Data Integration and Integrity Software Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premises), By Enterprise Type (Large Enterprises and Small & Medium Enterprises), By Industry (BFSI, Healthcare, Manufacturing, Retail, IT & Telecom, Media & Entertainment, Energy & Utility, Government, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

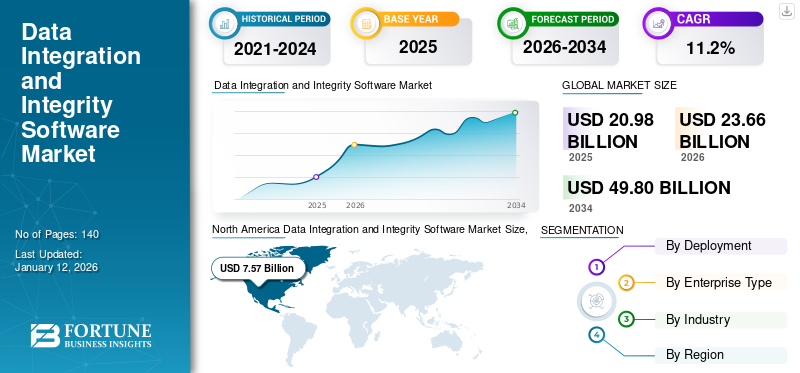

The global data integration and integrity software market size was valued at USD 20.98 billion in 2025 and is projected to grow from USD 23.66 billion in 2026 to USD 49.8 billion by 2034, exhibiting a CAGR of 11.2% during the forecast period. North America dominated the global market with a share of 37.2% in 2025. Additionally, the U.S. data integration and integrity software market is predicted to grow significantly, reaching an estimated value of USD 9,255.9 million by 2032.

Data integration and integrity software enables enterprises in combining all the data sources insights and making informed business decisions. The boost in digital transformation has fueled the data volume exponentially, thus driving the demand for cutting-edge software. The industries catering to consumer services and have multiple partners are significantly investing in the software. The key players are keen in offering advanced solutions as per the industry specific requirements that can help in building its future strategies. For instance,

- In June 2022, Precisely launched a data integrity suite with multiple interoperable Software as a Service (SaaS) modules to offer business-friendly user experience. The suit aims to offer accuracy and consistency of data to empower organizations.

Data Integration and Integrity Software Market Overview

Market Size:

- 2025 Value: USD 20.98 billion

- 2026 Value: USD 23.66 billion

- 2034 Forecast Value: USD 49.8 billion

- CAGR (2026–2034): 11.2%

Market Share:

- Regional Leader: North America led the global market with a 37.2% share in 2025.

- Fastest-Growing Region: Asia Pacific is expected to exhibit the highest growth rate during the forecast period, propelled by increasing investments in digital transformation and a growing number of internet users.

Industry Trends:

- Cloud Integration: The adoption of cloud computing is enhancing the scalability, flexibility, and cost-efficiency of data integration and integrity software.

- AI and Automation: Integration of artificial intelligence and automation tools is streamlining data management processes, improving accuracy and reducing manual intervention.

- Data Governance: Increasing emphasis on data governance and compliance is driving the demand for robust data integration and integrity solutions.

- Industry-Specific Solutions: Development of tailored solutions to meet the unique requirements of various industries, such as BFSI, healthcare, and retail, is gaining traction.

Driving Factors:

- Digital Transformation: The ongoing digital transformation across industries is generating vast amounts of data, necessitating effective integration and management solutions.

- Data-Driven Decision Making: Organizations are increasingly relying on data-driven insights to make informed business decisions, boosting the demand for data integration and integrity software.

- Regulatory Compliance: Stricter data protection regulations are compelling organizations to adopt solutions that ensure data integrity and compliance.

- Operational Efficiency: The need to streamline operations and reduce costs is driving the adoption of integrated data management solutions.

In the market study, we have considered the data integration and integrity software offered by players, such as SAS Institute Inc., IBM Corporation, SAP SE, Oracle Corporation, and Microsoft Corporation, operating across the globe.

The pandemic has significantly affected the strategies of the enterprises, and to cope-up with the drastic changes various new initiations took place. The development of various IT projects amid pandemic fueled the adoption of data integration & integrity software across industries. Market players were focused on completing multiple business strategies to cope with COVID-19 effects and provide cutting-edge software and services to their users. For instance,

- In July 2021, Informatica, a data integrity software solution provider, announced the launch of Intelligent Data Management Cloud on Azure for Asia Pacific in response to the region's increasing cloud momentum. The Intelligent Data Management Cloud (IDMC) system is an end-to-end Artificial Intelligence (AI)-powered cloud platform accessible on Microsoft Azure for the Southeast Asia and Asia Pacific regions.

- In May 2021, Precisely, the U.S.-based data integrity company, completed the acquisition of Infogix, data governance, data catalog, and data quality vendor. This acquisition assisted the companies in using trusted data more effectively with data integrity platforms.

Observing the business strategies of the data integration and integrity software players in response to the COVID-19, it is more likely that the market would witness a surging growth owing to the escalating adoption of cloud services.

Data Integration and Integrity Software Market Trends

Cloud Incorporation with Data Integration and Integrity Software to Propel Market Growth

One of the key trends that enables the overall market growth is cloud computing. The integration software is based on analytical models that hold and monitor a large amount of data. The requirement of data monitoring and integration can be operated by cloud technology in a secure and reliable environment at a low cost.

According to an article published by NetApp in January 2020, there is a rising demand to integrate heterogeneous cloud systems. Hybrid cloud and multi-cloud deployments are highly adopted across end-use organizations. Multiple apps in the private cloud, public cloud, and on-premises could use cloud-based data integrity to synchronize and communicate data reliably.

There are mature technologies, such as AWS or an OpenStack data center, for data integration and integrity software within public cloud platforms or private cloud platforms. Due to the growing adoption of cloud-based solutions, the market is expected to grow significantly.

Download Free sample to learn more about this report.

Data Integration and Integrity Software Market Growth Factors

Shifting Focus of Enterprises toward Maintaining Data Integrity to Maximize the Strategic Role of Data in Driving Innovation

Organizations adopt data integration tools across various applications and systems that support digital transformations. Hence, organizations are shifting their focus from developing better tools to manage, move, and store data more effectively to maximize the strategic role of data in driving innovation, tackling creative problems, establishing stronger customer relationships, and alerting business strategies.

Apart from this, the Industrial Internet of Things (IIoT) is a key market driver. According to a report published by Analytics Insight in May 2020, the demand for this software has increased along with the rise in the IIoT. The IIoT and data integration platforms are working together to create a connected, digital supply chain that allows players to monitor the supply of raw materials to the plant and finished goods to customers. Thus, the increase in IIoT adoption to drive the data integration and integrity software market growth.

RESTRAINING FACTORS

Rising Concerns Regarding Data Security to Hamper Growth

Data integrity can be threatened by human error or even worse, malicious acts. Hackers can compromise or even destroy mistakenly altered data while being transferred from one device to another. According to a report published by Empeek OU in February 2021, among the most significant obstacles to data integration in healthcare, 94% of respondents reported data security & privacy risks. Furthermore, the report states about the healthcare data breaches in the U.S that 1 out of 4 consumers’ healthcare data had been stolen in the U.S. Such security concerns are likely to restrict the data integration and integrity software market share.

Data Integration and Integrity Software Market Segmentation Analysis

By Deployment Analysis

Higher Trust in On-premises Data Security to Boost Market Share

Based on deployment, the market is categorized into cloud and on-premises.

Cloud-based software to gain rapid growth rate during the forecast period. The pandemic has created more challenges for IT teams to address remote workforces and support scalable infrastructure for their products and service offerings. As a result, cloud-based software is expected to gain traction post-outbreak of the pandemic. This trend is likely to persist as the migration to virtual work emphasizes the urgency for reliable, secure, scalable, and off-premises technology services.

The on-premises segment is expected to maintain dominance during the forecast period as enterprises are more assured regarding on-premises data security. The on-premises segment is expected to lead the market, contributing 43.2% globally in 2026. However, the maintenance and service cost is driving the shift toward cloud-based software.

By Enterprise Type Analysis

Vast Number of Customers to Boost Large Enterprises Investment in Data Management Software

Large enterprises segment is expected to hold a significant share of 44.72% in 2026; however, the small & medium enterprises segment is projected to increase their cloud-based software spending due to optimized maintenance costs and fewer infrastructure requirements.

Large enterprises have to scale their infrastructure to address the requirements and meet new demands raised by the remote workforce. In addition, enterprises need to maintain infrastructure support for their services and products. These factors are expected to contribute to the increase in enterprise cloud spending.

Small & medium enterprises are expected to lower their cloud spending due to a downturn in capital expenditure attributed to decreased demand for services and products and budget inflexibility during the pandemic crisis.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Extensively Growing User Data to Fuel Software Adoption in the BFSI Segment

By industry, the market is segmented into BFSI, healthcare, manufacturing, retail, IT & telecom, media & entertainment, energy & utility, government, and others.

The BFSI segment is expected to witness maximum revenue share during the forecast period considering the rapid growth of digital tools and platforms in the banking industry. This is driving a vast set of user data, and thus the banking institutes are investing in the software. The BFSI segment will account for 16.19% market share in 2026.

Healthcare is projected to be the fastest-growing segment during the forecast period. As digitalization is gaining traction to improve customer experience and streamline the process, the adoption rate of integration tools is growing in healthcare providing systems.

Similarly, the retail segment is expected to showcase rapid growth rate considering the rise in online shopping. The available data help companies in enhancing the customer experience across online platforms in boosting sales and profit margins.

REGIONAL INSIGHTS

Geographically, the market is fragmented into five major regions such as North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. They are further categorized into countries.

North America

North America Data Integration and Integrity Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 7.57 billion in 2025 and USD 6.98 billion in 2026. The market in North America is diverse, owing to rising technology investment by the leading players and rapid deployment of advanced technologies, such as cloud computing, Internet of Things (IoT), and AI, to automate business processes. A notable key driver boosting the growth opportunity across the region is the rising investment of enterprises in cloud services. Thus, such an increase in cloud computing and the adoption of advanced technology have driven the market growth. The U.S. market is valued at USD 5.69 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific has several small and leading data integration and integrity software players, due to which the market is highly fragmented. The key software providers and several other global players are expanding their footprint in this region due to the growing demand from industries such as BFSI, healthcare, and the fastest-growing manufacturing sector. The Japan market is valued at USD 0.76 billion by 2026, the China market is valued at USD 1.37 billion by 2026, and the India market is valued at USD 0.81 billion by 2026. For instance,

- In July 2021, Informatica, a data integrity software solution provider, announced the launch of Intelligent Data Management Cloud on Azure for Asia Pacific in response to the region's increasing cloud momentum. The Intelligent Data Management Cloud (IDMC) system is an end-to-end AI-powered cloud platform offering accessibility on Microsoft Azure for the Southeast Asia and Asia Pacific regions.

Europe

During the COVID-19 pandemic, players in European countries have created investments in many digitalizing industries, such as healthcare, manufacturing, and retail, to provide a seamless consumer experience. For instance, in December 2020, Talend invested in Europe to open a new data center exclusively for Stitch cloud data ingestion service providers. The UK market is valued at USD 1.81 billion by 2026, while the Germany market is valued at USD 1.77 billion by 2026.

The leading players are seeking opportunities in the Middle East and African countries, such as GCC, South Africa, Israel, and others, due to increasing investment by the private and public sectors for digital transformation.

The Latin America market is growing at a moderate growth rate, owing to increasing investment by the leading players with the surge in internet penetration and adoption of advanced technologies by the government and private with the use of hybrid cloud and artificial intelligence.

KEY INDUSTRY PLAYERS

Increasing Strategic Acquisitions by Key Players to Expand their Product Offerings

Key players operating in the market, such as IBM Corporation, Microsoft Corporation, Oracle Corporation, SAS Institute Inc., Informatica, SAP SE, Talend, and Alteryx, are entering into strategic partnerships and collaborations with other players. This strategy is adopted by the key players to enhance their market presence and launch new technology-based software. Similarly, merger and acquisition are growing in the market as the key players are expanding their global reach and focusing on maximum customer engagement. For instance,

- May 2023 – QlikTech International AB announced the closure of acquisition of Talend to expand the company’s capabilities with access to trusted data. With the acquisition, the company aims to provide various product offerings, investments in innovation, and enhanced customer services.

- April 2023 – Precisely announced a collaboration with customers worldwide to provide trusted data with effects of Environmental, Social, and Governance (ESG) reporting. The company is offering its customers the data as per ESG metrics and in compliance with the industry regulations.

List of Top Data Integration and Integrity Software Companies:

- Informatica LLC (U.S.)

- IBM Corporation (U.S.)

- SAP SE (Germany)

- Oracle Corporation (U.S.)

- SAS Institute Inc. (U.S.)

- Microsoft Corporation (U.S.)

- QlikTech International AB (Talend) (U.S.)

- TIBCO Software Inc. (U.S.)

- Denodo Technologies (U.S.)

- Precisely (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2023 – Precisely announced the acquisition of location intelligence provider, Transerve, that can help enterprises in decision making by using enriched and curated data.

- March 2023 – HARMAN International and Infor Ltd. announced collaboration to enhance their healthcare and life science platform. The companies’ integrated Infor data integration suite, Cloverleaf, with HARMAN Intelligent Healthcare Platform to provide transparency and secured data.

- November 2022 – Talend announced a strategic partnership with data cloud company, Snowflake, to incorporate a new vertical to offer customers worldwide secured data. The company is initially offering the new vertical solution to the financial services.

- March 2022 – Precisely, announced a strategic partnership with data cloud company, Snowflake, to enhance enterprise decision making strategies. Precisely Connect data integration solution integrated with Snowflake on Snowflake’s Data Cloud to provide complete picture and insights.

- July 2021 – Microsoft Corporation launched data integration wave 1 Microsoft Power Platform. It is used to democratize data for business users to seamlessly extract, transform, and load data into Microsoft Dataverse and Azure Data platforms. It enables businesses with new insights and improves data export services by enhancing the gateway for enterprises.

REPORT COVERAGE

The research report examines key regions worldwide to help users better understand the technology. Additionally, the research report gives insights into the most recent industry and market trends and an analysis of technologies deployed at a quick rate on a global scale. It also highlights some of the market's growth-stimulating elements and restrictions, allowing the reader to understand the market thoroughly.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.2% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 49.8 billion by 2034.

In 2025, the market size stood at USD 20.98 billion.

The market is projected to grow at a CAGR of 11.2% over the forecast period.

Enterprises shifting their focus toward maintaining data integrity and the proliferation of industrial IoT is likely to drive the market growth.

Microsoft Corporation, IBM Corporation, SAS Institute Inc., Oracle Corporation, and Informatica are the top players in the market.

North America is expected to hold the highest market share.

Asia Pacific is expected to grow at a significant CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us