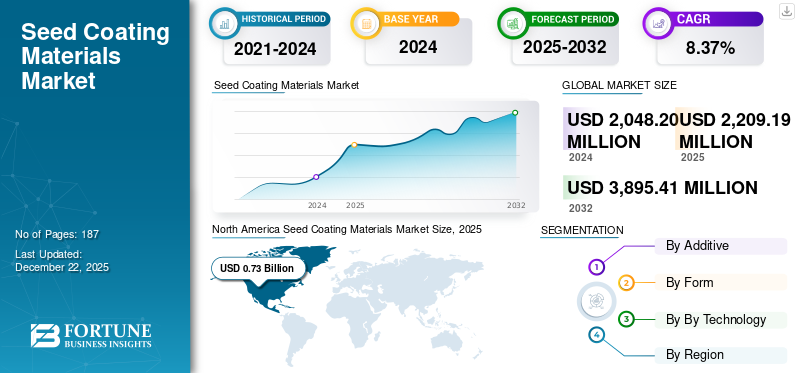

Seed Coating Materials Market Size, Share & Industry Analysis, By Additive (Polymers, Binders, Colorants, and Others), By Form (Solid and Liquid), By Technology (Film Coating, Encrusting, and Pelleting), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global seed coating materials market size was valued at USD 2.21 billion in 2025. The market is projected to grow from USD 2.39 billion in 2026 to USD 4.61 billion by 2034, exhibiting a CAGR of 8.37% during the forecast period. North America dominated the seed coating materials market with a market share of 33.11% in 2025.

Seed coating is applied to the surface of seeds to enhance their physical properties, improve handling, and provide additional functional benefits. These materials can include a combination of polymers, binders, fillers, colorants, and active ingredients such as nutrients, pesticides, fungicides, or growth promoters. The coating process aims to create a uniform layer over the seed, ensuring better performance during planting and germination. Seed coating materials are critical in modern agriculture for optimizing seed performance, increasing crop yields, and reducing environmental impact by minimizing the overuse of agrochemicals. The rising global population and triggered emphasis on high-quality seeds are the major factors driving the market growth.

Key players operating in the market are investing heavily in R&D and using the latest technologies to develop innovative ways to keep the seeds safe from soilborne diseases. This allows them to differentiate their products and stay ahead of the competition. BASF SE, Lanxess AG, Clariant AG, Solvay S A and Croda International plc are among the prominent players in the market.

Global Seed Coating Materials Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 2.21billion

- 2026 Market Size: USD 2.39 billion

- 2034 Forecast Market Size: USD 4.61 billion

- CAGR: 8.37% from 2026–2034

Market Share:

- North America dominated the seed coating materials market with a 33.11% share in 2025, driven by widespread adoption of precision agriculture and advanced seed technologies, particularly in the U.S. and Canada.

- By additive, polymers are expected to retain the largest market share in 2025 due to their role in enhancing seed viability, germination rates, and crop productivity. Liquid form remains dominant due to superior seed coverage and ease of application. Film coating technology leads due to its precision and effectiveness in reducing dust-off and maximizing active ingredient retention.

Key Country Highlights:

- United States: Heavy investment in agricultural R&D and adoption of polymer-based technologies like BASF’s Flo Rite Pro 02 are driving innovation and market growth.

- China: Home to over 170 registered seed-treatment agent manufacturers; growing investments in agriculture and innovation.

- India: Increasing demand for sustainable agriculture and high-quality seeds to boost food security.

- Brazil: Surge in soybean and corn production fuels demand for high-performance coated seeds.

- Germany: EU sustainability mandates encourage development of biodegradable seed coatings aligned with green policies.

- South Africa: Corteva’s new seed treatment lab (CSAT) in Pretoria bolsters localized innovation in seed technologies.

Market Dynamics

Market Drivers

Increasing Demand for High-Quality Seeds to Fuel Market Growth

The demand for high-quality seeds is significantly driving the global seed coating material market as farmers increasingly demand quality seeds for enhanced crop protection. "According to the Bioscience Biotechnology Research Communications, using good quality seeds can boost agricultural production by 15-20%."

High-quality seeds often require advanced coatings to protect them from pests, diseases, and environmental stresses. "According to the Horticultural Development Company, 68% of confirmed seed-borne diseases affecting ornamental crops are caused by fungi."

Farmers are increasingly recognizing the economic benefits of using high-quality seeds with effective coatings. The combination can lead to higher marketable yields and reduced reliance on chemical pesticides, thus lowering production costs in the long run. This economic viability encourages more farmers to invest in high-quality seeds, further driving seed coating materials market growth.

As consumers become more environmentally conscious, there is an increasing preference for seeds that support sustainable farming practices. High-quality seeds often align with these practices by requiring fewer chemical inputs and promoting biodiversity, further fueling the growth of the market.

Rising Global Population and Food Demand Contributes to Market Growth

As the global population continues to rise, the demand for food increases, necessitating higher agricultural productivity. The Food and Agriculture Organization (FAO) projects that food production must increase by 70% by 2050 to meet this demand. This includes the need for cereals and grains, fruits and vegetables and also efficient agricultural practices, including the use of seed coatings that enhance seed performance and crop yields. Coated seeds are better equipped to withstand adverse conditions such as drought, salinity, and pests. For instance, research has shown that seed coatings with protective materials can significantly enhance germination rates in saline soils, allowing crops to thrive in areas previously deemed as unsuitable for agriculture. This capability is essential as urbanization and industrialization reduce the availability of arable land.

Higher yields from coated seeds translate into increased income for farmers, particularly in developing regions where agriculture is a significant part of the economy. This economic stability encourages investment in agricultural innovations, creating a positive feedback loop that enhances food production capabilities.

Market Restraints

Climate Uncertainty to Pose a Significant Challenge for the Seed Coating Industry

Unpredictable weather, including extreme temperatures and inconsistent rainfall, can hinder the performance of seeds. Majority of the seeds are designed to optimize seed germination and growth, but when weather conditions deviate from expected norms, their efficacy may be compromised. Erratic weather patterns may also cause inconsistent moisture levels. Seed coatings are designed to protect seeds and enhance their germination rates by providing necessary moisture and nutrients. However, irregular rainfall can lead to either drought conditions or flooding, severely hindering seed germination and establishment. Seeds may not imbibe enough water during dry spells or may be washed away in excessive rain.

Climate change is leading to shorter growing seasons in many regions, which can affect the time available for seeds to germinate and establish themselves. This reduction in growing time may limit the benefits provided by seed coatings, particularly those aimed at enhancing early plant development. Moreover, in emerging markets, many farmers remain unaware of the benefits of seed coating technologies. This lack of knowledge can hinder adoption rates, particularly among small-scale farmers whom the initial high cost of seeds may deter despite the long-term advantages of seed coatings.

Market Opportunities

Technological Advancements in Biodegradable Seed Coatings to Represent a Pivotal Opportunity for Market Growth

Recent developments in seed coating technologies represent a significant opportunity for enhancing agricultural sustainability. The transition from traditional to biodegradable and organic seed coatings addresses critical environmental concerns while improving crop performance. The shift toward biodegradable seed coatings is driven by the need to reduce environmental pollution caused by non-degradable materials. Traditional coatings often rely on synthetic polymers, which can contribute to microplastic pollution. In contrast, biodegradable coatings utilize natural polymers such as cellulose, chitosan, and gelatin, which are more environmentally friendly and non-toxic.

Biodegradable coatings not only minimize environmental impact but also enhance seed performance. These coatings can improve seed germination rates, provide protection against pathogens, and offer nutrients during early growth stages. They help maintain seed viability under various stress conditions, thereby contributing to higher crop yields. Technological advancements in biodegradable and organic seed coatings represent a pivotal opportunity for sustainable agriculture. By addressing environmental concerns while improving crop yields, these innovations are set to transform the seed treatment landscape significantly.

Seed Coating Materials Market Trends

Sustainable Agriculture Trend Shapes the Seed Coating Industry Outlook

The major trend shaping the global seed coating industry is the rising demand for high-quality, sustainable, and environmentally friendly agricultural practices. As the world deals with the challenges of climate change, soil degradation, and dwindling natural resources, the seed coating industry is witnessing a significant shift toward the development of biodegradable, non-toxic, and eco-friendly coating materials. Biodegradable polymers, natural binders, and bio-based additives are replacing synthetic materials to ensure that seed coatings decompose harmlessly in the soil without leaving toxic residues. Additionally, the integration of bio-stimulants, beneficial microorganisms, and nutrients within seed coatings is gaining traction. These innovations not only promote plant health but also reduce the need for excessive fertilizer and pesticide use, aligning with sustainable agricultural goals.

Moreover, advancements in nanotechnology and microencapsulation techniques are revolutionizing the functionality of seed coatings. These technologies allow for the precise delivery of nutrients, growth stimulators, and pest repellents directly to the seed, improving germination rates and early plant development. The controlled-release mechanisms provided by such coatings ensure that seeds receive the right nutrients at the right time, optimizing resource use and reducing wastage. As a result, farmers are better equipped to combat unpredictable weather patterns and soil nutrient deficiencies, which are increasingly common due to climate change. North America witnessed a growth from USD 630.92 Million in 2023 to USD 679.14 Million in 2024.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic caused widespread disruptions in global supply chains, particularly affecting the availability of raw materials essential for seed coatings. Many agricultural chemical market players rely on imports from regions such as Asia, especially China, which is a major supplier of active ingredients used in seed coatings. This led to shortages and delays in production during the early months of 2020, resulting in a decline in sales volumes. Restrictions on transportation and movement during lockdowns delayed the delivery of coating materials.

Lockdowns and social distancing measures resulted in decreased farming activities. According to the National Center for Biotechnology Information, COVID-19 decreased agriculture production due to lockdowns and other emergency measures. Therefore, many farmers faced challenges in accessing necessary inputs, including seeds, which delayed planting seasons and reduced overall demand for seed treatments. This was particularly common in regions heavily reliant on seasonal planting schedules.

Segmentation Analysis

By Additive

Polymers Segment to Dominate the Market Due to Various Benefits of Polymers on Seeds

Based on additives, the market is segmented into polymers, binders, colorants, and others.

The polymer segment is expected to hold 45.67% of the major share of the global market in 2026. Polymers significantly improve seed performance by creating a protective layer around them, which enhances their resistance to environmental stresses, pests, and diseases. This protective barrier not only helps in maintaining seed viability during storage and transportation but also facilitates better germination rates and overall crop productivity. The low viscosity and water-based nature of polymer coatings contribute to faster seed germination.

The colorants segment is projected to grow significantly in the forecast period. Colorants are essential for the visual identification of seeds, allowing farmers to easily distinguish between different seed varieties and treatments. This is particularly important in large-scale agricultural operations where multiple seed types are used. Binders are crucial components in seed coating formulations, acting as adhesives that ensure the uniform application of other materials, such as fertilizers, pesticides, and colorants, onto the seed surface.

- The colorants segment is expected to hold a 31.93% share in 2024.

- The binders segment is expected to hold a 8.13% share in 2024.

The binders additive segment is expected to record 9.39% CAGR during the forecast period of the global market.

To know how our report can help streamline your business, Speak to Analyst

By Form

Liquid Segment Dominates Due to Widespread Adoption of Liquid Materials by Coating Companies

Based on form, the market is segmented into solid and liquid.

The liquid segment held a major share of the global market in 2024. Liquid coatings are preferred for their ease of application and superior seed coverage. They provide better protection against pests and diseases while promoting enhanced germination rates and seedling potency. The uniformity in application ensures that all seeds receive consistent treatment, which is crucial for optimal growth. Manufacturers favor liquid coatings as they are easier to handle and apply, which translates into lower labor costs and improved operational efficiency in agricultural practices. The liquid segment form is expected to attain 60.5% of the market share in 2026.

The solid segment is projected to grow significantly during the forecast period. Solid coatings enhance the physical properties of seeds, making them easier to handle and plant. They provide a uniform shape and size, which improves the accuracy of mechanical planting equipment, leading to consistent planting depth and spacing. Solid coatings can provide a protective barrier that extends the shelf life of seeds by reducing moisture absorption and protecting against environmental factors that could degrade seed quality before planting.

By Technology

Film Coating Segment to Dominate Market Due to Higher Impact among All Technologies

By technology, the market is segmented into film coating, encrusting, and pelleting.

The film coating segment is expected to hold 53.39% of the market share in the global market in 2026. Film coatings effectively retain Plant Protection Products (PPPs) on the seed, minimizing dust-off and ensuring that active ingredients are delivered directly to the soil with the seed. This enhances crop protection while reducing environmental exposure to chemicals.

The pelleting segment is projected to grow significantly in the global market. Pelleting increases the size and weight of seeds, making them easier to handle and sow. This improvement in physical characteristics facilitates faster and more efficient planting, reducing the time and labor required for sowing operations. The pelleting process enhances the flowability of seeds, which is crucial for mechanical planting systems. Encrusting provides a protective layer around the seeds, which helps shield them from environmental stressors, pests, and diseases. This protection is crucial for maintaining seed health and viability during germination and early growth stages.

On the other hand, the encrusting segment is projected to exhibit a strong CAGR of 10.06% during the forecast period.

Seed Coating Materials Market Regional Outlook

Geographically, the market is segmented into North America, Asia Pacific, Europe, South America and the Middle East & Africa.

North America

North America Seed Coating Materials Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is the largest region in terms of seed coating materials market share, led a market value of USD 0.73 billion in 2025. North America, particularly the U.S. and Canada, leads in the adoption of advanced farming practices and precision agriculture technologies. These practices enable more efficient application of seed coatings, enhancing their effectiveness while minimizing waste. North America is the third-largest region projecting to reach USD 0.79 billion in 2026.

Innovations in seed coating technologies, including the development of advanced polymers and bio-based materials, are crucial for improving seed performance. For instance, in November 2023, BASF launched Flo Rite Pro 02, an advanced seed coating technology designed to enhance seed performance in agricultural applications. Flo Rite Pro 02 utilizes a polymer-based formulation that combines superior adhesion properties with exceptional seed flow characteristics. These advancements allow for better protection against pests and diseases, enhanced germination rates, and improved crop yields. The integration of precision agriculture technologies further optimizes the application of seed coatings, making them more effective.

The U.S. market size is expected to hit USD 0.62 billion in 2026, as it heavily invests in Research and Development (R&D) within the agricultural sector. This investment fosters innovation in seed coating technologies, resulting in the creation of more effective and sustainable products. The U.S. agricultural sector has observed a notable increase in R&D spending focused on seed treatment technologies, enhancing the overall market growth.

Europe

The seed coating market in Europe is experiencing robust growth, driven by several interrelated factors that enhance demand and innovation within the sector. The growing use of Genetically Modified (GM) and hybrid seeds necessitates effective seed coatings to improve performance and resilience. These advanced technologies require coatings that can provide specific benefits such as pest resistance and improved nutrient uptake, thus driving market growth.

EU regulations play a crucial role in shaping the market by promoting safety, sustainability, and innovation while also presenting challenges related to compliance costs and market dynamics. These regulations are pivotal in steering the industry toward more environmentally responsible practices while ensuring the efficacy of agricultural inputs. Moreover, EU-funded projects often focus on developing new technologies and materials for seed coatings. Initiatives such as "Genome Editing in Plants" and the BRESOV project aim to enhance crop productivity and sustainability, leading to innovations in seed coating formulations that improve seed performance and resilience against environmental stressors. The U.K. market is predicted to reach USD 0.03 billion, while the market in France is likely to be USD 117.67 million. Germany to be USD 0.09 billion in 2026.

Asia Pacific

Asia Pacific is the second-largest region, anticipating a value of USD 0.69 billion in 2026 and exhibiting the second-largest CAGR of 9.09% during the forecast period. Economic growth and rising disposable incomes are significantly influencing the market in Asia Pacific. As economies in the Asia Pacific grow, particularly in China and India, there is a marked increase in investments in agriculture. Farmers are willing to invest more in advanced agricultural inputs, such as coating materials, which enhance seed performance and crop yields. This trend is particularly evident as farmers seek to maximize productivity amid shrinking arable land, to meet increasing food demand.

As disposable incomes rise, consumers are increasingly demanding higher-quality food products, which puts pressure on farmers to enhance their production methods. Coating materials play a vital role in improving the quality of crops, making them more appealing to consumers. The market is highly competitive, with companies focusing on research and development to introduce innovative products that cater to evolving agricultural needs. According to the International Fertilizer Association (IFA), as of May 2024, approximately 170 Chinese seed-treating agent manufacturers were registered, reflecting a robust industry focused on enhancing agricultural productivity through innovative solutions. The market in China is predicted to hit USD 293.01 million, whereas, Japan is likely to hit USD 91.68 million and India’s market to reach USD 181.69 million in 2025.

South America

South America is the fourth-largest region projecting a value of USD 295.83 million in 2025. Brazil is one of the largest agricultural producers in the world, particularly known for its soybean and corn production. According to the United States Department of Agriculture (USDA), in Brazil, the production of soybeans increased from 153,000 (000 tons) in 2023/2024 to 169,000 (000 tons) in 2024/2025. The significant scale of these crops drives demand for seed coating materials as farmers seek to enhance yields and protect their investments in high-value seeds. The country's agricultural sector is increasingly adopting seed coatings to improve germination rates and crop resilience.

Moreover, there is an increasing awareness among Brazilian farmers regarding the benefits of seed treatments, including enhanced disease resistance, improved germination rates, and overall yield improvement. Educational initiatives aimed at informing farmers about these advantages are crucial for driving market growth in South America.

Middle East & Africa

Investment in seed treatment technologies is poised to transform the agricultural landscape significantly in the Middle East & Africa. This transformation is driven by several interrelated factors that address both immediate agricultural challenges and long-term sustainability goals. The UAE market is likely to reach USD 7.04 million in 2025.

Increased investment in seed treatment technologies, such as those developed by companies including Corteva Agriscience, is expected to improve the quality and efficiency of seed production. For instance, in July 2022, Corteva Agriscience made a significant investment in the agricultural sector by launching a state-of-the-art seed treatment laboratory in Rosslyn, Pretoria, South Africa. This facility, known as the Centre for Seed Applied Technologies (CSAT), is one of only six such centers globally and is designed to enhance the development and production of crop-enhancing seed treatments tailored for the African and Middle Eastern markets. These technologies enhance seed resilience against pests and diseases, leading to higher crop yields and better-quality produce, which is crucial for meeting the growing demand for high quality seeds and the region's expanding population.

Competitive Landscape

Key Market/Industry Players

Technological Advancements and Emphasis on R&D Activities by Market Players to Gain Competitive Edge

The prominent players in the global seed coating materials market focus on two primary strategies – new product launches followed by partnerships and base expansion to expand their seed coating materials product lineup and strengthen their global presence.

The rise in demand for hybrid and genetically modified seeds that often require specific coatings for protection and performance enhancement is a significant driver for the seed coating material market. This trend is particularly evident in high-value commercial crops such as fruits and vegetables.

List of Key Seed Coating Materials Companies Profiled

- BASF SE (Germany)

- Chromatech Incorporated (U.S.)

- Cistronics Innovations Pvt. Ltd. (India)

- Clariant AG (Switzerland)

- Croda International plc (U.K.)

- Germains Seed Technology (U.K.)

- Lanxess AG (Germany)

- Solvay S.A. (Belgium)

- Summit Seed Coatings (U.S.)

- Universal Coating Systems, LLC (U.S.)

Key Industry Developments

- November 2024 – Milliken launched a microplastic-free polymer technology in Brazil, marking a significant advancement in sustainable materials. The company's new MPF (Microplastic-Free) solution would be integrated into the Milli Fusion product line and help improve seed performance through pigmentation.

- November 2024 – GROWMARK and Indigo Ag announced a strategic partnership to expand the availability of powder-based biological products in the agricultural sector. The catalyst for the partnership agreement is Indigo's new CLIPS device— an innovative flowable powder seed coating application system. This partnership reflects a growing trend in agriculture toward integrating biological solutions that promote environmental stewardship while also providing economic benefits to farmers.

- January 2024 – Lucent BioSciences launched Nutreos, a biodegradable seed coating designed to address the environmental challenges posed by microplastics in agriculture. The introduction of Nutreos aligns with recent regulatory changes in the European Union that phase out the use of micro-plastics in various products, including agricultural seed coatings.

- December 2024 – BioConsortia, Inc., announced a commercial agreement with New Zealand-based Hodder and Taylors Ltd. H&T is expected to introduce BioConsortia's FixiN 33 microbial seed treatment during the 2024/2025 season. This improved seed coating will be available for brassicas, corn, and cereals, helping farmers use nitrogen fertilizer effectively while reducing runoff and environmental impact.

- February 2022 – Xampla and Croda/Incotec formed a strategic partnership aimed at developing biodegradable seed coatings that are free from micro-plastics. This initiative aligns with Incotec's sustainability strategy, Mission Zero, which aims to minimize environmental impact and promote sustainable agricultural practices.

Report Coverage

The report analyzes the market in-depth and highlights crucial aspects, such as prominent companies, competitive landscape, additives, forms, and technology. Besides this, it provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, the report encompasses several factors contributing to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.37% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Additive

By Form

By Technology

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size is anticipated to be USD 2.39 billion in 2026 and reach USD 4.61 billion by 2034.

Fortune Business Insights says the global market value stood at USD 2.21 billion in 2025.

The global market will exhibit a CAGR of 8.37% over the forecast period of 2026-2034.

By additive, the polymers segment is predicted to dominate the market during the forecast period of 2026-2034.

Increasing demand for high-quality seeds to fuel the market growth.

BASF SE, Lanxess AG, and Clariant AG are some of the leading players globally.

North America dominated the global market in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us