Industrial Laundry Machine Market Size, Share & Industry Analysis, By Type (Industrial Washer, Industrial Dryer, Industrial Cleaner, Industrial Extractor, and Others (Garment Finishing, Ironing, etc.)), By Application (Hospitality, Healthcare, Food & Beverages, Automotive, and Others (Marine, etc.)), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

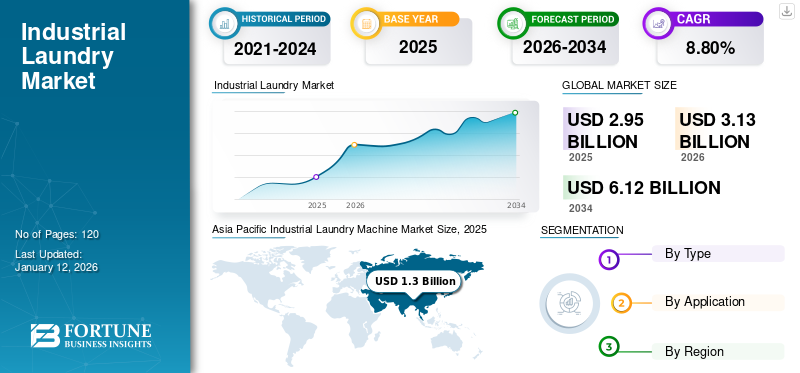

The global industrial laundry machine market size was valued at USD 2.95 billion in 2025 and is anticipated to rise from USD 3.13 billion in 2026 to USD 6.12 billion by 2034 and exhibit a CAGR of 8.80% during the forecast period. Asia Pacific dominated the global market with a share of 44.10% in 2025.

Laundry machines are configured and produced to wash large quantities of clothes and fabric using less time and maximum utilizable resources. The machines provide different services to end-users, including dry-cleaning and laundry services on rental or contractual terms. Industrial washer, industrial dryer, industrial cleaner, and industrial extractor are a few of the machines employed in laundry operations. Furthermore, the increasing regular use of work clothes, clean linen, and uniforms in massive industries such as hospital industry, healthcare, food and drink, automotive, and other (shipping) industries left a demand for proper laundry machines within the market. Owing to the increasing day-to-day cloth washing and drying operations, customers demand features such as proper monitoring, automated processes, and data management in commercial laundries. RFID tags and robots, certain technological innovations in washing machines, are fueling demand for laundry machines in the market. Also, stricter regulations on hygiene and textile care are encouraging plants to switch to high-capacity, modern industrial laundry machinery.

Key players in the market are Alliance Laundry Holdings LLC, Fagor Professional, Herbert Kannegiesser GmbH, and Jensen Group. These players have increased their market strength by improving their geographic footprint and investing in energy-efficient systems, fostering cost-efficiency, operational efficiency, and ability to keep up with emerging and evolving environmental standards.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand from Healthcare and Hospitality Sectors Boosting Market Growth

Rising hygiene consciousness after COVID-19 and the high cleanliness standards of hospitals and hotels are building strong demand for industrial laundry services. Post-pandemic hygiene consciousness and tougher safety measures in industries, especially in hospitals, aged care centers, and the hospitality sector, have grown the strategic value of industrial laundry services. For instance, the World Health Organization (WHO) released updated guidelines on healthcare linen and laundry practices in April 2024. The aim is to increase the prevention of infection and control in the healthcare space. The Ministry of Health and Family Welfare of India (MoHFW) issued guidelines that require NABH-accredited hospitals to outsource linen processing to certified industrial laundries, opening up high-volume business opportunities for organized laundry operators. These requirements spurred on industrial laundry equipment that is capable of consistently achieving these hygiene levels and meeting the needs of these industries.

MARKET RESTRAINTS

Higher Investment, Growing Maintenance Costs, and Shortage of Resources to Obstruct Market Growth

Potential factors such as high initial expenditure and maintenance costs restrain end users from shifting toward effective and efficient laundry solutions. Consumers demand lower operational and maintenance costs, while current electricity tariffs and high labor wages have negatively impacted the operational costs of industries. The end users are more concerned about the current raised cost of resources and the significantly rising cost of operation. Typically, the prices of industrial washers and dryers range from USD 1000 to USD 3,500 for each machine. Also, an average of USD 1,50,000 to USD 4,00,000 is required for establishing a laundry business. Such a huge investment consists of the cost of maintenance, installation cost, and electricity prices, which are not bearable for small players, restraining the growth of the laundry systems market. Moreover, the shortening of resources such as water, chemicals, and detergents for treatment purposes is further putting a load on the consumer. Thus, solution providers have to work for more energy-efficient and impactful machines that can operate with minimal resources, which restraints the growth market.

MARKET OPPORTUNITIES

Government Support and Regulatory Mandates Create Ample Growth Opportunities

Government policies and initiatives are proactively transforming the industrial laundry industry toward sustainability. Energy consumption and water efficiency norms are forcing manufacturers to think ahead. Strict measures on water usage, chemical effluent, and power consumption are forcing hospitals, hotels, and industries to invest in high-tech laundry systems.

Government programs aimed at enhancing access to clean water, sanitation, and hygiene (WASH) tend to include heavy investment in the water infrastructure and the efficiency of standards. These programs increase a more stable supply of water and raise the demand for laundry services in healthcare and hospitality sectors, which are key elements of WASH initiatives.

- In 2023, the U.K. pledged USD 19.78 million in funding to provide safe, reliable, and affordable water supply, sanitation, and hygiene (WASH) services in five countries, primarily in South Asia and sub-Saharan Africa.

INDUSTRIAL LAUNDRY MACHINE MARKET TRENDS

Technological Advancements and Sustainability Measures to Bolster Market Growth

Laundry operations are never a choice for anyone, and a time-bound work culture is an additional factor helping the growth of smart laundry solutions in the market. Consumers need more reliable, smart, and efficient laundry solutions that can solve hectic laundry operations with minimal guidance. Smart capabilities such as IoT and smart monitoring of the wash cycle are the features that dominate the industrial laundry machine market growth. For example, Danube International, a leading laundry solution provider in the residential and industrial segments, offers an IoT feature that actively contributes to the optimization and efficiency of machines. Also, reducing environmental impact through lower energy, water, and chemical consumption trends is increasing. This is driven by regulations, corporate social responsibility goals, and cost savings, which companies are focusing on in this market.

- Energy is a major operating cost (20-25%) in laundries, with 40% used for heating. As per the 2022 sustainability report, Girbau offers innovations (heat exchangers, non-steam solutions) to save up to 30% on gas/electricity.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Industrial Washers to Portray Highest CAGR owing to Benefits Associated with Washers

The market is classified by type into industrial washers, dryers, cleaners, extractors, and others (garment finishing, etc.).

Industrial washer to dominate the market share with 32.27% in 2026, driven by its heavy usage and innovations in critical high-speed and eco-friendly washer technologies. Also, rising demand for these systems in the hospitality, automotive, and marine sectors drives the growth of the market.

- In April 2025, Green Builder Media selected Electrolux 700 Series Front Load Laundry Set as a 2025 Sustainable Product of the Year due to its cold-water capability and innovative stain technology. The ENERGY STAR, Most Efficient washer allows consumers to save energy, water, and money without sacrificing cleaning performance. It includes features such as Smart Boost and Leaf indicator for eco-friendly decision-making.

To know how our report can help streamline your business, Speak to Analyst

By Application

Increasing Concerns for Cleanliness and Daily Health in Hospitality Sector to Stimulate Market Growth

Based on the application, the market is divided into hospitality, healthcare, food and beverage, automotive, and others (marine, etc.).

The hospitality segment captured the largest share of the market with 31.63% in 2026, owing to the increasing demand for laundry services in hotels, restaurants, and related industries. In 2025, the segment is anticipated to dominate with 31.7% share. The growing need for industrial washers, cleaners, and extractors is projected to drive the revenue for laundry services.

Further, expansion of the hotel industry, especially in Asia Pacific countries such as India, Japan, South East Asia, and others, is supporting the need for high-quality laundry services.

- In July 2023, Girbau U.K. launched its first commercial under-counter dryers and washers. The dryers and washers can be installed under standard 900 mm counters. They are highly energy efficient, easy-to-use, and durable, made specifically for the hospitality industry. Key features include the washer's Active Drum for gentler care and high spin efficiency, and the dryer's Sensi Dry system for optimal fabric care and energy savings.

The healthcare segment is expected to grow at a CAGR of 7.97% over the forecast period.

Industrial Laundry Machine Market Regional Outlook

Based on region, the market is segmented into five major regions: North America, the Middle East & Africa, Europe, Asia Pacific, and South America.

Asia Pacific

Asia Pacific Industrial Laundry Machine Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

Our findings suggest that Asia Pacific held the largest industrial laundry machine market share in the global market in 2025 valuing at USD 1.3 billion and also took the leading share in 2026 with USD 1.39 billion. The growth is due to rising health concerns and measures to minimize microbes or virus contact. Post-pandemic, rising consumer awareness about cleanliness and maintaining hygiene resulted in a rise in the use of commercial laundry equipment solutions across commercial and industrial sectors, which drives the growth of the market. In 2026, the China market is estimated to reach USD 0.58 billion. Japan to record USD 0.26 billion, and India to record USD 0.16 billion in 2026.

North America

As per our findings, the North America region holds substantial growth in the coming years, owing to features such as message updates and AI integration are the primary reasons for the adoption and growth of the market in this region. During the forecast period, the North America region is projected to record a growth rate of 8.00%, which is the second highest amongst all the regions and touch the valuation of USD 0.64 billion in 2025. The U.S. market for industrial laundry machines is expanding steadily valuing at USD 0.54 billion in 2026, driven by rising demand from the hospitality and healthcare sectors, stricter hygiene and environmental regulations, and a push for energy and water-efficient machines.

Europe

After North America, the Europe market is the third highest amongst all the regions, owing to increasing demand for energy-efficient washers and industrial dryers with features such as minimizing their operational costs and enhancing cost savings, which forces manufacturers to launch these systems. Such a factor drives the growth of the European market. During the forecast period, the European region is projected to record a growth rate of 7.17% and reach a valuation of USD 0.49 billion in 2025. Backed by these factors, countries including the U.K. anticipate to record the valuation of USD 0.11 billion, Germany to record USD 0.19 billion in 2026, and France to record USD 0.10 billion in 2025.

South America and Middle East & Africa

Over the forecast period, South America and the Middle East & Africa regions would witness a moderate growth in this marketspace. South America market in 2025 is set to reach USD 0.27 billion as its valuation. Rising disposable income of the working population and rising industrialization drive growth in these regions. In the Middle East & Africa, GCC is set to attain the value of USD 0.14 billion in 2025. Furthermore, a post-pandemic rise in the tourism and travel sector and urban living is contributing to the market expansion in Middle East & Africa.

COMPETITIVE LANDSCAPE

Key Industry Players

Prominent Players Integrating Smart and IoT Capabilities to Solidify Product Adoption

Key players such as Alliance Laundry Holdings LLC, Girbau Group, and other players are offering Internet of Things (IoT) in their industrial product solutions that enable a wide variety of controls at the user’s end. Such control allows them to manage the wash cycle time and wash cycle with just a small app. Furthermore, growing automation and AI integration as an advancement in machines has brought a push to the demand in the market. Furthermore, key players' dominance is owed to their wide range of product offerings, heavy investment in innovative technologies, and energy-efficient product launches that meet end-user needs and help build long-term relationships. For instance, in July 2024, Jensen Group, a major commercial and industrial laundry solution provider, announced that they have acquired 85% share capital of MAXI PRESS Holding GmbH. This acquisition will bolster Jensen Group's consumables, spares, and services offering and further establish it in the heavy-duty laundry business.

LIST OF KEY INDUSTRIAL LAUNDRY MACHINE COMPANIES PROFILED

- Alliance Laundry Holdings LLC (U.S.)

- Dexter Laundry, Inc. (U.S.)

- Electrolux Professional Group (Sweden)

- Ferrotec Holding Corporation (Japan)

- Fagor Professional (Onnera Group) (Spain)

- Girbau Group (Spain)

- Herbert Kannegiesser GmBH (Germany)

- Jensen Group (Belgium)

- Miele Professional (Germany)

- Whirlpool Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Dorian Drake International Inc., a veteran export management firm, has announced a strategic export partnership with Dexter Laundry, Inc. Under the terms of this pact, Dorian Drake will serve as agent for Dexter Laundry's on-premise laundry equipment line for select Asia-Pacific countries, including Malaysia, Singapore, Indonesia, and Japan.

- March 2025: Alliance Laundry Systems is expanding its laundromat business in Southeast Asia. The company opened 300 new locations based on its "Seed Store" strategy. The company is targeting Vietnam, Indonesia, Philippines, and Cambodia as core markets, aiming to capture 70 percent of the market share in the region. In addition, it is upgrading its StarLab factory in Chonburi, Thailand, to serve as an Asian hub for laundry product innovation.

- December 2024: DOMUS ECO-ENERGY has launched a new line of advanced industrial tumble dryers incorporating the revolutionary ECOVOLUTION by DOMUS technology to improve the energy efficiency and energy use in laundries. The ECO-ENERGY industrial dryers come equipped with air recovery systems, which provide shorter drying times with lower energy consumption. This series of Industrial dryers is known for the use of the Touch II microprocessor with a 7-inch touchscreen display for a better user experience.

- November 2024: Kannegiesser unveiled the innovations at Texcare 2024 to help laundries overcome staff shortages, rising costs, and market demands, focusing on automation, robotics, sustainability, and intelligent logistics. Highlighted the AutomaticDry Work Line for automated dry work processing, the SmartVue interface for real-time operation visualization, and the monorail system with eVueControl for a seamless, automated linen transport solution.

- October 2022: Domus, a laundry solutions company, showed off its newly patented end-to-end connected laundry solution. The firm now sells heat pumps and dryers ranging from 8-10 kg to 22 kg. These are small machines with 180-degree doors for easy use, and they are all interconnected via IoT.

- February 2022: Domus, a laundry solution provider in South America, with its completion of 100 years, has exhibited its newly developed facility in Vic, Barcelona. The development was especially clustered as laundry solutions for the hospitality, healthcare, and self-service sectors.

REPORT COVERAGE

The report provides a deep-dive analysis of the market dynamics and competitive landscape. It provides various key insights, including recent industry developments in the automated guided vehicle market, such as mergers & acquisitions of key industry players, market-supporting macro and micro economic factors, SWOT analysis of the industry, and company profiles of the major market players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Region

o Germany (By Type) o France (By Type) o U.K. (By Type) o Italy (By Type) o Rest of Europe

o China (By Type) o Japan (By Type) o India (By Type) o South Korea (By Type) o Rest of Asia Pacific

o GCC Countries (By Type) o South Africa (By Type) o Rest of the Middle East and Africa

o Brazil (By Type) o Argentina (By Type) o Rest of South America |

Frequently Asked Questions

Fortune Business Insights says that market was valued at USD 2.95 billion in 2025.

In 2034, the market is expected to be valued at USD 6.12 billion.

Growth of 8.80% CAGR is been observed in the forecast period.

Asia Pacific market size was valued at USD 1.3 billion in 2025.

The industrial washer is expected to be the leading segment within the type segment during the forecast period.

Growing demand from healthcare and hospitality sectors boosting the market growth.

Alliance Laundry Holdings LLC, Electrolux Professional Group (Sweden), Jensen Group, Herbert Kannegiesser GmbH, and Girbau Group are the top players in market.

The hospitality is expected to hold the highest share.

Higher investment, growing maintenance costs, and shortage of resources to obstruct market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us