India Dairy Market Size, Share & COVID-19 Impact Analysis, By Type (Milk (Loose Milk and Packaged Milk), Cheese, Butter, Dairy Deserts, Milk Powder, Curd & Yogurt, Cream, and Others) and By Distribution Channel (Supermarkets/Hypermarkets, Specialty Retailers, Online Retail Stores, and Others), 2025-2032

KEY MARKET INSIGHTS

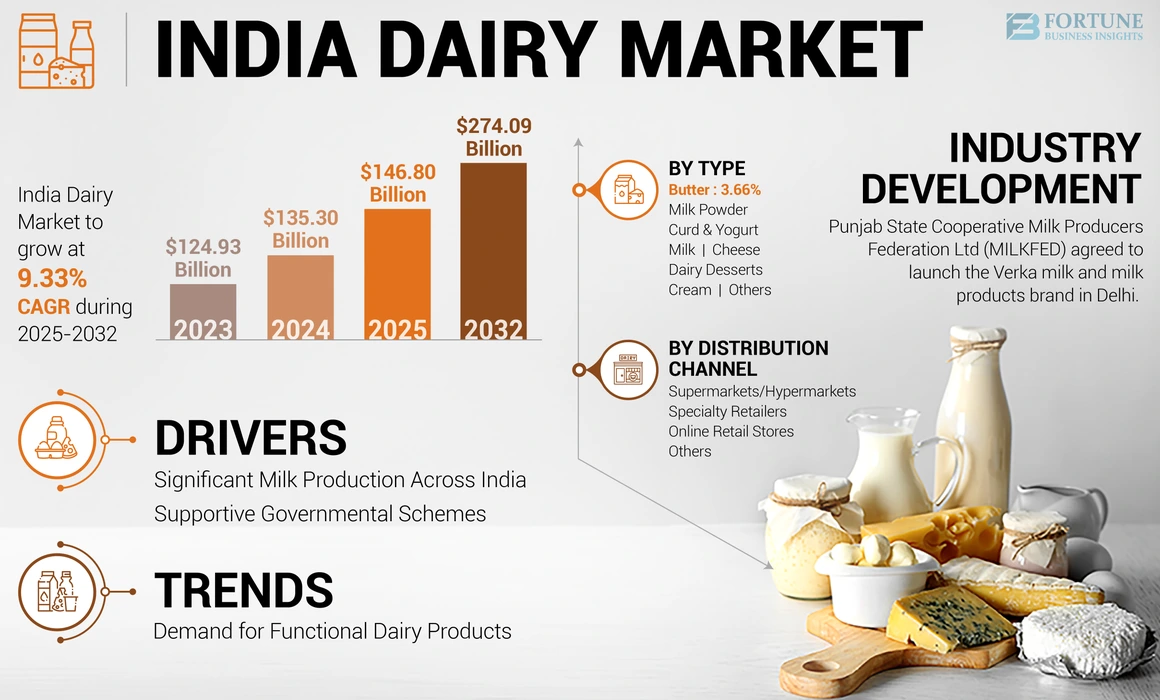

The India dairy market size was valued at USD 135.30 billion in 2024. The market is projected to grow from USD 146.80 billion in 2025 to USD 274.09 billion by 2032, exhibiting a CAGR of 9.33% during the forecast period.

India is currently the largest producer of milk and one of the world's largest exporters of dairy products. The Indian dairy industry contributes 5% to the national economy and directly supports over eight crore farmers. The major producers in India are Uttar Pradesh, Maharashtra, Himachal Pradesh, Madhya Pradesh, Rajasthan, Punjab, and Tamil Nadu. Moreover, the government has taken several initiatives for the development of the dairy industry in India; a few initiatives undertaken by the government to further boost the opportunities in the dairy sector in India are Rashtriya Gokul Mission, National Dairy Development Board (NDDB), State Cooperative Dairy Federations, National Programme for Dairy Development (NPDD), and Dairy Entrepreneurship Development Scheme (DEDS).

COVID-19 IMPACT

Shortage in Supply of Animal Feed Slightly Impacted the Market Growth

During the initial lockdown stage, there was a shortage in the supply of vital inputs, such as feed and fodder, which negatively impacted the India dairy market growth and production of raising animals and caused a huge financial loss. The closure of feed facilities and operation flood made it difficult for animal farms to provide food to their cattle. Dairy producers had to compromise feeding their cattle and buffalo with dry crop residues and bran availability as they lacked sufficient access to the feed supply. According to the National Bank for Agriculture and Rural Development (NABARD), dairy farmers reduced the doses of green and dry fodder, feed, and others to their animals, leading to a decline in their milk capacity. All these factors resulted in a reduction in production in the dairy sectors by about 6% in India within one month of the lockdown period.

Furthermore, in the early stages of the COVID-19 pandemic, consumers could not visit restaurants and cafes due to travel restrictions and lockdowns, which led to increased household consumption and a rise in demand for paneer, ghee, khoya, and other value-added products. This also encouraged the consumers to try new cuisines and prepare meals at home, which increased the demand for these value-added goods throughout the pandemic. In addition, the demand for curd, lassi, buttermilk, and other products increased owing to the onset of some prolonged heat period from April to June, which increased the sale of desserts. The pandemic created challenges for the dairy sector, but the crisis became an opportunity as the demand and supply of value-added dairy products such as butter, ghee, cheese, and others increased and are expected to continue upward.

LATEST TRENDS

Download Free sample to learn more about this report.

Growing Demand for Functional Dairy Products Influences the Market's Potential

The rising trend of using functional dairy products such as vitamins & minerals-fortified milk among health enthusiasts influences the market growth. Thus, customers are proposing their demand for value-added products to boost market growth. For instance, in March 2020, Hangyo, a South Mumbai-based industry, launched a new series of gourmet ice creams fortified with omega-3, 6, and 9. Moreover, in August 2021, Lactalis India announced its first-ever probiotic yogurt drink, Lactel Turbo Yoghurt Drink, in Chennai. The company aims at the "on-go youth" and will be available in mango and strawberry flavors.

Additionally, functional dairy products are recognized as additional nutrient supplements crucial to maintaining long-term health and wellness. For instance, in February 2022, Indian scientists developed a new next-generation probiotic bacterium, "Lactobacillus Plantarum JBC5," and it will be used in fermented dairy products to test its efficiency. Furthermore, the strain claims to improve longevity and healthy aging in the elderly population. Therefore, the trend of functional products in this market is further expected to support market growth.

DRIVING FACTORS

Significant Milk Production Across India Drives the Growth of the India Dairy Market

The dairy industry has been recognized as one of the dynamic sectors in the Indian agricultural industry and has witnessed phenomenal growth in its production and consumption in the last 15 years. The evolution of the dairy sector in India and the remarkable role played by the cooperatives and private dairies further make India the largest milk producer by contributing 23% of global milk production. Furthermore, recent growth in milk production is the changing composition of India's uniquely structured dairy herd. According to the data from the USDA's report on India Dairy and Products Annual 2021, around half of India's milk production is from water buffalo, and the other half is from cattle, including indigenous breeds and crossbred animals. Therefore, the huge availability of milk in the country boosts the production of value-added or processed products such as cheese, butter, curd, yogurt, ghee, and paneer. In addition, milk has strong demand in Indian households considering it wholesome food and drives the market growth.

Supportive Government Schemes to Contribute to the Stellar Growth of the Market

Dairy farming is one of the utmost components of agricultural activities in almost every part of the world, including India. The dairy industry in India serves as a tool for socioeconomic development. Thus, the Government of India is extensively working toward maintaining the standards of the industry by introducing different schemes/initiatives across the India market. The scheme includes National Action Plan for Dairy Development (NAPD), National Programme for Dairy Development (NPDD), Interest Subvention on Working Capital Loans for Dairy Sector, Nationwide Artificial Insemination Programme (NAIP), and the National Animal Disease Control Programme. These government schemes have different aims; for example, the NAPD Indian scheme is aimed to increase the national milk production from 254.55 MMT (2021-22) to 300 MMT by 2023-24.

On the other hand, the NPDD scheme was restructured in July 2021 and focused on strengthening the infrastructure for milk quality testing and primary chilling facilities. The NAIP programme aimed to increase milk production by giving birth to genetically superior male or female bovine breeds. Hence, such new plans further help dairy farmers, cooperatives, and private processors boost milk production.

RESTRAINING FACTORS

Lack of Fodder Supply and Emergence of Diseases Pose a Negative Impact on the Market Growth

In India, animals are fed low-cost inputs from crop residues and agricultural by-products. These low-cost inputs in the animal diet lead to nutritional deprivation of animals, thus impeding their productivity. Therefore, farmers often choose to feed concentrate to lactating animals to obtain maximum milk, but a high concentrate diet not only heightens production costs but also sometimes induces rumen metabolic disorders in the animals.

According to the estimates of the ICAR- Indian Grassland and Fodder Research Institute (IGFRI), Jhansi, there was a deficit of 11.24%, 23.4 % and 28.9% in green fodder, dry fodder, and concentrates, respectively, in the country in 2022. Therefore, shortage in fodder supply will impact milk production, which will impact the production and consumption of milk products.

In addition, the rising incidences of lumpy skin disease in India also restrains the growth of India's dairy market. The 2022 lumpy skin outbreak in India accounted for over 97,000 cattle deaths between July to September. Such instances further limit the growth of the cattle population, which, in turn, impacts the production and market growth.

SEGMENTATION

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Consumers’ Rising Health Awareness Related to Milk Boosts the Product Demand

Based on type, the market is segmented into milk, cheese, butter, dairy desserts, milk powder, curd & yogurt, cream, and others. The milk segment holds the highest revenue as it is recognized as an essential component of the diet of billions of people worldwide as it provides important macro and micronutrients. Moreover, with the rising popularity of natural and farm-sourced milk and the growing awareness regarding its health benefits, milk consumption is likely to increase at a higher pace in India. In addition, apart from being consumed normally, milk is the basis for many sweet and savory food preparations such as ice cream, puddings, cheese, cream soups, and milkshakes. Thus, due to the popularity of dairy in India, there have been constant efforts taken by dairy entrepreneurs/startups to develop attractive and indulgent flavors to entice consumers.

Furthermore, several uses of ghee in preparing multiple dishes are considered nutritionally more beneficial than other oils/fats, thus immensely contributing to driving its demand in recent years. Likewise, paneer has also emerged as one of the most popular dairy products in the Indian sub-continent as it contains high amount of protein. Hence, the demand for ghee also increases in the forecast period.

By Distribution Channel Analysis

Online Retail Channels to Witness Strong Growth due to Increasing Preference

Based on distribution channel, the market is segmented into supermarkets/hypermarkets, specialty retailers, online retail stores, and others. Out of all the categories, the others segment, which includes local milk vendors and convenience stores, dominate the market. The increasing number of convenience stores across the country and easy accessibility of dairy products, such as milk, curd, and paneer, at such stores significantly contribute to the segmental growth. For instance, in February 2020, Maahi Milk Parlour announced its new milk parlor, "Sifa Milk," across Bhuj, Gujarat. The new milk parlor sells ghee, buttermilk (chhaas), dahi, paneer, and flavored milk across the camp areas of Bhuj. Moreover, many consumers prefer milk vendors in India as they provide fresh and raw milk, further promoting the market growth. Factors such as easy affordability and increased profit margins for small-scale vendors are likely responsible for triggering market growth in the coming years.

Furthermore, specialty retailers are also growing swiftly in developing and developed countries, including India. Advantages such as product expertise, unparalleled customer experience, and a wide variety of higher-quality products help promote segmental growth. These stores are specialized in selling a particular product of various brands and would not offer any other product apart from the specific range. Such factors help generate huge profit income and improve sales of dairy and dairy-based products.

KEY INDUSTRY PLAYERS

Focus on Digitalization and New Product Launches of Key Players to Strengthen Market Growth

The Indian dairy industry is expanding rapidly due to the increasing consumption of liquid milk and milk products across the country and the rising demand for milk products owing to increased number of health-conscious consumers. Furthermore, the prominent players are expanding their business by establishing numerous manufacturing facilities, opening their outlets in different markets, and launching new products. They are emphasizing on initiating an e-commerce sales channel to start the distribution of products online, which is expected to increase their sales and revenue. For instance, in September 2020, Tata entered into the milk category under its brand Tata NQ and launched skimmed milk powder in a pack of 25kg to institutional customers.

LIST OF KEY COMPANIES PROFILED:

- Gujarat Cooperative Milk Marketing Federation Ltd. (GCMMF) (India)

- Heritage Foods Limited (India)

- Karnataka Cooperative Milk Producers Federation Limited (India)

- Kwality Milk Foods Ltd (India)

- Milk food Limited (India)

- National Dairy Development Board (India) (Mother Dairy)

- Parag Milk Foods (India)

- Punjab State Cooperative Milk Producers Federation Ltd (MILKFED) (India)

- Rajasthan Cooperative Dairy Federation Ltd (RCDF) (India)

- Tamil Nadu Cooperative Milk Producers Federation Ltd (TCMPF) (India)

KEY INDUSTRY DEVELOPMENTS:

- October 2022: Punjab State Cooperative Milk Producers Federation Ltd (MILKFED) agreed to launch the Verka milk and milk products brand in Delhi. This agreement benefited the milk producers and farmers of the state. The aim of this agreement was to benefit the dairy farmers with maximum support and good prices to these farmers through supplementing their income of the dairy farmers.

- August 2022: Parag Milk Foods launched its premium milk brand, Pride of Cows, in Ahmedabad. Pride of Cows offers its consumers fresh and good quality cow milk daily from its Bhagyalakshmi dairy farm to consumers in Ahmedabad. The product launch in Ahmedabad has helped the company to establish its strong market position in Ahmedabad, thereby increasing its consumer base.

- June 2022: Provilac announced the launch of lactose-free cow milk in India to capture increased market share. The company majorly focuses on innovating and launching with specialized milk products to differentiate its offerings in the industry.

- March 2022: Heritage Foods Ltd. launched its new Premium Badam Milk, Badam Charger, with real almond bits. The product is a recent addition to the company's growing list of value-added products portfolio. Badam Charger will be available across all modern and general trade stores and online grocery platforms.

- January 2022: The National Dairy Development Board is focusing on outpacing the industry growth in the ghee segment to achieve more than 20% growth in the coming years. The company emphasizes focusing on the ghee segment to expand its category by making the products available at 50,000 additional retail units in 200 different towns nationwide.

REPORT COVERAGES

The research report provides qualitative and quantitative insights into the market and a detailed analysis of the India dairy market share, market size, segmentation, and growth rate for all possible segments. The report provides various key insights, the overview of related markets, market dynamics, SWOT analysis, recent industry developments such as mergers & acquisitions, the regulatory scenario in key countries, key market trends, drivers, and competitive landscape.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 9.33% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

By Type |

|

|

By Distribution Channel |

|

Frequently Asked Questions

Fortune Business Insights says that the market was USD 135.30 billion in 2024.

Growing at a CAGR of 9.33%, the market will exhibit robust growth during the forecast period (2025-2032)

Milk segment is expected to hold a significant share in the forecast period.

Significant milk production across India supports the market growth.

Gujarat Cooperative Milk Marketing Federation Ltd. (GCMMF), Kwality Milk Foods Ltd, Sharetea, Amul, and Parag Milk Foods are some of the key players in the market.

The specialty retailers segment is expected to hold the dominant market share.

Growing demand for functional dairy products influences the markets potential.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us