India Artificial Intelligence Market Size, Share & Industry Analysis, By Component (Hardware, Software, & Services), By Deployment (On-premise & Cloud), By Enterprise Type (Large, Small & Medium-sized Enterprises), By Technology (ML, NLP, Computer Vision, Robotics & Automation, & Expert Systems), By Function (HR, Marketing & Sales, Product/Service Deployment, Service Operation, Risk, & Supply-chain Management), By Industry (Healthcare, Automotive, BFSI, Retail, Manufacturing, Agriculture, Government, IT & Telecom, Energy & Utilities, & Education), & Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

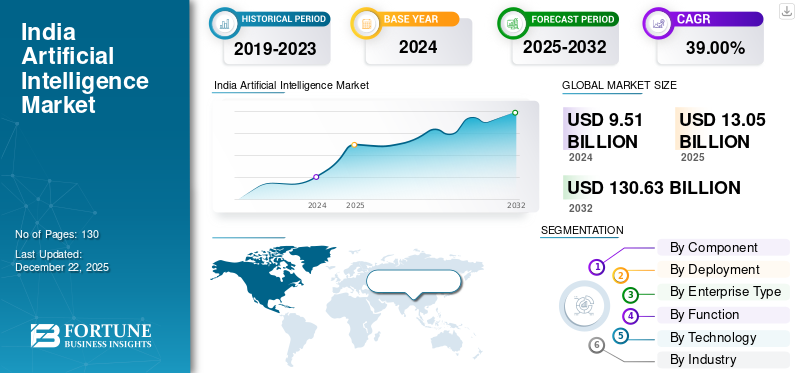

India artificial intelligence market size was valued at USD 9.51 billion in 2024. The market is projected to grow from USD 13.05 billion in 2025 to USD 130.63 billion by 2032, exhibiting a CAGR of 39.00% over the forecast period.

India’s artificial intelligence market is undergoing rapid transformation, positioning the country as a rising global leader in AI development and deployment. With a robust pool of engineering talent, a thriving digital infrastructure, and increasing investments from both government and industry, India is transitioning from a research-centric AI approach to one focused on scalable, real-world applications. For instance,

- According to PIB, India is the fastest-growing hub for AI developers and ranks second globally in public generative AI projects on GitHub, with 16 percent of the world's AI talent, highlighting its growing leadership in AI innovation.

Strategic national initiatives are fostering innovation across key sectors such as healthcare, agriculture, finance, and manufacturing. At the same time, the growing collaboration between academia, startups, and large enterprises is accelerating the development of AI solutions that are not only technologically advanced but also socially relevant and economically viable.

Impact of Generative AI

Generative AI is accelerating growth in the Indian AI market, increasing innovation and widespread adoption across multiple sectors. For instance,

- According to Times of India, India is the second-largest adopter of Generative AI globally, leading in content editing and educational tools. It holds 12% of the global market for AI in content editing and ranks third in productivity tools.

Generative AI helps businesses enhance their efficiency, enables businesses to automate work, and also provides more personalization and customization, increasing demand from large enterprises to include even the smallest SMEs. Indian Government initiatives to bolster AI and societal investment in AI infrastructure increases potential and capability

Impact of Reciprocal Tariffs

Reciprocal tariffs increase the cost of importing critical AI hardware, such as GPU's, inhibiting growth and innovation for Indian AI companies. In many instances, the added cost to run operations and delays to project timelines may weigh more heavily on startups and enterprises. But also, this may incentivize India to drive growth in AI and improve domestic AI capabilities lessening dependence on foreign technology ultimately resulting in long-term independence and resilience.

India Artificial Intelligence Market Trends

Government-Fueled Growth and Socially Responsible AI to be Key Driver for Market Growth

Governments are becoming an important player in advancing artificial intelligence through policy support, infrastructure investment, and regulatory guidance. Efforts are underway to develop holistic ecosystems that support the advancement of new ideas and optimism on responsible and inclusive uses of AI. For instance,

- In July 2025, India launched the SOAR program to teach AI skills to students in grades 6-12 through three 15-hour modules. The initiative aims to bridge the digital divide, providing AI education across rural areas and offering teacher training. SOAR is part of India’s broader goal to develop a future-ready workforce and foster global collaborations in AI.

Dedicated institutions are being created to promote values of alignment, guide responsible use, and establish appropriate standards for transparency, fairness, and accountability.

Key takeaways

- The India artificial intelligence market is projected to be worth USD 130.63 billion in 2032.

- In by component segmentation, software accounted for around 48.8% of the India artificial intelligence market in 2024.

- In the by deployment segmentation, cloud is projected to grow at a CAGR of 40.9% in the forecast period.

- In the enterprise type segmentation, large enterprises accounted for around 63.2% of the market in 2024.

- In the by function segmentation, risk is projected to grow at a CAGR of 42.0% in the forecast period.

- In the technology, machine learning accounted for around 41.4% of the market in 2024.

- In the industry segmentation, healthcare is projected to grow at a CAGR of 46.6% in the forecast period.

India Artificial Intelligence Growth Factors

Expansion of Data Center and Cloud Infrastructure to Boost Market Growth

India is experiencing important growth in data centre and cloud infrastructure, particularly in metropolitan hub locations such as Mumbai, Bengaluru, Hyderabad, and Pune. Significant technology companies such as AWS, Microsoft, and Google are investing heavily in the metropolitan regions to develop best-in-class data centres to offer the required compute power for the new advanced AI workloads, resulting in India artificial intelligence market growth. For instance,

- In September 2025, According to Bloomberg News, OpenAI announced plans to set up a 1-gigawatt data center in India. The company is looking for local partners and has already registered a legal entity in India and started building a team. The data center may be part of OpenAI’s "Stargate" AI infrastructure project, backed by Microsoft, SoftBank, and Oracle.

India Artificial Intelligence Market Restraints

High Cost of Implementation Hinder Market Growth

One of the main constraints in the artificial intelligence market in India is the high cost of implementation which is particularly challenging for small and medium-sized enterprises (SMEs). There is considerable interest in SMEs adopting AI, but the financial implications are often a barrier to entry. The costs part table machine plus the cost of hiring wi-fi connect worker operations and maintenance is often not achievable for SMEs with limited budgets,

India Artificial Intelligence Market Segmentation Analysis

By Component

Based on component, the market is divided into hardware, software, and services.

Software holds a majority India artificial intelligence market share, fueled by growing adoption of AI platforms, frameworks, and applications across every industry seeking to improve decision-making, automation, and user experience. The increasing access to cloud-based tools and open-source libraries has also helped to facilitate the incorporation of AI software into business processes.

Hardware is expected to grow with the highest CAGR, driven by increased demand for high-performance computing, AI-optimized chips, and edge devices. As these AI models continue to grow in complexity and data utilization, investing in the hardware infrastructure to support scalable and efficient deployment is becoming increasingly necessary.

By Deployment

Based on deployment, the market is bifurcated into on-premise and cloud.

In India’s AI market, cloud deployment leads in market share and is also projected to reach the fastest rate, as businesses are increasingly looking to utilize cloud-based AI as they move away from traditional infrastructure to on-demand and agile solutions. The cloud provides organizations with the robust capabilities of AI without a large capital cost, making it an attractive solution for organizations, especially those looking to scale rapidly and remain competitive in their markets. Additionally, recent product launches in the region also support this trend. For instance,

- In August 2025, Krutrim, Ola's AI venture, is developing a sovereign cloud and AI stack for India, focusing on affordability and scalability. Partnering with Cloudera, Krutrim aims to create an AI-powered cloud that simplifies AI application development, addressing India’s unique data and linguistic needs

By Enterprise Type

Based on enterprise type, the market is segmented into large enterprises and SMEs.

Large enterprises currently command a majority share in India's AI market as they can take advantage of greater access to resources, more developed digital infrastructure, and a better strategic approach toward AI adoption over the long term. These firms are the leaders in terms of adoption in automations, analytics, and customer engagement.

SMEs are expected to grow at the highest CAGR, as AI solutions are increasingly available, affordable and geared to the needs of smaller businesses. With a growing appreciation of how AI can support efficiency and competitiveness, more small and medium enterprises are starting to adopt AI to modernize their operations and leverage effective scaling opportunities.

By Function

Based on function, the market is segmented into human resources, marketing & sales, product/service deployment, service operation, risk, supply chain management, and others.

Service holds the majority share in the AI market as businesses strive to improve customer experience, automated workflows, and all-around efficiencies through smart support systems automating service delivery. Many of the use cases have facilitated digital transformation initiatives for many organizations across sectors.

Risk is expected to grow with the highest CAGR due to the fast-growing need for proactive threat detection, compliance monitoring, and risk assessment. Businesses in all sectors are focusing on AI solutions to identify vulnerabilities and lessen risks in real time which is spurring accelerated adoption in this region.

By Technology

Based on technology, the market is segmented into machine learning, natural language processing, computer vision, robotics and automation, and expert systems.

Machine learning is the largest segment of India's AI market, and the segment that is expected to grow the fastest. Its ability to analyze vast amounts of data and improve over time makes it relevant to the broadest range of applications, including anything from predictive analytics to automation and natural language processing. As industries continue to draw on data, intelligent systems, and decision-making capabilities, the desire for machine learning technologies is increasing, which is accelerating the development and growth of the market.

By Industry

Based on industry, the market is segmented into healthcare, automotive, retail, BFSI, manufacturing, agriculture, government and public sector, IT & telecom, energy and utilities, and education.

In the analysis by industry, the BFSI sector holds the largest share of India’s AI market, largely due to its early adoption of AI technology for fraud detection, risk management, customer service, and personalized financial solutions. The sector’s strong focus on digital transformation and data-driven decision-making has made it a key driver of AI demand.

- A report from the Reserve Bank of India suggests that generative AI could enhance Indian banking operations by as much as 46%.

Meanwhile, the healthcare industry is expected to witness the highest growth rate, fueled by increasing investment in AI-powered diagnostics, patient care, and drug discovery. With rising healthcare needs and a focus on improving outcomes, AI adoption in this sector is accelerating rapidly, presenting significant opportunities for innovation and expansion. For instance,

- According to Upgrad, 80% of pharmaceutical and life sciences companies in India have integrated artificial intelligence into their operations, leveraging it to enhance innovation and streamline processes.

List of Key Companies in India Artificial Intelligence Market

The Indian AI landscape is being shaped by leading companies including Bosch India, which is advancing intelligent mobility and smart manufacturing through AI-powered solutions in automation, predictive maintenance, and autonomous systems. Persistent Systems is driving innovation with its AI-led digital engineering services, focusing on intelligent automation, data-driven decision-making, and cloud-native AI platforms for enterprise transformation. Zensar Technologies is accelerating AI adoption across industries by delivering end-to-end AI and machine learning solutions that enhance customer experiences, optimize operations, and support data modernization. Infosys, a global IT leader, is leveraging AI through its Infosys Topaz platform, combining AI, analytics, and cloud to power business agility, operational efficiency, and responsible AI development across sectors such as finance, healthcare, and retail.

LIST OF KEY INDIA ARTIFICIAL INTELLIGENCE COMPANIES PROFILED

- Bosch Ltd (India)

- Persistent Systems (India)

- Zensar Technologies Ltd (India)

- Infosys (India)

- TATA Consultancy Services Limited (India)

- Wipro (India)

- HCL Technologies (India)

- Happiest Minds (India)

- Affle (India)

- Fractal Analytics Inc. (India)

- Jio Haptik Technologies Limited (India)

- ai (India)

KEY INDUSTRY DEVELOPMENTS

- September 2025: Union Communications Minister Jyotiraditya Scindia launched an AI-powered app for India Mobile Congress (IMC) 2025, calling it a gateway to "connections, collaborations and outcomes." The app features live session streaming, AI-based recommendations, networking tools, chatbots, and interactive elements.

- August 2025: Reliance Industries has partnered with Google and Meta to accelerate its AI driven initiatives in India. The company will use Google’s AI and cloud capabilities to drive innovation across sectors and set up a dedicated cloud region in India. It has also launched a joint venture with Meta, investing USD 100 million to develop enterprise-ready AI using an open-source model.

REPORT COVERAGE

This report provides a comprehensive overview of the artificial intelligence (AI) landscape in India, analyzing key trends, market dynamics, and sector-wise adoption. It examines advancements in machine learning, robotics, and edge AI, alongside the role of startups, established tech firms, and research institutions in shaping the ecosystem. The study also evaluates government-led initiatives around ethical AI, funding, and workforce development, offering insights into India’s growing influence in global AI innovation and commercialization.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 39.00% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component · Hardware · Processors (GPU, FPGA, ASIC and CPU) · Memory Systems · Storage Devices · Software · Services · AI Strategy Advisory/Consulting Services · System Integration and Deployment · AI Model Development · Process Automation and Optimization · AI Training · AI-powered Customer Experience · Support & Maintenance |

|

By Deployment · On-premise · Cloud · Public Cloud · Private Cloud · Hybrid Cloud |

|

|

By Enterprise Type · Large Enterprises · Small and Mid-sized Enterprises (SMEs) |

|

|

By Technology · Machine Learning · Supervised Learning · Unsupervised Learning · Reinforcement Learning · Natural Language Processing (NLP) · Speech Recognition · Text Analytics · Language Translation · Computer Vision · Image Recognition · Object Detection · Robotics and Automation · Expert Systems · Rule-based Expert System · Knowledge-based System |

|

|

By Function · Human Resources · Marketing & Sales · Product/Service Deployment · Service Operation · Risk · Supply-Chain Management · Others (Strategy and Corporate Finance) |

|

|

By Industry · Healthcare · Diagnostic AI · Clinical AI · Hospital Management System · Automotive · Autonomous Vehicle · AI in Mobility-as-a-Service · BFSI · Fraud Detection · Risk Management · Algorithmic Trading · Retail · Customer Analytics · AI-powered Marketing and Sales · Supply Chain Automation · Manufacturing · Predictive Maintenance · AI-driven Robotics and Automation · Agriculture · Smart Farming · Yield Monitoring and Optimization · Crop Disease Detection · Government and Public Sector · Smart City Initiatives · Law Enforcement AI · Disaster Management · IT & Telecom · Network Optimization · AI Chatbots · Intelligent Call Routing · Energy & Utilities · Grid Management · AI in Renewable Energy Management · Education · Adaptive Learning Platform · AI-assisted Learning Tools |

Frequently Asked Questions

Fortune Business Insights says that the India Artificial Intelligence market was worth USD 9.51 billion in 2024.

The market is expected to exhibit a CAGR of 39.00% during the forecast period of 2025-2032.

By industry, the BFSI industry is set to lead the market.

Bosch, Persistent Systems, Zensar Technologies, and Infosys are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us