mRNA Vaccines Market Size, Share & Industry Analysis, By Type (COVID-19 Vaccines and Non-COVID-19 Vaccines), By Indication (COVID-19 Infection, Respiratory Syncytial Virus (RSV) Infection, and Others), By Distribution Channel (Hospital & Retail Pharmacies, Government Suppliers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

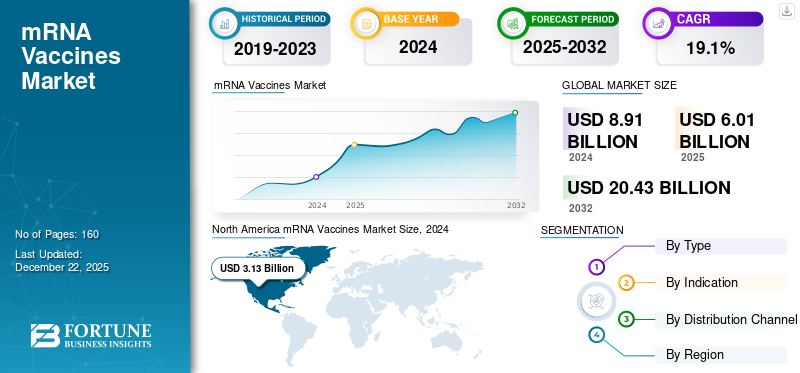

The global mRNA vaccines market size was valued at USD 6.01 billion in 2025. The market is expected to grow from USD 6.85 billion in 2026 to USD 25.64 billion by 2034, exhibiting a CAGR of 17.94% during the forecast period. North America dominated the mRNA vaccines market with a market share of 31.47% in 2025.

mRNA (messenger RNA) is a type of RNA that is essential for the production of protein. mRNA vaccines are the genetic instructor for cells on how to produce protein which triggers an immune response. The market has emerged as one of the most exciting and fastest-growing sectors in the global pharmaceutical industry, largely driven by the success of COVID-19 vaccines. Technological advancements, such as the rise in the use of AI tools during vaccine development, primarily drive the market growth.

Some of the key operating players in the market include Moderna Inc., BioNTech, CureVac SE, and Gsk plc. The high R&D investment to launch new vaccines in the market by these key players also supported the growth during the forecast period.

The COVID-19 pandemic was the booster for the initial adoption of mRNA-based vaccines, and their potential application is rapidly expanding into other areas, such as infectious diseases and autoimmune diseases. mRNA-based vaccines have faster development timelines, flexibility, and the potential for broad-spectrum protection, which makes them an alternative to traditional vaccine platforms.

- For instance, Pfizer Inc. utilized Smart Data Query (SDQ), an AI tool for the data review process during the pandemic. This tool helps to review clinical data and generate fewer queries, which raises the vaccine's development speed and supports market growth.

MARKET DYNAMICS

MARKET DRIVERS

Increase in R&D Activities for Development of mRNA Based Vaccines Boost Market Growth

The rise in research and development activities boost the mRNA vaccines market growth during the forecast period. The successful deployment of the COVID-19 mRNA vaccine promotes research activities for the development of mRNA-based vaccines for other diseases, such as influenza and RSV. Additionally, the rise in the prevalence of infectious diseases also promotes R&D activities and enhances market growth.

Moreover, the strong emphasis on well-established as well as emerging players exploring the potential of mRNA technology in various applications further boosts the market growth. Owing to this, both public and private sectors are ramping up investment in mRNA vaccine research, which supports the market growth.

- For instance, in September 2023, Moderna Inc. announced plans to invest approximately USD 25 billion in research and development from 2024 to 2028. This investment is done to expand its scope for mRNA medicines.

- Similarly, Moderna Inc. and Pfizer-BioNTech are expanding their vaccine pipelines, including vaccines for other infectious diseases.

MARKET RESTRAINTS

Stringent Regulatory Landscape to Hinder Market Growth

The strict rules and regulations resulted in delays for the product approvals which may hinder the market growth. Despite the U.S. FDA’s accelerated approval process for COVID-19 vaccines, there are still concerns regarding the approval timelines for other mRNA-based vaccines. The delays in the approval of licenses and other applications, such as the New Drug Application (NDA), may limit the market growth. Additionally, challenges in standardizing production processes and ensuring quality control can lead to regulatory bottlenecks.

- To get U.S. FDA approval for the utilization of mRNA products, sponsors need to submit an investigational new drug (IND) application through the FDA’s Center for Biologics Evaluation and Research (CBER), and prior to initiating any human clinical trials, sponsors receive a biologics IND number after successful human trials sponsors required to get approval from the CBER biological license application (BLA) process to market an mRNA-based product.

MARKET OPPORTUNITIES

Expanding Applications of mRNA-based Vaccines to Offer Lucrative Opportunities

The rise in the need for mRNA-based vaccines to treat various diseases, including infectious diseases, will create further growth opportunities in the coming years. The demand for mRNA-based vaccines has increased after the COVID-19 pandemic. Additionally, the rapid development of pipeline candidates is anticipated to boost market growth during the forecast period. The mRNA-based vaccines for other infectious diseases are a fast-growing area of research. Moreover, with the rapid advancements in mRNA technology, researchers are increasingly focusing on using mRNA vaccines to treat autoimmune diseases.

- Currently, there are several candidates in the clinical pipeline targeting other infectious diseases apart from COVID-19. This pipeline is anticipated to expand in the near future with the growing influx of R&D investments.

MARKET CHALLENGES

Vaccine Hesitancy May Challenge Market Growth

The mRNA vaccines have proven to be highly effective, but the public hesitancy fueled by misinformation and safety concerns over long-term side effects remains a major challenge. The distrust of vaccines can limit the uptake and undermine public health efforts, especially in regions with strained healthcare systems, thereby hindering market growth. Additionally, social norms, values, and beliefs also influence vaccine hesitancy, leading to delays in vaccine acceptance despite its availability.

- For instance, countries such as the U.S. have witnessed varying levels of vaccine uptake, particularly for booster doses for COVID-19. In addition, some regions have lower vaccine uptake rates, which affects global immunization efforts.

OTHER CHALLENGES

Intellectual Property and Legal Disputes

The mRNA vaccine market has witnessed various intellectual property disputes, particularly around the ownership of mRNA technology. For example, Moderna and Arbutus Biopharma have been involved in legal battles regarding patent rights, which can significantly affect market dynamics.

Production Challenges

The complexity of producing mRNA-based vaccines at a large scale is challenging. Issues such as the stability of mRNA and the cold storage requirements for vaccines can delay production and distribution, particularly in low-resource settings.

mRNA VACCINES MARKET TRENDS

Technological Advancements is a Prominent Market Trend

Technological advancements, such as the use of artificial intelligence tools during clinical trials, are one of the significant trends in the market. In recent years, the development of mRNA platforms and software, aided by AI, has significantly contributed to the creation of mRNA-based vaccines. Furthermore, an important trend in the mRNA vaccine market is the continuous improvement in delivery technologies.

- The development of lipid nanoparticles (LNPs), which encapsulate mRNA and facilitate its delivery to cells, has played an important role in the success of mRNA-based vaccines. Advances in self-amplifying mRNA could further enhance the efficacy and reduce costs.

Additionally, the speed and potential cost gains of mRNA technology make it an interesting technology for the development of individual therapies. All these factors have resulted in shaping the overall market in recent years.

OTHER TRENDS

Regulatory Support

Government and regulatory support during the pandemic is one of the major trends. Regulatory agencies such as the U.S. FDA and the EMA have shown unprecedented flexibility in their approval processes for mRNA-based vaccines, especially during the COVID-19 pandemic. This support has opened the door for faster development and approval timelines for future vaccines and therapeutics.

Strategic Collaborations

The strategic collaborations between major market players resulted in the rapid development of future vaccines. As mRNA technology matures, companies are increasingly collaborating to share knowledge and expand their product pipelines. For example, in September 2023, BioNTech partnered with the Coalition for Epidemic Preparedness Innovations (CEPI) to develop mRNA vaccines for neglected diseases such as Mpox and malaria.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Rise in Demand for mRNA Vaccines During Pandemic Boosted COVID-19 Vaccines Segment Expansion

Based on type, the market is segmented into COVID-19 vaccines and non-COVID-19 vaccines.

The COVID-19 vaccines segment dominated the market with a significant share in 2024. The growth of segment is augmented by a rise in demand for mRNA vaccines during the pandemic. The COVID-19 vaccines are the first approved mRNA-based vaccines on the market. During the pandemic, the U.S. FDA provided emergency use authorization for these vaccines.

- For instance, in April 2024, the COVID-19 vaccine of Pfizer-BioNTech got the Emergency Use Instructions (EUI) from the Centers for Disease Control and Prevention (CDC). These types of emergency approvals for mRNA-based vaccines increase the market growth during pandemics.

The non-COVID-19 vaccines segment is experiencing rapid growth. The growth of the segment is augmented by a rise in demand of mRNA-based vaccines for the treatment of various diseases, such as infectious diseases and autoimmune diseases.

- For instance, according to the data published by the World Health Organization in July 2024, new initiatives have been launched for the development of an advanced mRNA vaccine against human avian influenza (H5N1). This type of initiative supports the growth of non-COVID-19 vaccines segment.

By Indication

Emergence of New Variants of COVID-19 Infection Fueled Segment Growth

By indication, the market is segmented into COVID-19 infection, Respiratory Syncytial Virus (RSV) infection, and others.

The COVID-19 infection segment held a dominant share of the market in 2024 due to the presence of approved mRNA vaccines for the disease. Additionally, the emergence of new variants of the COVID-19 virus requires booster doses and advanced mRNA vaccines.

- For instance, according to the data published by the Centers for Disease Control and Prevention (CDC) in January 2025, the 2024-2025 COVID-19 vaccines are closely targeted to the JN.1 lineage for the Omicron variant. These vaccines are updated and provide high protection against currently circulating strains.

On the other hand, the Respiratory Syncytial Virus (RSV) infection segment accounted for a lower revenue share in the market. The first mRNA-based RSV vaccine was recently approved by the regulatory authorities, leading to relatively lesser market shares but stronger growth potential in the coming years.

- For instance, in May 2024, Moderna, Inc. received approval from the U.S. Food and Drug Administration for mRNA-based RSV vaccine mRESVIA.

By Distribution Channel

Convenience and Government Support Bolstered Hospital & Retail Pharmacies Segment Growth

By distribution channel, the market is segmented into hospital & retail pharmacies, government suppliers, and others.

The hospital & retail pharmacies held a significant mRNA vaccines market share in 2024. The substantial share of the segment is due to the high patient admission rate in hospitals. Hospitals were the main centers during the pandemic for the administration of prophylactic vaccines for COVID-19, including mRNA-based vaccines, which further supported the segment growth.

- For instance, according to the data published by the Centers for Disease Control and Prevention (CDC) in April 2024, the U.S. Federal Retail Pharmacy Program (FRPP) is a collaboration between the federal government and 21 national pharmacy chains to scale up the vaccination capacity during the COVID-19 pandemic.

The government suppliers segment held a considerable share of the market in 2024. Significant government initiatives during the COVID-19 pandemic to increase vaccine distribution and reach further augmented the segment growth.

mRNA Vaccines Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America mRNA Vaccines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.89 billion in 2025 and USD 2.28 billion in 2026. Key players in the market are based in North America, which supports the regional market growth. Strong emphasis by these players on the research & development of mRNA-based vaccines and technological advancements in vaccine development have supported the regional market growth.

The U.S. was the dominating country in the North American market. The U.S. market is valued at USD 2.04 billion by 2026. The region has advanced healthcare infrastructure and invests significantly in research and development, further leading to market growth. The first mRNA based COVID-19 vaccine was developed and approved in the U.S. Additionally, bio-manufacturing and government initiatives also boost the market growth during the forecast period.

- For instance, according to the data published by the British Medical Association in March 2023, the U.S. government invested approximately USD 31.9 billion for the development, production, and procurement of the mRNA COVID-19 vaccine. These public investments raise the mRNA vaccine market growth of this region.

Europe

Europe is the second-largest market. The rise in demand for mRNA-based vaccines for the treatment of COVID-19 drives the market growth in this region. Additionally, the growth of the region can be attributed to the presence of several established research institutions and favorable government policies. This region has a high adoption rate for mRNA-based vaccines, which also supports market growth. The UK market is valued at USD 0.28 billion by 2026, while the Germany market is valued at USD 0.25 billion by 2026.

- For instance, according to the data published by the European Commission in June 2020, the EU Vaccine Strategy was developed by the European Commission for the development, manufacturing and deployment of vaccines against COVID-19.

Asia Pacific

Asia Pacific is expected to grow substantially in the forthcoming years. The growth of the market in this region is attributed to the rise in the prevalence of infectious diseases and the rise in the number of clinical trials for mRNA vaccines. Additionally, government support for research and development, along with emerging healthcare needs, is projected to boost the market growth in this region. Moreover, a rise in investment in the biotechnology sector also helps to drive market growth. The Japan market is valued at USD 0.67 billion by 2026, the China market is valued at USD 0.15 billion by 2026, and the India market is valued at USD 0.14 billion by 2026.

- For instance, according to the data published in BioSpectrum Asia Edition in November 2024, more than 800 prophylactic vaccines are in the pipeline, of which 18% are mRNA-based vaccines.

Rest of the World

The rest of the world region is expected to hold a considerable share of the market in the near future. The growth in these regions is augmented by increasing government initiatives and rapidly evaluating regulatory policies. In addition, strategic initiatives undertaken by the operating players to increase access to vaccines further propelled regional growth.

- In response to global vaccine shortages, in December 2023, BioNTech opened an mRNA vaccine production facility in Kigali, Rwanda, aimed at increasing access to vaccines across the African continent.

COMPETITIVE LANDSCAPE

Key Industry Players

Introduction of New Products and Strong Pipelines by Key Companies Resulted in their Leading Positions in Market

The global market is concentrated, with companies such as Pfizer Inc., Moderna Inc., and BioNTech accounting for a significant share.

Pfizer Inc. is one of the leading players in the market and is actively involved in the development of mRNA technology. The company, in collaboration with BioNTech, developed the world’s first mRNA based COVID-19 vaccine during a pandemic. The company has robust and rapid manufacturing capabilities. Additionally, the company has a strong focus on various strategic initiatives, such as collaboration, acquisitions, and others, which make it a key market player.

Moderna Inc. is another prominent player in the market. It strongly invests in research and development activities for the development of mRNA-based vaccines. The company has extensive research and development technology for COVID-19 vaccines. Additionally, Moderna has current late-stage products as well as pipeline products, which makes it a potential player in the market. As one of the leading players in the mRNA vaccine space, Moderna has revolutionized the COVID-19 vaccine market. It is also working on expanding its pipeline to include vaccines for RSV (respiratory syncytial virus), HIV, and other rare diseases.

Additionally, BioNTech, CureVac SE, and GSK plc are the other prominent players in the market. These players are increasing investments in research activities for the development of innovative products and pipeline candidates, support the companies’ share in the market.

- For instance, in July 2024, GSK plc and CureVac N.V. restructured their previous collaboration into a new licensing agreement. This agreement allowed both of the companies to prioritize their investment and focus on respective mRNA development.

LIST OF KEY mRNA VACCINE COMPANIES PROFILED

- Moderna Inc. (U.S.)

- BioNTech (Germany)

- CureVac SE (Germany)

- GSK plc (U.K.)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- Gennova Biopharmaceuticals Limited (India)

- Walvax Biotechnology Co., Ltd. (China)

- Arcturus Therapeutics (U.S.)

KEY INDUSTRY DEVELOPMENTS

- September 2023: Moderna, Inc. expanded its scope for mRNA medicines by showing positive clinical results for rare diseases, cancer, and infectious diseases.

- August 2023: CureVac N.V., in collaboration with GSK, developed the dosing of the first participant in the phase 2 study of monovalent and bivalent modified mRNA COVID-19 vaccine.

- December 2022: CSL Limited collaborated with Arcturus Therapeutics Holdings Inc. and entered into an agreement that grants access to the Arcturus Therapeutics late-stage self-amplifying mRNA vaccine platform technology.

- December 2022: Moderna, Inc. received Emergency Use Authorization (EUA) from the U.S. Food and Drug Administration for Omicron-Targeting Bivalent COVID-19 Booster Vaccine for children of 6 months to 5 years.

- January 2022: Moderna, Inc. received approval for a Biologics License Application (BLA) from the U.S. Food and Drug Administration for SPIKEVAX (COVID-19 Vaccine, mRNA).

REPORT COVERAGE

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 17.94% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Indication

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 6.01billion in 2025 and is projected to record a valuation of USD 25.64billion by 2034.

In 2025, the market value stood at USD 1.89 billion.

The market is expected to exhibit a CAGR of 17.94% during the forecast period of 2026-2034.

The COVID-19 vaccines segment led the market by type.

The key factors driving the market are the increasing burden of infectious diseases and technological developments in mRNA technology.

Pfizer Inc., Moderna Inc., and BioNTech are the top players in the market.

North America dominated the market in 2025.

The rise in the prevalence of infectious diseases, such as COVID-19, and the rise in the demand for mRNA vaccines in developing markets are some of the factors that are expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us