Solar Ingot Wafer Market Size, Share & COVID-19 Impact Analysis, By Type (Monocrystalline and Polycrystalline), and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

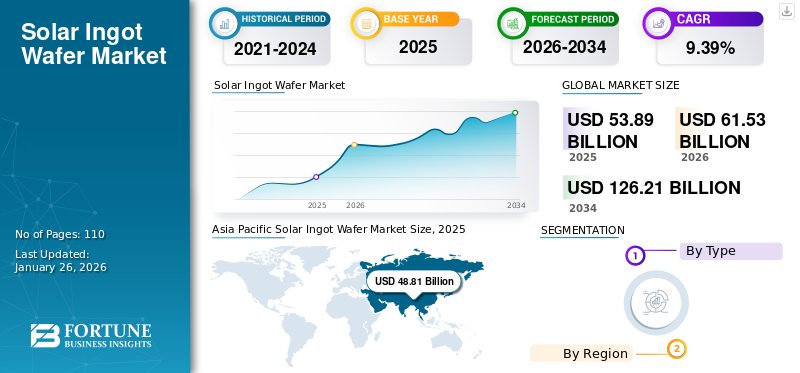

The global solar ingot wafer market size was valued at USD 53.89 billion in 2025 and is projected to grow from USD 61.53 billion in 2026 to USD 126.21 billion by 2034, exhibiting a CAGR of 9.39% during the forecast period. The Asia Pacific dominated the solar ingot wafer market with a share of 90.57% in 2025. The Solar Ingot Wafer market in the U.S. is projected to grow significantly, reaching an estimated value of USD 3.72 billion by 2032, driven by the growing demand for solar energy production backed by government tax credits and other incentives.

The solar ingot is a raw material for the production of solar cells. The ingots form the initial step in producing the solar wafers that are the basis for manufacturing solar modules. The absorption and reflectance of the sun's rays falling on the solar panels determine the solar system's efficiency, depending on the properties of the solar ingot wafer used.

The growth of the automotive industry will drive the demand for solar bar wafers as they will be used in upcoming electric vehicles to store more energy and boost the vehicle's performance. The market growth is attributed to the growing adaptability of carbon emission in the transportation sector, as solar ingot wafers are the basic components of solar modules.

COVID-19 IMPACT

Shutdown of Almost all Services due to COVID-19 Hindered the Market Growth

The COVID-19 pandemic has significantly affected various commercial and industrial operations worldwide. Almost all nations worldwide have observed a steep increase in the affected population since the beginning of the current year. The unavailability of cures or vaccines against the viral infection has prompted many industry experts and players to continuously adopt multiple counter measures to mitigate the effects.

Further, the impact of the pandemic has revealed various issues such as shortage of operating staff, deficits in operating income, closure of various plants, restricted global trade, and many more specified by the nature of operations.

LATEST TRENDS

Download Free sample to learn more about this report.

Stringent Government Policies Likely to Produce an Opportunity for the Market Growth

The governments of various countries focus on producing energy through renewable energy resources. This is the primary reason for the solar ingot wafer market growth. With stringent government regulations regarding carbon emissions, companies are more inclined to use renewable energy sources for power generation, particularly solar energy and wind power. This is expected to increase the solar PV market during the forecast period. For example, the Middle East & North Africa region has a target of 26 GW of solar PV installation by 2026. The MNRE, the Ministry of Power, and the Government of India also provide 30% capital subsidy on solar projects. Additionally, the Indian government gives subsidies against installing solar power in residential buildings, which surges the demand for solar along with ingot and wafers.

Market players are also exploring opportunities to cater to solar energy demands from consumers in the coming years. Governments' tax benefits and subsidies help manufacturers develop the necessary infrastructure for solar power plants.

DRIVING FACTORS

Increase in Demand for Clean Energy Worldwide Has Promoted the Adoption of Solar Energy

Global energy demand is rising worldwide owing to population and economic growth. As per IEA, global electricity demand reached 24,700 TWh in 2021, a 6% year-on-year increase, reflecting a recovery in economies globally. More than 60% of the projected demand for electricity came from emerging and developing countries, such as China, the U.S. and Europe, where China alone accounts for around 50% of the global electricity demand.

Renewable energy demand has risen by 3% in 2020 and is further projected to grow significantly across all major sectors such as power, heat, industry, and transport. As per IEA's 2021 global energy review report, the energy sector is dominating, with renewable energy demand growing by around 8% to 8,300 terawatt hours.

Solar PV is the most significant contributor to the growing renewable energy sources and is expected to provide two-thirds of renewables' growth in 2021. Global solar PV power generation is expected to increase by 145 terawatt hours and reach 1000 terawatt hours in 2021. An increase in electricity generation from solar resources is estimated to increase the demand for solar panels and other equipment needed to build solar power plants. Solar bar wafers are used as raw materials for developing solar panels. Thus, installing solar panels to meet the rising electricity demand will propel the consumption of solar ingot wafers during the forecast period.

Additionally, increasing global demand for green energy has impacted the adoption of solar energy. The growth of the automotive industry will surge the demand for solar bar wafers as they will be used in the upcoming electric vehicles to store more energy and boost the vehicle's performance. The market growth is directly dependent on the growth of solar PV development as solar ingot wafers are essential for solar modules.

Increase in Focus on Kerfless Wafers to Propel the Demand for Solar Ingot Wafers

Wafers are majorly made up of silicon material with a process where silicon ingots are produced in energy-intensive furnaces and are sawed into wafers using wires. The process creates enormous amounts of silicon wastes and requires a lot of energy that affects the efficiency of solar panels. Furthermore, the increasing focal point on reducing material waste while enabling the production of thin and ultra-thin crystalline silicon PVs is forcing researchers to adopt a highly effective wafer production process. Kerfless wafering is the primary wafer fabrication process.

Various major companies are investing in Kerfless wafers. For instance, Nexwafe introduced a 250 MW Kerfless wafer production plant in Bitterfeld, Germany. Additionally, Leading Edge Equipment Technologies developed a furnace for silicon wafers named Ribbon Solar. The Ribbon Solar technology can reduce the cost of the wafer by 50% and also can increase commercial solar module performance by up to 7%, further reducing the emissions from the manufacturing process by more than 50%.

Introducing a Kerfless wafer production method would reduce solar ingot waste and operational costs. Therefore, the production of Kerfless wafers is expected to offer significant opportunities to the market growth during the forecast period.

RESTRAINING FACTORS

Expense of Solar Ingot Wafer and the Complex Manufacturing Process May act as Restraining Factors

The key market restraint is the expensive and precise process used to manufacture solar ingot wafers, which have a minimal thickness and require special techniques to ensure proper manufacturing. This increases the initial cost, and thus can hinder the market growth.

Additionally, the overall cost of solar bars/wafers is higher, likely reducing their adoption in residential uses where energy demands are generally lower. For comparison, installing 15 ground-mounted solar panels rated at 300 watts, costs approximately USD 14,625. Installing solar would cost an additional USD 500 per solar panel. This increase in acquisition costs leads to lower acceptance of the solar tracking system.

Furthermore, lack of necessary infrastructure is the other factor holding back investments in the market. In Asia Pacific and Europe, lack of awareness of the benefits and increasing preference for fixed-pitch installations over tracked installations have hampered growth.

SEGMENTATION

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Polycrystalline Segment Holds the Dominant Share due to its Efficiency and Durability

The polycrystalline segment accounted for a higher market share of 64.53% in 2026 due to its high efficiency and long service life.

Monocrystalline solar ingot wafers are gaining popularity as they exhibit excellent heat resistance and work better in low sun exposure, making them ideal for cloudy areas. Further research & development activities are being carried out at various levels to improve the efficiency of different types, including monocrystalline and thin-film solar modules.

In November 2022, researchers from Zhejiang University in China announced that they developed a new manufacturing technique to produce high-quality mono-cast silicon ingots with a stable monocrystalline ratio for solar cell applications.

REGIONAL INSIGHTS

Asia Pacific Solar Ingot Wafer Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 48.81 billion in 2025 and USD 55.92 billion in 2026. Asia Pacific dominated the solar ingot wafer market share in 2024 due to enhancing manufacturing potential in the region. For example, in December 2022, Adani Solar installed India’s first monocrystalline silicon ingot at the Intersolar India 2022 expo in Gujarat. Adani Solar is planning to build 2 GW of ingot and wafer capacity by December 2023 to expand to 10 GW by 2025. Further, the Ahmedabad-based Chiripal Group has a new solar cell, module, and glass manufacturing unit under its subsidiary Chiripal Renewable Energy. Grew Energy will commission 4 GW PV modules, 3 GW PV cells, and 300 tons/day tempered glass production capacity over the next four years. It will open the lines in phases across India, starting with a 2GW factory in Rajasthan.

Followed by Asia Pacific, North America accounts for a substantial share of the global market. Increasing focus of energy production through solar systems is driving the market growth across the region. For example, as per Solar Energy Industries Association (SEIA), the U.S. produced 50% of its total electricity generation through solar power, which is the highest annual production rate. Major countries in Europe hold significant market share with a target to cut carbon emission and are investing in solar which will likely to push demand for ingot & wafer across the region. The EU solar PV association endorsed and supported the aim to set up 320 GW of solar photovoltaic by 2025 and almost 600 GW by 2030.

KEY INDUSTRY PLAYERS

Key Participants are Concentrating on Enhancing their Product Capacities

The global market is highly consolidated, with numerous active players. Major players include Shin-Etsu Chemical Co Ltd, Sumco, SK Siltron, and LDK Solar. The major companies constitute around half of the market, and regional and local players dominate the remaining market share.

Shin-Etsu's strength is in technological capabilities and aggressively investing in silicon wafers and other businesses in their electronics materials segment.

SUMCO offers excellent-quality silicon wafers. Raw materials with an excellent level of quality are utilized. The wafers are produced under stringent quality control to manufacture products that serve customer needs in various ways.

SK Siltron engages in processes of filling high-purity poly-crystal silicon in a quartz crucible. In addition, it also engages in processes where poly-crystal silicon is melted in high temperatures and then grown into a single crystal ingot.

List of Key Companies Profiled:

- Shin-Etsu Chemical Co., Ltd (Japan)

- CETC Solar Energy Holdings Co., Ltd. (India)

- DCH Group (Hong Kong)

- KONKA SOLAR Cell Co., Ltd (China)

- Sumco Corporation (Japan)

- Siltronic AG (Germany)

- GlobalWafers (Taiwan)

- JA SOLAR Technology Co., Ltd. (China)

- SK Siltron (Korea)

- Okmetic (China)

- LDK Solar Technology Co., Ltd. (China)

- SN Materials (South Korea)

- Targray (Canada)

- EPC Group (German)

- GCL-Poly Energy Holdings (Hong Kong)

KEY INDUSTRY DEVELOPMENTS:

- December 2022 – Adani Solar introduced India’s first large monocrystalline silicon ingot. The monocrystalline ingots will drive indigenization to produce renewable electricity from silicon-based PV modules with efficiencies between 21% and 24%. While the company's initial production has already begun, it intends to add 2 GW of ingot and wafer capacity by the end of 2023.

- December 2022 – Longi reduced the price of its wafers by more than 27%. The company said that its M6 wafers are now priced at USD 0.65, which has been reduced by 27.24% from November 2022. The company presently sells P-type M10 wafers for a lesser price.

- December 2022 – TCL Zhonghuan, a wafer producer, announced wafer price cuts. Moreover, its p-type G12 wafers prices were reduced by 23.7%. Additionally, the price for N-type M10 wafers and G12 wafers was reduced from November 2021 price levels.

- December 2022 – CubicPV, a solar energy technology company, planned to build a 10-GW-capacity wafer plant that it says would be the largest of its kind in the U.S. CubicPV says the design is underway, and a construction manager is on board. A company spokesperson declined to name team members or to disclose the cost.

- July 2020 – India plans to announce solar wafers & ingot manufacturing tenders to cut Chinese imports. India plans to develop tenders that could provide profitability gap financing (VGF) to attract domestic manufacturers to build much-needed solar wafer and ingot capacity in the country. India has introduced a basic tariff (BCD) on all imported solar cells, modules, and inverters to control imports from China as part of its economic strategy. This has prompted companies to set up domestic production of solar cells and modules.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The global solar ingot wafer market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.39% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type and Region |

|

Segmentation |

By Type

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was USD 53.89 billion in 2025.

The global market is projected to grow at a CAGR of 9.39% over the forecast period.

The market size of Asia Pacific stood at USD 48.81 billion in 2025.

Based on type, the polycrystalline segment holds the dominating share in the global market.

The global market size is expected to reach USD 126.21 billion by 2034.

An increase in demand for clean energy worldwide has promoted solar energy adoption.

The top players in the market are Sumco Corporation, Canadian Solar, Mitsubishi Materials Corp, and Targay.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us