Hearing Aids Market Size, Share & Industry Analysis, By Product (Hearing Devices (BTE {Behind the Ear}, ITE {In the Ear}, RIC {Receiver in the Canal}, CIC {Completely in the Canal}, and Others) and Hearing Implants (Cochlear Implants and Bone-anchored Implants)), By Patient Type (Adult and Pediatric), By Technology (Digital and Analog), By Severity (Mild, Moderate, and Severe & Profound), By Type of Hearing Loss (Sensorineural, Conductive, and Mixed), By Distribution Channel (OTC, Medical Channel, and Private Practices), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

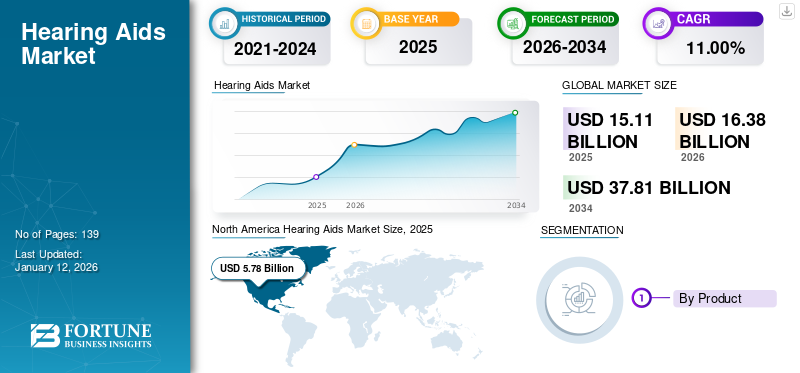

The global hearing aids market size was valued at USD 15.11 billion in 2025. The market is projected to grow from USD 16.38 billion in 2026 to USD 37.81 billion by 2034, exhibiting a CAGR of 11.00% during the forecast period. North America dominated the hearing aids market with a market share of 38.30% in 2025.

Hearing aids are electronic medical devices designed to aid people with hearing impairment. The growing prevalence of hearing loss and impairment among the patient population, particularly geriatric patients, is one of the crucial factors anticipated to boost the demand for hearing aids in the market.

- For instance, according to a 2025 report published by the British Academy of Audiology (BAA), it was reported that about 1 in 6 people are affected by some form of hearing loss in the U.K.

Additionally, the increasing prevalence of mild or moderate hearing loss is resulting in a growing diagnosis rate among the patient population, further supporting the rising adoption of hearing devices in the market. This, coupled with growing focus towards inorganic strategic initiatives such as acquisitions and collaborations among the prominent players in the market, is anticipated to foster growth during the study period.

Moreover, increasing emphasis on research and development activities to develop and introduce novel hearing devices among the major players, such as Demant A/S, Sonova, and WS Audiology, is anticipated to boost market growth.

Market Dynamics

Market Drivers

Increasing Prevalence of Hearing Loss to Drive Market Growth

The increasing prevalence of partial and complete hearing loss is one of the crucial factors resulting in a growing diagnosis and treatment rate among the patient population. The increasing aging population is another factor supporting the growing number of patients suffering from the condition, as the risk of hearing loss is higher among this age group.

- For instance, according to 2025 data published by the British Academy of Audiology (BAA), about 8.0 million people aged 60 and above are affected by hearing loss in the U.K.

Additionally, various factors such as chronic ear inflammation, vascular disorders, noise exposure, and genetic susceptibility, among others, have been preliminary factors for the cause of hearing loss in the population. Hearing loss not only significantly impacts the individual but also loss of productivity of the individual and increases the direct costs. Therefore, to decrease the prevalence and reduce the cost burden, manufacturers, along with governmental organizations, are focusing on increasing the usage of hearing aid devices by patients across the globe.

Moreover, the key players are also focusing on integrating technology in these devices, further expected to boost the adoption rate further, thereby driving the global hearing aids market growth.

Market Restraints

Lower Penetration Rate of the Devices in Developing Nations to Hamper Market Growth

There is an increasing demand for technologically advanced hearing devices among the patient population globally. However, despite many clinical advantages associated with hearing devices for patients suffering from hearing loss and impairment, a certain proportion of the patient population still does not address their hearing loss, which hampers the adoption rate of these devices in the market.

Additionally, the research findings have also concluded that people with hearing problems never get tested for their hearing impairment, limiting the adoption of these devices in the market.

- For instance, according to a 2021 study published by SCIELO Brasil with 1,100 participants, it was reported that about 86.5% of people do not wear hearing devices in Brazil.

This, along with limited awareness about the benefits of hearing devices, along with lower disposable income rates among lower-income countries, is also anticipated to hamper the adoption rate of these products in the market, thus limiting the market growth.

Market Opportunities

Increasing Technological Advancements in these Devices to Foster Growth Opportunities for Key Players

There is an increasing prevalence of hearing loss and impairment, resulting in a growing demand for technologically advanced hearing devices among the population. Increasing demand is driving the focus of prominent players to develop and introduce novel devices in the market. Increasing improvements in hearing aid technology, incorporating digital and smart technology, artificial intelligence, and others, result in increased user benefits, further augmenting the adoption of these devices in the market.

Additionally, hearing devices with advanced features including bluetooth connectivity, compatibility with smartphones, noise cancellation, real-time translation, speech clarity, tinnitus masking, and high sound processing, among others, are leveraging the functioning of these devices to no bounds. Moreover, the prominent players are emphasizing the integration of smart and digital features in these hearing devices, such as wireless devices and others, further supporting the adoption rate of these devices among the patient population in the market.

- For instance, in February 2025, GN Store Nord A/S launched ReSound Vivia, an artificial-intelligence-powered hearing aid to strengthen its product portfolio.

Moreover, increased adoption is further leading to the growing sales of these devices, aiding in the revenue of key players. According to the European Hearing Instrument Manufacturers Association (EHIMA), approximately 22.69 million hearing aid units were sold globally in 2024, representing a growth of 4.0% compared to the previous year.

Market Challenges

High Cost Associated with Advanced Hearing Devices to Hamper Market Growth

There is an increasing penetration rate for advanced hearing devices to treat hearing loss and impairment among the patient population. However, the high cost associated with these devices is blocking patients from adoption the devices on a larger scale.

- According to 2024 data published by Healthy Hearing, the average selling price of a pair of hearing aid devices ranges from USD 2,000-7,000 in the U.S.

Increasing incorporation of digital technologies is supporting the growing prices of these devices. Moreover, developing an advanced hearing aid requires advanced processors and other accessories, further contributing to the increasing price value. According to Williams, the components required to make a single hearing aid cost about USD 100.

Therefore, the factors mentioned above, coupled with limited awareness about the benefits of these devices, are likely to limit the adoption rate, especially in emerging countries such as Brazil, China, and others.

Other Prominent Challenges

- Regulatory Barriers to Hamper Market Growth: The hearing aids industry is subjected to strict compliance with regulatory standards that vary across regions. The Food and Drug Administration (FDA) regulates medical devices in the U.S. market, classifying hearing devices as Class I and II. On the other hand, hearing devices are regulated by Medical Device Regulation (MDR) in Europe, which has a different set of requirements for the design, development, clinical evaluation, and post-market surveillance of these devices. Obtaining regulatory approval for new hearing devices, especially for start-ups, becomes challenging due to the costly and lengthy process, which may further slowdown the adoption rate for these devices in the market.

- Supply Chain Constraints to Limit Market Growth: The global disruptions and delays in manufacturing are leading to chip shortages, further expected to limit market growth.

- Data Privacy Risks to Hamper Product Adoption: The AI-powered devices are increasing concerns over user data security, further expected to hamper the product adoption.

Hearing Aids Market Trends

Preferential Shift Toward Over-the-Counter Hearing Devices

There is a preferential shift toward over-the-counter hearing devices owing to certain benefits such as accessibility, affordability, lower upfront cost, broader availability, and others among the patient population. Over-the-counter hearing devices can be purchased directly from online or retail stores, making them easier to access for people in remote areas or those with limited mobility.

- For instance, according to an article published by the National Center for Biotechnology Information (NCBI), it was reported that the average price of a pair of traditional hearing devices is around USD 4,600, and the average price for an over-the-counter hearing device is approximately USD 1,600

Furthermore, these devices are equipped with technological advancements with features such as seamless hearing, geotagging, and health measures tagging, among others, which is a significant trend among the market players.

Moreover, the implementation of regenerative fuel to generate electrical charge to power these hearing devices is also becoming a popular trend among the market players. The use of methanol, which reacts with these devices in a controlled fuel cell, provides negligible loss of power and reduces wastage. The sustainable power source can be used as a sustainable alternative to the batteries in these devices to reduce the economic burden, especially in emerging countries.

Thus, the shifting focus and effort of the market players in the advancement of these products is a significant trend in the global market.

Other Prominent Trends:

Increasing Adoption of Tele-audiology: Remote fitting and diagnostics are expanding rapidly, especially post-pandemic, making hearing solutions accessible even in rural or underserved areas.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product

Increasing Adoption of Hearing Devices Led to Dominance of Segment

Among product, the market is bifurcated into hearing devices and hearing implants. The hearing devices segment is bifurcated into BTE (behind the ear), ITE (in the ear), RIC (receiver in the canal), CIC (completely in the canal), and others. Furthermore, the hearing implants are segmented into cochlear implants and bone anchored implants.

The hearing devices segment dominated the market with a share of 77.96% in 2026. The increasing prevalence of hearing loss and impairment among the population, coupled with growing awareness about the benefits of hearing devices such as canal hearing aids and others, is resulting in a growing demand for these products. This, along with increasing focus of key players toward research and development activities to introduce advanced hearing devices, is likely to boost the segmental growth in the market.

- In February 2024, Starkey Laboratories Inc., launched Genesis AI hearing devices to widen its geographical presence in India.

On the other hand, the hearing implants segment is poised to grow with the highest CAGR during the study period. The rising prevalence of hearing loss and impairment among patients supports the increasing demand for these devices. Furthermore, strong strategic initiatives to raise awareness about the benefits of hearing implants are likely to aid in the segmental growth in the market.

To know how our report can help streamline your business, Speak to Analyst

By Patient Type

Increasing Prevalence of Hearing Loss among Aging Population to Drive Adoption among Adults

Among patient type, the market is bifurcated into adult and pediatric.

The adult segment dominated the market contributing 91.45% globally in 2026. The growing prevalence of hearing loss among adults is supporting the growing demand for diagnostic and treatment services in the market. This, along with the growing focus of key players toward R&D activities to launch innovative devices, is likely to support the growth of the segment in the market.

- For instance, in August 2024, Sony collaborated with WS Audiology to launch an innovative OTC hearing device designed for adults with mild-to-moderate hearing loss, featuring advanced sound technology, to strengthen its product portfolio.

On the other hand, the pediatric segment is expected to grow with a considerable CAGR during the forecast period. The segment growth is due to certain factors, such as the increasing infant population suffering from hearing defects, along with the effectiveness of cochlear implantation in restoring children’s hearing.

- According to an article published in Medscape in July 2022, approximately 2-4 infants per 1,000 suffer from hearing loss yearly. Moreover, studies across Europe and North America found a prevalence of 0.1% of children with hearing loss.

By Technology

Increasing Adoption of Digital Hearing Aids to Boost Segmental Growth

Based on technology, the market is segmented into digital and analog.

The digital segment dominated the market accounting for 84.62% market share in 2026. The increasing prevalence of hearing loss, increasing technological advancements in these devices, growing focus of key players toward R&D activities to launch innovative digital hearing devices, among others, are some of the factors supporting the growth of the segment in the market.

- For instance, in July 2024, Concha Labs launched its FDA-cleared Concha Sol Hearing Devices, an over-the-counter solution enabling users to personalize their hearing profiles with their mobile phones. This helped the company to increase its brand presence.

On the other hand, the analog segment is also expected to grow with a considerable CAGR during the forecast period. The growth is due to growing demand for these devices, coupled with increasing focus of major companies toward acquisitions and mergers among the other players to strengthen their market positions, thereby contributing to the segmental growth.

By Severity

Increasing Prevalence of Severe & Profound Hearing Loss to Drive Segmental Growth

Based on severity, the market is segmented into mild, moderate, and severe & profound.

The severe & profound segment dominated the market in 2024. The growing prevalence of severe & profound hearing loss, resulting in a growing diagnosis rate in hospitals and ENT clinics, subsequently fuels the adoption of these devices among patients. In addition, increasing demand for these devices is further enabling the key players’ focus on research and development activities to launch these devices specific to this condition, further augmenting the growth of the segment in the market.

- For instance, according to the 2025 data published by the British Audiology of Association (BAA), it was reported that about 900,000 people are suffering from severe or profound hearing loss in the U.K.

On the other hand, the moderate segment is projected to witness considerable growth during the forecast period. The growth is due to an increasing patient population suffering from moderate hearing loss, resulting in increasing product launches and approvals.

Additionally, the mild segment is also expected to grow with a considerable CAGR during the forecast period. The growth is due to the increasing diagnosis rate for hearing loss among these patients, coupled with growing technological advancements in hearing devices, further contributing to the growth of the segment in the market.

By Type of Hearing Loss

Increasing Prevalence of Sensorineural Hearing Loss to Augment Product Demand

Based on the type of hearing loss, the market is segmented into sensorineural, conductive, and mixed.

The sensorineural segment dominated the market in 2024. Increasing prevalence of sensorineural hearing loss among children and adults, coupled with the growing focus of key players toward R&D activities to launch innovative products, is likely to support the growth of the segment in the market.

- For instance, according to 2021 statistics published by the Indian Journal of Otology, about 7.9% -13.3% people were affected by unilateral sensorineural hearing loss in India.

On the other hand, conductive and mixed segments are also expected to grow during the forecast period. The growth is due to the increasing prevalence of mixed and conductive hearing loss, resulting in the increasing diagnosis and treatment rate among the patient population. This, along with growing technological advancements in these devices, is further likely to support the growth of the segment in the market.

By Distribution Channel

Growing Patient Admissions to Hospitals & ENT Clinics for Treatment to Boost Medical Channel Growth

Among the distribution channel, the market is segregated into OTC, medical channel, and private practices.

The medical channel segment dominated the market with a share of 63.74% in 2026. The growing number of patient visits to hospitals and specialty clinics to avail ENT and audiology consultations and services is one of the major factors supporting segmental growth. Along with this, rising favorable health reimbursement for hearing implantation surgery and increasing penetration of hearing implants among the patient population are some factors expected to boost the medical channel segment growth.

Additionally, the private practices segment is expected to grow at a considerable growth rate during the study period. The majority of players, such as Sonova, Amplifon, Demant A/S, and Lucid Hearing, among others, are intensifying their efforts to strengthen their retail channels across the world. In addition, the growth is due to the increasing number of private practices for ENT services, coupled with the rising number of patient admissions to these healthcare facilities.

- In February 2023, Lucid Hearing partnered with several retail groups to improve access to hearing devices by making them available over the counter among the patient population.

On the other hand, the OTC segment is expected to grow with increasing focus of governmental bodies and prominent players on improving access to hearing devices. Over-the-counter products are one of the major factors anticipated to fuel segmental growth in the coming years.

- In January 2024, RCA Accessories launched three new over-the-counter hearing aid models, including RSH082, RSH072, and RSH053, to expand its presence in the global market.

Hearing Aids Regional Outlook

Among regions, the market is segmented into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Hearing Aids Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market and generated a revenue of USD 5.78 billion in 2025. The dominance is due to the growing demand for technologically advanced hearing devices, adequate reimbursement policies, strong regulatory support, significant adoption rate for hearing devices, and new product launches are some of the factors expected to drive market growth in the region.

- In September 2024, WS Audiology launched Signia Active Pro IX for hearing-impaired individuals to strengthen its product offerings in Canada.

U.S.

The growing prevalence of hearing loss, increasing awareness about the benefits of hearing devices, developed healthcare infrastructure, growing number of acquisitions and mergers among other players, are some factors contributing to the market's growth. The U.S. market is valued at USD 5.68 billion by 2026.

Asia Pacific

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The increasing geriatric population suffering from hearing loss and impairment, resulting in a growing diagnosis rate, is increasing the demand for hearing devices in the Asia Pacific. Additionally, increasing healthcare expenditure and a growing number of players focusing on expanding their geographical footprint in Asia Pacific countries to manage the rising demand for these devices are likely to contribute to the market growth in the region. The Japan market is valued at USD 1.09 billion by 2026, the China market is valued at USD 0.74 billion by 2026, and the India market is valued at USD 0.11 billion by 2026.

- For instance, according to 2024 data published by The People’s Republic of China, about 297 million people are aged 60 and above in China.

Europe

Europe also accounted for a considerable share of the market in 2024. The increasing prevalence of hearing ailments, a growing aging population, and a strong government focus on improving access to these products are a few factors supporting the product demand in Europe. The increasingly favorable reimbursement scenario in countries, including Germany and U.K., among others, coupled with rising product approvals and launches in European countries, is expected to contribute to the market's growth. The UK market is valued at USD 1.69 billion by 2026, while the Germany market is valued at USD 1.35 billion by 2026.

- For instance, according to a report published by Value Dx in 2021, Germany and Belgium offer reimbursements for hearing devices through pharmacies and medical supply stores through social health insurance (SHI), along with co-payments.

The Rest of the World

On the other hand, the rest of the world is also expected to grow at a considerable rate during the forecast period. Increasing focus toward improvement of healthcare infrastructure among governmental organizations, growing establishment of hearing aid startups, and increasing healthcare expenditure, among others, are vital factors supporting the market growth. Improving access to hearing devices in emerging countries, including Mexico, Brazil, and African nations, is one of the additional factors driving the market's growth.

- For instance, according to 2023 statistics published by the International Trade Administration (ITA), Brazil spends about 9.47% of its GDP on healthcare.

Competitive Landscape

Key Market Players

Increasing Product Launches Among Sonova and WS Audiology to Strengthen Their Presence

There are a few prominent players operating in the industry, accounting for the majority of the hearing aids market share. The increasing focus of research and development activities to launch novel products among the major players such as Sonova, Demant A/S, and WS Audiology, is expected to increasing their brand presence in the market, thereby contributing to their market respective shares.

- In October 2024, Sonova launched Unitron Ativo hearing devices with the introduction of two new Vivante styles, Stride V-M and Stride V-SP, to strengthen its product portfolio in the market.

Additionally, GN Store Nord A/S, Cochlear Ltd., and Starkey Laboratories Inc. are focusing on launching technologically advanced over-the-counter products and making effective and accurate products accessible to the patient population, which is expected to increase the adoption of these devices and strengthen their global presence in the market.

List of Key Hearing Aids Companies Profiled

- Starkey Laboratories Inc. (U.S.)

- WS Audiology (Denmark)

- GN Store Nord A/S (Denmark)

- Cochlear Ltd. (Australia)

- RION Co., Ltd. (Japan)

- Sonova (Switzerland)

- Demant A/S (Denmark)

- MED-EL (Medical Electronics) (Austria)

Key Industry Developments

- July 2025 – Cochlear received U.S. FDA approval for the Nucleus Nexa System, a smart cochlear implant with upgradable firmware to strengthen its product offerings.

- January 2024 – Starkey Laboratories Inc. launched the Genesis AI hearing device in Australia and New Zealand to advance products among the patient population. The Genesis AI features an advanced processor, a long-lasting rechargeable battery, and one of the smallest rechargeable RICs with the sensor.

- October 2022 – GN Store Nord A/S announced the launch of the Jabra Enhance Plus hearing enhancement earbuds to help patients with unaddressed hearing loss.

- August 2022 – Sonova launched Oticon, its new hearing device, which provides hearing aid wearers with an exceptional sound experience.

- March 2022 – Demant A/S expanded the Radiant family by adding new miniBTE styles to provide personalized solutions with the exceptional sound quality, listening comfort, and speech intelligibility that Radiant delivers.

REPORT COVERAGE

The global hearing aids market report offers a detailed analysis and overview of the market. It focuses on key aspects such as competitive landscape, product, patient type, technology, severity, type of hearing loss, distribution channel, and region. Along with this, it offers insights into the market dynamics such as drivers, trends, among others, in the market, and other key insights. In addition to the factors above, the report covers several factors that have contributed to the market’s growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

| Estimated Year | 2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.00% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Patient Type

|

|

|

By Technology

|

|

|

By Severity

|

|

|

By Type of Hearing Loss

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 15.11 billion in 2025 and is projected to reach USD 37.81 billion by 2034.

In 2025, the North America market value stood at USD 5.78 billion.

The market is expected to exhibit a steady CAGR of 11.00% during the forecast period.

By product, the hearing devices segment led in 2025.

Increasing geriatric population, rising prevalence of hearing loss, growing diagnosis of the condition, increasing R&D activities by key players, and rising number of product approvals & launches of hearing devices are the key driving factors.

Demant A/S, WS Audiology, Sonova, and Cochlear Ltd. are the major players in the market.

Yes. OTC devices improve accessibility and affordability for adults with mild-to-moderate loss, expanding retail availability while accelerating first-time adoption.

Sensorineural hearing loss is most prevalent across children and adults, supporting sustained demand for advanced digital devices and implants.

The medical channel (hospitals, ENT clinics, audiology centers) leads; private practices are expanding retail footprints; OTC is rising on policy support and consumer electronics partnerships.

I-driven sound processing, noise reduction and speech enhancement, smartphone integration, tinnitus masking, real-time personalization, rechargeable batteries, and remote fitting via tele-audiology.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us