Dairy Alternatives Market Size, Share & Industry Analysis, By Source (Soy, Almond, Coconut, Rice, Oats, and Others), By Product Type (Non-dairy Milk, Butter, Cheeses, Yogurts, Ice Cream, and Others), By Price Range (Low {Non-dairy Milk, Butter, Cheese, Yogurts, Ice Cream and Others} Medium {Non-dairy Milk, Butter, Cheese, Yogurts, Ice Cream and Others} and Premium {Non-dairy Milk, Butter, Cheese, Yogurts, Ice Cream and Others}), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

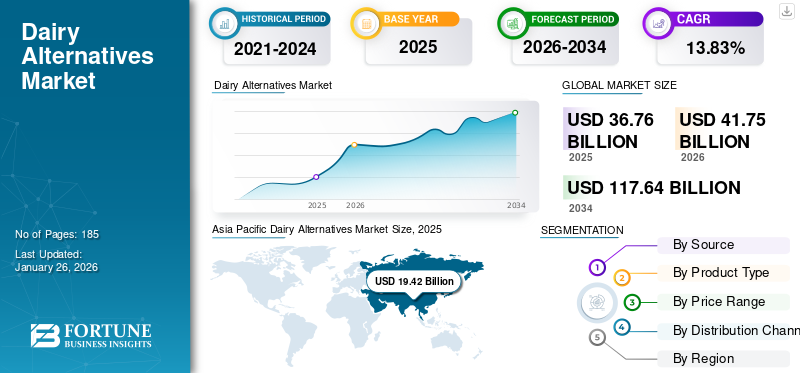

The global dairy alternatives market size was valued at USD 36.76 billion in 2025. The market is projected to grow from USD 41.75 billion in 2026 to USD 117.64 billion by 2034, exhibiting a CAGR of 13.83% during the forecast period. Asia Pacific dominated the dairy alternatives market with a market share of 52.83% in 2025.

Plant-based milk substitutes are leading to the recent surge in demand for non-dairy products or dairy alternatives. Vegan milk is a suspension of dissolved and disintegrated plant extracts in water as a base. Homogenization and thermal treatments are the two processing techniques utilized to improve the suspension and stability of such plant-derived products.

Vegan milk has occupied the center stage in the non-dairy sector and is intensively marketed as a healthy, sustainable, and animal-welfare-friendly alternative. The sources of such alternative products are legumes, nuts, or cereals, which are the recognizable ingredients among most consumers from developed and developing economies. Additionally, the evolution and improvisation in dietary lifestyles, such as veganism and flexitarianism, fuel the demand for plant milk and associated products.

Danone S.A., Archer-Daniels-Midland Company, Blue Diamond Growers, SunOpta, Inc., and Vitasoy International Holdings Ltd are some of the key players in the market.

Dairy Alternatives Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 36.76 billion

- 2026 Market Size: USD 41.75 billion

- 2034 Forecast Market Size: USD 117.64 billion

- CAGR: 13.83% from 2026–2034

Market Share:

- Asia Pacific dominated the dairy alternatives market with a 52.83% share in 2025, driven by rising adoption of plant-based diets, lactose intolerance concerns, and growing veganism.

- By product type, non-dairy milk led the market in 2024, supported by strong consumer demand, interest from key market players, and robust growth potential for plant-based beverages.

Key Country Highlights:

- China: Rising lactose intolerance and increasing market penetration by dairy alternative companies fuel growth.

- India: Rising consumer awareness, veganism adoption, and demand for plant-based milk alternatives drive market expansion.

- U.S.: Shift toward plant-based diets and high consumer awareness of dairy alternatives support market growth.

- Europe (U.K., Germany, France, Spain, Italy): Sustainability concerns, environmental awareness, and innovative product launches drive adoption of plant-based dairy products.

- Brazil & Argentina: Increasing shift from animal-based to plant-based dairy products, particularly among millennials, fuels market growth.

MARKET DYNAMICS

Market Drivers

Growing Concerns Regarding Processed Dairy Products to Drive Market Growth

The market for dairy alternatives is primarily driven by lactose-intolerant consumers. Besides, there is an increasing perception among the general consumers that lactose-free products are healthy alternatives to conventional dairy. Lactose intolerance is due to the absence of the enzyme called lactase, which breaks down lactose. Nearly 65% of the human population shows reduced ability to digest lactose after infancy.

The developed markets of Western Europe and North America witnessed a remarkable fall over the past two decades in the volumetric and value-based consumption of specific dairy categories. Consumers are inclining toward plant-based alternatives, especially in the most prominent markets of dairy products, due to their rising concerns over allergens, hormones, and unethical animal husbandry practices prevalent in the dairy sector. The manufacturing of dairy products has significant environmental impacts that contribute to soil degradation, air and water pollution, and consequent loss of biodiversity.

Product Innovation and Wider Reach to Ensure Success for Market

Plant milk and milk products are expected to fetch a more significant market share and stronger growth rates than their conventional dairy counterparts in the coming years as veganism is set to go mainstream. The growing preference for flexitarian, vegetarian, and vegan food lifestyles would further push the sales of plant-based dairy substitutes. This trend, coupled with the ever-increasing health, animal welfare, and environmental issues, may constrain the revenue performance of the dairy sector. The sustainable growth trajectory of products hinges on value-added products that appeal to consumers’ nutritional and aesthetic needs. Moreover, such products must establish effective market penetration along with economies of scale so that they are widely available, affordable, and accessible at all sales points where dairy products are normally marketed.

Furthermore, celebrities are engaging in promoting vegan food and beverages, including alternatives to dairy products, which will propel the market in the coming years. For instance, in February 2023, one of the world’s leading plant-based milk brands, Silk, unveiled an advertising campaign called ‘Got Milk?’ to promote out-of-home consumption. The brand collaborated with well-known celebrities, such as Brooklyn Peltz Beckham, Ella Bleu Travolta, and Sailor Brinkley Cook.

Market Restraints

Sub-optimal Market Penetration and Low Consumer Awareness to Lower Sales

One of the key restraints in the plant-based milk and milk products market is the organoleptic profiles of such novel products. Processors usually encounter challenges with solubility issues and taste while developing non-dairy products. The repeated purchase rates for these dairy-free products are far below in comparison to conventional dairy products. This indicates that the sensory profiles of milk alternatives are not yet at par with dairy milk and its derivatives. Moreover, plant-based milk, yogurt, and cheese have very low macro and micronutrients. Thus, they cannot compete with conventional dairy products in terms of nutritional content. Soy milk naturally has a protein content similar to cow’s milk. Almond milk, one of the most popular non-dairy options, contains only 1 gram of protein per 8 ounces. Additionally, increasing raw materials prices will also adversely affect market growth in the near future.

Market Opportunities

Emerging Mergers and Acquisitions are Likely to Shape Industry Landscape

Increasing consumer demand for plant-based products globally forces companies to introduce new products to cater to the market growth. Increasing companies' desire to expand their presence and product range exposes intense competition in the industry. Thus, key food companies are acquiring emerging brands to overcome the market competition and expand their market share. Furthermore, mergers & acquisitions allow established companies to grow in the industry speedily and provide global market access to emerging companies. Increasing merger & acquisition activities in the industry are likely to drive the dairy alternatives market growth. For instance, in January 2025, Misha, the U.S. plant-based food company, acquired Vertage, a non-dairy cheese producer. This strategic acquisition will assist the company in expanding its product range in the shredded and sliced plant-based cheeses category in the market.

Dairy Alternatives Market Trends

Emerging Veganism and Growing Inclination of Consumers toward Plant-based Foods to Boost Growth

Plant-based milk is a well-established food category. Major players such as Oatly or Alpro launched such products in Europe in the 1980s. The recent surge in demand for dairy alternatives, coupled with the dynamic growth in the past few years, is due to the robust popularity of plant-based ingredients and rising adoption rates for meat and dairy substitutes. In 2022, the U.S. Department of Agriculture reported that approximately 8 million people followed a vegetarian diet, while about 1.58 million people adhered to a vegan diet.

From an environmental standpoint, the dairy and meat sectors are the most significant greenhouse gas emitters. Furthermore, milk and dairy commodities' water and carbon footprint are significantly higher than that of horticultural products. Additionally, growing consumer preference for plant-based dairy products, investments from private & public companies, and the rising influence of Western countries are boosting product demand in Asian countries, such as China and India. According to a combined study report by the Associated Chambers of Commerce and Industry of India and Vegan First, published in 2023, the plant-based dairy industry in India will grow by about 20% from 2023 to 2027. The rising concern about environmental sustainability will positively influence the global dairy alternatives market share expansion in the upcoming years.

Impact of Tariff

The U.S. has imposed a reciprocal tariff on Canada, Mexico, China, India, and Europe. Dairy alternative manufacturers depend on importing ingredients such as nuts, grains, oats, soy, and others. Canada is one of the key oat manufacturers in the world. According to Cereals Canada, Canada has produced more than 3.7 million tons of oats annually, and 81% of the produced oats will be exported to the U.S., which accounts for 96% of the import share. Imposing a tariff on importing oats and other ingredients from countries will increase the price of oat milk and milk-based dairy alternatives. As tariffs increase the production overheads, manufacturers plan to source the ingredients locally. It may significantly change the industry's supply chain in the near future.

SEGMENTATION ANALYSIS

By Source

Soy Segment to Exhibit Astonishing Growth Backed by Broader Availability

Based on the source, the market is segmented into soy, almond, coconut, rice, oats, and others.

Soy milk has been a clear leader in terms of source, owing to its broader availability in the Asia Pacific market, particularly in China. The Soy segment is anticipated to hold a dominant market share of 43.83% in 2026.The milk market is heavily commoditized, and thus, consumers are experimenting by purchasing innovative products, which drives the segment’s growth.

Oat milk will witness faster growth than all the other sources of dairy alternatives. It is rapidly gaining popularity among consumers as they avoid soy due to allergies or other health concerns associated with the products. Oat milk is low in calories, and recently, oat-based non-dairy products have been witnessing stronger acceptance rates in the North American, European, and Australian beverage markets. These products are also well-branded and marketed sophisticatedly, appealing to younger consumers.

By Product Type

Non-dairy Milk Segment to Lead Owing to Favorable Demand Dynamics

Based on product type, the market is classified into non-dairy milk, butter, cheeses, yogurts, ice cream, and others.

The non-dairy revolution began with the development of milk alternatives. The non-dairy milk segment is dominating the global market with a share of 72.19% in 2026, owing to favorable demand dynamics, increasing interest among the key giants and private-label players to develop milk from plant-based sources, and strong growth potential for vegan beverages.

The ice cream segment showcases a faster growth rate, owing to its rising popularity among consumers across all age groups. The emerging foodservice sector is rapidly evolving in terms of product offerings, and claims such as ‘non-dairy,’ ‘vegan,’ ‘plant-based,’ and ‘natural’ are experiencing considerable consumer attention. Additionally, changing consumers' diet practices and the adoption of a vegan diet are likely to drive the demand for vegan frozen dessert and ice cream products during the forecast period. Additionally, companies' strategies such as new product development, geographical expansion, and marketing activities are also likely to push the segment’s growth.

To know how our report can help streamline your business, Speak to Analyst

By Price Range

Low Price Range Segment Dominates Due to High Affordability of Product

The market has been segmented into low, medium, and premium based on price range.

The low segment dominated the market, holding the largest market share in 2024. Consumers, especially from developing countries, seek healthy dairy alternative products that are relatively less expensive or in a price range similar to traditional products. Furthermore, less expensive vegan-dairy products are more accessible and available across the retail shelves.

Medium price range dairy-alternative products, such as non-dairy milk, butter, cheese, and creamers, exhibit the highest growth rate. Increasing consumers' disposable income, growing numbers of women working, and the urban population are significantly influencing individuals to choose premium products. Furthermore, changing consumer lifestyle makes them opt for quality and healthy products over price. Thus, the medium price range products are becoming more popular in the industry.

By Distribution Channel

Supermarkets/Hypermarkets to Dominate Market Owing to Introduction of Novel Products

Based on distribution channel, the market has been segmented into supermarkets/hypermarkets, convenience stores, online retail, and others.

Supermarkets/hypermarkets are leading and holding the largest market share of 74.06% in 2026 in the distribution channel owing to their proximity, accessibility, and affordability. A dedicated retail shelf for vegan and plant-based products, coupled with attractive discounts offered to entice consumers and increase their adoption rates. Plant-based products are increasingly developing their own identity. They are undergoing a remarkable transition from their traditional image of being meat or dairy alternatives. These products have successfully moved to the convenience space, and consumers are finding them easy to store, prepare, and eat.

Online retail stores, with their robust convenience, enhanced shopping experience, and increased digital literacy rates among individuals, are expected to contribute to the segment's stronger growth rate during the forecast period.

Dairy Alternatives Market Regional Outlook

Geographically, the global market report covers analysis across North America, Europe, Asia Pacific, South America, the Middle East & Africa.

Asia Pacific

Asia Pacific Dairy Alternatives Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The increasing cases of cow milk allergies and lactose intolerance drive the Asia Pacific market growth dominated the global market in 2025, with a market size of USD 19.42 billion. Additionally, calorie concerns and higher prevalence of hypercholesterolemia and obesity have made consumers shift to vegan diets, thereby adopting cow milk alternatives. Enlightened consumers are becoming highly critical of dairy products' nutritional attributes. These can serve as a cost-effective substitute for poor economic groups in developing countries. They can also be marketed in regions with an insufficient cow milk supply. The Japan market is projected to reach USD 1.15 billion by 2026, the India market is projected to reach USD 0.84 billion by 2026.

China

China is one of the leading consumers of vegan food products, such as non-dairy milk, butter, and cheese. Increasing lactose intolerance among individuals is likely to drive the industry’s growth. According to the National Institute of Health, the prevalence of lactose intolerance in China is approximately 40%, and 12-30% of children are lactose intolerant. Additionally, increasing companies' market penetration activities are likely to push the industry's growth in the upcoming years. The China market is projected to reach USD 18.07 billion by 2026,

Download Free sample to learn more about this report.

North America

The North America market is expanding rapidly, with the emerging vegan diet being adopted among users. It is expected to utilize more plant-based options vital to providing food and nutritional security. Consumers in the region are well-informed about the plethora of dairy alternatives, which are also more readily available than ever before. The regional market will witness growth owing to the rising number of consumers eating more plant-based food, and not due to those who are adopting vegan diets. The U.S. market is projected to reach USD 7.45 billion by 2026.

The U.S. is one of the key markets for vegan products. Changing users' food habits and health awareness has led to a shift toward plant-based diets. Additionally, international companies are expanding their business to the U.S. market. For instance, in November 2023, Naturli, a Danish plant-based food manufacturer, expanded its business operation to the U.S. market by introducing its vegan butter. The vegan butter and spreads are made from cocoa butter and almond butter.

Europe

Consumers in Europe are increasingly motivated to seek innovative plant-based products. Furthermore, the concerns regarding plant-based products' sustainability and eco-friendly aspects will generate more sales among the younger cohort. Increasing consumer concerns toward environmental-friendly food products, health awareness, and cruelty-free products are likely to drive the market in the coming years. The UK market is projected to reach USD 1.19 billion by 2026, while the Germany market is projected to reach USD 1.53 billion by 2026.

South America

In South America, the market is mainly influenced by the rising shifts toward reducing or completely abandoning the consumption of animal-based products, such as dairy items. This shift is driven by concerns regarding health, animal welfare, and environmental sustainability. In major economies, such as Brazil and Argentina, the popularity of dairy-free yogurts and ice cream has grown substantially, as prominent players, such as Danone SA and So Delicious, are introducing innovative and attractive options in the vegan segment. The trend is observed mainly among millennials due to their growing interest in plant proteins.

Middle East & Africa

The Middle East & Africa observe a gradual rise in demand for vegan products, owing to their evolving consumption patterns and diets. This change is mainly attributed to urbanization and exposure to the Western food culture. The growing awareness of the detrimental greenhouse gas emissions from the livestock sector has also supported this shift. The emerging trend of modernization and evolving modern trades are some factors expected to support the growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Global Market Space is Led by Highly Dynamic and Moderately Consolidated Market Conditions

The global market is moderately consolidated with a significant presence of key dairy alternatives giants. These players are also actively embarking on acquisitions and mergers to further strengthen their position and make a decisive shift to ensure their future growth amidst a decline in the popularity of dairy products. For instance, Danone SA, a French multinational food-products corporation, recently acquired several leading plant-based brands, such as Silk, Vega, and Alpro, to strengthen its vegan products portfolio. The competitive intensity of the market is expected to increase during the foreseeable years if such globally recognized players develop and offer alternatives that are nutritionally adequate and environmentally sound and economical and acceptable. At the same time, they are constantly trying to keep up with the dairy substitutes market trends to create more products.

Key Players in the Dairy Alternatives Market

|

Rank |

Company Name |

|

1 |

Danone S.A. |

|

2 |

Archer-Daniels-Midland Company |

|

3 |

Blue Diamond Growers |

|

4 |

SunOpta, Inc. |

|

5 |

Vitasoy International Holdings Ltd |

Danone S.A., Archer-Daniels-Midland Company, Blue Diamond Growers, SunOpta, Inc., and Vitasoy International Holdings Ltd. are the top players in the market. The global market is fragmented, with the top 5 players accounting for a limited portion of the global market share.

List of Key Dairy Alternative Companies Profiled

- Danone S.A. (France)

- Archer-Daniels-Midland Company (U.S.)

- Blue Diamond Growers (U.S.)

- SunOpta, Inc. (Canada)

- Vitasoy International Holdings Ltd (Hong Kong)

- Daiya Food, Inc. (Canada)

- Conagra Brands, Inc. (U.S.)

- Living Harvest Foods, Inc. (India)

- Organic Valley (U.S.)

- Eden Foods, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2025 – Eclipse Food, a Californian plant-based dairy brand, released a new whole milk product. This non-dairy whole milk is made from isolated proteins from peas and chickpeas and replicates the molecular structure of dairy.

- August 2024 – NIÚKE Foods, an emerging plant-based food brand, expanded its product offerings by launching QMILQ, a quinoa-based milk, to the market.

- February 2024 – Califia Farms, an American plant-based milk company, launched a creamy plant-based milk made from a blend of pea, chickpea, and fava bean protein that consists of nine essential nutrients and amino acids.

- February 2023 – Kagome USA, a leading global sauce-producing company, launched sweet and savory vegan butter blends in the U.S. market.

- June 2022 – Strive Nutrition Corp., a plant-based beverages manufacturing company, signed a partnership with Perfect Day to launch a new line of milk alternatives. This new range of products is enriched with Perfect Day’s animal-free whey protein.

REPORT COVERAGE

The global dairy alternatives market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, market segmentation, product types, and leading distribution channels. Besides this, the report offers insights into the market trends, key players, and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth prospects of the market in recent years. Along with this, the report provides an exhaustive analysis of the market dynamics and competitive scenario. Various critical insights presented in the report are the overview of related markets, recent developments such as mergers & acquisitions, the regulatory situation in prominent countries, and key industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.83% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Source

|

|

By Product Type

|

|

|

By Price Range

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 36.76 billion in 2025.

Exhibiting a CAGR of 13.83%, the market will exhibit robust growth during the forecast period.

Non-dairy milk segment is expected to be the leading segment in the market.

Growing awareness among consumers regarding the health benefits of these products and increasing number of cases of lactose intolerance around the globe are the key factors that drive the market growth.

Danone S.A., Archer-Daniels-Midland Company, Blue Diamond Growers, SunOpta, Inc., and Vitasoy International Holdings Ltd. are the top players in the market.

Asia Pacific held the highest market share in 2025.

Robust popularity of innovative products, increasing investments by key dairy companies, organizations, & angel investors, and strong popularity of veganism and flexitarian diets are the latest market trends.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us