Hot Sauce Market Size, Share & Industry Analysis, By Type (Tabasco Pepper Sauce, Habanero Pepper Sauce, Jalapeno Sauce, Sweet and Spicy Sauce, and Others), By Distribution Channel (Mass Merchandisers, Specialist Retailers, Convenience Stores, Online Retail, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

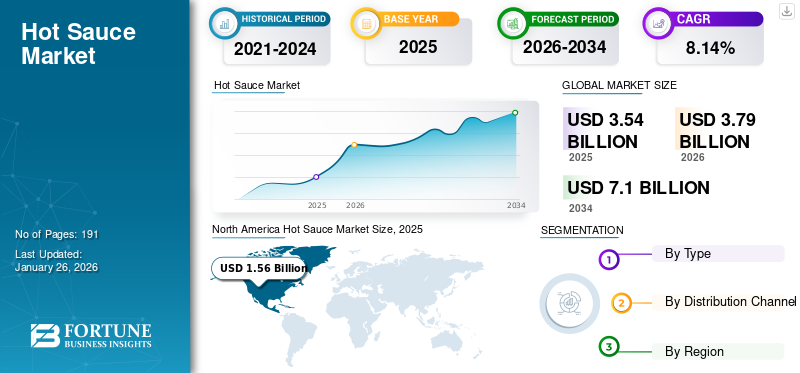

The global hot sauce market size was valued at USD 3.54 billion in 2025. The market is projected to grow from USD 3.79 billion in 2026 to USD 7.10 billion by 2034, exhibiting a CAGR of 8.14% during the forecast period. North America dominated the hot sauce market with a market share of 44.01% in 2025. Moreover, the hot sauce market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.94 billion by 2032, driven by increasing demand of Mexican and Asian cuisines in the country and increased product launch by key market size players.

The increasing globalization is the major factor driving the sales of condiments, spices, and sauces across the globe. The popularity of savory foods is growing tremendously among consumers worldwide, attributed to their unique umami flavors. Hot sauce is emerging as a widely accepted accompaniment to savory foods. They combine perfectly with various delicacies such as meat-based snacks, sweet & salty snacks, and others. Moreover, the players operating in the market are increasing their presence on a global level, which is expected to positively impact the hot sauce market growth.

The outbreak of the COVID-19 pandemic affected businesses with varying intensities across different regions and various parts of the supply chain. Several governments enforced lockdown and quarantine measures to control the spread of the virus, which led individuals to explore fresh cooking options. As a result, the global demand for hot sauce recorded positive growth during the pandemic period. According to one of the prominent hot sauce manufacturers, Truff in the U.S. stated in an article that it has witnessed an increase in its sales and generated around USD 25 million in revenue in 2020, a sales growth of 400% since March 2020.

Global Hot Sauce Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 3.54 billion

- 2026 Market Size: USD 3.79 billion

- 2034 Forecast Market Size: USD 7.10 billion

- CAGR: 8.14% from 2026–2034

Market Share:

- North America dominated the hot sauce market with a 44.01% share in 2025, driven by increasing demand for Mexican and Asian cuisines in the U.S. and a surge in new product launches by key players.

Key Country Highlights:

- United States: The Infrastructure Investment and Jobs Act is accelerating the use of eco-friendly and flavorful ingredients like hot sauce in national foodservice offerings, boosting domestic consumption.

- Mexico: A major global influencer in chili-based products, Mexico’s traditional recipes and export strength support continued global demand for hot sauce.

- India: Rising consumption of spicy fast food, growing middle-class spending, and the influence of Western dining trends are increasing hot sauce usage.

- United Kingdom: An evolving multicultural food scene and demand for bolder global flavors have led to rising imports and local production of hot sauces.

Hot Sauce Market Trends

Rising Adoption of Premium Products due to High Quality to Foster Growth

Premium product offerings in the market are expected to have higher profit margins in the coming years. According to the U.S. Bureau of Labor Statistics, the price trend for seasonings, spices, sauces, and condiments has seen an uptick of 10.89% in the last few years. This increase is attributed to the increasing availability of innovative and premium product offerings, which attract customers' attention due to their functional superiority. Several companies are indulging in the production of various premium chili sauces in the market to capitalize on the ongoing trend. For instance, Gringo Bandito incorporates various premium ingredients to produce a premium cayenne pepper sauce variety. These ingredients are Scotch bonnet peppers, habaneros, water, distilled vinegar, Mexican onions, garlic, salt, spices, and xanthan gum.

Download Free sample to learn more about this report.

Hot Sauce Market Growth Factors

Increasing Demand for Healthy Appeasement to Spur Product Sales

The global market has witnessed a considerable growth trajectory for hot sauces due to their evolving popularity and enhanced consumers' inclination toward innovative and bold flavors. The increasing young population and fostering of globalization have led to the advent of diversity in young people's food choices. These people are significantly proffering spices attributed to producing flavors such as spicy, peppery, and others, thus fueling revenues in the global market.

There is a rise in consumption of fast food among the busy & urban population, which will trigger a surge in sauce sales, especially in developing countries in Asia Pacific. Customers worldwide are opting for healthy appeasement in a way that provides taste and beneficial traits such as higher nourishing profiles, structured retail positioning, and non-GMO. This trend is set to deliver a significant boost to the sauce sales in developed and developing markets.

Surging Consumption and Innovations in Mexican and Asian Cuisines to Drive Growth

The primary factor driving product demand is the rising influence of Asian, especially Latin and Indian, cooking across all geographies. For instance, the U.S. possesses the largest Mexican population, followed by China and India. This trend influences the population and market dynamics with the rapidly evolving dietary patterns. The popularity of such regional and ethnic cuisines is expected to drive sales of innovative products such as cayenne pepper sauce.

The developed western markets have witnessed significant growth in the inflow of different immigrants, mainly from South America and Asia Pacific. This particular factor has resulted in the rising popularity of their cuisines that utilize various types of chili sauces, in which spicy condiments are primarily used. Expanding hospitality and the tourism sector worldwide have further deepened the internationalization of various cuisines. These days, consumers are seeking numerous bold and new ethnic flavors. An ongoing trend in gourmet cuisine has widened the accessibility of multiple sauces containing cayenne pepper among the retail sector and younger consumers. As a result, new players in the industry are keen to secure a competitive edge by introducing different varieties of hot sauces. For instance, in January 2024, TRUFF, a global hot sauce and condiments company, expanded its hot sauce offerings by introducing the TRUFF Jalapeño Lime Hot Sauce. The product is an innovative hot sauce variation made from the blend of fiery green jalapeño peppers and refreshing lime with black winter truffle.

RESTRAINING FACTORS

High Fluctuations in Raw Material Prices to Impede Hot Sauce Market Growth

A major restraint in the market is price fluctuation, especially in raw materials such as tomatoes, peppers, chilies, jalapenos, and others. The sudden outbreak of the COVID-19 pandemic globally caused disturbances in the transportation service, which impacted raw material prices. For instance, China and India are the leading exporters of tomatoes. The outbreak of COVID-19 across the globe is expected to impact the exports of various regional vegetables, including tomatoes. This factor could eventually result in a shortage in the market. As a result, the price of tomatoes is predicted to increase.

Similarly, the retail prices of chili peppers in China rose in 2018 as there was a delay in the entrance of dried chili peppers into the market due to bad weather conditions. This further resulted in product scarcity in the market. The prices of straight peppers, pointed peppers, and sweet peppers also increased.

Hot Sauce Market Segmentation Analysis

By Type Analysis

Tabasco Pepper Sauce Segment to Hold Major Share in the Coming Years due to High Demand

Based on type, the market is classified into tabasco pepper sauce, habanero pepper sauce, jalapeno sauce, sweet and spicy sauce, and others.

The tabasco pepper sauce segment accounted global market share of 22.69% in 2026. The rising consumer's inclination toward bold, spicy, and combination flavors is expected to support the steady growth of the segment.

The popularity of sweet and spicy sauce is growing considerably across the globe due to its tastefulness and healthy quotient. Moreover, premiumization of sweet and spicy sauce offerings, increasing popularity of "better for you" ethnic food products, and rising consumer interest in innovative condiments laced with exotic and spicy flavors are projected to offer huge growth opportunities to the segment.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel

Product Sales through Mass Merchandisers to Grow at a Rapid Pace in Near Future

Based on distribution channel, the market is divided into mass merchandisers, specialist retailers, convenience stores, online retail, and others. The mass merchandisers segment captured the lion's share of 62.53% in 2026 across the globe, as supermarkets and hypermarkets are highly preferred by consumers to shop for condiments and food ingredients such as chili sauce.

However, in the coming years, sales of chili sauce through online retail channels are expected to expand due to the increasing consumer interest in online shopping as it offers high convenience and wide product & brand choices. Moreover, the rising internet penetration in emerging economies is anticipated to support the steady growth of the segment.

REGIONAL INSIGHTS

North America

North America Hot Sauce Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.56 billion in 2025 and USD 1.67 billion in 2026. This region's dominance of the North American market is attributed to consumers' high spending power. Also, the intensifying diversification in food flavors makes it possible for chili sauce to become a potential staple in the American kitchen rather than a fringe ethnic food. The wide popularity of chili sauce in countries such as the United States and Canada has positively impacted the trade of the product across the region, which is a beneficial aspect associated with the market's growth. The United States and Canada are among the top five global importers of chili sauce. The U.S. market is projected to reach USD 1.25 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Based on revenue, Asia Pacific secured the second-largest position in the market in 2025. The gradually growing population in major Asian economies, such as China and India, and the expansion of the foodservice industry in these economies are aiding in escalating the sales volume of various chili sauces. Earlier, chili sauce was a part of restaurants, cafes, and small and large food joints, but increasing consumer interest in mimicking the restaurant-like taste at home has made it possible for chili sauce variants to pave their way in Asian households.

Europe

The sauce market in Eurpoe is getting rapid recognition growth in 2025. The UK market is projected to reach USD 0.2 billion by 2026, and the Germany market is projected to reach USD 0.13 billion by 2026.

Middle East & Africa

On the other hand, the Middle East & African market is expected to exhibit a comparatively slow growth rate due to less expenditure on fast food and a greater preference for native condiments and sauces.

Latin America

The sauce market in Latin America is getting rapid recognition as a significant ingredient in the preparation of widely consumed meat-based food products and snacks, vegetable and stew preparations, and as an accompaniment for food products such as sandwiches and pizzas, salads, grilled or fried seafood, and others.

Key Industry Players

Companies to Introduce Innovative Product Variants to Remain Competitive

The market is moderately consolidated, with a few global key players. The emergence of new players during the upcoming years and multiple innovative product launches are predicted to extend the global market's scope. Companies operating in the global market are embarking on new product launches and partnerships with relevant stakeholders for product marketing and portfolio broadening. Some startups are also providing free samples of their products to attract new consumers and expand market penetration.

In addition, leading companies such as the Kraft Heinz Company, McCormick & Company, Inc., and Mcllhenny Company are focusing on restructuring their marketing campaigns to communicate and promote their products. The adoption of new marketing tactics will allow them to strengthen their shares in the global hot sauce market. For instance, in February 2023, the Kraft Heinz Company signed a collaboration with renowned musician Ed Sheeran to launch its new hot sauce product, Tingly Ted’s.

LIST OF TOP HOT SAUCE COMPANIES:

- The Kraft Heinz Company (U.S.)

- McCormick & Company, Inc. (U.S.)

- Campbell Soup Company (U.S.)

- Unilever PLC (U.K.)

- Conagra Brands Inc. (U.S.)

- McIlhenny Company (U.S.)

- Southeastern Mills, Inc. (U.S.)

- Hormel Foods Corporation (U.S.)

- Baumer Foods, Inc. (U.S.)

- T.W. Garner Food Company (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: MegaMex Foods, an emerging Mexican food company, launched its new Habanero Hot Sauce made with real habanero peppers and the fiery under its brand HERDEZ®.

- April 2023: The Kraft Heinz Company, a global food manufacturing company, expanded its product line by launching its first-ever Heinz Hot 57 Sauce with three spicy ketchups: Chipotle, Jalapeño, and Habanero.

- November 2022: Edible Garden AG Incorporated, a leading manufacturer of farming produce, acquired hot sauce manufacturing company Pulp in 2022. Such a strategy helped the company expand product availability and sell through established retail supermarkets and distributor channels of Edible Garden AG in U.S.

- September 2021: Kraft Heinz announced the launch of its hot sauce in the U.K. market. The new avocado-based hot sauces are Venezuelan-inspired and are named Kumana.

- August 2021: U.S.-based Company Bibigo announced the launch of GOTCHU, an authentic Korean hot sauce, to its portfolio of traditionally inspired Korean foods such as Mini Wontons, Mandu, and Steamed Soup Dumplings.

REPORT COVERAGE

The research report includes quantitative and qualitative insights into the industry. It also offers a detailed market analysis, including market size and growth rate for all possible segments and regional analysis. Several key insights are an overview of the parent market, competitive landscape, regulatory scenario in critical countries, consumer buying behavior, recent industry developments, such as mergers & acquisitions, and key hot sauce industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 8.14% over 2026 to 2034 |

|

Segmentation |

By Type

By Distribution Channel

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 3.54 billion in 2025 and is projected to reach USD 7.10 billion by 2034.

The market will exhibit a CAGR of 8.14% during the forecast period (2026-2034).

The tabasco pepper sauce segment is expected to lead during the forecast period based on product type.

The markets key factor is the intensifying demand for hot sauces across the rapidly growing food service industry.

Kraft Heinz Co., McCormick & Co., Inc., Campbell Soup, Unilever Group, and Conagra Brands Inc. are a few of the leading players in the market.

North America dominated the hot sauce market with a market share of 44.01% in 2025.

The mass merchandisers segment holds a major share in the global market based on distribution channels.

Premiumization of products is the current market trend.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us