Empty Capsules Market Size, Share & Industry Analysis, By Type (Gelatin, Hydroxypropyl Methylcellulose (HPMC), and Others), By Functionality (Immediate Release, Sustained Release, and Delayed Release), By End User (Pharmaceutical Companies, Nutraceutical Manufacturers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

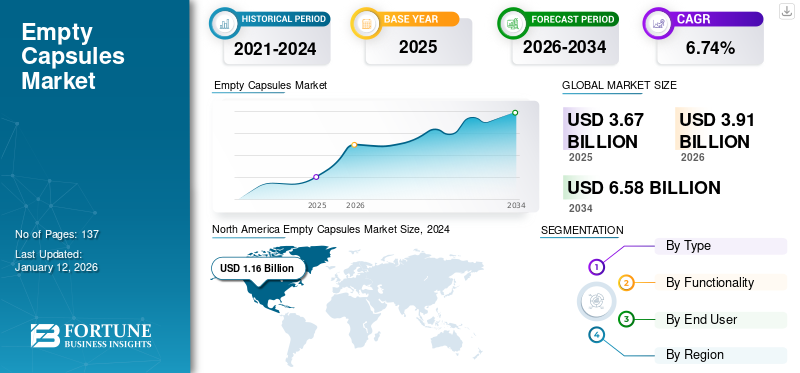

The global empty capsules market size was valued at USD 3.67 billion in 2025. The market is projected to grow from USD 3.91 billion in 2026 to USD 6.58 billion by 2034, exhibiting a CAGR of 6.74% during the forecast period. North America dominated the empty capsules market with a market share of 33.66% in 2025.

Empty capsules are a form of shells in which medicinal agents and inert substances can be enclosed. These empty shells are made up of gelatin, Hydroxypropyl Methylcellulose (HPMC), or starch or pullulan, a special film-forming material. The growing adoption of capsule formulations by pharmaceutical manufacturers, the increasing demand for nutraceuticals among the aging population, and the growth of empty capsules in cosmeceutical and food industries are some factors boosting the market growth.

- For instance, in June 2022, Nitta Gelatin India published an article that stated that capsules are the second most delivery format of drugs and contribute to around 13.0% of the new drugs approved by the Food and Drug Administration (FDA).

- According to a news published by Mexicobusiness in December 2020, Capsutec, a Mexican manufacturer and distributor of empty capsules, had 70.0% of its sales in the nutraceutical sector.

Along with this, the increasing research and development activities among market players for advancements in capsule delivery technologies are also contributing to the growth of products in the market.

The COVID-19 impact demonstrated considerable growth in the market during the forecast period, attributed to the acceleration in the adoption of dietary supplements such as vitamins and minerals to boost immunity. Major players operating in the market witnessed a growth in their revenues due to the increased demand for empty capsules during the COVID-19 pandemic. For instance, NATURAL CAPSULES LIMITED generated a revenue of USD 10.8 million in FY 2020, compared to 8.3 million in FY 2019. The company demonstrated growth of 29.2% in FY 2020, compared to 3.0% in FY 2019. Post-pandemic, the market witnessed a steady growth with majority of the players focusing on building a market base for HPMC capsules in domestic and international markets.

Global Empty Capsules Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 3.67 billion

- 2026 Market Size: USD 3.91 billion

- 2034 Forecast Market Size: USD 6.58 billion

- CAGR: 6.74% from 2026–2034

Market Share:

- Region: North America dominated the market with a 33.72% share in 2024. This is due to the growing prevalence of various health disorders, high diagnosis and treatment rates, and a strong preference for capsule-based dosage forms among the population.

- By Type: The gelatin segment held the largest market share in 2024. Its dominance is attributed to its widespread use in pharmaceutical applications, the growing adoption of capsule formulations by manufacturers, and its proven effectiveness and efficiency with minimal manufacturing difficulties.

Key Country Highlights:

- Japan: As part of the fast-growing Asia Pacific market, growth is driven by local manufacturers gaining approvals from international regulatory bodies, allowing them to expand their brand presence and export products to global markets.

- United States: The market is fueled by the high consumption of dietary supplements, with around 77% of American adults using them. There is also a strong consumer preference for capsules, with 54% of patients favoring them over other oral dosage forms.

- China: The market is propelled by increasing health awareness among the public and a growing focus on preventive healthcare, which drives the demand for nutraceutical products commonly delivered in capsule form.

- Europe: Market dynamics are significantly influenced by regulations, such as the ban on Titanium Dioxide (TiO2) in capsules. This has pushed major players to innovate and launch TiO2-free product lines to meet the evolving demands of the European Union market.

Empty Capsules Market Trends

Surge in Demand for Hard Capsules for the Protection of Liquid Contents is Anticipating the Market Growth

Soft gelatin capsules are the preferred dosage for filling liquid, semisolid, and poorly soluble ingredients. Softgel capsules contain plasticizers and glycerol that are hygroscopic. During the manufacturing process, the equilibrium moisture content of softgel capsules is achieved after several hours/ days, during which the degradation of the inner content is possible. Many nutraceutical companies prefer softgels for liquid encapsulation. Still, as they also tended to stick, scientists emphasized seeking two-piece hard gelatin to overcome this situation.

This enabled the focus of market players on liquid encapsulation technology's research and development activities. Liquid-filled Hard Capsules (LFHCs) are made of gelatin and HPMC, which can withstand higher temperatures and offer long shelf life for encapsulating liquid-filled products, compared to softgel capsules. This led to the preferential shift of manufacturers toward the use of liquid-filled hard capsules, contributing to the global empty capsules market growth.

- For instance, in February 2022, CapsCanada, a Lyfe Group company, received approval for a liquid-filled aspirin capsule. This product is based on the PLxGuard drug delivery platform aimed at delivering drugs in the gastrointestinal tract.

- In March 2021, CapsCanada, a Lyfe Group company, launched a new liquid-filled hard capsule manufacturing service in North America. The launch of this service aims to support the manufacturing process, from formulation and development to full-scale production.

Download Free sample to learn more about this report.

Empty Capsules Market Growth Factors

Acquisition of Competitor Players as an Expansion Strategy and Launch of New Products is Spurring the Market Growth

The growth in the aging population is leading to an increase in the prevalence of health conditions related to joint, bone, skin, hair, gut, and liver functioning, contributing to an increase in the geriatric patient population across the globe.

- For instance, according to the statistics published by the World Health Organization (WHO) in July 2022, approximately 1.71 billion across the globe are suffering from a musculoskeletal condition, out of which 528 million people are suffering from osteoarthritis, and 222 million are suffering from neck pain, being the major reasons.

- According to the statistics published by the International Foundation for Gastrointestinal Disorders, Inc. (IFFGD) in March 2021, around 5.0% to 10.0% of the population across the globe has irritable bowel syndrome (IBS), among which 2.4 million to 3.5 million people are from the U.S.

This rising prevalence contributed to the adoption of dietary supplements and brought opportunities for empty capsule manufacturing companies to introduce new products to the market. For instance, in February 2023, Vivion, a brand of Operio Group, launched its new product range of empty gelatin, HPMC, and pullulan capsules. The launch of this product range aims to provide more comprehensive solutions to their customers.

In addition to this, the emphasis of major players on the expansion of their global footprints is contributing to the market growth in the global empty capsules market analysis. For instance, in December 2022, Vantage Nutrition LLC, an ACG Group company, acquired Philadelphia-based AquaCap, an asset of Nestle Health Science. This acquisition aimed to expand its footprint and manufacturing capability.

Increasing Demand for Nutraceutical Products in Capsule Form is Augmenting Market Growth

The increasing health awareness among the general public and their growing focus on preventive healthcare are contributing to the growing demand for nutraceutical products. Moreover, the COVID-19 pandemic garnered significant attention from people seeking stronger immunity to prevent getting infected. A considerable amount of the population has realized that the use of dietary supplements can aid in maintaining optimum health. Therefore, many patients and consumers have started opting for dietary and natural treatment options for chronic diseases as they have long-term tolerance and safety.

For instance, according to an article published by Franchise India Holdings Ltd in July 2021, the demand for nutraceutical products is driven by the fact that 15.0% of the population is malnourished in many developing countries, such as India.

The increasing adoption of unhealthy lifestyles by urban consumers across the globe is fueling the demand for nutraceutical products in the market. In addition, leading players' emphasis on initiating campaigns to attract new customers to their improved manufacturing capabilities contributes to the global market growth.

- For instance, according to an article published by Saffron Media Pvt. Ltd, veg capsules are used in almost 50.0% of the nutraceutical products in the U.S. and Europe.

- According to an article published by ETHealthworld.com in November 2021, ACG launched the ‘ACG loves nothing’ campaign to demonstrate its focus on developing high-quality capsules for pharmaceutical and nutraceutical products.

Thus, the increasing number of the patient population following unhealthy lifestyles and the preference of people undergoing chronic disease treatments, along with improved manufacturing capabilities of major players, is expected to spur growth during the forecast period.

RESTRAINING FACTORS

Inflating Prices of Raw Materials Used for Manufacturing Empty Capsules are restraining the Market Growth

The global demand for gelatin for the pharmaceutical, nutraceutical, cosmeceutical, and food industries continue in its growth phase. The capsule market is growing globally, and gelatin is an inevitable ingredient. With the exceeding applications in food, pharma, and nutritional products, the demand for raw gelatin is expanding at an optimum rate. Also, the growing adoption of capsule formulation, along with increasing R&D activities and clinical trials, are contributing to the increase in the pricing of gelatin as a raw material from the manufacturers. Although during the COVID-19 restriction, the demand for gelatin was low, the prices remained on the higher side in the market.

In a discussion about hydroxypropyl methylcellulose (HPMC) capsules, The European ban on Russian oil and Western sanctions for their exports, along with solid demand from the pharma sector, caused the HPMC's prices to inflate in the European region. The raw material prices increased in the Asian market due to raised crude oil prices, disruptions in trade, congestion in ports, and robust demand from the pharmaceutical and polymer industries.

- For instance, according to an article published by Procurement Resource in August 2022, hydroxypropyl methylcellulose (HPMC) was priced at USD 6,015.6/ Metric Ton in the first half of the Indian domestic market.

Empty Capsules Market Segmentation Analysis

By Type Analysis

Hydroxypropyl Methyl Cellulose (HPMC) Capsules are Expected to Grow at the Highest CAGR due to Their Rising Popularity

Based on type, the market is segmented into gelatin, hydroxypropyl methylcellulose (HPMC), and others.

The gelatin segment held the largest market share in 2024 owing to its strong use in pharmaceutical applications, growing adoption of capsule formulation, and advancements in capsule delivery technologies. Many studies have also demonstrated that the administration of gelatin-based capsules is generally the safest choice as they are effective, efficient, and least prone to manufacturing difficulties.

The hydroxypropyl methylcellulose (HPMC) segment is expected to grow at a significant CAGR during the forecast period. The low moisture percentage of the HPMC capsules, proven stability in extreme conditions, resistance to bacterial growth, and no requirement of preservatives for manufacturing are some factors contributing to their rising popularity. Moreover, these capsules are starch-free, gluten-free, and preservative-free, which meet an individual's dietary needs with vegetarian lifestyle. These proficiencies have contributed to the growth of their demand in the developed markets and have encouraged major players to expand their production capacities of HPMC capsules.

- For instance, according to news published by Economic Times India in November 2021, ACG, one of the leading suppliers of capsules globally, planned to set up a vegetarian capsule factory in Maharashtra, India.

On the other hand, the rising prevalence of various diseases and increasing R&D focus of the market players, collaborations, and acquisitions among these players to develop and introduce new products to cater to the rising demand for empty capsules are expected to fuel the segmental growth in the market.

- In May 2021, QUALICAPS launched a range of titanium dioxide free capsules in Europe. This launch led to the expansion of the company’s product portfolio.

To know how our report can help streamline your business, Speak to Analyst

By Functionality Analysis

Immediate Release Segment Dominated Market Owing to the Clinical Benefits of Products

On the basis of functionality, the market is segmented into immediate release, sustained release, and delayed release.

The Immediate Release segment dominated the market accounting for 65.98% market share in 2026. The highest market share is attributed to the demand for these capsules for manufacturing drug preparations such as antacids, antibacterial antibiotics. Thus, the huge demand for immediate release capsules for the manufacturing of therapeutic products such as antacids and antibiotics is contributing to the growth of the segment in the market.

- For instance, according to an article published by Nitta Gelatin India in June 2022, immediate release capsules are the most commonly prescribed for treating a wide range of diseases and disorders.

On the other hand, sustained and delayed release capsules are expected to grow sluggishly due to the increased cost of drug per dosage unit, difficulty in delivering high molecular weight compounds, and potential toxicity if the system fails. Furthermore, factors contributing to the segment’s growth are its growing utilization for the stable release of a drug through the stomach and small intestine to improve the performance of the medicine.

By End User Analysis

The Pharmaceutical Companies Segment Dominated the market Owing to their Continuous Growth

On the basis of end user, the market is segmented into pharmaceutical companies, nutraceutical manufacturers, and others.

The Pharmaceutical Companies segment is expected to lead the market, contributing 59.13% globally in 2026. The rising disease prevalence among the general population is the primary reason for the growing number of patients. Most domestic pharma companies focus on regulated markets, as the demand for capsules with excellent quality and dissolution properties will grow as they are preferred in the regulated market. Moreover, in addition to this, the government's support and incentives for manufacturing different pharmaceutical products are major factors contributing to segmental growth.

- For instance, according to an article published by Invest India in January 2021, the cabinet in India approved production linked incentive (PLI) scheme 2.0 for pharmaceuticals in November 2020, which includes empty capsules, biopharmaceuticals, and complex generic drugs.

The nutraceutical manufacturers segment is expected to grow at the highest CAGR due to the increasing preference for nutraceutical products globally. The general population's adoption of a sedentary lifestyle has led to an increase in chronic conditions such as diabetes and cardiovascular disease, for which consumers perceive nutraceuticals as an alternative to prescription drugs. The increasing use of dietary supplements among the elderly population for the regular maintenance of their vital organs, such as the brain and heart is further boosting the segment’s growth. Moreover, the growing consumption of dietary supplements among the younger population for maintaining their physical endurance and boosting their mental alertness will further propel the segment’s growth.

- For instance, according to an article published by M & R Label in May 2022, around 77.0% of American adults consume dietary supplements and spend an average of USD 56 per month on dietary supplements.

Thus, the rising prevalence of disease conditions across the globe and the preferential shift of patients to the use of nutraceutical products for boosting immunity are some factors contributing to the growth of the segments.

REGIONAL INSIGHTS

North America Empty Capsules Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.23 billion in 2025 and USD 1.31 billion in 2026. The region is anticipated to dominate the market in the upcoming years owing to the growing prevalence of various disorders and higher diagnosis and treatment rates. Moreover, the increasing preference of the general population toward opting for capsules as a form of dosage is contributing to the growth of the market during the empty capsules market forecast. The U.S. market is projected to reach USD 1.13 billion by 2026.

- For instance, according to an article by Lonza, a survey conducted by authoritative institutions in the U.S. demonstrated that out of 1,000 selected patients, 54.0% preferred hard capsules, 29.0% considered sugar-coated pellets, and only 13.0% chose tablets as their preferred dosage form.

On the other hand, Europe accounted for a substantial share of the market. Empty hard capsules use titanium dioxide due to its excellent pacifying properties, its ability to withstand both light and heat exposure, and its ability to absorb UV rays and avoid degradation of the capsule’s fill by the light. As per an article published by Capsuline in 2022, Titanium Dioxide (TiO2) was banned in Europe due to some European studies and regulatory bodies demonstrating that ingestion of TiO2 can be harmful and unsafe. This restriction has emphasized key players in the market to focus on introducing alternative products that are titanium dioxide-free and safe for usage by the general population in the region. The UK market is projected to reach USD 0.32 billion by 2026, and the Germany market is projected to reach USD 0.29 billion by 2026.

- For instance, in May 2022, Lonza led to the expansion of their Capsugel offerings by adding titanium dioxide-free (TiO2-free) white hard gelatin capsules to meet the rising demand for these capsules in the European Union.

The market in Asia Pacific is expected to grow at a higher CAGR during the forecast period. The emphasis of manufacturers on receiving approvals from the international regulatory authorities for introducing their products in the international markets aided them in expanding their brand presence in the overseas market. The Japan market is projected to reach USD 0.05 billion by 2026, the China market is projected to reach USD 0.62 billion by 2026, and the India market is projected to reach USD 0.28 billion by 2026.

- For instance, according to a news published by EThealthworld.com in July 2022, Akums Drug & Pharmaceuticals Ltd. received approval from the European Union (EU) Good Manufacturing Practice (GMP) for their empty hard gelatin capsules manufacturing plants in Haridwar, India.

Further, Latin America and the Middle East regions are expected to grow minimally during the forecast period. The highly attractive government incentives provided for foreign direct investments and the initiatives taken by the country's various states to promote industrial investments have encouraged many industry players to set up their manufacturing units in the region to improve their exports to North and South America.

- For instance, according to an article published by Mexicobusiness, in July 2020, Capsutec, a young Mexican empty capsule distributor, planned to open manufacturing operations in the region.

Thus, these are some of the factors expected to augment the market's growth in these regions.

List of Key Companies in Empty Capsules Market

Lonza to Lead the Market with Strong Product Portfolio

The empty capsule is a consolidated market comprising players with a wide range of products developed from different types of material. The increasing sales of empty capsules in the U.S. and other markets is a major reason for the company's growing market share. Also, the rising R&D expenditure of the market player for the launch of new products is another factor due to which it holds highest global market share.

- In November 2022, Lonza launched Enprotect, a new capsule solution designed to target the delivery of ingested acid-sensitive Active Pharmaceutical Ingredients (APIs). The launch of this product led to the expansion of the company’s product portfolio.

QUALICAPS is increasing its focus on introducing new titanium dioxide-free (TiO2) capsule products, as the demand for these products is rising in the European market. The introduction of these products globally with strategic acquisitions catering to the population's rising demand is aiding the company's strong market hold.

- In February 2021, QUALICAPS Europe S.A.U. Led to an expansion of their presence in the South Asia region. This ensured the continuous supply of their products to their multi-national customers and expanded their geographical footprint.

The growing investments of other players in research and development activities for developing novel empty capsules with improved shelf life in different sizes that are ethylene oxide-free are expected to increase the market share of these companies in the future. Moreover, the increasing number of dietary supplement manufacturers in the market will further propel the growth of the market players.

- For instance, in FY 2021-2022, Nectar Lifesciences Ltd. launched Nexxicap Minty, an empty hard gelatin capsule, and Nexxicap Pearl capsules, leading to the expansion of the company’s product portfolio in the market.

LIST OF KEY COMPANIES PROFILED:

- Lonza (Switzerland)

- ACG (India)

- QUALICAPS (U.S.)

- CapsCanada (U.S.)

- NATURAL CAPSULES LIMITED (India)

- Nectar Lifesciences Ltd. (India)

- HealthCaps India Ltd. (India)

- Sunil Healthcare Limited. (India)

- Bright Pharma Caps (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2023 – VANTAGE NUTRITION, an ACG company, acquired ComboCap, Inc. in the U.S. and BioCap in South Africa, intending to expand their technology and footprint in North America and across the globe.

- January 2022 - Xi'an Le-Nutra Ingredients Inc. shipped 8.0 million HPMC capsules to Latvia, in Europe. These capsules were without titanium dioxide (TiO2), demonstrating the company’s efforts to meet the demand for the product in the region.

- July 2020 - QUALICAPS Group, formerly a part of Mitsubishi Chemical Holdings Corporation (MCHC), transferred to the Mitsubishi Chemical Corporation (MCC). This transformation aids QUALICAPS in leveraging the advantage of its network and expanding its capsule business.

- June 2020 – Lonza introduced DBcaps (double-blinded capsules), an HPMC capsule for clinical trials designed to address the clinical trial challenge of testing.

- April 2020 - QUALICAPS expanded its presence in the Middle East & Africa and signed collaboration agreements with several leading companies in the region. This collaboration strengthened its presence in the region.

REPORT COVERAGE

An Infographic Representation of Empty Capsules Market

To get information on various segments, share your queries with us

The market report covers a detailed analysis and overview. It focuses on key aspects such as competitive landscape, types of empty capsules, functionality, end user, and region. Besides this, it offers insights into the market drivers, market trends, market dynamics, COVID-19 impact on the market, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.74% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

By Type, Functionality, End User, and Region |

|

|

Segmentation |

By Type

|

|

By Functionality

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.91 billion in 2026 and is projected to reach USD 6.58 billion by 2034.

In 2025, the market value stood at USD 3.67 billion.

The market will exhibit steady growth at a CAGR of 6.74% during the forecast period of 2026-2034.

Currently, the gelatin segment is leading by type during the forecast period.

The rising prevalence of various diseases, increasing diagnosis of the condition, increasing research and development activities with strategic acquisitions by the major market players, and the launch of new products are the markets key drivers.

Lonza, ACG, and QUALICAPS are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic