakers and making it easier and faster for customers to achieve intelligent load management functionality that helps optimize energy use and extend backup.

- March 2024: GS Yuasa Corporation received orders for a 14.9MWh lithium-ion battery storage system from a joint venture company jointly established by the sub-subsidiary of Mizuho Leasing Company and Tohoku Electric Power Co., Inc. The battery storage system is characterized by a high level of safety, with the voltage of all cells being monitored and the temperatures of all modules being controlled, thus helping prevent potential issues.

- June 2023: AES Corporation acquired a 2 GW Bellefield project in California, which is the largest permitted solar-plus-storage project in the U.S. This acquisition strengthens the company's position in providing renewable energy solutions to commercial sectors under long-term contracts. Phase one of the project includes a 15-year Power Purchase Agreement (PPA) to deliver hourly, carbon-free energy to an existing AES corporate customer.

INVESTMENT ANALYSIS AND OPPORTUNITIES

- Investing in advanced energy storage technologies presents substantial growth prospects. Targeted investment in research and development, scalable manufacturing, and favorable policy frameworks will propel market growth over upcoming years. These investments enable cost savings, improved performance, and broader acceptance in multiple industries, cultivating a strong and competitive energy storage market.

- There is continuous investment and development of various energy storage systems. For instance, in February 2025, Hydrostor, a worldwide developer and operator of Long-Duration Energy Storage (LDES), has obtained a USD 200 million investment from Canada Growth Fund Inc. (“CGF”), Goldman Sachs Alternatives (“Goldman Sachs”), and Canada Pension Plan Investment Board (“CPP Investments”). The deal will aid Hydrostor in its ongoing investment in Advanced Compressed Air Energy Storage (A-CAES) initiatives in Canada and globally.

REPORT COVERAGE

The report delivers a detailed insight into the market, focusing on key aspects such as leading companies and their operations offering advanced energy storage system. Besides, the report offers insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.07% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 295.28 billion in 2026.

The market is likely to grow at a CAGR of 15.07% over the forecast period (2026-2034).

The utility segment leads the market.

The Asia Pacific market size stood at USD 149.01 billion in 2026.

Rising peak energy demand, coupled with a favorable policy framework, are the key factors driving market growth.

ABB Ltd, AES Corporation, Ecoult, LG Chem Ltd., and others are some of the markets top players.

The global market size is expected to reach USD 788.82 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us