Crop Protection Chemicals Market Size, Share & Industry Analysis, By Type (Herbicides, Insecticides, Fungicides, and Others), By Source (Synthetic Chemicals and Biologicals), By Mode of Application (Foliar Spray, Soil Treatment, Seed Treatment, and Others), By Crop Type, and Regional Forecast, 2026-2034

Crop Protection Chemicals Market Size

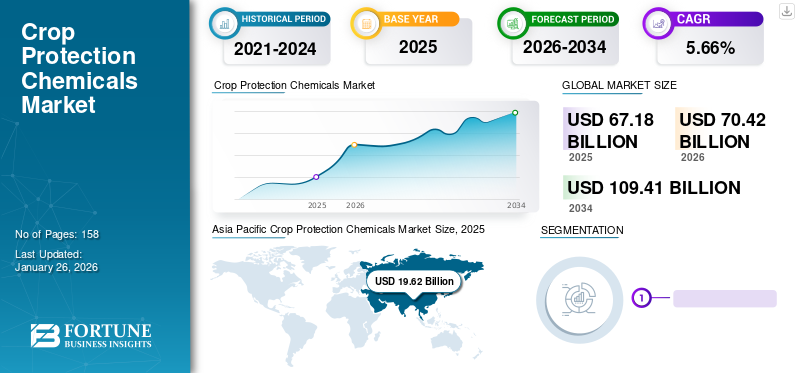

The global crop protection chemicals market size was USD 67.18 billion in 2025. The market is projected to grow from USD 70.42 billion in 2026 to USD 109.41 billion by 2034 at a CAGR of 5.66% during the analysis period from 2026 to 2034. Moreover, the crop protection chemicals market in the U.S. is projected to grow significantly, reaching an estimated value of USD 11.14 billion by 2032, driven by strong adoption of advanced technologies and modern farming practices. Asia Pacific dominated the crop protection chemicals market with a market share of 29.20% in 2025.

The global impact of COVID-19 has been unprecedented and staggering, with these protection chemicals witnessing a positive impact on demand across all regions amid the pandemic. Based on our analysis, the global market exhibited a growth of 2.50% in 2020 as compared to the average year-on-year growth during 2017-2019. The rise in CAGR is attributable to this market’s demand and growth rate, returning to pre-pandemic levels once the pandemic is over.

Crop protection products, such as crop pesticides, reduce yield losses caused by pests and diseases. According to the Royal Society of Chemicals, about 800 chemically active ingredients are registered for use as crop protection solutions worldwide. These chemicals are broadly categorized into herbicides, fungicides, and insecticides groups.

The focus of research in recent years in the crop protection type of products domain has been on developing compounds safer than older counterparts to meet the demand for new molecular solutions for control of pests that have developed resistance to the older compounds. Other key research and development (R&D) interest areas include selectivity to control target pests, per hectare low application rate requirement, broad-spectrum control to cover a diverse group of pests and diseases, and meet regulatory mandates regional and local markets.

The COVID-19 outbreak had a significant impact on the global economy. Industries across the globe faced multiple challenges, which were majorly attributed to the stringent regulations implemented by governments of countries across regions. The global economy saw a significant decline more than the great depression of 1930s. For instance, as per the United Nations World Economic Situation and Prospects report, the global economy contracted by 3.2% in 2020. Furthermore, as per the United Nations Department of Economic and Social Affairs, around 90% of the world economy sources were under lockdown, which significantly disrupted the global supply chain, influencing consumer behavior and also putting millions of individuals out of work. The agrochemicals industry was not an exception and did face a disruption in the supply chain with a critical impact on its production and distribution owing to the closing of borders and limited raw materials supply.

Global Crop Protection Chemicals Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 67.18 billion

- 2026 Market Size: USD 70.42 billion

- 2034 Forecast Market Size: USD 109.41 billion

- CAGR: 5.66% from 2026–2034

Market Share:

- Asia Pacific dominated the crop protection chemicals market with a market share of 29.20% in 2025.

- Herbicides led the market due to rising weed populations and labor shortages in developing nations. Cereals remained the top crop type due to growing demand and yield focus. Synthetic chemicals continued to dominate the market, driven by affordability and efficacy. Seed treatment gained traction as a preferred application method for its cost-effectiveness and safety profile.

Key Country Highlights:

- U.S.: Crop protection chemicals market projected to reach USD 11.14 billion by 2032 due to adoption of advanced technologies and modern practices.

- India: Integrated Pest Management led to a 40.14% and 26.63% increase in yield for rice and cotton, respectively.

- Brazil: Major pesticide consumer; market supported by exports, expanded cultivation, and modern farming inputs.

- China: High consumption of crop protection products contributes to rising crop yield.

- Europe: Strong presence of major manufacturers and increasing awareness of integrated pest management support market growth.

- Middle East & Africa: High demand for grain crops and large-scale field crop cultivation enhance product adoption.

Crop Protection Chemicals Market Trends

Growing Adoption of Integrated Pest Management to Enhance Yields

Integrated pest management strategy focuses predominantly on long-term prevention of pests by combining techniques such as biological control, utilization of resistant variants, and modification of cultural practices. Different pest control methods and extensive information on the pest life cycle and their interaction result in proper pest management with the most negligible hazard to human and animal health. Thus, farmers are inclining towards such methodologies as it reduces the environmental risks associated with pest management. For instance, according to the Directorate of Plant Protection Quarantine & Storage (India), agricultural crop yield has increased by 40.14% and 26.63% in rice and cotton crops, respectively, with integrated pest management practices.

According to the research findings, the global losses due to insect pests have declined from 13.6% in the post-green revolution era to 10.8% towards the beginning of this century. This decline in pest infestation was due to the tremendous change in the crop production systems, use of these protection chemicals, increased awareness about field & post-harvest losses, and required control measures. Improved infrastructure facilities for post-harvest management of crop produce across the world. Asia Pacific witnessed a growth from USD 17.88 Billion in 2023 to USD 18.71 Billion in 2024.

Download Free sample to learn more about this report.

Crop Protection Chemicals Market Growth Factors

Increasing Utilization of Crop Protection Solutions for High Yield to Fuel Growth

Crop protection chemicals are widely utilized in modern agriculture as an effective and economical solution to enhance crop yield by preventing crops from harmful pests and weeds. Thus, the rise in crop yield helps to ensure food security for the growing populations. According to the Food and Agriculture Organization (FAO), Brazil, China, and the U.S are major consumers of these protection products. High usage of pesticides in these countries can be identified as one of the main causes for rising crop yield.

Emergence of Pests and Diseases Due to Fluctuations in Climatic Conditions to Aid Growth

Changes in climatic conditions have accelerated the occurrence and prevalence of plant diseases and pests. Climatic fluctuations have a significant impact on crop production and susceptibility to pest problems. Climate change increases the susceptibility of crops to different pests and diseases, which, in turn, affects crop yield. Therefore, any change in the climate leads to deviation in farming practices, leading to a decline in productivity. Further, irregular rainfall in various regions led to a rise in the fungal population. These factors have increased the dependability of farmers on the products for efficient pest prevention, thereby fueling the growth of the market.

RESTRAINING FACTORS

Growth in Resistance of Pests to Crop Pesticides to Hamper the Market

The increased resistance of pests toward certain crop protection chemicals is a major factor restraining the market growth. The significant decline in the effectiveness of certain active ingredients has led to enhanced resistance to pests. This resistance can be attributed to the change in metabolism patterns in insects, increasing reproductive rates, and extreme pest proliferation.

Crop Protection Chemicals Market Segmentation Analysis

By Type Analysis

Rising Weed Population to Spike Adoption of Herbicides

The herbicides segment dominated the global market as many developing countries, such as India and China, face shortage of laborers for mechanical weeding with a share of 39.26% in 2026. High efficiency offered by herbicides over manual weeding techniques is expected to support the market segment growth in the coming years. The launch of various herbicide products having unique features based on the selectivity of weed and emergence of crops, adds stimulus to the crop protection chemicals market growth. On the other hand, the increasing area under genetically modified crops across various regions also attracts increased usage of herbicide products in crop cultivation.

- The herbicides segment is expected to hold a 39.38% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Crop Type Analysis

Cereals Segment to Observe Robust Growth

The cereals segment has been observing a robust growth in recent years, owing to the high adoption of crop protection products in cereal production with a share of 39.31% in 2026. According to FAO, world cereal production is projected to rise by 2.6% in 2020 from previous year levels. Additionally, the rising global population has led to an increased focus on food security and high demand for crops, thereby contributing to the growth of the cereals segment.

By Source Analysis

Synthetic Chemicals Segment to Emerge Dominant

The synthetic chemicals segment holds a major market share due to the high use of these chemicals in developing countries of Asia, South America, Africa, and the Middle East with a share of 85.69% in 2026. The increased usage of synthetic chemicals is primarily attributed to their lower price and pest-targeted effectiveness. On the other hand, the demand for biologically sourced protection products is increasing as the regional, country, and local governments promote environment-friendly crop protection products.

By Mode of Application Analysis

Seed Treatment Mode of Application to Display Strong Growth

Conventional modes of application, such as foliar and soil application segments, accounts for a significant market share of 48.25% in 2026. Still, seed treatment has emerged as a popular method of applying these protection chemicals in recent years. Considering its cost, efficacy, and safety, the seed treatment method of application is fast emerging as a better alternative to conventional/traditional pest control methods. It can supplement other pest control measures to achieve satisfactory results in the field.

REGIONAL INSIGHTS

Asia Pacific Crop Protection Chemicals Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the crop protection chemicals market with a market share of 29.20% in 2025. The growing awareness about the use of protection products for crops among small and marginal crop producers in the region has supported the market's strong growth. Expansion of areas under cultivation of high-value and export-oriented crops is projected to support the market growth in Asia Pacific. The rising population in the region and the increasing need for food crops also enhance pesticides in the region.

- In Asia Pacific, the herbicides segment is estimated to hold a 38.66% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

South America is now the second-largest consumer of crop protection chemicals, and its usage is projected to surpass the dominating region by 2024. Brazil is the key pesticide consumer in the region. The growth of the Brazil crop protection chemicals market is driven by growing exports of agricultural commodities, an increasing area under cultivation, and modern farm inputs, including these protection products.

The consumption of crop protection chemicals in Europe is supported by increasing awareness regarding integrated pest management approaches, advances in farming practices, and the need to increase yield per hectare. The presence of key manufacturers such as Bayer, BASF, and Syngenta also drives the high use of pesticides in the region.The Germany market is projected to reach USD 2.42 billion by 2026.

The North American crop protection chemicals market is driven by declining arable land and food security. Large area under cultivation of cereal crops also fuels the use of such chemicals in the region. The U.S. is the major pesticide consumer in the region, and its growth is driven by the adoption of advanced technologies and modern farming practices.The U.S. market is projected to reach USD 8.83 billion by 2026.The Japan market is projected to reach USD 3.48 billion by 2026, the China market is projected to reach USD 6.54 billion by 2026, and the India market is projected to reach USD 2.78 billion by 2026.

The cost-effectiveness of chemical pesticides and the need to increase agricultural productivity boost crop protection products in the Middle East and African region. The large area under field crop cultivation and high demand for grain crops also fuel the adoption of these products in the region.

KEY INDUSTRY PLAYERS

Key Players to Intensively Focus on New Product Launches for Efficient Crop Protection Solutions

Industry players are launching new crop protection products considering the diversified demand from farmers and agriculturists. The manufacturers are focusing on expanding their geographical presence as well as increasing their production capabilities. This will help in delivering better quality products to consumers.

UPL (India) made significant acquisitions in recent years to strengthen its position in the global market. The company completed the acquisition of Arysta LifeScience Inc. from Platform Specialty Products for USD 4.2 billion in 2019 (February). Now, the company has its footprint in 76 countries and sales in more than 130 countries.

List of Top Crop Protection Chemicals Companies:

- Bayer CropScience (Leverkusen, Germany)

- Syngenta AG (Basel, Switzerland)

- BASF (Ludwigshafen, Germany)

- Corteva, Inc. (Delaware, U.S.)

- FMC Corporation (Pennsylvania, U.S.)

- ChemChina (Beijing, China)

- Sumitomo Chemicals (Tokyo, Japan)

- UPL Ltd. (Mumbai, India)

- Nufarm (Melbourne, Australia)

- Rotam CropScience Ltd (Hong Kong, China)

KEY INDUSTRY DEVELOPMENTS:

- In November 2023, Insecticides (India) announced the launch of four new crop protection products. The four new products include Nakshatra, Supremo SP, Opaque, and Million. The launch was intended at catering to the increasing sowing demand as there is a rising sowing of Rabi crops in India.

- In September 2023, ADAMA Ltd., one of the leading crop protection companies, announced the launch of its all-new crop protection products in India. These new products are called Cosayr and Lapidos. These are the first-ever insecticides that are said to contain the active ingredient Chlorantraniliprole (CTPR). These products are designed to assist in the protection of paddy and sugarcane crops.

- In June 2022, Bayers, one of the well-known agrochemical companies, announced the launch of Curbix Pro and Kollar to assist farmers in tackling plant hoppers in paddy farms. The products are designed to reduce crop loss and generate higher yield with dual action.

- In January 2020, Crystal Crop Protection Ltd acquired three insecticide brands, Dursban, Nurelle-D, and Predator, from Corteva Agriscience. This acquisition will be a valuable addition to the company's business and strengthen its market presence.

- In May 2019, BASF launched an innovative fungicide, ‘Seltima,’ for rice crop protection in Thailand. The product contains unique encapsulation technology to ensure the controlled release of the active ingredient directly on the plant surface.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading product applications. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the advanced market over recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.66% over 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Crop Type

|

|

|

By Source

|

|

|

By Mode of Application

|

|

|

By Geography

|

Frequently Asked Questions

The global crop protection chemicals market size was USD 67.18 billion in 2025. The market is projected to grow from USD 70.42 billion in 2026 to USD 109.41 billion by 2034 at a CAGR of 5.66% during the analysis period from 2026 to 2034.

Growing at a CAGR of 5.66%, the market will exhibit steady growth during the forecast period (2026-2034).

The herbicides segment is expected to be the leading segment based on type in the global market during the forecast period.

The rising utilization of crop protection products to protect from pests and diseases and produce high yields to meet global food security is the key driver for the market.

Bayer CropScience, Syngenta AG, BASF, FMC Corporation, and Adama Agricultural Solutions are the key players in the market.

Asia Pacific held the highest market share in 2026.

Seed treatment mode of application is expected to grow at the fastest rate.

The increasing global population has led to a rise in demand for crops, which is driving the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us