The ambulatory centres segment is projected to remain dominant by end user, accounting for 57.46% of the global market share in 2026. These settings experience high volume of patients, making efficiency and streamlined workflows critical. Ambulatory care relies heavily on EHR systems and integrated solutions for documentation, scheduling, billing, and e-prescribing to manage large patient inflows. Moreover, the global shift toward outpatient services and increasing collaborations among key operating players further strengthen this segment’s dominance. Furthermore, the segment is set to hold 57.0% share in 2025.

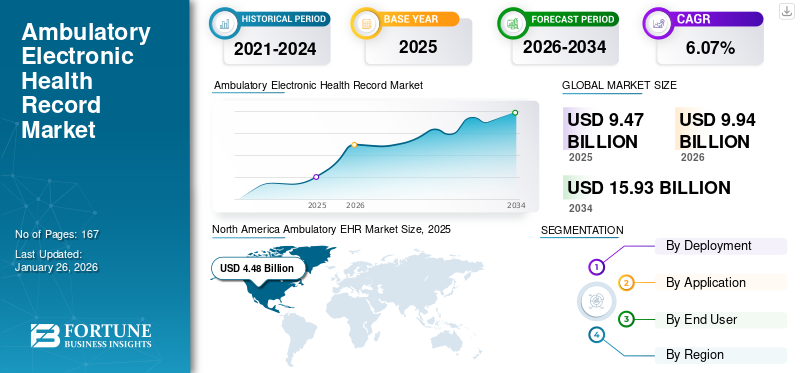

Ambulatory EHR Market Size, Share & Industry Analysis, By Deployment (On Premise, Cloud based, and Web based), By Application (Clinical Documentation, Appointment Management, E-Prescribing, Clinical Decision Support (CDS), Remote Patient Monitoring, Revenue Cycle Management/Billing, Analytics & Reporting, and Others), By End User (Ambulatory Centres, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global ambulatory EHR market size was valued at USD 9.47 billion in 2025 and is projected to grow from USD 9.94 billion in 2026 to USD 15.93 billion by 2034, exhibiting a CAGR of 6.07% during the forecast period. North America dominated the ambulatory EHR market with a market share of 47.26% in 2025.

An ambulatory Electronic Health Records (EHR) system is a digital platform designed for outpatient care settings. It helps healthcare providers to record, store, and access patient medical information in real time, by providing real-time access to patient records, lab results, and treatment plans. The global ambulatory EHR market is witnessing significant growth as healthcare providers are increasingly adopting these digital solutions to manage patient information efficiently. The growing need for real-time access to patient data is expected to further drive the global market growth while supporting regulatory compliance and data interoperability across healthcare networks.

Furthermore, to secure the market dominance, various key companies are investing profoundly and directing their resources towards strategic activities such as mergers and collaborations to launch innovative platforms in the market.

- For instance, in August 2025, CareCloud, Inc. acquired the business assets of Medsphere Systems Corporation, an inpatient and ambulatory solutions provider, with the development aimed at creating a faster and smarter next-generation platform.

Furthermore, many key industry players, such as Epic Systems Corporation, Oracle, Medical Information Technology, Inc., TruBridge, and Veradigm LLC. are operating in the market, and focusing on developing various innovative solutions to support the rising demand for effective patient monitoring in outpatient settings.

MARKET DYNAMICS

MARKET DRIVERS

Shift Towards Outpatient and Ambulatory Care to Drive Market Growth

The shift toward outpatient and ambulatory care is one of the most influential drivers of the market, primarily driven by growing emphasis on cost efficiency, patient convenience, and operational flexibility of healthcare systems’. The demand for effective EHR due to cost restraints is growing. With hospitalization, costs continue to rise and inpatient capacity remains constrained.

Furthermore, government support and incentives for digital adoption for outpatient care support the market growth.

For instance, in February 2022, the U.S. launched CMS’s initiatives to expand outpatient reimbursements under the “Hospital Without Walls” framework, which incentivizes adoption of digital technologies. Such initiatives to drive the ambulatory EHR market growth.

MARKET RESTRAINTS

High Setup Cost Hampers the Product Adoption, Restricting Market Growth

The high costs associated with adopting ambulatory EHR systems present a significant barrier to market growth, particularly for small and independent healthcare providers. These expenses encompass not only the initial purchase price but also ongoing costs related to system maintenance, staff training, and necessary infrastructure upgrades. These financial challenges contribute to hesitancy among smaller practices to invest in EHR systems, thereby slowing the overall adoption rate and hindering the potential benefits of digital transformation in healthcare.

- For instance, in July 2025, iCare.com, Inc. reported the high setup cost of ambulatory EHRs that expands beyond technological setup costs. They reported that the implementation cost might reach USD 300 million. Such a high cost hampers the adoption and restricts the market growth.

MARKET OPPORTUNITIES

Adoption of Innovative Technologies Such as Voice Recognition to Offer Lucrative Avenues for Market Growth

The adoption of innovative technologies such as voice recognition and ambient documentation technologies is emerging as a major growth opportunity within the ambulatory EHR market. These innovations are anticipated to reduce clinician burnout and improve documentation efficiency in high-volume outpatient settings. Ambulatory physicians spend a significant portion of their time on manual data entry. Integrating AI-powered voice recognition and ambient listening tools directly into EHR workflows enables real-time, automated transcription, structuring, and coding of clinical notes, dramatically reducing administrative burden.

- For instance, in August 2025, Oracle launched Electronic Health Records (EHRs) for ambulatory providers in the U.S. that enhance care quality with AI-fueled conversational intelligence. The new Oracle EHR enabled clinicians to use voice commands to ask for the information they need, such as a patient’s recent lab results and current medications. Such developments are anticipated to propel the market growth.

MARKET CHALLENGES

Limited Interoperability Among Various EHR Systems to Restrict Market Growth

Limited interoperability among various EHR systems is one of the most significant market challenges in the global market. Despite widespread EHR adoption, data exchange between different systems, vendors, and care settings is fragmented and inconsistent. Many ambulatory providers use heterogeneous EHR platforms that lack standardized interfaces, making it difficult to share patient information with hospitals and outpatient clinics. This lack of interoperability leads to administrative inefficiency and delayed clinical decision-making.

- For example, in January 2025, BMC Health Services Research published a report titled ‘Lower electronic health record adoption and interoperability in rural versus urban physician participants: a cross-sectional analysis from the CMS quality payment program’, which reported that there are significant disparities that exist in EHR adoption and there is interoperability between rural and urban physicians.

AMBULATORY EHR MARKET TRENDS

Strategic Collaborations Among Key Players to Combat Interoperability is a Prominent Market Trend

As interoperability among various systems has proved and can be one of the barriers in outpatient digital health. Thus, many key industry players are participating in strategic collaborations to address these interoperability challenges through cross-vendor alliances and technology partnerships, enabling data exchange across care settings. As value-based care and remote monitoring models become central to outpatient practice, such collaborations ensure that ambulatory EHRs can exchange real-time clinical, diagnostic, and administrative data efficiently.

- For instance, in June 2025, Altera Digital Health partnered with Health Gorilla, a leading national interoperability platform and Qualified Health Information Network (QHIN). The partnership integrated the company’s national interoperability network into its Sunrise Electronic Health Record (EHR) platform for mid-size hospitals and health systems.

Download Free sample to learn more about this report.

Segmentation Analysis

By Deployment

Increasing Product Launches for Cloud Based EHR Systems to Propel Segmental Growth

Based on the deployment, the market is divided into on premise, cloud-based and web-based.

The cloud-based segment accounting for 37.30% of the global market share in 2026 due to its cost efficiency, scalability, and interoperability. In addition, cloud-based EHRs offer better data accessibility, faster updates, and compliance with HIPAA regulations, which enhances security and interoperability. Additionally, major EHR vendors are increasingly investing in AI-enabled, cloud-integrated modules for predictive analytics, and telehealth support, strengthening cloud adoption trends.

- For instance, in October 2025, eClinicalWorks, an ambulatory cloud EHR, announced that First Care Family Medicine successfully utilized Sunoh.ai, the EHR-agnostic, AI-powered medical scribe. The EHR was integrated with the eClinicalWorks EHR, Sunoh.ai, and added clinical notes, administrative workload, and improved the quality of documentation and patient care.

To know how our report can help streamline your business, Speak to Analyst

By Application

Increasing Adoption Across Hospitals and Clinics to Drive Segmental Growth of Clinical Documentation

On the basis of application, the market is segmented into clinical documentation, appointment management, e-prescribing, clinical decision support (CDS), remote patient monitoring, revenue cycle management/billing, analytics & reporting, and others.

The clinical documentation segment is expected to lead by application, contributing 19.70% globally in 2026 as it directly impacts the clinical workflows and patient safety. To reduce the documentation efforts of the healthcare providers and optimize the workflows, the healthcare providers are rapidly adopting EHR systems for this application, leading to segment accounting for segment’s leading share. Moreover, its widespread adoption across hospitals and clinics and rising investment in technological advancements make it the most significant contributor compared to other specialized functionalities. Furthermore, the segment is set to hold 20.1% share in 2025.

- For instance, in February 2025, Abridge raised a USD 250.0 million in investment from NVIDIA, Redpoint Ventures, Spark Capital, and SV Angel—the investment aimed to fuel the development of AI capabilities and commercial growth to support broader documentation applications.

In addition, clinical decision support application segment (CDS) is projected to grow at a CAGR of 10.75% during the study period.

By End User

High Patient Volume in Ambulatory Centres to Lead the Segmental Growth

Based on end user, the market is segmented into ambulatory centers, specialty clinics, and others.

- For instance, in August 2023, HCA Healthcare, Inc., a healthcare provider comprising approximately 2,300 ambulatory sites, collaborated with Google Cloud to use generative AI technology and improve workflows on clinical documentation—such development is expected to drive the growth of the segment.

In addition, specialty clinics segment is projected to grow at a CAGR of 5.50% during the study period.

Ambulatory EHR Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Ambulatory EHR Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

North America accounted for USD 4.48 billion in 2025. The ambulatory EHR market in North America is expected to grow strongly due to a combination of favorable government initiatives, advanced healthcare infrastructure, and rapid integration of AI, cloud, and interoperability frameworks. In addition, rapid adoption of these ambulatory EHRs in the region is also bolstering the market growth.

- For instance, in July 2025, the Ambulatory Surgery Center Association (ASCA) conducted a survey and reported a record high utilization with 76.0% of ASCs using EHR.

Additionally, the U.S is projected to dominate the regional market due to supportive regulatory environment, early adoption of technologically advanced products, and well-developed healthcare infrastructure. The U.S. market reaching USD 4.20 billion by 2026.

Europe

Europe, is anticipated to witness a notable growth in the coming years. During the forecast period, European region is projected to record the growth rate of 5.85%, and reach the valuation of USD 2.19 billion in 2025. The growth in the region is attributed to rising investments in cloud-based and AI-integrated EHR solutions by public and private healthcare providers. The UK market reaching USD 0.48 billion by 2026 and the Germany market reaching USD 0.55 billion by 2026.

Asia Pacific

After Europe, the market in Asia Pacific is estimated to reach USD 1.95 billion in 2025 and secure the position of the third-largest region in the market. The Japan market reaching USD 0.38 billion by 2026, the China market reaching USD 0.52 billion by 2026, and the India market reaching USD 0.34 billion by 2026. The growth in the Asia Pacific region is attributed to government-led healthcare digitalization programs and increasing adoption of AI-enabled, mobile, and cloud-based EHR solutions.

Latin America and Middle East & Africa

Over the forecast period, Latin America and Middle East & Africa regions would witness a significant growth in this marketspace. Latin America market in 2025 is set to record USD 0.62 billion as its valuation. Strong public and private investments, rapidly advancing healthcare infrastructure, and the rising number of digital hospitals and specialty outpatient centers are fueling EHR adoption in the region. They are expected to drive market growth in these regions further. In the Middle East & Africa, GCC is set to attain the value of USD 0.09 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players are Focusing on Strategic Activities to Capitalize on Market Share

The global market holds a semi-consolidated market structure, constituting prominent players such as Epic Systems Corporation, Oracle, Medical Information Technology, Inc., and TruBridge, among others. The significant share of these companies is due to numerous strategic activities such as key mergers and acquisitions for robust product offerings, along with collaboration with other operating entities for technological developments.

- For instance, in November 2023, Thoma Bravo acquired NextGen Healthcare, Inc. for USD 1.8 billion. This was aimed to enhance the delivery of transformational solutions to the ambulatory healthcare marketplace.

Other notable players in the global market include Veradigm LLC, Azalea health, and MEDHOST. These companies are anticipated to prioritize new product launches and collaborations to boost their global ambulatory EHR market share during the forecast period.

LIST OF KEY AMBULATORY EHR COMPANIES PROFILED

- Epic Systems Corporation (U.S.)

- Oracle (U.S.)

- Medical Information Technology, Inc. (U.S.)

- TruBridge (U.S.)

- Veradigm LLC (U.S.)

- Azaleahealth (U.S.)

- MEDHOST (U.S.)

- Netsmart Technologies, Inc. (U.S.)

- Greenway Health, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS

- September 2025: Athenahealth launched advancements in its electronic health record (EHR) designed, automating routine tasks and delivering personalized insights. The development was a part of the company's ongoing launch of new features within its AI-native athenaOne platform.

- June 2025: Medical Information Technology, Inc., in collaboration with Willis Knighton Health, launched an initiative titled ‘MEDITECH Expanse’ in its 132 clinics. The initiative established integration across the organization’s care facilities and replaced three separate EHR systems to enable better care coordination, increased efficiencies, and improved outcomes.

- February 2025: Athenahealth partnered with Abridge to empower ambulatory care practices and enhance generative AI capabilities.

- January 2024: Harris Computer Corporation acquired MEDHOST, a leader in electronic health records (EHR) and healthcare IT solutions. The acquisition included MEDTEAM Solutions, a service provider specializing in application, revenue cycle, IT, and security management. MEDHOST provides clinical and financial solutions, including an integrated EHR, to enhance patient care and financial success.

- December 2021: Netsmart Technologies, Inc. acquired Remarkable Health to accelerate AI innovations and expand the Netsmart CareFabric platform capabilities that improve human services and post-acute care clinical staff productivity and efficiency. The acquisition also provided the company with access to the company’s HER platform, CT One, and Bells, a virtual clinical documentation solution.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.07% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment, Application, End User, and Region |

|

By Deployment |

· On Premise · Cloud based · Web based |

|

By Application |

· Clinical Documentation · Appointment Management · E-Prescribing · Clinical Decision Support (CDS) · Remote Patient Monitoring · Revenue Cycle Management/Billing · Analytics & Reporting · Others |

|

By End User |

· Ambulatory Centers · Specialty Clinics · Others |

|

By Region |

· North America (By Deployment, Application, End User, and Country) o U.S. o Canada · Europe (By Deployment, Application, End User, Distribution Channel, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (By Deployment, Application, End User, and Country/Sub-region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Deployment, Application, End User, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa ( By Deployment, Application, End User, and Country/Sub-region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 9.47 billion in 2025 and is projected to grow from USD 9.94 billion in 2026 to USD 15.93 billion by 2034

In 2025, the market value stood at USD 4.48 billion.

The market is expected to exhibit a CAGR of 6.07% during the forecast period.

The cloud-based segment led the market on the basis of deployment.

Shifting focus on outpatient care and technological advancement to drive the market growth during the forecast period.

Epic Systems Corporation, Oracle, Medical Information Technology, Inc., and TruBridge, Inc. are some of the major players in the global market.

North America dominated the market in 2024.

Seeking Comprehensive Intelligence on Different Markets?Get in Touch with Our Experts

Speak to an Expert

Download Free Sample

Healthcare

Clients

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us