Plant Based Protein Supplements Market Size, Share & Industry Analysis, By Type (Soy Protein, Pea Protein, and Wheat Protein), Distribution Channel (Mass Merchandisers, Pharmacies/Drugstores, Specialty Stores, Online Retail, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

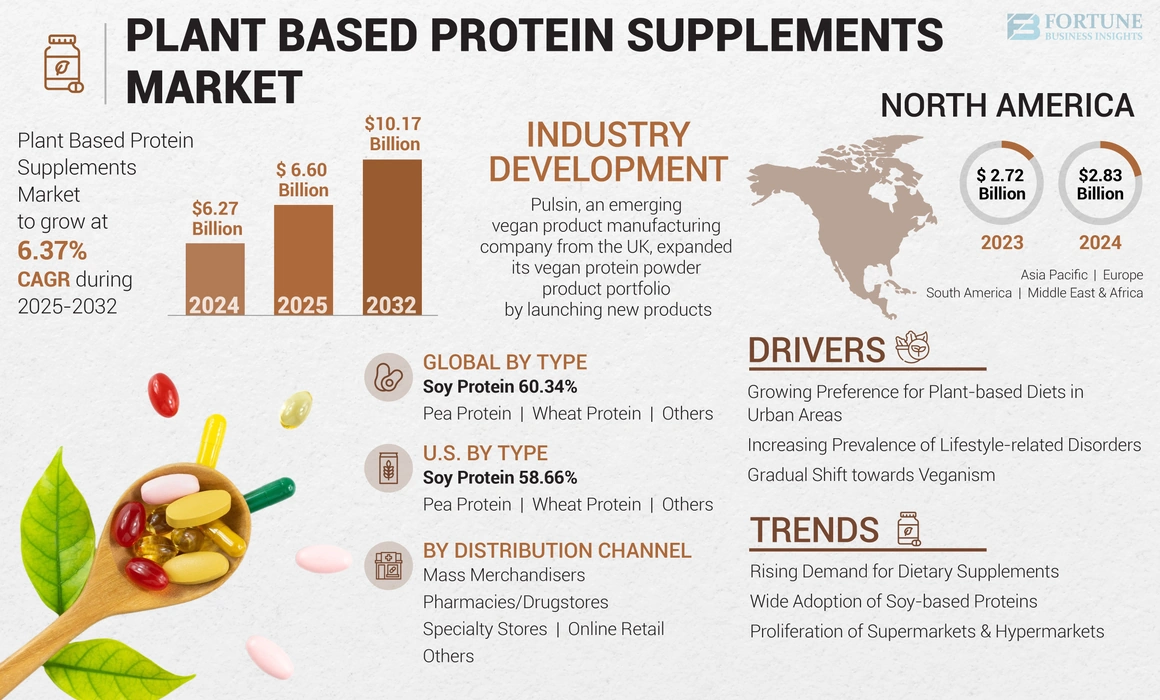

The global plant based protein supplements market size was USD 6.27 billion in 2024. The market is expected to grow from USD 6.60 billion in 2025 to USD 10.17 billion by 2032 at a CAGR of 6.37% over the 2025-2032 period. North America dominated the plant based protein supplements market with a market share of 45.14% in 2024. Moreover, the plant based protein supplements market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 4.28 billion by 2032, driven by heightened consumer awareness regarding the ecological impact of animal-based proteins, the health benefits from plant-based proteins and the overall sustainability factor associated with vegan products.

The growing popularity of veganism primarily drives this market. Plant-based products are perceived to be healthier and safer as compared to animal-based products. Rising concerns regarding animal welfare have significantly contributed to the growth of the plant protein supplements industry. The increasing interest in food safety and better-for-you products is expected to fuel market growth. The leading manufacturers are focused on investing in research of innovative protein sources, which will further propel the growth of the market.

The sale of plant-based foods has significantly increased amidst the outbreak of the COVID-19 pandemic. According to a Plant-Based Foods Association survey, the U.S. retail plant-based foods sale was 35% higher than total retail food amid the panic buying period around March & April 2020. The pandemic has considerably transformed consumer buying patterns, with a steady shift being witnessed toward health-improving products. People are buying supplements owing to their healthier & safer properties as compared to their animal-based counterparts. However, the supply chain disruption has affected the availability of raw materials required for the production of plant-based supplements. The growing concerns surrounding food safety amidst the pandemic are expected to boost the demand for these supplements in the upcoming years.

Global Plant Based Protein Supplements Market Overview

Market Size & Forecast:

- 2024 Market Size: USD 6.27 billion

- 2025 Market Size: USD 6.60 billion

- 2032 Forecast Market Size: USD 10.17 billion

- CAGR: 6.37% from 2025–2032

Market Share:

- North America dominated the plant based protein supplements market with a 45.14% share in 2024, driven by heightened consumer awareness regarding the ecological impact of animal-based proteins, the health benefits from plant-based proteins, and the overall sustainability factor associated with vegan products.

- By type, the soy protein segment is expected to retain dominance in 2025, supported by its superior nutritional value and wide availability. However, pea protein is projected to surpass soy protein in value and volume due to rising popularity in supplements.

Key Country Highlights:

- U.S.: Market projected to reach USD 4.28 billion by 2032, fueled by strong consumer shift toward veganism, sustainability, and health-conscious diets.

- U.K.: Over 1.1 million new vegan diet adopters in 2023, with Gen Z at the forefront of the shift away from meat consumption.

- China: Rapidly expanding sports nutrition sector is boosting interest in vegan protein supplements.

- Brazil: 67% of consumers express interest in plant proteins, contributing to robust regional growth.

Plant Based Protein Supplements Market Trends

Rising Trend of Dietary Supplements to Heavily Contribute to Market Growth

Growing awareness about the benefits of daily consumption of concentrated nutrients has significantly increased dietary supplements’ demand. Urbanization and hectic lifestyles have augmented the prevalence of lifestyle-related health conditions. According to the Global Diabetes Community, U.K., it is estimated that 415 million people had diabetes in 2018 across the world and is expected to rise to 642 million people living with the disease worldwide by 2040.

The rising prevalence of obesity, diabetes, and cardiovascular diseases is projected to drive the demand for a variety of dietary supplements. Studies have shown that the moderate consumption of proteins on a daily basis helps prevent various lifestyle-related chronic conditions. There is a wider acceptance among consumers about the importance of protein supplements in preventing deteriorating health conditions. Protein-based dietary supplements are also gaining popularity among fitness enthusiasts for muscle-building purposes. Furthermore, the rising popularity of protein supplements among pregnant women and children is expected to fuel the market growth.

Download Free sample to learn more about this report.

Plant Based Protein Supplements Market Growth Factors

Increasing Preference for Plant-based Diets to Fuel the Market

Growing awareness about animal welfare as well as environmental sustainability has been pushing consumers towards adopting plant-based diets. The evolving perception of consumers that plant-based products are safer & healthier than animal-originated products fuels the plant based protein supplements market growth. The growing vegan population and preference for vegetarian diets have forced manufacturers to innovate novel sources of plant proteins. According to Plant Based News, a leading global vegan news media, the number of vegan diet followers has increased approximately by 1.1 million from the start of 2023 in the U.K. The PBN also reported that the younger generation is avoiding meat and becoming at the forefront of the dietary shift in the U.K. The increasing prevalence of lactose intolerance and lactose allergies has further contributed to plant proteins' sales growth. Lastly, rising interest in natural, organic, and clean-label products is projected to boost plant-based protein supplements' demand.

Robust Demand for Protein Supplements to Propel Market Growth

The rising demand for protein supplements to improve health and wellness significantly fuel the growth of the vegan protein supplements market. Modern-day hectic lifestyles and busy schedules have surged the demand for instant sources of proteins. Protein powder supplements are also becoming very popular among fitness enthusiasts for muscle development due to their higher amino acid content. Aggressive marketing and promotional activities by companies across fitness centers and the introduction of several ready-to-drink protein supplements are expected to expand the sale of plant protein supplements in the upcoming years. Companies are introducing new products to fulfil the growing demand for vegan protein supplements. For instance, in March 2023, Premier Protein, a vegan supplement brand of BellRing Brands, Inc., introduced its NEW Plant Protein Powder in two flavors- Chocolate and Vanilla. This product is made from pea protein. The vegan protein supplement products are widely popular among vegan-diet followers, which is expected to further drive market growth.

RESTRAINING FACTORS

Challenges Faced in Improvement of Palatability of Plant based proteins to Hamper Growth

The sensory parameter, i.e., the flavor profiles of plant based proteins, is the area where some serious improvements are required to increase the finished products' palatability and acceptability. Proteins extracted from plants generally impart off-flavors and unacceptable tastes when added to the product. Although formulating with functional ingredients addresses consumer demand for customized health and wellness, these products' purchase is often driven by taste and flavor.

The challenges faced in improving the palatability of plant based proteins are acting as a key restraint for market growth. Various technologies such as microencapsulation, polymer coating, and flavor solutions can be applied to mask and modify these unpleasant tastes and produce better tasting final products. Flavour addition to reducing bitterness or masking flavors is one of the most significant protein supplement industry trends. Flavors that complement plant proteins are mainly used for masking purposes. For instance, natural fruit and vegetable flavors such as orange, strawberry, fungi, pods, and seeds are generally used in plant based proteins owing to their natural origin.

Plant Based Protein Supplements Market Segmentation Analysis

By Type Analysis

Soy Protein Segment to Emerge as the Dominant Segment

Based on type, the market is segmented into soy protein, pea protein, wheat protein, and others. Soy protein, albeit exhibiting a slowdown in its sales, remains a dominating segment in this market, according to the plant proteins industry analysis. The superior nutritional value and easy availability of raw materials are some of the driving factors for soy protein.

However, the pea protein segment (particularly concentrates & isolates) is expected to surpass the soy protein segment both by value and volume-based sales due to its robust popularity and increasing utilization in various dietary supplements. The market has recently witnessed companies exploiting novel sources for plant protein such as spirulina, pumpkin seeds, and hemp. Such industry trends are predicted to boost revenue further.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel Analysis

Mass Merchandisers to be the Primary Leading Distribution Channels

The market is segmented into supermarkets/hypermarkets, pharmacies/drugstores, specialty stores, online retail, and others by distribution channel. Mass merchandisers viz. supermarkets/hypermarkets are continuously changing, and investors capitalize on buyers’ comfort to offer an easy shopping experience. The adoption of technological advancements and equipment on the floor will help retailers provide adequate quality products to the consumers. Mass merchandisers' dominance in the supplements market is being overshadowed by the rapidly growing online retail platforms and the increasing presence of specialty stores.

Companies are re-designing their distribution channels to reach consumers effectively as this distribution channel is becoming more popular among young consumers. After COVID-19, industry players are spending more to strengthen their e-commerce channel presence. It will drive product sales from the online sales channels.

REGIONAL INSIGHTS

North America Plant Based Protein Supplements Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The developed markets of North America and Europe contribute more than half of the global revenue in this market and are thus leading the plant based protein supplements market share. This is ascribed to the heightened consumer awareness in these regions regarding the ecological impact of animal-based proteins, the health benefits from the plant based proteins, and the overall sustainability factor associated with such vegan sources. The vegan trend in these markets is expected to stay strong during the foreseeable future, and the growing demand for healthy and nutritional products is expected to further fuel the demand for natural protein supplements.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is expected to witness growth rates higher than the global average during the forecast period. Consumers are gradually showing interest in dietary supplements in vegan proteins as the sports nutrition sector becomes mainstream. Developing markets such as China, India, and Indonesia are projected to propel plant based protein supplements' sales growth due to the increasing aging population and growing interest in dietary supplements to improve overall health.

The South American market for plant-based protein supplements is projected to exhibit substantial growth owing to the growing popularity of healthy eating. According to a survey conducted by the leading nutrition company DuPont Nutrition & Biosciences, Colombia, Brazil, and Argentina are leading the way in South America with 78%, 67%, and 65% consumers respectively showing interest in plant proteins. The market is further fuelled by the rising trend of flexitarian diets among millennials in the region. The growing popularity of on-the-go proteins among these individuals is expected to considerably drive the market growth in the upcoming years.

The market is still at the nascent stage in the Middle East and Africa region. Dairy proteins have been popular in the region. However, rising awareness regarding vegan and flexitarian diets has contributed to recognizing plant proteins among consumers. The growing interest in consuming protein supplements to maintain health is expected to propel the market growth in the region in the forthcoming years.

Key Industry Players

Companies are Embarking on Product Launches and Base Expansion to Strengthen their Share in the Market

Roquette Frères is focused on investing in expanding its plant protein product to strengthen its position in the global market. For instance, in February 2024, the company expanded its NUTRALYS® plant protein portfolio by launching four pea protein ingredients – NUTRALYS® Pea F853M (isolate), NUTRALYS® H85 (hydrolysate), NUTRALYS® T Pea 700FL (textured) and NUTRALYS® T Pea 700M (textured).

The market exhibits a moderately consolidated structure, dominated by large multinational companies. The key players such as Glanbia Plc, Kerry Group, and Roquette focus on strategic mergers, acquisitions, and partnerships to gain a competitive edge that comes from such synergies. Growing demand for plant-based products supports the companies to launch various products with innovative ingredients to meet the consumer-specific demand.

LIST OF TOP PLANT BASED PROTEIN SUPPLEMENTS COMPANIES:

- Danone S.A. (Paris France)

- Roquette Frères (Lestrem, France)

- Kerry Group plc (Listowel, Ireland)

- BENEO GmbH (Mannheim, Germany)

- Glanbia plc (Kilkenny, Ireland)

- Iovate Health Sciences International Inc. (Ontario, Canada)

- Amway (Michigan, U.S.)

- MusclePharm Corporation (California, U.S.)

- Sakara Life, In (New York, U.S.)

- Tiba Starch & Glucose Manufacturing Company (Ash Sharqia Governorate, Egypt)

- Nuzest Life Pty Ltd. (New South Wales, Australia)

KEY INDUSTRY DEVELOPMENTS:

- July 2023 – Pulsin, an emerging vegan product manufacturing company from the UK, expanded its vegan protein powder product portfolio by launching new products. The new collections are available in four flavors: Berry, Chocolate, Chocolate Hazelnut, and Vanilla. These products are developed from pea, faba, and pumpkin seed proteins.

- October 2022 - An Indian former cricket player, M.S. Dhoni, invested in an Indian plant-based protein start-up, Shaka Harry. Furthermore, the company raised around USD 2 million funds from its seed round funding led by Better Bite Venture, Blue Horizon, and Panthera Peak Ventures.

- July 2022 - Dymatize, a brand of global nutrition company - BellRing Brands, Inc., launched its new high-performing plant-based protein powder - Dymatize Complete Plant Protein™. These products are sourced from five types of plant-based proteins to ensure maximum delivery of high-quality protein pre- or post-workout.

- February 2022 – Ingredion Incorporated, a leading global food ingredient manufacturing company, invested an undisclosed amount in InnovoPro, an emerging Foodtech chickpea solutions company, to unlock huge consumer appeal for chickpea protein concentrates.

- June 2021 - Huel, an emerging vegan nutrition product manufacturer, launched vegan protein powder in six variants- Chocolate Fudge Brownie, Strawberries & Cream, Banana Milkshake, Vanilla Fudge, Salted Caramel and Unflavoured & Unsweetened. These products are sourced from hemp, faba, and pea.

REPORT COVERAGE

The plant based protein supplements market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading distribution channels of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation:

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 6.37% from 2025 to 2032 |

|

Segmentation

|

By Type

Distribution Channel

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 6.27 billion in 2024 and is projected to reach USD 10.17 billion by 2032.

In 2024, the North America market size stood at USD 2.83 billion.

Growing at a CAGR of 6.37%, the market will exhibit steady growth during the forecast period (2025-2032).

The soy-based protein supplements segment is expected to be the leading segment in this market during the forecast period.

The rising popularity of plant-based diets is the key factor driving the growth of the market.

Danone S.A., Glanbia Plc, and Roquette are the major players in the market.

North America dominated the market share in 2024.

Popularity of dietary supplements and plant-based diets are expected to drive product adoption, globally.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us