Industrial Packaging Market Size, Share & Industry Analysis, By Material (Plastic, Paper & Paperboard, Metal, and Others), By Product Type (Drums, IBCs, Boxes & Cartons, Crates, Trays & Pallets, Bags & Sacks, Pails & Cans, and Others), By End-use Industry (Food & Beverage, Pharmaceuticals, Consumer Goods, Chemicals, Agriculture, Building & Construction, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

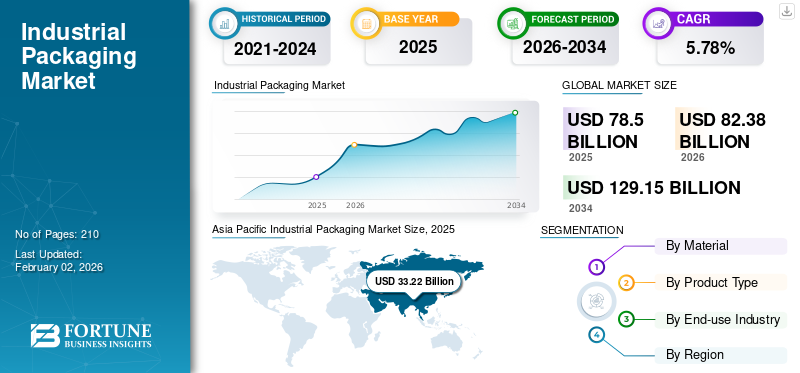

The global industrial packaging market size was valued at USD 78.50 billion in 2025. The market is projected to be worth USD 82.38 billion in 2026 and reach USD 129.15 billion by 2034, exhibiting a CAGR of 5.78% during the forecast period. Asia Pacific dominated the industrial packaging market with a market share of 42.32% in 2025. Moreover, the industrial packaging market in the U.S. is expected to reach USD 25.33 billion by 2032. This growth is fueled by the increasing demand for durable and protective packaging solutions in heavy-duty industries such as chemicals, construction, and automotive.

Industrial packaging products are often designed to protect, store, or transport large quantities of finished or unfinished products. They are very robust and designed to make transporting and storing industrial goods easier. Industrial products such as chemicals, beverages, food products, paints, dyes, petrochemicals, and fertilizers are generally transported by trucks, ships, and rails using heavy-duty packaging solutions that are often built with specific purpose and to sustain extreme temperature and pressure conditions.

Manufacturing of industrial packaged products and the choice of materials depend upon the type of product being packed due to its specialized nature. Packaging manufacturers prioritize products that are cost-effective, lightweight, and provide high-barrier properties to optimize the supply chain. Mondi Group and Westrock are the leading manufacturers, accounting for the largest global industrial packaging market share.

GLOBAL INDUSTRIAL PACKAGING MARKET SNAPSHOT & HIGHLIGHTS

Market Size & Forecast:

- 2025 Market Size: USD 74.94 billion

- 2026 Market Size: USD 78.5 billion

- 2034 Forecast Market Size: USD 114.54 billion

- CAGR: 5.45% from 2026–2034

Market Share:

- Asia Pacific led the global industrial packaging market in 2025 with a share of 42.32%, valued at USD 29.96 billion, up from USD 28.49 billion in 2022. This dominance is attributed to increasing demand from pharmaceutical, food, and manufacturing sectors, coupled with rapid industrialization in countries like China, India, and Japan. Plastic was the most widely used material in 2023 due to its versatility across drums, IBCs, jerry cans, and trays. Boxes and cartons dominated the product type segment, owing to their adaptability, recyclability, and cost-effectiveness.

- By end-use industry, the food & beverage segment held the largest market share at 24.54% in 2026, driven by demand for contamination-free, durable, and extended shelf-life packaging solutions. The pharmaceutical industry followed as the fastest-growing segment due to globalization of drug supply chains and demand for protective packaging materials.

Key Country Highlights:

- United States: The industrial packaging market in the U.S. is projected to reach USD 25.33 billion by 2032, driven by growth in the e-commerce, manufacturing, and healthcare sectors. The country’s adoption of reusable packaging and intelligent tracking solutions is supporting demand across logistics and industrial supply chains.

- China: The country dominates the Asia Pacific region, supported by strong growth in manufacturing and export-driven industries. In 2023, China's industrial packaging demand was largely driven by food, agriculture, and consumer goods sectors.

- Germany: Germany continues to lead Europe’s market through demand in pharmaceuticals, petrochemicals, and export goods. However, increasing pressure from environmental regulations is accelerating the shift toward paper-based and sustainable packaging solutions.

- Brazil & Mexico: In Latin America, growth is supported by increased automation and the rising automotive sector. According to the International Trade Administration, Mexico produced 3.1 million vehicles in 2023, bolstering demand for bulk packaging, boxes, and IBCs.

- UAE & South Africa: The Middle East & Africa region is seeing increased demand for safe, bulk packaging across food and beverage industries, alongside industrial growth in GCC economies. In the UAE, demand for food-grade industrial packaging surged as online F&B sales rose by 255% in 2020. South Africa leads in Africa, with increased adoption of packaging solutions for industrial and consumer goods.

MARKET DYNAMICS

MARKET DRIVERS

Rapidly Growing Food and Agribusiness Value Chain to Drive Market Growth

Agriculture plays a crucial role in driving economic growth, contributing significantly to the global gross domestic product (GDP). The agriculture and food business value chain comprises companies that utilize industrial packaged products from business areas ranging from seeds, chemicals, vaccines for farm livestock, and crop yields.

According to the World Bank, agriculture constitutes approximately 4% of the total GDP, while in some of the least developing countries, this figure soars to over 25% of their GDP. In particular, agricultural growth is key for overall growth, development, and poverty reduction, especially in nations where agriculture plays a dominant role in their economies.

Packaging products such as plastic drums, IBCs (Intermediate Bulk Containers), bags, and sacks help to contain foods in a clean and secure environment without leakage or breakage until they are used. They also provide a barrier from dirt or dust, microorganisms, and other contaminants. They also protect against damage caused by insects, birds, and rodents, as well as heat, oxidation, and moisture fluctuations. The selection of packaging materials, particularly for food items, depends on technical requirements, cost-effectiveness, and government regulations. Hence, industrial package products can maintain a streamlined flow of raw materials to finished goods in such interconnected supply chains.

Use of Intelligent Packaging Systems for Controlling, Monitoring, and Optimizing the Material Flow to Fuel Market Growth

The use of technology as a medium for tracking and managing raw materials and finished and unfinished goods is on the rise. Manufacturers, distributors, and retailers can access detailed information about the location and condition of their products through the intelligent features of industrial packages. Intelligent industrial packages are experiencing faster growth, mostly due to the increasing use of indicators such as time and temperature indicators, product differentiation, traceability, and other interactive features at more reasonable prices.

For instance, Greif Inc. has introduced the first Internet of Things (IoT) based device to be applied to an IBC that can track real-time information and check the filling level of the IBC. These factors increase the demand for intelligent packaging and drive the global industrial packaging market growth.

Radiofrequency identification (RFID) tags are an innovative form of data information carrier that can identify and trace products, making them a highly effective solution for managing industrial bulk packaging within a warehouse, facility, or during transportation.

MARKET RESTRAINTS

Rising Scrutiny Around Usage of Plastics in Industrial Packaging to Hamper Market Growth

Scrutiny around industrial packages has increased in recent years due to growing concerns about environmental sustainability and landfill pollution. Regulatory bodies have tightened regulations, placing pressure on packaging manufacturers to shift toward recycled or eco-friendly materials to reduce their environmental impact. Additionally, consumers are looking for more durable and robust packaging solutions. Hence, manufacturers are confronted with the necessity of substantial investments in R&D and in testing to develop products that align with sustainability goals and environmental consciousness, slowing down market growth.

MARKET OPPORTUNITIES

Rising Shift in Adopting Environmentally Friendly Practices to Provide Several Growth Opportunities

There is a clear movement in the industry toward adopting sustainable and environmentally friendly solutions. Many companies have started implementing eco-friendly practices by using recycled materials and reducing emissions. The shift is driven by increasing awareness and worries about the environmental impacts of traditional packaging materials such as plastic and metal. As a result, there is a growing need for packaging options that are both biodegradable and compostable.

According to the World Economic Forum, 40 million tons of plastic waste were generated in the U.S. in 2021, and only 5% to 6%, or about two million tons, were recycled. Approximately 36% of all plastic produced is used for packaging, and 85% of it ends up in landfills.

In addition to sustainability, technological progress has also transformed the industry. For example, the integration of automation in packaging activities has significantly boosted efficiency and lowered costs.

MARKET CHALLENGES

Fluctuating Raw Material Prices and Demand Variability Challenges Market Expansion

A consistent supply of raw materials such as recycled paper, wood pulp, and chemicals is essential for the industry. Disruptions in the supply chain cause production delays and higher costs. Additionally, fluctuating raw material and production costs and rising demand for personalized packaging present challenges for businesses. Rising costs of energy, raw materials, and transportation affect profit margins. In addition, evolving consumer trends continue to impact the industry, requiring companies to adapt quickly. Striking a balance between overstocking and understocking is crucial to meet consumer needs while avoiding excessive inventory costs.

Download Free sample to learn more about this report.

MARKET TRENDS

Accelerating Growth in the Manufacturing Industry is Poised to Boost Market Growth

Manufacturers who increased their digital investment and adopted emerging manufacturing technologies over the recent years have shown greater resilience during the pandemic and gained momentum in manufacturing across all sectors. Developed regions, due to the wide range of consumer demands and technological advancements contributing to the increasing demand, and developing regions and countries, fueled by population growth and globalization, are set to drive continued demand for industrial packaged solutions.

The latest report published by the United Nations Industrial Development Organization (UNIDO) shows a recovery from the damages done to the industry during the pandemic in 2020, with year-over-year growth of 3.3 percent in the fourth quarter of 2021 in global manufacturing production.

Industrial bulk packaging products such as intermediate bulk containers (IBCs), flexible intermediate bulk container (FIBC) bags, and drums are reusable and, hence, are in greater demand across the manufacturing industry. Each packaging type plays a key role in adding economic and environmental value to supply chains, accelerating their growth in the manufacturing industry. Asia Pacific witnessed a industrial packaging market growth from USD 28.49 billion in 2022 to USD 29.96 billion in 2023.

IMPACT OF COVID-19

The COVID-19 pandemic had a multifaceted impact on the industrial package market worldwide. Manufacturing facilities faced temporary closures, leading to a shortage of raw material components and packaging materials due to supply chain disruptions that affected production and delivery timelines for a period. It thus, affected various sectors such as food & beverage, pharmaceuticals, and automotive, which rely heavily on efficient and timely packaging. Innovation and rapid development of pharmaceutical packaging helped the industry to recover from this short setback in the post-pandemic era.

SEGMENTATION ANALYSIS

By Material

Rising Demand for Plastic Products in the Industrial Sector Enhances Segmental Growth

Based on material, the market is segmented into plastic, paper & paperboard, metal, and others.

Plastic is a widely used material in the market. Plastic can be used in the form of IBCs, drums, jerry cans, bags, and sacks for packaging, creating a huge demand in industrial applications and having the largest market share in the market. The plastic trays and pallets provide protection and a good mechanical interface for handling and shipping products. The segment is likely to hold 43.53% of the market share in 2026.

Paper is the second-largest material used. The demand for corrugated boxes is attributed to their lightweight, foldability, rigidity, and printability. Additionally, the major players in the packaging industry are increasingly incorporating sustainability goals into their business models. These goals are achieved more simply by adding the percentage of paper products in the company’s product portfolio, resulting in increased use of paper for the packaging of industrial products. Paper & paperboard segment is anticipated to exhibit a CAGR of 5.41% during the forecast period.

By Product Type

Boxes & Cartons to Dominate due to Availability in Different Sizes and Shapes

Based on product type, the market is segmented into drums, IBCs, boxes & cartons, crates, trays & pallets, bags & sacks, pails & cans, and others.

Boxes & cartons are the dominating product type segment. Boxes and cartons offer remarkable versatility due to their availability in different sizes and shapes. This versatility makes them an ideal packaging solution for a wide range of products, from small semiconductor components to large manufacturing machinery. They can be easily customized through labeling, printing, and branding, and through attractive marketing, they can help consumer brands stand out from the competition. The segment is expected to hold 25.09% of the market share in 2026.

Boxes are made from various materials and can be easily recycled, making them an eco-friendly packaging option. They are cost-effective compared to most rigid packaging solutions and offer excellent stack ability for the optimization of warehouse space and transport.

Drums are the second-dominating product type segment. Drums are long-lasting and resilient and protect the contents from damage and contamination, thus boosting the segment’s growth.

Trays & pallets segment is likely to exhibit a CAGR of 5.97% during the forecast period.

By End-use Industry

To know how our report can help streamline your business, Speak to Analyst

Rising Demand for Industrial Packages from Food & Beverages End-User Industry Drives the Segment’s Growth

Based on the end-use industry, the market is classified into food & beverage, pharmaceuticals, consumer goods, chemicals, agriculture, building & construction, and others.

These products help extend the shelf life of perishable food and beverage products. The food & beverage segment captured 24.54% of the market share in 2024. This is vital for both manufacturers and retailers to reduce waste and manage inventory. Due to these reasons, the food & beverage segment has the highest market share. Rising demand from the food and beverage sector to carry liquid and solid products also enhances segmental growth.

The pharmaceutical industry is the second-dominating segment and stands out as the most rapidly growing sector during the forecast period due to the globalization of pharmaceutical supply chains. Pharmaceutical products are often sensitive to environmental factors such as light, moisture, and extreme temperatures. Products such as barrels, cans, and bags protect these drugs from external factors, preserving their stability and effectiveness and thus cushioning the segment’s growth.

INDUSTRIAL PACKAGING MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific Industrial Packaging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific is the fastest-growing region and holds the largest share of the market. The regional market value in 2026 was USD 35.08 billion, and in 2025, the market value led the region by USD 33.22 billion. China, India, and Japan are the leading countries in the manufacturing of industrial products. The growth is attributed to the rising demand for pharmaceutical and food products, which further provides lucrative growth for the market in this region. The market value in China is expected to be USD 11.78 billion in 2026.

On the other hand, India is projecting to hit USD 5.73 billion and Japan is likely to hold USD 8.56billion in 2026.

North America

North America is the second-largest region with a value of USD 20.41 billion in 2025 contributing to the market, and the U.S. is the leading contributor. The region is likely to exhibit a CAGR of 4.91% during the forecast period. Factors such as e-commerce, sustainability trends, and improvements in the supply chain influence the North American industrial packaging market. The U.S. industrial manufacturing market is a dynamic segment that plays an important role in supporting the complex logistics and distribution needs of various industries. The U.S. market size is likely to forecast USD 18.67 billion in 2026. This market specializes in providing specialized medical solutions for the transport, storage, and protection of goods in industrial environments. Tailored to the unique challenges of manufacturing, logistics, and distribution, these solutions support a wide range of materials and container types, including robust options such as pallets, boxes, drums, intermediate bulk containers (IBC), and special cases.

In 2021, according to the Reusable Industrial Packaging Association, the number of composite IBCs reprocessed rose to 3.6 million, the majority of which were 275-gallon capacity. The number of scrapped IBC bottles is reported as 1.9 million. Approximately 61% of steel drums are used for hazmat, 68% of plastic drums, 20% of fiber drums, and 64% of IBCs. These numbers have changed very little over the last several years.

Europe

Europe is also one of the key regions contributing to the market. The region is the fourth-largest region with a market value of USD 17.79 billion in 2025. However, the growth of this region is declining, owing to stringent regulations over plastic consumption. Europe contributed to a large sum of the growth of the industry owing to the rising demand for industrial products such as petrochemicals and energy sources. This has surged the demand for industrial packages, which, in turn, propelled the market in Europe. The market value in U.K. is expected to be USD 2.74 billion in 2026.

On the other hand, Germany is projecting to hit USD 4.59 billion in 2026 and France is likely to hold USD 3.43 billion in 2025.

As per European Steel Association AISBL, Europe imported 25.6 million tonnes of finished products and exported 16.3 million tonnes of finished steel products in 2023.

As per the European Federation of Pharmaceutical Industries and Associations (EFPIA), the world pharmaceutical (prescription) market was estimated at USD 1,256,863 million in 2021, with China accounting for 9.4% of global sales. Rapid market growth and research environments in countries such as China and Korea are contributing to the move of economic and research activities to non-European markets.

Latin America

The Latin American region is witnessing a major shift toward automation in industrial production. This region is likely to be the fourth-largest market size with USD 4.22 billion in 2025. This shift is driven by the need to improve efficiency in collection and production processes. Automation makes packaging operations faster and more accurate, reduces production time, and increases overall production, enabling companies to meet growing customer needs and optimize production capacity.

According to the International Trade Administration, in 2023, Mexico was the largest producer of motor vehicles in Latin America, producing around 3.1 million vehicles. Brazil was the largest producer of passenger cars in the region, producing nearly 1.8 million automobiles.

Augmenting Demand for Bulk Containers Bolster the Market Growth

Increasing demand for bulk containers in food and beverage applications for storage of food, pulp, preservation, and additives is driving the growth of the market. Additionally, increasing demand for safe packaging of industrial products is expected to propel market expansion further. The severe adverse impact of the pandemic on the export and import activities of several end-use sectors is expected to hinder the development of the industrial manufacturing market during the forecast period.

As per the Bureau of International Recycling, a key factor influencing the recycled plastics market is the increased demand for food packaging and construction applications. Recycled plastics demand achieved record online sales within the UAE’s food and beverage market, surging by 255% year-on-year in 2020 to reach USD 412 million, according to a Dubai Chamber analysis. Saudi Arabia is expected to be USD 0.50 billion in 2025.

KEY INDUSTRY PLAYERS

Key Market Participants to Witness Significant Growth Opportunities with New Product Launches

The global industrial packaging market is highly fragmented and competitive. A few significant players are dominating the market by offering innovative packaging solutions in the packaging industry. Major players in the industry include Mondi, WestRock, Smurfit Kappa, Sonoco, DS Smith, Amcor Limited, Greif Inc, and others. These major market players constantly focus on expanding their customer base across regions by innovating their existing wide range of products. The market report also highlights the key developments by the manufacturers. Numerous other companies operating in the market are focused on market scenarios and delivering advanced packaging solutions.

List of Key Companies Profiled in the Report:

- Mondi Group (U.K.)

- WestRock (U.S.)

- Smurfit Kappa (Ireland)

- Sonoco (U.S.)

- DS Smith (U.K.)

- Amcor Limited (Australia)

- Greif Inc. (U.S.)

- Mauser Packaging Solutions (U.S.)

- Ball Corporation (U.S.)

- Schütz GmbH & Co. KGaA (Germany)

- Berry Global Inc. (U.S.)

- Stora Enso Oyj (Finland)

- Orora Limited (Australia)

- BAG Corp (U.S.)

- Snyder Industries (U.S.)

- Sealed Air (U.S.)

- WINPAK LTD. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 – Novvia Group, a worldwide provider of life sciences packaging, announced the acquisition of JWJ Packaging, a U.S.-based supplier of drum pails and other rigid container products. Based in Millstone Township, New Jersey, JWJ Packaging has been serving customers across the tri-state area with a diverse range of products and services.

- July 2023 – Berry Global launched a new version of its high-performance, patented NorDiVent form-fill-seal (FFS) film for powdered products, incorporating up to 50% recycled plastic content, helping its customers achieve sustainability goals.

- July 2023 – Smurfit Kappa inaugurated the new integrated corrugated plant in Rabat, Morocco. It marks Smurfit Kappa’s first operation in North Africa, where the plant is powered by green energy.

- January 2022- Sonoco acquired Ball Metalpack to expand Sonoco’s already established sustainable packaging portfolio to include metal packaging, which is one of the world’s top circular economy-adapted products.

- August 2022- Leading coatings manufacturers BASF and Nippon Paint China announced the collaboration and introduced eco-friendly industrial package products. With BASF's water-based acrylic dispersion Joncryl® High-Performance Barrier (HPB) as the barrier material, the new packaging material is highly commercialized for the development of dry mortar products of Nippon Paint.

INVESTMENT ANALYSIS AND OPPORTUNITIES

In April 2023, Berry Global Group, Inc., a leader in the design, development, and production of innovative, sustainable stretch films, announced the expansion of its stretch film manufacturing facilities in Lewisburg, Tennessee. The 25,000-square-foot expansion is scheduled for completion by early 2024. This project aims to support the growing demand for Berry’s high-performance, sustainable stretch films. The expansion and investment made by the company will drive progress toward a circular, net-zero economy.

REPORT COVERAGE

The research report provides a detailed market analysis of the market. It offers an overview that highlights key aspects, such as top key players, competitive landscape, product types, market segments, Porter’s Five Forces analysis, and leading segments of the product. Besides, the report offers insights into market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation:

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.78% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Material

|

|

By Product Type

|

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market size was valued at USD 78.50 billion in 2025.

The market is projected to grow at the highest CAGR of 5.78% during the forecast period.

The market size of Asia Pacific was valued at USD 33.22 billion in 2025.

The Asia-Pacific region leads the market, with a market share of 42.32% in 2025, supported by strong manufacturing output, export-driven economies, and demand from the automotive and chemical sectors.

Key industries include chemicals, pharmaceuticals, food and beverages, automotive, construction, and e-commerce logistics, all requiring secure and compliant packaging solutions.

Trends include smart packaging technologies, biodegradable materials, returnable packaging systems, and the use of automation and tracking features like RFID and QR codes.

Top companies include Mondi, WestRock, Smurfit Kappa, Sonoco, DS Smith, Amcor, Greif, and International Paper, all known for innovation, global reach, and sustainability initiatives.

Growth is driven by global trade expansion, increasing need for durable and protective packaging, rising e-commerce, and greater supply chain transparency.

Challenges include raw material price volatility, environmental regulations, pressure to reduce plastic and carbon footprints, and adapting to customized packaging needs.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us