Floating Power Plant Market Size, Share & Industry Analysis, By Power Source (Non Renewable {Gas Turbines and IC Engines} and Renewable {Solar and Wind}), By Power Rating (Low, Medium, and High), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

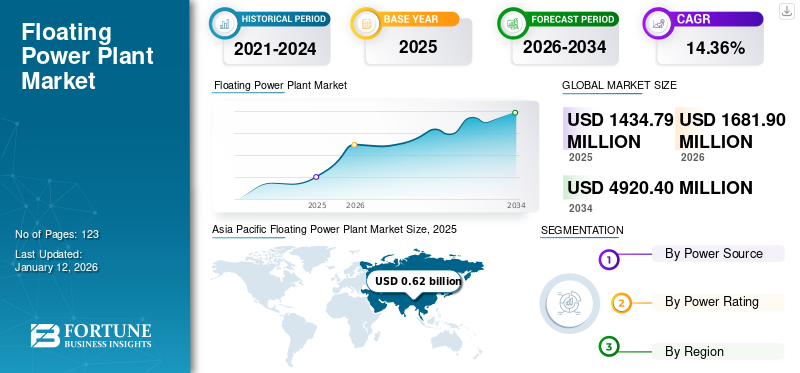

The global floating power plant market size was valued at USD 1.435 billion in 2025. The market is projected to be worth USD 1.682 billion in 2026 and is expected to reach USD 4.920 billion by 2034, exhibiting a CAGR of 14.36% during the forecast period. Asia Pacific dominated the floating power plant market with a market share of 42.98% in 2025.

Floating power plants are energy-generating units mounted on floating platforms such as ships and barges. These offer mobile or semi-permanent power stations that are increasingly being adopted due to their flexibility, space, efficiency, fast deployment, and growing energy demands. It can be deployed quickly and relocated as needed. It is ideal for meeting temporary or emergency power needs, including natural disasters or grid outages.

Siemens Energy holds a leading market share, particularly for thermal-based (LNG/diesel/gas) and hybrid floating power solutions. Many regions face land constraints for new power infrastructure. Floating power plants, solar, wind, or gas are installed on water bodies such as reservoirs, lakes, and coastal areas without utilizing valuable land.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Renewable Energy to Drive Market Growth

Solar farms and wind turbines need large land areas for energy generation, which are often scarce or costly, especially near urban centers or in densely populated countries. Floating solar and offshore floating wind projects allow the installation of renewable capacity on water surfaces, saving precious land for other uses. Many reservoirs, lakes, and coastal areas remain unused or underutilized. Floating solar and wind farms tap into these spaces, unlocking new renewable energy solutions without ecological or social disruption. In March 2025, Bharat Petroleum Corporation's floating solar power plant was built in the rainwater harvesting pond and covers eight acres of the waterbody, which has a complete area of about 19 acres. The plant has been built at a cost of USD 3.37 million.

Hybrid Integration and Energy Storage Combination in Floating Power Plant Drives Market Expansion

Floating solar and wind are intermittent by nature as energy output varies with sunlight and wind availability. Integrating energy storage systems (such as batteries or hydrogen) smoothens the power supply, ensuring consistent electricity delivery. Hybrid plants combining renewables with storage or backup power sources including gas turbines can offer stable, dispatchable power. This lowers grid fluctuations and advances reliability, which is crucial for both island grids and mainland networks. Storage allows excess energy generated during peak times to be saved and used later, increasing overall plant efficiency. Hybrid setups optimize energy use and reduce wasted energy, further leading to the global floating power plant market growth. In May 2025, Scientists energized the incorporation of solar panels into Switzerland's Etzelwerk, an open-loop pumped storage hydropower plant that utilizes 10% of the upper reservoir for the solar panels. The result of the replication revealed that the addition of FPV to the plant had expanded the total energy production by around 20%.

MARKET RESTRAINTS

High Initial Capital Investments Hamper Market Development

Floating power plants, especially offshore wind or hybrid systems, require specialized floating platforms, mooring systems, corrosion-resistant materials, and marine construction. These components are costlier than their land-based counterparts. Deploying power plants on water involves marine transport, offshore cranes, and underwater anchoring, which remarkably raise project development and commissioning costs. Many floating power plants currently comprise batteries or hybrid systems to stabilize the energy supply. These systems add substantial upfront costs, hampering the floating power plant market share.

MARKET OPPORTUNITIES

Rising Need for Remote and Island Power to Create Growth Opportunities

The rising need for remote and island power is creating opportunities for floating power plants as they offer flexible, fast, and reliable solutions where conventional power infrastructure is unfeasible or limited. Remote regions and islands often lack access to national power grids, making it difficult and expensive to build traditional land-based infrastructure. Many isolated regions rely on diesel imports, which are expensive, polluting, and subject to supply disruptions. Floating renewable systems (solar, wind, or hybrid) replace or supplement diesel with clean, cost-effective alternatives. For instance, in January 2025, Solar Energy Corporation of India Limited declared its plan to choose project developers for grid-connected floating solar PV projects with battery energy storage systems in Lakshadweep. The choice will follow a tariff-based competitive bidding procedure under RESCO mode. The entire capacity of the projects is 2.7 MW and will require the construction of floating solar installations on the Lakshadweep island.

MARKET CHALLENGES

Technical and Engineering Complexity to Restrain Market Growth

Floating energy is a relatively new domain. There is a shortage of specialized engineers and a lack of global standards for its design, safety, and performance. This adds to uncertainty for project developers and investors. All these factors increase cost, time, and risk, thereby restraining market growth unless mitigated through innovation and experience building. Routine operations, inspections, and repairs are more difficult and expensive on water than on land. This requires specialized vessels, marine crews, and equipment, increasing O&M (Operations and Maintenance) costs.

FLOATING POWER PLANT MARKET TRENDS

Faster Deployment and Mobility has Emerged as a Trend in the Market

Floating power plants can be built and deployed much faster than traditional onshore or offshore power plants. There is no need for large-scale civil construction, land preparation, or long permitting processes, which shortens project timelines significantly. Floating units are ideal for disaster recovery or emergency power needs, where speed of deployment is critical. Mobile floating power plants can be relocated seasonally or when demand shifts to another region, offering flexible grid support or backup capacity. It is ideal for temporary industrial projects, including mining or construction in remote locations where permanent infrastructure is not viable.

Download Free sample to learn more about this report.

IMPACT OF TARIFFS

The impact of tariffs on the market, consisting of power barges or floating power stations, can be significant and multi-dimensional, depending on the type of tariff and the context (import/export, electricity pricing, and other.) Higher upfront costs, mainly for critical components sourced internationally, are expected to limit the market expansion. Tariffs lead to delays in sourcing parts or finding alternate suppliers, which leads to a Lower internal rate of return (IRR) and net present value (NPV) due to higher Capex. Higher costs may result in funding challenges or the need to re-evaluate suppliers, delaying construction and commissioning timelines. Tariffs force a shift to less experienced or costlier local suppliers, affecting quality or reliability.

SEGMENTATION ANALYSIS

By Power Source

Rising Demand for Clean Energy to Drive Renewable Energy Segment Growth

By power source, the market covers (non renewable {gas turbines and IC engines} and renewable {solar and wind}).

The renewable segment dominates due to several key factors such as government initiatives, energy generation, and others that align with the global push for clean energy and innovative power generation solutions. The renewable segment is projected to dominate the market with a share of 73.43% in 2026.

The non-renewable segment is the second dominating segment. Many regions (especially in Asia, Africa, and island nations) face power shortages or grid limitations in remote or coastal locations.

Non-renewable floating power plants typically powered by gas turbines, diesel, or heavy fuel oil offer a quick solution to add capacity where land-based power plants are difficult to build.

By Power Rating

To know how our report can help streamline your business, Speak to Analyst

Better Use of Large Water Bodies to Drive Low Capacity Segment Growth

Based on power rating the market is segmented into low, medium, and high.

Low capacity installations hold major market share due to their flexibility, ease of deployment, and suitability for remote or island regions with limited grid infrastructure. These plants, often powered by solar or small-scale gas/diesel generators on barges or platforms, require lower capital investment and shorter installation times compared to medium or high-capacity units. This makes them a viable solution for countries seeking quick, modular, and mobile energy access without major infrastructure development. The low segment is expected to lead the market, contributing 38.53% globally in 2026.

Medium is the second dominating segment and is growing at the fastest rate in the market. Medium-capacity floating plants provide enough power to meet the needs of small grids, island communities, and industrial sites without overloading the local infrastructure.

FLOATING POWER PLANT MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Strong Push for Decarbonization to drive Market Growth in North America

The market in North America, especially in renewable floating segments such as floating solar PV and floating offshore wind, is growing remarkably due to a combination of energy, environmental, and economic factors. The U.S. and Canada have ambitious net zero targets and state/provincial mandates for renewable energy. Floating renewables (especially floating wind in deep waters) help meet these targets where land-based or fixed-bottom projects are less feasible.

In January 2023, New Jersey Resources (NJR) Clean Energy Ventures declared that it now possesses and functions the largest floating solar array in North America, carrying 95% of the power required for New Jersey American Water’s Canoe Brook Water Treatment Plant. The 8.9-megawatt solar array covers 17 acres of the Canoe Brook waterbody in Short Hills, New Jersey, with 16,510 solar panels.

U.S.

Deepwater Offshore Wind Potential Fuel Market Growth in the U.S.

The U.S. market, mainly driven by floating offshore wind and floating solar, is growing as it aligns with the nation's clean energy transition and leverages unique geographic and technical advantages. Most of the U.S. offshore wind resources (especially along the West Coast and parts of the East Coast) lie in deep waters where traditional fixed bottom turbines are not feasible. Floating wind technology enables harnessing these rich wind resources, especially in California, Oregon, Maine, and Hawaii. The U.S. market is estimated to reach USD 96.56 billion by 2026.

Europe

Strong Government Support and Funding Drive European Market Growth

Europe is the fastest-growing region in the market due to high efforts of the European countries to have deep offshore areas where fixed-bottom wind turbines are not feasible. Floating wind technology enables tapping into these stronger, steadier wind resources further offshore.

The U.K., Norway, France, Portugal, and Spain have launched national strategies, auctions, and subsidies specifically to accelerate floating offshore wind and hybrid floating plants. The EU’s horizon and Innovation Fund also supports floating power technology development. The UK market is expected to reach USD 134.04 billion by 2026.

Asia Pacific

Asia Pacific Floating Power Plant Market Size, 2025 (USD billion)

To get more information on the regional analysis of this market, Download Free sample

Scarcity of Suitable Land for Large Renewables Drive Market Growth

Asia Pacific holds the dominant share of the market as many Asian Pacific countries (e.g., Japan, South Korea, Singapore, India, and China) face land constraints, especially near major urban and industrial hubs. Floating solar wind plants allow these nations to utilize reservoirs, lakes, coastal waters, and offshore deep-sea areas without competing for land needed for agriculture or development. China, India, and Indonesia have ambitious net zero goals and aggressive renewable energy targets. The China market is forecast to reach USD 359.49 billion by 2026, and the India market is likely to reach USD 169.52 billion by 2026.

China

China’s Cost Advantage and Domestic Supply Chain Boost its Growth

China has the world’s most cost-competitive solar PV manufacturing and floating system suppliers. Local production of components (modules, floats, mooring systems) helps keep project costs low and accelerate deployment. Coastal provinces (e.g, Guangdong, Fujian, Shandong) have deep sea wind resources inappropriate for fixed bottom turbines, driving interest in floating offshore wind technology.

Latin America

Efficient Use of Existing Water Bodies to Drive Latin America Market Growth

Latin America is also showing positive growth in the market as Brazil, Colombia, Argentina, and Chile have vast hydropower reservoirs (e.g., Sobradinho, Balbina, Itumbiara). These reservoirs offer large, calm water surfaces ideal for installing floating solar PV without demanding new land or major environmental clearances. Many reservoirs already have grid infrastructure due to hydro plants. Floating solar can share these connections, reducing costs and speeding up deployment.

Middle East & Africa

Water Scarcity and Land Constraints to Drive Market Growth

Middle East & Africa is the second dominant region in the market attributed by the growing deployment of power barges in the developing nations as well as rising focus of the countries towards offshore renewable energy sources. Floating solar helps optimize water bodies (reservoirs, desalination products, irrigation canals) without taking up valuable land. Middle East & Africa countries are under pressure to diversify their energy mix, reduce dependence on fossil fuels, and meet net-zero targets (e.g, UAE by 2050, Saudi Arabia by 2060, South Africa’s clean energy transition plants.) Floating power plants provide a flexible way to add renewable capacity near cities and industries.

KEY INDUSTRY PLAYERS

Competitive Landscape

Technological Development in Solar & Wind Power to Amplify Company’s Growth

The global market is highly fragmented, with different key players operating in the floating power plant industry. Globally, Siemens is one of the key players in the market. In October 2024, Siemens Gamesa decided to contribute 15MW turbines to the 750MW Firefly floating wind project in South Korea under a treaty that would view the local assembly of nacelles.

In addition Karpowership, based in Turkey, is also among the global pioneers in barge-mounted power plants, operating a fleet of “Powerships” deployed in Africa, South Asia, and Latin America. The company focuses on rapid deployment of turnkey floating plants powered by dual-fuel engines (HFO and LNG) and has been expanding into South Africa and Mozambique. Wärtsilä of Finland specializes in modular engine-based FPPs that can be installed on floating platforms. It emphasizes flexible, hybrid systems with energy storage, targeting island nations and regions with unstable grids, while also pursuing decarbonization through future fuels such as hydrogen and ammonia.

List of Key Floating Power Plant Companies Profiled

- China Energy International Group Co., Ltd. (China)

- Siemens (Germany)

- Ciel & Terre (France)

- Kyocera Corporation (Japan)

- Sungrow FPV (China)

- Ocean Sun (Norway)

- D3Energy (U.S.)

- Floating Power Plant (Denmark)

- Swimsol (Austria)

- Equinor (Norway)

- Principle Power (U.S.)

- Vikram Solar Pvt. Ltd. (India)

- Aker Solutions (Norway)

- Karpowership (Turkey)

- Power Barge Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Ciel & Terre completed a 120 MWp floating solar project in India, presenting various company firsts in engineering and design, comprising rock bolt mooring and a build-up fiberglass inverter barge. The system also labels the French PV specialist’s first usage of spin welding in its floating platform assembly.

- May 2025: Wärtsilä will provide power generation apparatus for a new 30 MW power plant being established on Victoria Island in Lagos by a Nigerian independent power producer (IPP). Wärtsilä will also function and support the power plant for five years in place of the custom.

- November 2024: Uttar Pradesh government of India has partnered with NTPC to establish floating solar power plants and increase its renewable energy capacity. The state targets 14,000 MW of solar power generation by 2027.

- June 2024: Floating Power Plant obtained a wind turbine generator from Siemens Gamesa Renewable Energy for its radical project off the coast of Gran Canaria. The selected wind turbine is a 4.3 MW SWT-DD-120, which will be involved in the full-scale demonstrator project, displaying the amalgamation of wind power, wave power, and hydrogen storage technologies. Currently, the project gained a grant of USD 30,060 million from the European Union Innovation Fund.

- December 2023: Vikram Solar, one of India’s dominating module manufacturers, declared the registering of an order won with the National Thermal Power Corporation (NTPC) to supply 152 MW of streamlined Crystalline Bifacial Solar PV Modules at Nokh, Rajasthan.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Countries worldwide have a strong focus toward clean energy and curb carbon emission. The deployment of solar and wind power plant in offshore areas is projected to play a key role in achieving these target. In August 2024, India’s highest floating solar projects in north and central India, producing 90 MW, has been appointed at Omkareshwar, Madhya Pradesh. The USD 7.48 million project will offer 196.5 million units in its initial year while lowering carbon emissions by 2.3 lakhs tons. Evolved by SJVN Green Energy Limited, it will preserve water by lowering evaporation.

REPORT COVERAGE

The global floating power plant market report delivers a detailed insight and focuses on key aspects such as leading companies and their operations offering floating power plant. Besides, the report offers insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several aspects and challenges that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.36% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Power Source · Non-Renewable o Gas Turbines o IC Engines · Renewable o Solar o Wind |

|

By Power Rating · Low · Medium · High |

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 1.43 billion in 2025.

The market is likely to grow at a CAGR of 14.36% over the forecast period (2026-2034).

The renewable energy segment is expected to lead the market in the forecast period.

The market size of Asia Pacific stood at USD 0.617 billion in 2025.

Rising demand for renewable energy to drive the market growth.

GE, Siemens, Karpowership, Wartsila, and others are some of the market's top players.

The global market size is expected to reach USD 4.920 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us