Palm Oil Derivatives Market Size, Share & Industry Analysis, By Product Type (Palm Kernel Oil, Oleochemicals, Palm Kernel Fatty Acids Distillate, and Others), By Application (Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, Industrial, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

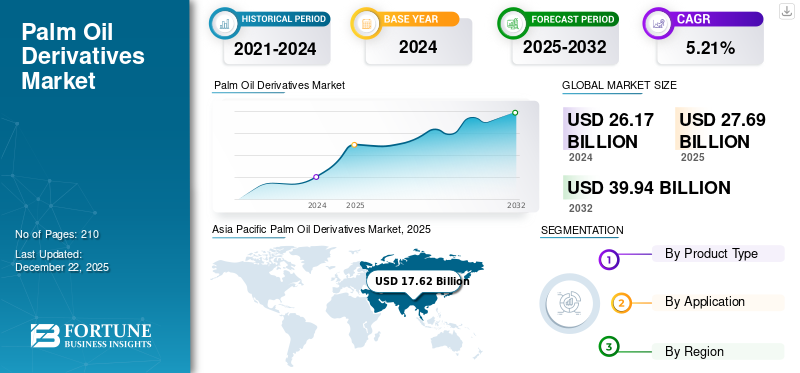

The global palm oil derivatives market size was valued at USD 27.69 billion in 2025. The market is projected to grow from USD 29.24 billion in 2026 to USD 43.91 billion by 2034, exhibiting a CAGR of 5.21% during the forecast period. Asia Pacific dominated the palm oil derivatives market with a market share of 63.63% in 2025.

Increasing product adoption in diversified applications such as food, beverages, cosmetics, pharmaceuticals, and biofuel industries is significantly driving the market growth. Palm oil derivatives are substances derived from crude palm oil through various processes such as refining, fractionation, and chemical reactions. Palm kernel oil, oleochemicals, palm cake, and palm kernel fatty acids distillate, are widely considered derivatives from palm fruit. They are widely utilized in various applications, including foods & beverages, personal care products, cosmetics, pharma, and animal feed applications. Major market players operating in the industry include Asian Food Ingredients Sdn. Bhd., BASF SE, Cargill, Incorporated, Catania Oils, and Golden Agri-Resource Ltd. These market players are competing with each other to hold the dominant proportion of the market share in the upcoming years.

Palm Oil Derivatives Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 27.69 billion

- 2026 Market Size: USD 29.24 billion

- 2034 Forecast Market Size: USD 43.91 billion

- CAGR: 5.21% from 2026–2034

Market Share:

- Asia Pacific dominated with a 63.63% share in 2025, led by Indonesia and Malaysia’s strong production and regional demand across food, personal care, and industrial sectors.

- By type, Palm Kernel Oil is expected to lead in 2025, driven by high usage in snacks, cosmetics, and biofuels.

Key Country Highlights:

- Indonesia & Malaysia: Major producers and exporters of palm oil derivatives.

- India: High demand in processed food and soap industries.

- U.S.: Growth driven by packaged food and cosmetic applications.

- Brazil: Rising biofuel adoption boosts palm derivative use.

Market Dynamics

Market Drivers

Expanding Food Processing Industry Triggers Adoption of Palm Oil Derivatives

The food processing market is recognized as one of the fastest-growing and largest industries globally, and it has a strong potential to fulfill diversified consumer preferences. This sector has mainly evolved due to advancements in food processing technologies and sustainability concerns, which are dynamically shaping the processed food industry landscape.

In the current scenario, consumers' lifestyles have changed, and they live a hectic routine. In this fast-paced world, a major chunk of consumers seek time-saving options that reduce the burden of cooking. As a result, the reliance on frozen/ready-to-cook or ready-to-eat meals has gradually increased. The product will assist processed food manufacturers in enhancing the texture, freshness, and stability of frozen foods and ready-to-eat meals. Additionally, palm oil-based derivatives are known for their high oxidative stability, which is necessary for maintaining the shelf life and overall quality of food items such as snacks, confectionery, and others. Therefore, the emerging processed food industry is significantly contributing to the global palm oil derivatives market growth.

Surging Adoption of the Product in the Cosmetics Industry Bolsters Market Growth

The personal care industry is transforming considerably by blending global traditions with innovations. Over the period, the cosmetic sector has evolved due to the shifting preferences of consumers and technological advancements, giving rise to ingredient-centric brands that emphasize efficacy and transparency. The majority of consumers are highly drawn to end products that highlight key ingredients, demanding more clean and natural components to cater the evolving natural ingredients trend. The products can be utilized as they are considered essential ingredients in the production of personal care items due to their versatility.

Additionally, the product can act as an emulsifier and natural binder and aid in mixing water and oil-based ingredients. Moreover, these derivatives are rich in antioxidants, which help extend the shelf life of cosmetics by preventing rancidity. As a result, such advantages influence manufacturers to produce cosmetic and personal care products using palm oil derivatives. Hence, the rising adoption of natural-driven ingredients in cosmetics & personal care will drive the global palm oil derivatives market growth in the upcoming years.

Market Restraints

Deforestation and Habitat Loss Inhibit Production Rate to Restrict Market Growth

As consumers are significantly inclining toward sustainability, habitat loss, and deforestation are other critical hurdles faced by palm oil derivative producers worldwide. Large-scale plantations of palm oil are considered a substantial factor for deforestation, particularly in the Southeast Asian region, as Malaysia and Indonesia are the prominent producers. Thus, the association of palm oil plantations with habitat loss and deforestation negatively inhibits the production rate of derivatives from palm fruit.

Market Opportunities

Increasing Use of Oleochemicals in Production of Bio-Based Lubricants to Drive Market in Near Future

In the world of commercial activities, where equipment and machinery are the pivotal tools of yield production, the utilization of lubricants is highly important. These products are required to minimize the heat and friction of mechanical components. However, conventional lubricants, which have been utilized for decades, are frequently used at a substantial environmental cost. This scenario has resulted in the increasing adoption of eco-friendly and sustainable alternatives, which maintain the efficiency of industrial machinery while reducing the ecological footprints. In order to produce bio-based lubricants, oleochemicals extracted from oils and fats are utilized, providing non-toxic and biodegradable substitutes to petroleum-sourced traditional lubricants. Thus, the advantages of oleochemicals in the industrial sector open numerous possibilities for its growth across the global market.

Palm Oil Derivatives Market Trends

Download Free sample to learn more about this report.

Increasing Trend of Sustainability to Drive Industry Growth in Upcoming Years

Sustainable agriculture plays an integral role in minimizing the adverse impact of climate change and in sustainably feeding the evolving global population. In today’s modern world, consumers are continuously seeking ingredients and products that are manufactured sustainably, resulting in a high focus on sustainable production. As a result, the surging need for responsibly sourced items unlocks growth chances for the production of sustainable palm oil derivatives.

The palm oil derivatives industry faces major scrutiny worldwide, especially because of its environmental impacts, which include biodiversity loss, greenhouse gas emissions, and deforestation. Such challenges fuel the need for the adoption of sustainable practices and necessitate businesses to opt for sustainable certifications, which reassure consumers about quality.

Impact of COVID-19

The COVID-19 pandemic emerged as a human and health crisis and resulted in the biggest decline in economic activity worldwide. In the initial days of March 2020, many government organizations imposed nationwide lockdowns, which led to persistent inflation, coupled with supply chain disruptions, closure of production facilities, and restricted mobility. Thus, such hurdles posed adverse stress on numerous industry groups (cosmetics, biodiesel, and others) across the world.

Predominantly, the sector faced numerous challenges during the COVID-19 timeframe due to logistics limitations, poor availability of the labor force, and closure of manufacturing facilities. As a result, such difficulties hampered the production volume of the derivatives. According to the United States Department of Agriculture (USDA), a government agency, the production of palm kernel oil in Malaysia reached 2,006 kilo metric tons in 2020/21, compared to 2,160 kilo metric tons in 2019/20. Moreover, trade activities were hindered during the 2020-21, mainly because of transportation restrictions. However, despite low production, the prices of the product witnessed a drastic spike, owing to a combination of factors, which include global economic factors, climatic challenges, and a shortage of labor. Thus, such factors are responsible for the positive growth of the market during the pandemic phase.

Segmentation Analysis

By Product Type

Wide Application of Palm Kernel Oil in the Food Industry to Drive Segment Growth

The global market is segmented by product type into palm kernel oil, oleochemicals, palm kernel fatty acids distillate, and others.

The palm kernel oil segment dominated the global market share by 38.47% in 2026. Palm kernel oil holds the largest share owing to its versatile applications in various industries such as food and beverages, biofuel production, personal care and cosmetics, and others. The product is known to be affordable and durable, which makes it an ideal edible oil option for frying and baking. Additionally, palm kernel oil is one of the key raw materials to produce specialty fats such as cocoa butter alternatives. Its functional properties and texture make it more feasible for specialty fat manufacturers, and it is more adaptable in various food products such as ice cream, coffee & cake creamers, confectionery, and dairy products. Therefore, the segment is anticipated to hold a higher share of the market.

The oleochemicals segment is expected to grow significantly in the global market with 36% of the market share in 2025. The product is experiencing significant demand due to the rising adoption of sustainable practices and eco-friendly products across various industries. Furthermore, the utilization of oleochemicals in various applications, including personal care, cosmetics, lubricants, and others. It will significantly contribute to the segment growth and is anticipated to expand with the highest growth trajectory during the foreseeable period.

The palm kernel fatty acids distillate is anticipated to exhibit a CAGR of 4.85% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Application

Utilization of Natural Ingredients in the Processed Food Industry to Drive Segment Growth

Based on application, the market is segmented into food and beverages, personal care and cosmetics, pharmaceuticals, industrial, and others.

The food and beverage segment is expected to hold a major share of the global market by 39.30% in 2026. The product is favored in the food and beverage industry owing to their high oxidative stability, affordability, and versatile applications, making them ideal for baking, frying, and confectioneries. Moreover, hydrogenated palm kernel oil is often replaced with butterfat in filled milk, imitation cream, and coffee creamers, owing to its higher melting point. Increasing demand for natural and plant-based fat replacer products to replace animal-sourced fats in processed food products is likely to drive industry growth.

The industrial segment is expected to grow at a high CAGR of 5.81% during the forecast period. Industrially, derivatives of palm fruit act as key components in biodiesel, lubricants, and other applications. Palm Fatty Acid Distillate (PFAD) is also used as animal feed, which assists in providing energy to dairy cows. Additionally, the biodiesel industry is expected to have immense growth opportunities owing to increasing demand for the world's renewable energy sources. Palm oil derivatives form a primary feedstock for biodiesel production, with Indonesia being the largest producer. According to the European Biodiesel Board, in 2022, Indonesia produced 9.7 million tons of palm oil-based biodiesel and stood as the third-largest producer of biodiesel.

Palm Oil Derivatives Market Regional Outlook

North America

Asia Pacific Palm Oil Derivatives Market, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is anticipated to be the third-largest market, with a USD 2.46 billion in 2026, and expected to showcase high growth in the palm oil derivatives market share owing to rising demand for plant-based products as well as rising consumption of processed and convenience foods. According to research from Northeastern University’s Network Science Institute, 73% of the foods consumed in the U.S. are ultra-processed. Moreover, the functional properties of the product, such as emulsification, stability to high temperatures, and cost efficiency, further fuel their demand in the region’s food processing industry. Furthermore, it is mainly used in ultra-processed foods such as margarine, ice cream, non-dairy creamers, and others.

The U.S. holds a significant share of the market with imports of North America. Furthermore, the industry players in the region are undertaking base expansion projects to increase production and generate employment. Catania Oils is focusing on base expansion, which will help the enterprise gain a competitive advantage in the global market. For instance, in September 2022, the firm expanded its business base by opening a 50,000-square-foot plant in the U.S. This plant extension offers space for nearly 30 new jobs, along with increasing chances of strong palm kernel oil production in the nation. It is further contributing to the consumption of palm oil derivatives in the region. The U.S. market size is estimated to be USD 2.27 billion in 2026.

Europe

The Europe is projected to be the second-largest regional market with USD 6.16 billion in 2026, exhibiting a CAGR of 5.05%. The Netherlands, Spain, Italy, and Germany are known to be by far the biggest importers of palm oil and its derivatives. The region has been one of the leaders in sustainable palm oil. According to the Sustainable Palm Oil: Europe’s Business Report 2022, Europe accounted for 45% of the total global use of certified sustainable palm oil. While Europe’s use of Certified Sustainable Palm Oil has reached a high level, the markets for Certified Sustainable Palm Kernel Oil and Certified Sustainable Palm Kernel Expeller still need to be developed in the coming years. The U.K. market is expected to hit USD 0.85 billion in 2026. Germany market is expected to reach USD 1.48 billion and France is likely to reach USD 0.29 billion in 2025.

Asia Pacific

Asia Pacific is expected to hold the highest palm oil derivatives market share. China, India, Japan, Australia, and Indonesia are the key markets for the product in the region. The region is said to consume the highest proportion of palm oil and its derivatives, and Indonesia, India, and China are among the world’s top-consuming countries. According to the United States Department of Agriculture, in 2020, Malaysia and Indonesia accounted for 86% of global palm oil production. This wide availability of raw materials makes the product widely accessible in Asia Pacific, offering derivatives such as fatty acids, oleochemicals, and others. According to the USDA, palm kernel oil production in Indonesia has increased from 5,191 thousand tons in 2022/23 to 5,274 thousand tons in 2023/24. Asia Pacific led the market value of USD 17.62 billion in 2025.

Additionally, the food processing industry in Asia Pacific is emerging with the fastest growth rate due to the rising youth population, purchasing power, and urbanization. The processed food industry often uses palm kernel oil in various applications, including frying, fat replacers, and others. This will drive industry growth across the region during the forecast period.

South America

South America is expected to be the fourth-largest region in the market with a value of USD 1.25 billion in 2025. The South American region includes Brazil, Argentina, and the rest of South America, including Chile and Peru. South America is one of the most promising markets for palm oil derivatives owing to the rising urbanization in Brazil, Argentina, and other major countries, which contribute substantially to this market's growth. Thus, the rapid economic development in the region is expected to boost product sales during the forecast period.

With growing urbanization and disposable incomes, consumers, particularly young consumers such as Gen Z, have increasingly turned to "better-for-you" products that focus on natural content and sustainability. This trend has been instrumental in driving demand for palm oil and palm derivatives, which are used to produce bio-based and sustainable products used in a broad range of industries, such as food and beverages, personal care and cosmetics, biodiesel, and others.

Middle East & Africa

The Middle East & Africa includes South Africa, UAE, and the rest of the Middle East & Africa. Factors such as rapid population growth, economic development, urbanization, and rising consumer inclination toward sustainable products drive the palm oil derivatives market in this region. Palm oil and its derivatives also play a vital role in fulfilling this demand owing to their versatility in food applications and affordability. Additionally, key players are investing in expanding their production capacity in African countries due to the availability of human resources and expanding their geographical presence. For instance, in December 2023, Henan DOING Machinery Co., Ltd., one of the leading Chinese manufacturers of cooking oil production machines, established a new subsidiary, Henan DOING Machinery Nigeria Ltd., in Nigeria. The UAE market is anticipated to reach USD 0.11 billion in 2025.

Competitive Landscape

Key Market Players

The global palm oil derivatives industry is highly developed, with several multinational companies occupying the majority share. The market competition is significantly increasing due to rising product demand from different industries. Cargill Incorporated, The Archer-Daniels-Midland Company, BASF SE, Wilmar International Ltd., and Golden Agri-Resource Ltd are among the prominent manufacturers in the market. These manufacturers cater to the evolving needs of consumers, which in turn will help propel market growth in the coming years. The industry is highly fragmented, with both global conglomerates and specialized regional players competing across various product categories. Key players engage in mergers and acquisitions to expand product portfolios and gain access to new markets. Furthermore, prominent players are focusing on achieving sustainability-related certifications, collaborations, and innovative approaches to tackle the rising market competition worldwide.

List of Key Palm Oil Derivatives Companies:

- Asian Food Ingredients Sdn. Bhd. (Malaysia)

- BASF SE (Germany)

- Cargill, Incorporated (U.S.)

- Catania Oils (U.S.)

- Golden Agri-resource Ltd. (Singapore)

- Gustav Heess (Germany)

- SD Guthrie Berhad (Malaysia)

- The Archer-Daniels-Midland Company (U.S.)

- TVO Vegetable Oil (Turkey)

- Wilmar International Ltd. (Singapore)

Key Industry Developments:

February 2025 – PT Unilever Indonesia Tbk (UNVR), an Indonesian consumer products firm, entered into a partnership with PT Perkebunan Nusantara IV, a state-owned plantation firm in Indonesia, to improve its supply chain for palm kernel oil. Both parties signed the agreement in the U.K.

July 2024 – Kuala Lumpur Kepong Berhad (KLK), a multinational enterprise in Malaysia, expanded its oleochemical-based processing capacity in the Chinese market. This strategic approach will help fulfill the increasing demand for sustainable oleochemicals in the region.

September 2023 – Catania announced its second expansion, adding a 215,000-square-foot warehouse at 90 Nemco Way, U.S. This move represents a remarkable expansion of the enterprise's operations, aimed at streamlining the shipping of its items and strengthening the firm’s capacity to store end products, including palm oil derivatives.

June 2023 – Oleon, Part of the Avril Group of companies and one of the biggest European oleochemical producers expanded its base by opening a new plant in Antwerp, a city in Belgium.

November 2021 – Cargill, Incorporated, a U.S.–based enterprise, acquired an edible oil refinery in Andhra Pradesh, India. The company invested USD 35 million in upgrading and acquiring the latter firm. Thus, with the help of this acquisition, Cargill offers sunflower oil and refined palm olein across India.

Report Coverage

The market research report offers qualitative and quantitative insights into the industry. It focuses on significant aspects such as company profiles, competitive landscape, product type, and product application areas. Besides this, it offers insights into the various market trends and highlights vital industry developments. In addition to these mentioned factors, it encompasses several other factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.21% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Application

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 27.69 billion in 2025 and is anticipated to record a valuation of USD 43.91 billion by 2034.

The global market will exhibit a CAGR of 5.37% during the forecast period 2026-2034.

By product type, the palm kernel oil segment is predicted to dominate the market during the forecast period of 2026-2034.

The expanding food processing industry triggers the adoption of the product.

Cargill Incorporated, The Archer-Daniels-Midland Company, BASF SE, Wilmar International Ltd., and Golden Agri-Resource Ltd are some of the leading players.

Asia Pacific dominated the global market in 2025.

The increasing trend of sustainability boosts the market growth.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us