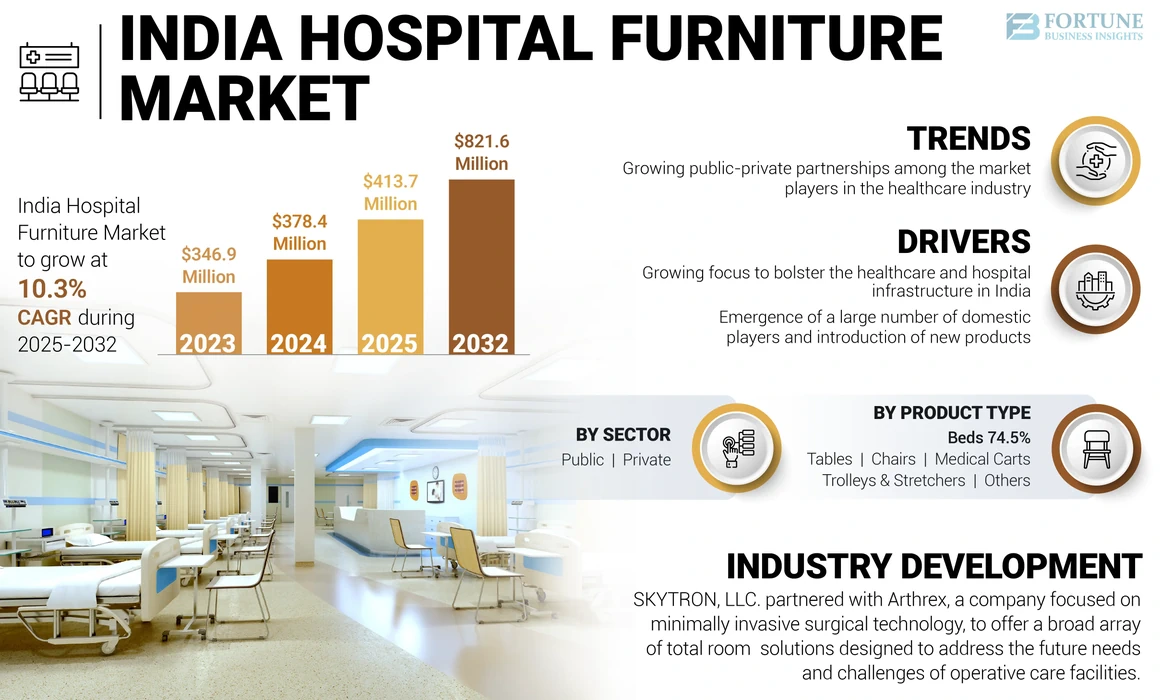

India Hospital Furniture Market Size, Share & COVID-19 Impact Analysis, By Product Type (Tables {Examination Table, Surgical Table, and Others}, Beds {Acute Care Beds, Psychiatric Beds, ICU Beds, and Others}, Chairs {Manual and Electric}, Medical Carts, Trolleys & Stretchers, and Others), By Sector (Government and Private), and Forecast, 2025-2032

KEY MARKET INSIGHTS

The India hospital furniture market size was valued at USD 378.4 million in 2024. The market size is projected to grow from USD 413.7 million in 2025 to USD 821.6 million by 2032, exhibiting a CAGR of 10.3% during the forecast period.

The Indian healthcare sector is emerging faster owing to insurance coverage, services, and increasing expenditure by public and private payors. The healthcare infrastructure in India is categorized into two major segments, public and private. Hospital is one of the major segments of the healthcare industry in India. Components, such as well-equipped furniture and healthcare professionals, are required to make a hospital functional.

Hospital furniture comprises hospital beds, examination tables, operation tables, medical carts, and trolleys & stretchers, among others. The rising number of hospitals in the country is one of the predominant factors leading to an increase in demand for hospital furniture, thereby propelling market growth. Additionally, the rising focus on expanding healthcare facilities in semi-urban and rural areas to improve patient access to better healthcare infrastructure also augments the market growth in the country.

Moreover, the Government of India is strengthening the country's healthcare industry by launching various initiatives to bolster hospitals. Additionally, the government is focusing on promoting medical tourism in the country. The rising influx of patients for medical tourism is anticipated to increase the demand for well-equipped hospitals integrated with advanced facilities. To meet the increasing demand among domestic and international patients and deal with the overburdening of healthcare infrastructure owing to the rising patient pool suffering from chronic disorders, various hospitals are expanding their facilities, thereby fueling the product demand.

- For instance, in May 2022, Fortis Group of Hospitals, one of the leading hospitals dedicated to medical tourism, planned to add 1,500 new beds to its network to take the total to around 5,000 beds in the next three years.

COVID-19 IMPACT

Rise in Demand for Various Hospital Furniture amid COVID-19 Pandemic Propelled Market Growth

The unprecedented COVID-19 pandemic had an overall positive impact on the India hospital furniture market owing to a surge in demand for hospital beds, overburdening of healthcare infrastructure due to high number of COVID-19 infection cases and diversion of healthcare facilities in managing the rising cases of infection. To cope with the growing number of cases, the government launched various initiatives along with private hospitals focused on expanding their bed facilities.

- For instance, according to a news article published in June 2021, the central government planned to strengthen New Delhi’s healthcare infrastructure to rapidly bolster the COVID-19 hospital capacity in areas of acute requirement.

However, the furniture market post-pandemic is expected to grow at the pre-pandemic level due to the growing efforts by central and state governments to strengthen the country's healthcare infrastructure.

- For instance, according to March 2022 budget highlights, the Haryana government allocated around USD 119.4 million toward strengthening urban hospitals and dispensaries.

LATEST TRENDS

Download Free sample to learn more about this report.

Growing Public-Private Partnerships Among Market Players in the Healthcare Industry

In India, the Public-Private Partnership (PPP) has great potential to reduce the current issues of affordability and accessibility. Currently, the private sector in the country accounts for about 60% of the entire hospital industry and is becoming one of the preferred sources of healthcare investment as government spending on health remains considerably low. The rising shift toward public-private partnerships is expected to improve and strengthen the healthcare industry by amalgamating the finances and expertise from the private sector with the subsidies and access of the public sector.

Additionally, the expansion of private hospital players entering Tier 2 and Tier 3 locations over metropolitan cities is anticipated to raise the demand for hospital furniture during the forecast period.

- For instance, in April 2022, Paras Hospitals, a chain of hospitals focused on providing specialized tertiary care facilities, invested an estimated USD 101.0 million to expand its operation into smaller towns and cities.

Thus, increasing number of hospitals and clinics owing to growing public-private partnerships is an upcoming trend observed in the market.

DRIVING FACTORS

Growing Focus to Bolster the Healthcare and Hospital Infrastructure in India to Augment Market Growth

Diseases such as cardiovascular diseases, diabetes, hypertension, cancer, chronic respiratory disorders, and others are some of the most prevalent chronic diseases leading to disability and mortality among the Indian population. At present, the country is experiencing an enormous burden of lifestyle-associated and non-communicable diseases, requiring early diagnosis and treatment to prevent premature deaths, ultimately surging the demand for well-equipped hospitals.

According to an article published in the NCBI in 2022, approximately 27% of the Indian adult population suffers from cardiovascular disorders and around 18% are diagnosed with diabetes. These chronic diseases are more prevalent in urban areas than in rural areas. Furthermore, about 10% of the patient population in rural areas has no access to essential medicines, and only about 19% have health insurance.

Additionally, to improve patient access to healthcare facilities and the country's healthcare index, the government of the country is taking various initiatives and launching awareness programs. However, rising awareness has increased the patient influx to hospitals for early management resulting in overburdening of healthcare infrastructure in India due to lack of sufficient healthcare resources.

- For instance, according to OECD Health Statistics 2021, India has only 0.5 beds per 1,000 people, which is lower than the average of 4.7 beds per 1,000 people among other OECD countries.

Thus, to cater to the rising demand for well-equipped hospitals by the patient population, the government has increased efforts to strengthen the healthcare infrastructure by expanding the existing hospital facilities and establishing new hospitals & clinics. Hence, such initiatives are raising the demand for hospital furniture, thereby fueling the market growth.

Emergence of a Large Number of Domestic Players and Introduction of Products to Fuel the Market

The key players operating in the market are continuously trying to develop and launch technologically advanced hospital furniture to support the government’s effort to strengthen the country's healthcare infrastructure. Moreover, various domestic players are entering the market in order to cater to the growing demand of the population along with strengthening the healthcare facility.

- For instance, in May 2020, Tata Projects, an engineering firm, augmented hospital infrastructure by manufacturing and adding 2,304 hospital beds at multiple locations in the country.

Therefore, the rising emergence of domestic players coupled with the integration of advanced technology in the products raises the demand.

RESTRAINING FACTORS

Rising Preference Toward Refurbished and Rental Hospital Furniture is Likely to Impede the Market Growth

India is witnessing a surge in demand for refurbished products. Refurbished products are propelling a new trend in almost every business owing to the rising focus on sustainability. Similarly, there is an inclination toward refurbished products in the healthcare industry as well.

The country is spending only about 3.2% of its GDP on the healthcare industry, limiting hospitals and other healthcare facilities from investing in their infrastructure. Furthermore, the limited budget allocated to hospital facilities and the high cost of various furniture are shifting buyers' preference toward the refurbished and rental market to lower the cost of procurement.

Additionally, there is an increase in the number of sellers selling refurbished products and renting hospital furniture in the market. However, the shifting preference for refurbished and rental product items owing to lower hospital budgets might hamper the Original Equipment Manufacturer (OEM) market, ultimately restraining the India hospital furniture market growth.

SEGMENTATION

By Product Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Beds Segment to Hold a Dominant Market Share Owing to Rising Number of Hospitals

Based on product type, the market is segregated into tables, beds, chairs, medical carts, trolleys & stretchers, and others.

The beds segment accounted for the largest market share in 2024 and is estimated to dominate the market during the forecast period. Currently, there is a rising burden of the patient population in the country suffering from various chronic ailments. However, the country has inadequate hospital bed capacity to cater to the increasing patient demand. Therefore, to meet the rising demand for beds in hospitals, the Government of India has increased its efforts to provide optimum number of hospital beds to the country’s population.

- According to a report published by the NITI Aayog in 2021, approximately 65% of the hospital beds cater to almost 50% of the population living in seven states, and the people living in 21 states and eight union territories in the country have access to only 35% of hospital beds. Thus, the government is focusing on increasing the number of hospital beds by at least 30% to ensure equitable access to healthcare for Indian citizens.

On the other hand, the tables segment accounted for the second-largest revenue share and is expected to grow at a higher pace during the forecast period. The rising number of patients requiring surgery as one of the inevitable treatment options is surging the demand for operation tables. In addition, the expansion of hospital facilities and the opening of new hospitals are also projected to boost segment growth.

- For instance, according to an article published in the Journal of Surgery and Surgical Research in 2020, an estimated 18,882,734 surgeries were performed during 2019-2020 in public health facilities. Moreover, out of the total surgeries performed, 4,851,788 were major surgeries and 14,030,946 were minor surgeries.

Thus, the spike in surgical procedures would require functional operation facilities owing to which the government and private players are expanding the hospitals, including operation theaters. Such strategies are expected to drive the market.

By Sector Analysis

Private Segment to Witness Highest CAGR Due to Rising Privatization of the Healthcare Industry

Based on sector, the market is categorized into public and private.

The private segment is anticipated to witness the highest CAGR over 2025-2032. The rising privatization of the healthcare industry, increase in the entry of private players in the industry, and initiatives by private hospitals to expand in semi-urban areas apart from metropolitan cities are some of the factors primarily driving the market growth of the private sector.

- For instance, in August 2022, the 2,400-bed Amrita Hospital, the largest private hospital in India, was launched in Faridabad.

Furthermore, the government sector is anticipated to grow significantly in the forecast period due to the increase in the public-private partnership, the launch of various welfare schemes to improve access to multiple treatments, rise in investments to expand and establish new healthcare facilities.

- For instance, according to the Budget 2022-23, the Telangana government allocated USD 270.5 million toward constructing super specialty hospitals and medical colleges.

KEY INDUSTRY PLAYERS

Companies with a Wide Product Portfolio and Strong Geographical Footprint Dominate the Market

The India hospital furniture market share is highly fragmented owing to the presence of various international and domestic companies operating in the market. However, Hill Rom (Baxter), Paramount, Midmark India Pvt. Ltd., and Godrej Interio together accounted for the majority share of the market. The dominance of these players is attributable to various factors, such as the establishment of new manufacturing facilities, the presence of the product in PAN India, and the launch of technologically advanced products in the country, among others.

- In August 2022, Dozee and Midmark India Pvt. Ltd. launched India’s first connected bed platform to integrate and automate patient monitoring in non-ICU hospital beds. The intelligent connected bed has the ability to monitor vital parameters such as heart rate, respiration rate, oxygen saturation, blood pressure, temperature, and ECG.

Additionally, Godrej Interio is actively engaged in strengthening its market position by increasing its manufacturing capacities for various furniture required by hospitals & clinics and launching new products.

- For instance, in May 2021, Godrej & Boyce, the largest company of the Godrej Group, increased its production capacity of beds by 2.5x daily to meet the rising demand in the wake of the COVID-19 crisis in the country. The company supplied over 10,000 hospital and ICU beds along with similar mattresses and other accessories. Additionally, the company has set up a new manufacturing plant at Khalapur in Maharashtra with a capacity of manufacturing 300 hospital beds per day, among other healthcare accessories.

Other prominent players in the market are various local and regional players such as Unipro, Medicare, PMT Healthcare, GPC Medical Ltd., and others.

LIST OF KEY COMPANIES PROFILED

- Stryker (U.S.)

- Herman Miller, Inc. (U.S.)

- GPC Medical Ltd. (India)

- SKYTRON, LLC (U.S.)

- PMT Healthcare (India)

- Midmark India Pvt. Ltd. (Midmark Corporation) (U.S.)

- Baxter (U.S.)

- STERIS (U.S.)

- Narang Medical Limited (India)

KEY INDUSTRY DEVELOPMENTS:

- July 2022 - SKYTRON, LLC. partnered with Arthrex, a company focused on minimally invasive surgical technology, to offer a broad array of total room solutions designed to address the future needs and challenges of operative care facilities.

- December 2021 - Baxter acquired Hillrom, a medical device company aiming to transform healthcare and advance patient care worldwide.

- May 2021 - Mediland launched a novel operating table “C800 electro-hydraulic operating table”, along with SunLED Series surgical light to improve the operation process.

- January 2021 - Godrej Interio, a Godrej and Boyce business unit, launched the “Acura” range of hospital beds to address the need for functional, suitable infrastructure for hospitals in rural and urban areas in India.

- October 2020 - Stryker launched a wireless hospital bed, Procuity, to help reduce in-hospital patient falls at all acuity levels, improve nurse workflow efficiencies and safety, and help lower hospital costs.

REPORT COVERAGE

An Infographic Representation of India Hospital Furniture Market

To get information on various segments, share your queries with us

The research report provides a detailed market analysis. It focuses on key aspects, such as furniture market overview, hospital furniture market segmentation and its market analysis, types of products, competitive landscape of the key players, and the comparative analysis of the average prices of products. Besides this, it offers insights into market trends and highlights key industry developments. The report further includes recent developments, an overview of healthcare infrastructure, and the COVID-19 impact analysis on the market.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 10.3% from 2025-2032 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Product Type and Sector |

|

By Product Type |

|

|

By Sector |

|

Frequently Asked Questions

Fortune Business Insights says that the India market stood at USD 378.4 million in 2024 and is projected to reach USD 821.6 million by 2032.

The market is expected to exhibit steady growth at a CAGR of 10.3% during the forecast period (2025-2032).

By product type, the beds segment is set to lead the market.

The rising focus on strengthening the healthcare infrastructure, growing investment by private and public sectors in the hospital industry, and the launch of technologically advanced products, among others are the key factors driving the market growth.

Midmark India Pvt. Ltd., Godrej Interio, Paramount Bed Co., Ltd., and Hillrom (Baxter) are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic