Recombinant Vaccines Market Size, Share & Industry Analysis, By Type (Subunit Vaccines and Vector-Based Vaccines), By Disease Indication (Human Papillomavirus (HPV), Hepatitis B, Herpes Zoster, and Others), By Route of Administration (Oral and Parenteral), By Distribution Channel (Hospital & Retail Pharmacies, Government Suppliers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

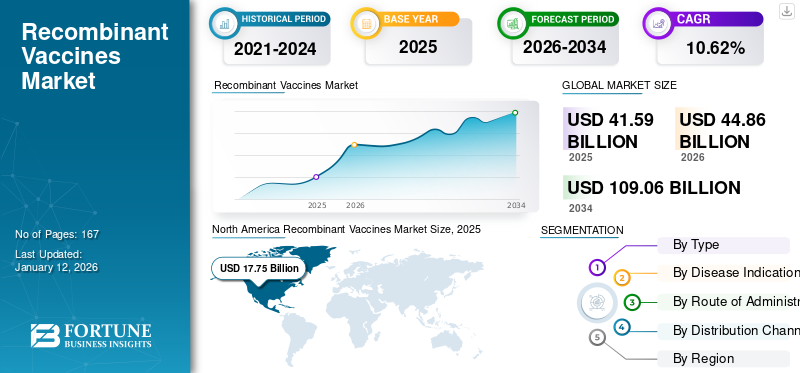

The global recombinant vaccines market size was valued at USD 41.59 billion in 2025 and is projected to grow from USD 44.86 billion in 2026 to USD 109.06 billion by 2034, exhibiting a CAGR of 10.62% during the forecast period. North America dominated the recombinant vaccines market with a market share of 42.67% in 2025.

Recombinant vaccines are genetically engineered vaccines which are used in specific genes or proteins to target an immune response focused against a few antigens with enhanced safety and efficiency. With the rising prevalence of infectious diseases such as papillomavirus infection, hepatitis B, COVID-19, and others, the need and demand for effective and safe vaccines is rising. These recombinant vaccines offer scalability, high specificity, and overcome the safety concerns associated with traditional vaccines. Underscoring these advantages, many key operational organizations are entering strategic collaboration and investment ventures, followed by regulatory approvals by the governing bodies.

- For instance, in May 2023, GSK received the U.S. FDA approval for Arexvy, a recombinant vaccine for preventing lower respiratory tract disease (LRTD) caused by respiratory syncytial virus (RSV) in the population aged 60 years and older.

Furthermore, the market encompasses several major players with Bavarian Nordic, GSK plc, Pfizer Inc., and Merck & Co., Inc. at the forefront. Broad product portfolio with innovative product launches and strong geographic presence expansion have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Rising Investment Opportunities for Research and Development to Drive the Market Growth

Recombinant vaccines provide scalability advantages coupled with heightened safety and specificity. These vaccines are developed without the use of the whole pathogen. This reduces the risk of infection and adverse events. Due to these enhanced benefits, many key operating players are focusing on recombinant vaccines and investing profoundly in their development. This has led to a rise in investment opportunities and research initiatives. Such factors drive the global recombinant vaccines market growth by enabling rapid scale-up and cater to rising demand.

- For instance, in September 2024, the U.S. International Development Finance Corporation (DFC) committed a loan of up to USD 20.0 million to Panacea Biotec Limited to develop IPV-based recombinant polio vaccine EasySix.

MARKET RESTRAINTS

Risk of Failure in Clinical Trials and High Manufacturing Cost for Vaccine Development to Restrict Market Expansion

High cost associated with the development of the vaccine and the financial risk associated with failure are one of the major restraints on the market. The vaccine development involves advanced cell culture systems, purification processes, and expensive bioreactors. With these various upstream processes, the capital expenditure for vaccine development increases. Also, this heightens the risk of loss associated with high capital expenditure. Such factors restrict the market growth.

- For example, in August 2023, GSK plc invested USD 270.6 million to expand recombinant vaccine capacity in Belgium, demonstrating the high financial barrier to scaling production.

- Similarly, in August 2025, the U.S. Department of Health and Human Services (HHS) terminated its mRNA vaccine development activities under the Biomedical Advanced Research and Development Authority (BARDA). The termination was executed because the data showed that these vaccines failed to protect effectively against upper respiratory infections such as COVID-19 and flu.

MARKET OPPORTUNITIES

Focus on the Development of Therapeutic Vaccines Offer Significant Growth Avenues for the Market

The vaccine development for therapeutic purposes offers significant expansion of application and offers unprecedented growth avenues for the market. With the growing burden of diseases such as viral infection and cancer, among others, there are certain limitations with traditional therapies. Recombinant vaccines provide a new platform for therapeutics due to their high specificity, enabling targeted response with minimal systemic side effects.

- For instance, in March 2025, ImmunityBio, Inc. partnered with U.S. Urology Partners to participate in the company’s Expanded Access Program (EAP) for recombinant Bacillus Calmette-Guérin (rBCG) to address the current shortage of TICE BCG in the U.S. The recombinant vaccine is an immunotherapy for bladder cancer. Such developments offer market growth opportunities.

- Similarly, in June 2024, Moderna and Merck reported positive Phase 2 data for their personalized recombinant mRNA cancer vaccine in melanoma patients, showing reduced recurrence rates.

MARKET CHALLENGES

Cold Chain and Supply Challenges to Hamper Market Growth

The need for cold chain logistics and supply challenges is one of the major factors hampering the market growth. These vaccines are sensitive to temperature variations and need to be stored in cold temperatures to retain their effectiveness. Disruption in logistics can compromise vaccine efficiency, leading to wastage. In low- and middle-income countries, where electricity reliability and infrastructure are limited, dependence on cold chain restricts accessibility and poses a challenge for market growth.

- For instance, in September 2021, the World Health Organization reported an article reporting efforts to provide ultra-cold chain freezers around the world. The organization aimed to deliver 350 units of UCC to more than 45 countries. Such initiatives are undertaken to overcome the shortage of cold chain supply logistics.

RECOMBINANT VACCINES MARKET TRENDS

Emphasis on the Development of Combination Vaccines is a Prominent Trend Observed in the Market

Development of combination vaccines has emerged as one of the key global market trends. The combination vaccines offer coverage for multiple diseases in a single shot. This results in fewer shots, enhancing compliance. This also reduces the cold chain and storage challenges. Due to these benefits, companies are actively pursuing to develop of combination vaccines to integrate multiple antigens into a single formulation.

- For instance, in December 2024, Sanofi received Fast Track designation for two combination vaccine candidates administered to prevent influenza and COVID-19 in individuals above 50 years and older.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

High Demand for Subunit Vaccines Contributed to Its Segmental Dominance

The segmentation on the basis of type, is classified into subunit vaccines and vector-based vaccines.

The subunit vaccines segment held a significant share of the market in 2026, accounting for 77.11% of the total market share. The high market share is attributed to various benefits, such as high stability, targeted immune response, and higher safety profiles exhibited by these vaccines over live vector based vaccines. Many key players are focusing on new product launches due to such attributes.

- For instance, in January 2023, the Indian government, through its Mission COVID Suraksha, developed ORBEVAXTM, a protein subunit COVID-19 vaccine.

To know how our report can help streamline your business, Speak to Analyst

By Disease Indication

Expansion of Production Capacity to Cater to Increasing Demand for HPV Vaccines to Supplement Segmental Growth

Based on disease indication, the market is segmented into human papillomavirus (HPV), herpes zoster, hepatitis B, and others.

The HPV segment held the leading market position in 2026, accounting for 38.29% of the total market share. This is attributed to rising prevalence of HPV disease and launches of novel vaccines. Additionally, to cater to the increasing demand for HPV vaccines, key players are directing their resources towards the expansion of production capacity.

- For instance, in April 2022, Merck & Co Inc. invested in expanding its Elkton, Virginia, manufacturing facility to increase capacity and supply human papillomavirus vaccines (HPV) to prioritize the country's high burden of major diseases.

The segment of Hepatitis B is set to flourish with a growth rate of 15.1% over the forecast period.

By Route of Administration

Considerable Presence of Parenterally Administered Recombinant Vaccines to Lead to its Segmental Dominance

In terms of route of administration, the market is categorized into oral and parenteral.

The parenteral segment captured the larger share of the market in 2026, accounting for 78.38% of the total market share. The parenterally administered vaccines provide site-specific action and greater bioavailability. These factors contribute to a higher segmental share, along with these new product launches and their subsequent approvals by the regulatory bodies, to further support the market growth.

- For instance, in November 2023, Valneva SE received the U.S. FDA approval for Ixchiq, the first chikungunya vaccine to prevent infection in individuals 18 years of age and above administered parenterally.

The oral segment is expected to grow at a significant CAGR over the forecast period.

By Distribution Channel

Emphasis on Collaboration between Government Suppliers and Pharmaceutical Manufacturers Propelled Segmental Growth of Government Suppliers

Based on distribution channel, the market is segmented into hospital & retail pharmacies, government suppliers, and others.

In 2024, the global market was dominated by government suppliers, in terms of the distribution channel. Emphasis on strategic collaboration with pharmaceutical companies, routinely vaccination programs scheduled by the government suppliers in the low and middle income groups, validates the dominance of the segment in the market. Strategic collaborations between government suppliers and pharmaceutical companies to provide essential vaccines is further supporting this segment’s growth.The hospitals & retail pharmacies segment accounted for 60.89% of the total market share in 2026.

- For instance, in 2024, Merck & Co Inc., partnered with Gavi, the Vaccine Alliance, through an agreement with UNICEF, to supply low- and middle-income countries with over 115 million doses of HPV vaccine by 2025, to appropriately support local immunization programs.

In addition, government suppliers as distribution channels are projected to grow at a CAGR of 10.9% during the study period.

Recombinant Vaccines Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Recombinant Vaccines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the dominant recombinant vaccines market share, valued at USD 17.75 billion in 2025, and also took the leading share in 2026 with USD 19.22 billion. The factors influencing high regional share are robust healthcare infrastructure, high expenditure, and increasing prevalence of chronic vaccine-preventable diseases, novel pipeline with a focus on research and development. Furthermore, the presence of well-established market players, active involvement of the research community in research, and the presence of large-scale contract research organizations, among others.The US market is projected to reach USD 17.32 billion by 2026. The country exhibited dominance due rising demand for safer, highly specific recombinant vaccines against prevalent diseases.

- For instance, in October 2023, Pfizer Inc. received approval from the U.S. FDA for PENBRAYA, a recombinant vaccine for the prevention of meningococcal diseases in adolescents.

Europe

Other regions, such as Europe and the Asia Pacific, are anticipated to witness a notable growth in the coming years. During the forecast period, European region is projected to record a growth rate of 8.68%, which is the second highest amongst all the regions and touch the valuation of USD 8.11 billion in 2025. This is primarily due to the advancing research capabilities in the region, leading to high global recombinant vaccines market demand. Backed by these factors, in 2025, these countries including the UK market is projected to reach USD 1.73 billion by 2026, while the Germany market is projected to reach USD 2.11 billion by 2026.

Asia Pacific

After Europe, the market in the Asia Pacific is estimated to reach USD 9.74 billion in 2025 and secure the position of the third largest region in the market. In the region, Japan market is projected to reach USD 1.61 billion by 2026, the China market is projected to reach USD 2.53 billion by 2026, and the India market is projected to reach USD 2.23 billion by 2026.

Latin America and Middle East & Africa

Over the forecast period, the Latin America and Middle East & Africa regions would witness a moderate growth in this market. The Latin America market in 2025 is set to record USD 2.09 billion as its valuation, rising incidence of various diseases is driving the adoption trends in these regions. In the Middle East & Africa, GCC is set to attain the value of USD 0.18 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

New Product Launches and Strategic Collaboration among Key Players are Supporting their Leading Positions

The global recombinant vaccines market shows a semi-concentrated structure with numerous small- to mid-size companies actively operating across the globe. These players are actively involved in product innovation, strategic partnerships, and geographic expansion. Bavarian Nordic, GSK plc, and Merck & Co., Inc., are some of the dominating players in the market. A comprehensive range of recombinant vaccines, global presence through a strong distribution network, and collaborations with research and academic institutes are a few characteristics of these players that support their dominance.

Apart from this, other prominent players in the market include Mitsubishi Chemical Group Corporation, AstraZeneca, Sanofi, EMERGENT, Serum Institute of India Pvt, and others. These companies are undertaking various strategic initiatives, such as investments in R&D and partnerships with pharmaceutical companies to enhance their market presence.

LIST OF KEY RECOMBINANT VACCINE COMPANIES PROFILED

- Bavarian Nordic (Denmark)

- GSK plc (U.K.)

- Pfizer Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- CSL (Australia)

- Mitsubishi Chemical Group Corporation (Japan)

- AstraZeneca (U.K.)

- Sanofi (France)

- EMERGENT (U.S.)

- BIKEN (Japan)

KEY INDUSTRY DEVELOPMENTS

- July 2025: GSK plc received approval from the U.S. FDA for prefilled syringe of Shingrix (Recombinant Zoster Vaccine) for the prevention of shingles (herpes zoster). The vaccine eliminates the need to reconstruct separate vials prior to administration, simplifying the vaccine administration process for healthcare professionals.

- April 2025: GC Biopharma received approval from the Korean Ministry of Food and Drug Safety (MFDS) for its anthrax vaccine, BARYTHRAX. The recombinant vaccine is developed through a collaboration between GC Biopharma and the Korea Disease Control and Prevention Agency (KDCA).

- March 2024: IIT Guwahati completed technology transfer to launch the first recombinant vaccine for the Swine Fever Virus in India.

- July 2023: VBI Vaccines Inc. expanded its hepatitis B partnership with Brii Biosciences. The partnership aimed to provide the hepatitis B candidate with an exclusive license for PreHevbri, VBI’s 3-antigen hepatitis B vaccine, in the Asia Pacific region (APAC).

- May 2023: Pfizer Inc. received approval from the U.S. FDA for ABRYSVO (Respiratory Syncytial Virus Vaccine) administered for the prevention of lower respiratory tract disease caused by RSV in individuals 60 years and older.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.62% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Subunit Vaccines · Vector-Based Vaccines |

|

By Disease Indication · HPV · Herpes Zoster · Hepatitis B · Others |

|

|

By Route of Administration · Parenteral · Others |

|

|

By Distribution Channel · Hospital & Retail Pharmacies · Government Suppliers · Others |

|

|

By Region · North America (By Type, Disease Indication, Route of Administration, Distribution Channel, and Country) o U.S. o Canada · Europe (By Type, Disease Indication, Route of Administration, Distribution Channel, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (By Type, Disease Indication, Route of Administration, Distribution Channel, and Country/Sub-region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Type, Disease Indication, Route of Administration, Distribution Channel, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Type, Disease Indication, Route of Administration, Distribution Channel, and Country/Sub-region) o GCC o South Africa · Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 41.59 billion in 2025 and is projected to reach USD 109.06 billion by 2034.

In 2025, the market value stood at USD 41.59 billion.

The market is expected to exhibit a CAGR of 10.62% during the forecast period.

The subunit segment led the market by type.

The key factors driving the market are increasing prevalence of vaccine-preventable diseases, rising investment and research and development, and others.

Bavarian Nordic, GSK plc, and Merck & Co., Inc. are some of the prominent players in the market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us