Business Jet Market Size, Share & Industry Analysis, By Business Jet Type (Light Business Jet, Mid-sized Business Jet, and Large Business Jet), By System (Propulsion System, Aero structure, Cabin Interiors, Avionics, and Others), By End-User (Operators and Private), By Ownership (Pre-owned and New Deliveries), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

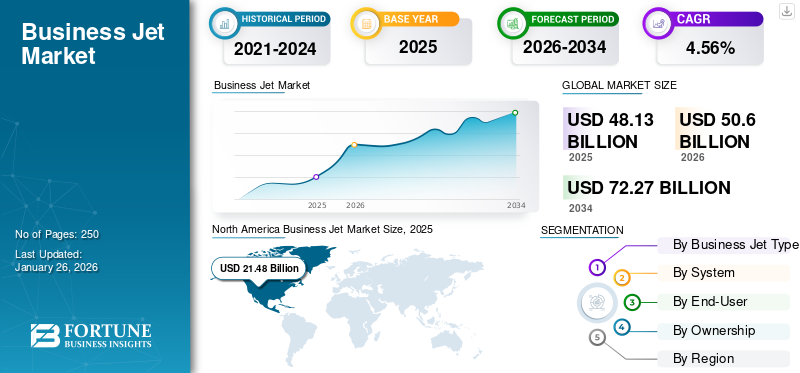

The global business jet market size was valued at USD 48.13 billion in 2025. The market is anticipated to grow from USD 50.60 billion in 2026 to USD 72.27 billion by 2034, exhibiting a CAGR of 4.56% during the forecast period. North America dominated the business jet market with a market share of 44.64% in 2025.

A business jet is designed to transport small groups of people. Recently, there has been exceptional growth in the number of high-net-worth travelers, thereby generating a high demand for private aviation and procurement of enhanced business aircraft. Additionally, fleet modernization programs by developed and emerging economies are anticipated to improve fleet capabilities and generate demand for new charter services with enhanced cabin interiors and advanced avionics.

A crucial trend seen in the market is the adoption of improved interiors and technological equipment in aircraft. This entails the incorporation of cutting-edge safety features, combat technology, and a modern flight deck in business aircraft. Additionally, major market participants are concentrating on introducing state-of-the-art private jets to offer clients an unparalleled experience equipped with various safety measures. For instance,

- In May 2021, Dassault Aviation, a military and business aircraft manufacturer headquartered in France, introduced the Falcon 10X, featuring the industry's largest cabin and latest technology equipped on a corporate jet. The Falcon 10X is expected to provide unrivaled passenger comfort on long and short-haul flights and ground-breaking safety measures derived from Dassault's frontline fighter technology.

During the COVID-19 pandemic, airport operations were completely stopped, subsequently leading to a strong decline in the demand for business jets. However, as the number of COVID-19-positive cases declined, airport operations were resumed and a huge growth in the number of passengers was observed after two years of the pandemic. This growth is expected to drive the market’s development during the forecast period.

Business Jet Market Overview & Key Metrics

Market Size & Forecast

- 2025 Market Size: USD 48.13 billion

- 2026 Market Size: USD 50.60 billion

- 2034 Forecast Market Size: USD 72.27 billion

- CAGR: 4.56% from 2026–2034

Market Share

- North America dominated the business jet market with a 44.64% share in 2025, driven by the presence of major players, largest fleet size, and strong demand for electric aircraft and fleet modernization initiatives. Increasing private jet usage among high-net-worth individuals and corporate clients further strengthens the region’s market position.

- By business jet type, large business aircraft held the largest share, supported by a post-pandemic rebound in business travel and demand for longer-range corporate jets with enhanced comfort and safety features.

Key Country Highlights

- United States: Strong demand fueled by modernization programs, operator fleet expansions, and high private aviation adoption. Significant developments include integration of hybrid-electric propulsion and next-gen avionics.

- France: Dassault Aviation’s launch of the Falcon 10X with advanced safety and largest cabin highlights innovation in Europe’s business jet segment.

- Japan & China: Rapid infrastructure development and high demand for large jets for long-distance corporate travel drive Asia Pacific’s growth.

- Middle East (UAE, Saudi Arabia): High concentration of HNWIs and emerging fractional ownership/private jet card programs boost regional demand.

- Brazil: Growth supported by Embraer’s strong regional presence and demand for cost-effective mid-sized and light jets.

Business Jet Market Trends

Increasing Use of eVTOL Jets to Bolster Market Growth

The rise of electronic transportation methods has created a necessity to modify eco-friendly air travel techniques. A similar trend can be seen with the rising adoption of jets equipped with eVTOL technology. eVTOL stands for Electronic Vertical Takeoff and Landing, representing an advanced type of aircraft that is sustainable, quiet, and safe for travel. The demand for eVTOL is expected to rise during the forecast period due to greater awareness and adoption of environmentally friendly travel options. Furthermore, the increasing purchasing capabilities of individuals and a consequent rise in regular travel are anticipated to enhance the demand for eVTOL jets during the forecast period. For instance, in December 2022, the creator of eVTOL, AIR, completed its first full flight of eVTOL airplane, AIR ONE. This flight marked the switch from cruise to hover. The AIR ONE prototype is loaded to a full capacity of about 1,100 kgs.

- North America witnessed business jet market growth from USD 19.71 Billion in 2022 to USD 20.81 Billion in 2023.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Increase in Purchasing Power and Net Worth of Individuals and Growth in Air Travel to Accelerate Market Growth

A steady rise in air travel in both developing and developed nations is expected to boost the need for new airports in key countries. This is a result of an increase in people's total wealth and buying power in a post-pandemic environment. The global economy is slowly thriving and reverting to its pre-pandemic state, increasing individuals' net worth, which, in turn, drives the business jet market growth.

Moreover, the rising urban development in Asia and increasing demand from nations, such as India and China will drive the market's expansion. The increasing demand for sophisticated business jets from wealthy individuals and the flourishing aviation industry is expected to propel the market's growth. Furthermore, with the global economy reopening post-pandemic, travel for business purposes has restarted, resulting in a general increase in the sales of these jets. The rising demand for suitable jet interiors and related services will also enhance the market’s growth during the forecast period.

- For instance, in January 2024, Adani Group, an Indian multinational company, announced that it purchased six business jets. The jets were Pilatus PC-24, and the contract was worth USD 36.29 million.

Increase in Refurbishment of Pre-Owned Aircraft and Emergence of OEM Players to Drive Market Growth

A rise in the number of pre-owned planes being converted into corporate jets, along with a growth in the number of original equipment manufacturers in the business aircraft sector, is expected to fuel the market’s development during the forecast timeframe. The introduction of new models within the current fleet will stimulate the expansion of the global business aircraft market. As per data from the General Aviation Manufacturers Association (GAMA), corporate jet deliveries rose by more than 12% statistically in the first half of 2019. Owing to their benefits, the need for new designs, such as the Pilatus PC-24, Cirrus SF50 Vision, and Gulfstream G500, is at its peak. As purchasing power increases, numerous buyers of business jets have begun seeking customized interiors.

- For instance, in October 2023, Boeing Business Jets, a business jets segment of The Boeing Company, unveiled a premium cabin selection for its range of Boeing VIP Jets. The premium cabin selection is available for BBJ 737-7 at a fixed price.

The emergence of new market players is expected to impact the market positively. Furthermore, advancements and customized aircraft refurbishment are significant drivers for the market. Key players are involved in creating customized corporate aircraft for customers, which will help them strengthen their positions in the market.

MARKET RESTRAINTS

Cost of Procurement to Limit Market Growth

Acquiring private jets is expensive and requires a lot of time, making it unaffordable for most people. Only individuals with significant wealth and purchasing power, such as prominent business owners and celebrities, can afford these jets. The modification of used aircraft increases the total cost as it includes routine maintenance and repairs along with extra costs for new interiors. Moreover, various government approvals are required for purchasing a private jet, which consumes a lot of time. Therefore, although there is an increasing demand and technological progress, the expenses and time involved in buying a business aircraft can restrict the market to a certain extent.

Segmentation Analysis

By Business Jet Type

Large Business Aircraft Segment Captured Largest Market Share Owing to Increased Business Travel

Based on business jet type, the market is segmented into light, mid-size, and large business aircraft.

The large business aircraft segment accounted for the highest market share of 39.80% in 2026, owing to a strong rise in business travel after the pandemic. In a post-pandemic scenario, after the resumption of air travel, companies and the global economy have started to show pre-pandemic growth patterns, leading to a subsequent rise in air travel for business.

The light and mid-sized corporate jet segments held significant market shares and are projected to record a steady CAGR owing to their high availability and comparatively lower procurement cost than that of large private jets.

By System

Increased Investments in Aerospace Technology to Boost Propulsion System Segment Growth

Based on system, the market is divided into propulsion system, aero structure, cabin interiors, avionics, and others.

The propulsion system segment will dominate the market share of 34.07% in 2026. This highlights the segment's importance and priority for investments in aerospace technology. The propulsion system segment is expected to dominate the North America business jet market during the forecast period. The push for environmentally friendly air travel through fuel efficiency and emission reduction efforts, including hybrid-electric propulsion systems, is a key driver.

The cabin interiors segment is expected to grow significantly during the forecast period due to the demand for MRO services and aircraft modernization programs.

- The aero structure segment is expected to hold a 21.17% share in 2023.

- For instance, in November 2023, Soisa Aircraft Interiors, a Mexico-based aircraft interiors company, announced the expansion of its facility in Dubai. The new facility has quadrupled in size, featuring specialized production lines with dedicated units for dress cover lamination, curtains, and cutting areas.

To know how our report can help streamline your business, Speak to Analyst

By End-user

Fleet Modernization and an Increasing Demand for Jets Boost Operators Segment Growth

Based on end-user, the market is classified into operators and private.

The operators segment dominated the market share of 76.89 in 2026, driven primarily by fleet modernization and an increasing demand for jet operators, especially in North America and Europe. This trend is expected to continue, with the operator segment projected to be the fastest-growing in the market. Operators and charter providers are investing heavily in modernizing their aging fleets. Operators have cost advantages due to economies of scale, enabling them to service their fleets more efficiently than private owners.

The private segment is anticipated to grow during the forecast period. This is due to the increasing demand for private jets from high-net-worth individuals and corporate companies.

By Ownership Analysis

Pre-Owned Segment Held Market Dominance Owing to Increased Demand for Refurbished Aircraft

The market is divided into pre-owned and new deliveries based on ownership.

The new deliveries segment accounted for a higher market share of 55.85% in 2026, owing to the historical availability of pre-owned aircraft. Additionally, a rise in the refurbishment of old aircraft as new private jets is anticipated to boost the segment’s growth during the forecast period.

Growth in net worth, purchasing power, and increased business-related travel are expected to boost the new deliveries segment’s growth during the forecast period of 2025-2032.

BUSINESS JET MARKET REGIONAL OUTLOOK

The market is segmented into North America, Europe, Asia Pacific, Middle East, and the rest of the world.

North America

North America Business Jet Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 21.48 billion in 2025 and USD 22.54 billion in 2026. The market’s growth in this region is due to the presence of major players & the largest fleet size, rising demand for electric aircraft, and availability of required infrastructure. The growing demand for business aircraft in the U.S. and Canada will drive the market’s growth in North America. The U.S. market is projected to reach USD 19.18 billion by 2026.

Asia Pacific

Asia Pacific is expected to demonstrate significant growth between 2025 and 2032. The regional market’s expansion is attributed to the rising advancements and funding of infrastructures by nations, such as Japan, India, and China. Furthermore, the utilization of business aircraft in these countries is expected to propel the regional market’s growth as operators and service providers are increasingly employing aircraft in these nations. Clients normally use corporate jets for challenging long-distance routes and due to additional travel limitations. In the global market, Asia Pacific has seen the greatest demand for large jets. The Japan market is projected to reach USD 2.48 billion by 2026, the China market is projected to reach USD 2.32 billion by 2026, and the India market is projected to reach USD 0.99 billion by 2026.

Europe

Europe is expected to exhibit substantial growth between 2025 and 2032. This is attributed to an increase in leasing options, technology-enhanced aircraft, and charter service companies and operators. Air Partner, Jetfly, NetJets Europe, and VistaJet are among the leading charter companies in this region. Moreover, due to changes in passengers' flying habits, the expansion of the market increased significantly in 2024. The UK market is projected to reach USD 3.78 billion by 2026, and the Germany market is projected to reach USD 2.65 billion by 2026.

Middle East

During the forecast period, the Middle East is projected to witness constructive growth owing to high product demand in large economies, such as UAE, Saudi Arabia, and Israel. The growing implementation of aviation emission rules has fueled the demand for private and newer aircraft. Furthermore, prominent High-Net-Worth Individuals (HNWI) in the Middle East have positively impacted the market's demand-side dynamics. In contrast, the associated ownership benefits, such as evolving fractional ownership or private jet card programs, have been critical in promoting the market’s growth.

Rest of the World

The market in the rest of the world will grow moderately from 2025-2032. The growth in these regions is due to increased spending on procuring next-generation jets from Latin America and Africa. Rising budgets and the growing introduction of programs for modernizing fleets will propel the market’s growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players to Focus on Providing Variety of Cost-Effective Services to Survive Market Competition

The market's competitive landscape is highly fragmented due to the presence of several major players, such as Airbus SAS and The Boeing Company. These companies are focusing on providing best-in-class corporate jets. Moreover, jet manufacturers are producing technologically advanced hybrid engines and establishing solid partnerships with emerging economies.

List of Key Business Jet Companies Profiled

- Airbus SAS (Netherlands)

- The Boeing Company (U.S.)

- Bombardier (Canada)

- Dassault Aviation (France)

- Embraer SA (Brazil)

- Gulfstream Aerospace Corporation (U.S.)

- HondaJet (U.S.)

- Textron, Inc. (U.S.)

- Eviation Aircraft (Israel)

- XTI. Aircraft (U.S.)

KEY INDUSTRY DEVELOPMENTS

- December 2024 - Airbus Corporate Jets (ACJ) signed a partnership agreement with AMAC Aerospace in Basel, Switzerland, to enter the ACJ Services Centre Network. AMAC will provide ACJ customers with a wide spectrum of customized capabilities – including maintenance, engineering, VIP cabin refurbishment, and upgrade services. The agreement took place at MEBAA 2024, the Middle East and North Africa's leading business aviation event in Dubai.

- March 2024 – Honda Aircraft Company named Japan General Aviation Service (JGAS) as its new Authorized Service Center in Japan, replacing previous partner Marubeni Aerospace Co., Ltd. This change was part of Honda's broader strategy to enhance its global sales & service network, aiming to provide HondaJet customers with better access to maintenance and support services across the region.

- December 2022 – The Indian government announced the launch of the luxury business jet terminal operation in Kochi, Kerala. The primary draw of the terminal is the minimal car-to-aircraft distance - the distance from the car parking to the airside is approximately 100 meters. Once a passenger finishes the security check-in and immigration procedures, they can access the aircraft in under two minutes.

- December 2022 – Gulfstream Aerospace Corp. and Rolls Royce announced that they would perform an OEM test flight of a business jet utilizing sustainable aviation fuel. The plane was reported to have an ultra-long range and twin engines, with the test flight occurring at Gulfstream's headquarters.

- July 2022 – Dassault Aviation chose IAI (Israel Aerospace Industries) to create and design all-composite wing movable components for the long-range Falcon 10X business jet. The IAI was anticipated to enhance the design stage of adjustable wing surfaces and assist in addressing the high demand for new aircraft.

REPORT COVERAGE

The report provides detailed information on the market and focuses on aspects, such as service types, airport types, infrastructure types, and key players. In addition, it provides insights into the market trends, competitive environment, market competition, product prices, and market conditions, focusing on key industry developments. In addition to the above-mentioned factors, the report contains several factors that have contributed to the growth of the global market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 4.56% from 2026-2034 |

|

Segmentation

|

By Business Jet Type

|

|

By System

|

|

|

By End-user

|

|

|

By Ownership

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights stated that the global market size was valued at USD 50.60 billion in 2026 and is anticipated to grow to USD 72.27 billion by 2034.

Registering a CAGR of 4.56%, the market will exhibit rapid growth during the forecast period of 2026-2034.

By ownership, the pre-owned segment will dominate this market during the forecast period.

The Boeing Company and Airbus S.A.S are the leading players in the global market.

North America dominated the business jet market with a market share of 44.64% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us