Cancer Biomarkers Market Size, Share & Industry Analysis, By Cancer Type (Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, and Others), By Biomarker Type (PSA, HER-2, EGFR, KRAS, and Others), By End User (Pharmaceutical & Biotechnology Companies, Diagnostics & Research Laboratories, Hospitals & Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

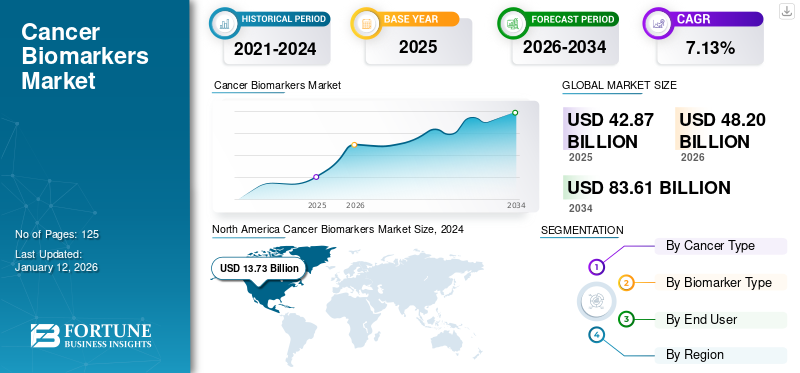

The global cancer biomarkers market size was valued at USD 42.87 billion in 2025. It is projected to grow from USD 48.2 billion in 2026 to USD 83.61 billion by 2034, exhibiting a CAGR of 7.13% during the forecast period. North America dominated the cancer biomarkers market with a market share of 35.94% in 2025.

The increasing global incidence of cancer, expanding research on cancer biomarkers, expanding use of biomarkers in drug development and discovery, and technological advancements are the main factors propelling this cancer biomarkers market's growth.

Biomarkers in oncology are the molecules secreted by a tumor or a specific response of the human body, indicating the presence of cancer. Biomarkers enable cancer detection at an early stage and facilitate high-speed noninvasive diagnosis using various genomics and proteomics tools. Biomarkers are used for various applications such as cancer diagnostics, drug discovery and development, prognostics, personalized medicine, and others. Additionally, the increasing demand for biomarkers in drug discovery and the development of personalized medicine are boosting the growth of the global market.

Research collaborations by various institutions and key market players to develop biomarkers for disease diagnosis are one of the major factors anticipated to upsurge the cancer biomarkers market's growth. For instance, in May 2019, Biotech Support Group (BSG) entered into a research collaboration with Leiden University Medical Center (LUMC) to develop Stromal conditioning biomarkers in cancer (protein biomarker).

Global Cancer Biomarkers Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 42.87 billion

- 2026 Market Size: USD 48.2 billion

- 2034 Forecast Market Size: USD 83.61 billion

- CAGR: 7.13% from 2026–2034

Market Share:

- North America dominated the cancer biomarkers market with a 35.94% share in 2025, driven by high cancer prevalence, advanced diagnostic technologies, and increasing use of biomarkers in drug discovery and personalized medicine.

- By cancer type, the breast cancer segment is expected to retain its largest market share owing to its high global incidence, growing awareness of early detection, and continued research efforts to develop novel biomarker-based diagnostic tools.

Key Country Highlights:

- United States: Growth supported by strong R&D investments, high adoption of precision medicine, and rapid regulatory approvals for biomarker-based diagnostics.

- Europe: Market expansion fueled by government-backed cancer screening initiatives, integration of biomarkers into clinical guidelines, and collaborative research networks.

- China: Increasing healthcare infrastructure investment, rising adoption of biomarker-based diagnostics, and strong pipeline development are driving market growth.

- Japan: Focus on early cancer detection programs, incorporation of advanced biomarker testing in clinical practice, and development of novel oncology diagnostics support market advancement.

Cancer Biomarkers MARKET TRENDS

The Paradigm Shift towards Personalized Medicine for Cancer Treatment is Fueling the Demand for Cancer Biomarkers

One of the major factors anticipated to increase demand for cancer biomarkers is the paradigm shift toward personalized medicine for cancer treatment due to the lack of standard diagnosis and treatment. Additionally, the importance of biomarkers is increasing in personalized medicine, with applications in diagnosis, prognosis, and selection of targeted therapies. Collaborations of various key market players with research institutes to develop novel cancer biomarkers for personalized medicine are also one of the major elements anticipated to drive the market growth during the forecast period.

Download Free sample to learn more about this report.

- North America witnessed a cancer biomarkers market growth from USD 12.24 Billion in 2023 to USD 13.73 Billion in 2024.

The continuous development and identification of biomarkers specific to the disease and individual patients are vigorous for personalized medicine, and biomarkers play a vital role in terms of calculating disease risk and response to therapy. Thus, the field of personalized medicine is expected to offer impending growth opportunities for players operating in the oncology biomarkers market.

MARKET DRIVERS

Rising Prevalence of Cancer to Fuel Market Growth

Cancer biomarkers are prominently used in companion diagnostics, personalized medicines, and other disease diagnostics, including disease risk assessment and drug discovery and development. The rising adoption of biomarkers in disease diagnostics is one of the major factors expected to drive cancer biomarkers market growth during the forecast period of 2025-2032.

Rising prevalence of cancer globally, leading to increasing demand for the early disease diagnosis, subsequently propelling the growth of the market. For instance, the National Cancer Institute, in 2018, an estimated 1,735,350 new cases of cancer were diagnosed in the United States. Additionally, according to the World Cancer Research Fund International, an estimated 18.0 million people were suffering from globally in 2018. Lung and breast cancers were the most common cancers reported globally, contributing to 12.3% of the total number of the cases diagnosed in 2018.

The rising prevalence of cancer biomarkers in emerging and developed countries is anticipated to increase the demand for cancer diagnostics and treatment. These factors are anticipated to propel the demand for these biomarkers during the forecast period of 2025-2032.

Presence of Potential Pipeline Candidates to Boost the Market

Many pharmaceutical companies are actively investing in research and development of novel biomarkers for the diagnosis and treatment of cancer. Many potential candidates are in their end stages of development and are projected to give a tremendous boost to the market after their launch.

According to the U.S. National Library of Medicine, around 1,515 cancer biomarkers are under clinical trials. For instance, Lund University Hospital in collaboration with South Sweden Breast Cancer Group is currently conducting clinical trials to compare the efficacy and tolerability of atorvastatin (in phase 2). This is evaluated against resistance to endocrine treatment (Fulvestrant/Aromatase Inhibitors) in patients with advanced breast cancer (ABC-SE). The study is estimated to be accomplished by April 2022. The introduction of new biomarkers for cancer screening and diagnosis during the forecast period is anticipated to propel the oncology biomarkers market growth.

MARKET RESTRAINT

Lack of Reimbursement Policies for Biomarker Testing is one of factor Limiting Use of Cancer Biomarkers

Despite the increasing incidence of cancer globally, and growing number of patients requiring diagnostic tests, lack of reimbursement policies for biomarker tests in emerging and developed countries, is one of the factor that is limiting the demand for these biomarkers globally. Another major factor restricting the growth of the market is the high cost for diagnosis and treatment for cancer in emerging countries. This is limiting the number of patients undergoing biomarker testing, and growing preference of patients towards other low-cost detection tests.

Cancer Biomarkers Market SEGMENTATION

By Cancer Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Lung Cancer Segment is anticipated to grow at Significant CAGR

Based on type, the market is segmented into breast cancer, lung cancer, colorectal cancer, prostate cancer, and others. The breast cancer segment dominated the oncology biomarkers market in 2024. Increasing prevalence of breast cancer, coupled with the rise in awareness about breast cancer diagnosis are factors presenting large patient pool undergoing diagnostic tests. This coupled with, rising research activities focusing on new biomarkers for detection of breast cancer are some of the major factors driving the breast cancer segment growth. However, the lung cancer segment is anticipated to grow at a significant CAGR during the forecast period of 2025-2032. This is attributable to the rising investment into research & development of biomarkers for lung cancer by key market players.

- By cancer type, the breast cancer segment is expected to hold a 32.59% share in 2026.

By Biomarker Type Analysis

EGFR Biomarker to Grow at Significant CAGR during Forecast Period of 2019-2026

Based on biomarker type, the market is segmented into PSA, HER-2, EGFR, KRAS and others. HER-2 segment held the largest share with a share of 33.34% in 2026, due to the rising prevalence of breast cancer and increasing awareness about disease diagnosis in both developed and developing countries. This along with new biomarker based tests being introduced by market players for breast cancer diagnosis, based on liquid biopsy is propelling the demand for these tests globally. However, the EGFR biomarker segment is anticipated to grow at a faster pace due to the rising prevalence of lung cancer and increasing demand for diagnosis. For instance, according to the American Cancer Society, an approximate of 234,030 new cases of lung cancer were reported in the United States in 2024.

- By biomarker type, the HER-2 segment is projected to generate USD 14.25 billion in revenue by 2025.

By End User Analysis

Increasing Use of Biomarkers for Drug Discovery and Development to Fuel Growth of Pharmaceutical & Biotechnology Companies Segment

Based on end user, the market is segmented into pharmaceutical & biotechnology companies, diagnostics & research laboratories, hospitals & specialty clinics and others. Among end users, the diagnostics & research laboratories segment held the dominant cancer biomarkers market with a share of 53.49% in 2026. The introduction of new products for diagnosis is one of the additional factor driving the segment growth. For instance, QIAGEN launched Therascreen PIK3CA RGQ PCR Kit, in May 2019 to identify detect breast cancer patients who are eligible for treatment through PIQRAY – a first and only approved treatment for PIK3CA mutation in breast cancer. Additionally, the test kit is the first FDA approved assay which uses plasma specimen as a liquid biopsy to guide treatment decisions in breast cancer.

The increasing investment by key market players, and growing importance of biomarker tests in drug discovery and development, is one factor propelling the demand for cancer biomarkers from pharmaceutical & biotechnology companies. Growing number of tests being performed at hospitals for inpatients suffering from various cancers, is driving the growth of the hospitals & specialty clinics segment.

REGIONAL ANALYSIS

North America

North America Cancer Biomarkers Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The cancer biomarkers market in North America was valued at USD 17.29 billion in 2026, accounting for the largest share of the global market and maintaining its dominant position ahead of Europe. Strong market maturity is supported by a well-established regulatory framework, rapid clinical adoption of advanced technologies such as next-generation sequencing, and extensive validation of biomarkers in oncology drug discovery, development, and diagnostics. High healthcare spending, robust reimbursement mechanisms, and sustained investment in translational research continue to reinforce demand, with the U.S. market projected to reach USD 15.03 billion by 2026.

Europe

Europe represents the second-largest regional market and is anticipated to grow at a CAGR of 12.5% during the forecast period, driven by expanding precision medicine initiatives and increasing integration of biomarker testing into routine oncology care. A harmonized yet stringent regulatory environment emphasizes clinical evidence and companion diagnostics, supporting steady adoption across healthcare systems. Demand is underpinned by strong academic–industry collaboration and public funding for cancer research, with the UK market projected to reach USD 2.19 billion by 2026 and the Germany market projected to reach USD 3.8 billion by 2026.

Asia Pacific

Asia Pacific is anticipated to grow at a significant CAGR during the forecast period, reflecting accelerating uptake of biomarker-based cancer diagnostics and wider deployment of technologically advanced laboratory instruments. Regulatory pathways are evolving to support faster approvals and local innovation, while increasing public and private investment in oncology research is expanding testing capacity. Rising cancer incidence and growing emphasis on personalized medicine are strengthening demand across the region, with the Japan market expected to reach USD 3.40 billion by 2026, the India market projected to reach USD 1.35 billion by 2026, and China projected to witness a strong CAGR of 13.90% during the forecast period.

Latin America

The cancer biomarkers market in Latin America is expected to expand steadily, supported by gradual improvements in healthcare infrastructure and increasing awareness of biomarker testing in cancer diagnosis and treatment planning. Regulatory environments are becoming more aligned with international standards, facilitating technology transfer and market entry. Demand growth is primarily driven by rising cancer prevalence, expanding access to diagnostic services, and increasing adoption of targeted therapies in major economies.

Middle East & Africa

The Middle East & Africa market is projected to grow at a moderate pace during the forecast period, reflecting improving diagnostic capabilities and growing focus on early cancer detection. Regulatory frameworks are strengthening to support advanced diagnostic technologies, while public and private investments are gradually increasing in oncology care. Demand trends are supported by rising disease burden, expanding healthcare coverage in select countries, and increasing awareness of the clinical value of biomarker-based testing in cancer management.

KEY INDUSTRY PLAYERS

F. Hoffmann-La Roche Ltd., Abbott, and Thermo Fisher Scientific, Inc. are Leading Market Players

The cancer biomarkers market is a semi-consolidated market. To strengthen their position, key market players are focusing on the introduction of novel biomarker tests, and mergers & acquisitions with other prominent companies with an aim to establish a strong brand presence. For instance, in November 2016, Thermo Fisher Scientific Inc., launched four new additions to its product portfolio of multi-biomarker targeted assays. This includes the Oncomine Immune Response Research Assay, which is designed to cross-examine the microenvironment of the tumor and allow further identification of prognostic biomarkers.

F. Hoffmann-La Roche Ltd., Abbott, and Thermo Fisher Scientific, Inc. are among the top market players in the global oncology biomarkers market. Other players operating in the market are Bio-Rad Laboratories, Inc., Sino Biological Inc., BioVision Inc., Myriad RBM, R&D System, Axon Medchem, CENTOGENE N.V., and others.

LIST OF KEY COMPANIES PROFILED:

- F. Hoffmann-La Roche Ltd.

- Abbott

- Thermo Fisher Scientific

- Bio-Rad Laboratories, Inc.

- CENTOGENE N.V.

- Axon Medchem

- Sino Biological Inc.

- R&D System

- BioVision Inc.

- Myriad RBM

- Other players

KEY INDUSTRY DEVELOPMENTS

- March 2021- Roche made an announcement that company has received the approval from US Food and Drug Administration for VENTANA ALK (D5F3) CDx Assay as a companion diagnostic. This assay test is the only test which was approved by FDA for as a companion diagnostic for LORBRENA and will help in identifying patients with this cancer biomarker quickly so they can be given more effective treatment.

- July 2020 - Thermo Fisher Scientific has announced that the company has signed a companion diagnostic (CDx) agreement with Chugai Pharmaceutical Co., Ltd., and has applied to the Ministry of Health, Labour and Welfare (MHLW) to increase the use of the Oncomine Dx Target Test in Japan. This agreement focuses on accelerating the local biomarker testing of NSCLC patients eligible for entrectinib in Japan.

- November 2020 - Agilent Technologies Inc. made an announcement of the launch of the Biomarker Pathologist Training Program which is a worldwide initiative built to enable pathologists to score biomarkers precisely. The program initially was available in Europe and North America, along with China and Asia which utilizes a digital platform.

REPORT COVERAGE

The cancer biomarkers market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, cancer type, and leading biomarker types. Besides, the report offers insights into the market, current trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Cancer Type

|

|

By Biomarker Type

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global cancer biomarkers market size was valued at USD 48.2 billion in 2026 and is projected to reach USD 83.61 billion by 2034.

Breast Cancer held the largest market share due to its high global prevalence and rising awareness about early diagnosis. However, lung cancer biomarkers are projected to grow at a significant CAGR owing to increasing R&D investments and new diagnostic innovations.

Growing at a CAGR of 7.13%, the market will exhibit steady growth in the forecast period (2026-2034)

Breast cancer is expected to be the leading segment with respect to cancer type, in this market during the forecast period.

Key factors driving growth include the rising global cancer rates, growing use of personalized medicine, wider application in drug development, and advances in biomarker detection technologies like genomics, proteomics, and liquid biopsies.

F. Hoffmann-La Roche Ltd., Abbott, Thermo Fisher Scientific are some of the top market players in the global market

North America dominated the market in 2025.

The paradigm shift towards personalized cancer medicine is one of the major elements anticipated to drive the adoption of cancer biomarkers.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us