System Integration Market Size, Share & Industry Analysis, By Service Type (Infrastructure Integration, Application Integration, and Consulting), By End User (IT and Telecom, BFSI, Defence, Healthcare, Retail, and Others), and Regional Forecast, 2026–2034

GLOBAL SYSTEM INTEGRATION MARKET OVERVIEW

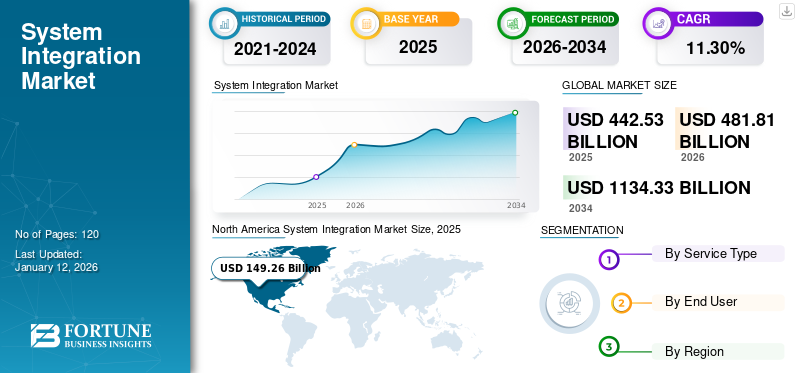

The global system integration market size was valued at USD 442.53 billion in 2025 and is projected to grow from USD 481.81 billion in 2026 to USD 1,134.33 billion by 2034, exhibiting a CAGR of 11.30% during the forecast period. North America dominated the system integration market with a market share of 33.40% in 2025.

The market involves integrating multiple hardware and software components into a unified system to meet business and technological needs. System integrators combine networking, storage, server, and other IT infrastructure from various vendors, ensuring seamless interoperability. They take responsible for designing, implementing, and managing complex IT solutions, often developing certain components to address specific requirements of the clients. System integration connects different subsystems into a single, cohesive system that functions as one. In software solutions it typically refers to linking several IT systems, services, and software to enable smooth functionality.

Market Size:

- 2025 Value: USD 442.53 billion

- 2026 Value: USD 481.81 billion

- 2034 Forecast Value: USD 1,134.33 billion, at a CAGR of 11.30% (2026–2034)

Market Share:

- Regional Leader: North America held 33.40% market share in 2025, led by IT modernization and cloud adoption.

- Fastest-Growing Region: Asia Pacific expected to grow fastest, driven by government digitalization and infrastructure expansion.

- End-User Leader: IT & Telecom sector led in 2024 due to network complexity and rapid 5G expansion.

Industry Trends:

- Cloud Integration Platforms gain traction among hybrid infrastructure setups.

- iPaaS Adoption simplifies cloud-to-on-premise system workflows.

- Remote Work Systems drive seamless collaboration platform integration.

- AI Integration enhances system intelligence and automation capabilities.

- IoT Connectivity supports unified data and device ecosystems.

Driving Factors:

- Legacy and Modern Systems need streamlined interoperability support.

- Cloud Migration Growth boosts demand for integrated infrastructure.

- IT Complexity Rising across multivendor software and hardware ecosystems.

- AI & ML Tools automate repetitive and data-driven processes.

- SME Digital Transformation accelerates demand for integration solutions.

The market is experiencing robust growth, driven by the increasing need for organizations to streamline operations and enhance productivity through technology. As businesses adopt various applications, databases, and telecommunications systems, the demand for integrating these disparate components into a cohesive framework is becoming essential. The growing adoption of cloud computing, the rise of small and medium enterprises (SMEs), and the demand for energy-efficient processes are further propelling this growth.

The market is dominated by a mix of global giants and specialized service providers, each contributing unique strengths to the sector. Companies such as Deloitte and Infosys are notable for their strategic consulting services, while Tata Consultancy Services and Fujitsu focus on delivering comprehensive IT solutions. Additionally, the market's competitive dynamics are influenced by smaller, agile firms that offer specialized integration services, often leveraging cutting-edge technologies to cater to niche industry needs.

The COVID-19 pandemic initially disrupted the market by causing supply chain delays and project postponements. However, as organizations accelerated toward digital transformation and adopted remote operations, the demand for system integration solutions surged. This shift has led to increased investments in infrastructure development and project management solutions, enabling businesses to enhance operational capabilities in a post-pandemic era.

System Integration Market Trends

Expansion of Cloud-Based Solutions to Boost Market Growth

Cloud-based solutions are transforming the market by enabling organizations to integrate various applications and services hosted in the cloud. This approach leverages Integration Platform as a Service (iPaaS), which allows businesses to develop, execute, and manage integration flows between disparate applications without extensive hardware or middleware investments. iPaaS solutions enhance connectivity, eliminate data silos and improve operational efficiency.

A key advantage of cloud-based integration is its flexibility and scalability. Businesses can easily adapt their integration strategies, deploy new applications, and scale operations without the complexities of managing physical infrastructure. Additionally, cloud integration supports various types of integrations, including cloud-to-cloud, cloud-to-on-premises, and hybrid models that combine both environments. This versatility allows organizations to optimize their IT ecosystems by integrating legacy systems with modern cloud applications, enhancing data accessibility and collaboration across departments. As a result, cloud-based solutions are becoming increasingly essential for businesses aiming to streamline processes and improve overall agility in a rapidly changing technological landscape.

Download Free sample to learn more about this report.

The COVID-19 pandemic accelerated the adoption of cloud-based solutions as organizations sought to maintain operations amid remote work challenges. Companies increasingly turned to cloud integration to ensure seamless communication and data sharing across distributed teams. This shift has solidified the importance of cloud-based integration as a critical component in supporting business continuity and digital transformation initiatives.

MARKET DYNAMICS

Market Drivers

Increasing Complexity of IT and Coexistence of Legacy and Modern Systems to Fuel Market Growth

The increasing complexity of IT environments is driven by the rapid adoption of diverse technologies and the integration of various systems within organizations. As businesses expand, they implement a multitude of applications, platforms, and services to meet specific operational needs. However, this results in highly interconnected systems that are difficult to manage and optimize. For instance, large enterprises operate thousands of applications, each with its own data sources and workflows, leading to reduced visibility and control. Ensuring seamless interoperability among these systems is essential for maintaining operational efficiency and achieving strategic objectives.

Moreover, the coexistence of legacy systems with modern technologies further exacerbates this complexity. Many organizations continue to rely on outdated applications while integrating new solutions, creating compatibility issues and increased maintenance demands. This duality complicates IT management, as teams must navigate both old and new technologies while managing dependencies between them. The complexity increases operational costs and hampers innovation, as making changes becomes a challenging and risk-prone process. Consequently, organizations are compelled to seek effective system integration solutions that can simplify their IT environments, enhance interoperability, and enable them to respond more agilely to market demands.

Market Restraints

DATA Compatibility Issues and Scalability and Performance Limitations to Hinder Market Growth

Integrating legacy systems with modern technologies presents significant challenges that can hinder the effectiveness of system integration efforts. One primary issue is data format incompatibility, as legacy systems often utilize outdated formats or proprietary standards that do not seamlessly integrate with contemporary applications. This necessitates robust data transformation layers, which can be both time-consuming and resource-intensive. Additionally, performance bottlenecks can arise as legacy systems are not designed to handle the increased processing demands of modern applications, leading to slow performance and potential system failures. Security concerns further complicate integration, as older systems often lack modern security features. To mitigate risks, organizations must implement additional security layers and strong authentication mechanisms, increasing complexity.

The lack of documentation for legacy systems poses another critical hurdle, making it difficult for IT teams to understand their structure and logic. This knowledge gap can lead to increased project delays and higher expenses as organizations invest time in uncovering necessary information. Furthermore, there is a growing shortage of skilled professionals familiar with legacy technologies, further complicating integration efforts. As organizations navigate these complexities, they may experience project delays and increased costs, ultimately impacting the system integration market growth. Addressing these challenges is essential for businesses looking to modernize their operations while effectively leveraging existing legacy systems to enhance operational efficiency and maintain a competitive edge in an increasingly digital landscape.

Market Opportunities

Integration of AI and Machine Learning Technologies to Automate Repetitive Tasks Fuels Market Growth

The integration of AI and Machine Learning (ML) technologies into various systems is creating significant opportunities for tailored solutions across industries. By incorporating AI and ML, businesses can automate complex tasks, analyze vast amounts of data, and gain valuable insights to drive smarter decision-making. AI-powered systems streamline operations by automating repetitive tasks, reducing human error, and enhancing customer experiences through AI-driven chatbots. Additionally, AI-based fraud detection software can analyze data in real-time and adapt to evolving patterns, making it crucial for enhancing security and risk management.

Effective AI and ML integration requires careful planning, including defining clear objectives, preparing high-quality data, and continuously monitoring performance. Challenges such as data quality, ethical and privacy concerns, high costs, talent shortages, and integration complexity must be addressed to unlock the benefits fully. Seamlessly integrating AI and ML into systems enhances user experiences and represents a strategic investment in long-term success by optimizing processes, improving decision-making, and increasing overall competitiveness.

SEGMENTATION ANALYSIS

By Service Type

Infrastructure Integration Holds the Highest Market Share due to Critical Role in IT Operations

By service type, the market is segmented into infrastructure integration, application integration, and consulting.

Infrastructure integration is projected to dominate the system integration market with a 42.56% share in 2026 due to its critical role in establishing a robust IT framework essential for efficient business operations. This segment encompasses the integration of hardware, networking components, and data centers, which are essential for supporting various applications and services. As businesses increasingly rely on complex IT infrastructures to manage their operations, the demand for robust infrastructure integration solutions continues to rise.

Application integration is experiencing the highest compound annual growth rate (CAGR) as organizations focus on enhancing interoperability between software applications. The growing adoption of cloud-based solutions and the need for real-time data sharing across platforms are key drivers of this segment's rapid expansion.

The consulting segment provides valuable insights and strategic guidance for organizations navigating their integration journeys. While this segment may not grow as rapidly as application integration, it remains essential for businesses to align their integration strategies with broader organizational goals and ensure optimal implementation.

Overall, these segments reflect the diverse needs of organizations striving to streamline operations, enhance connectivity, and optimize IT ecosystems in an increasingly digital landscape.

To know how our report can help streamline your business, Speak to Analyst

By End User

IT and Telecom Sector Takes the Lead Owing to the Necessity for Managing Complex Networks and Ensuring Seamless Communication

By end user, the market is segmented into IT and telecom, BFSI, healthcare, defence, retail, and others.

The IT and Telecom segment is expected to lead the market, contributing 34.16% globally in 2026 due to its reliance on integrated systems to manage complex networks and ensure seamless communication across platforms. The rapid rollout of 5G networks and increased cloud adoption further drive demand for robust integration solutions in this sector.

The healthcare segment is experiencing the highest compound annual growth rate, fueled by the growing adoption of Electronic Health Records (EHRs), telemedicine, and the need for secure, integrated healthcare systems. As healthcare providers strive to enhance patient care and streamline workflows, system integration plays a vital role in connecting various medical systems while ensuring compliance with regulations.

The defence, retail, and others segments, collectively contribute to market growth by addressing specific integration needs across diverse industries. The defence sector relies on integrated systems for enhanced security and operational efficiency. The retail industry increasingly implements integration solutions to streamline supply chain management and improve customer experiences. Additionally, other industries leverage system integration to adopt advanced technologies to enhance productivity and maintain competitiveness.

These segments reflect the widespread adoption of system integration across industries, highlighting their critical role in driving digital transformation and operational excellence.

SYSTEM INTEGRATION MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America

North America System Integration Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for USD 149.26 billion in 2025 and is characterized by significant technological advancements and substantial investments in digital transformation initiatives. The region holds the largest market share, driven by the increasing adoption of IoT in industrial automation and the growing reliance on cloud-based services across various sectors, particularly in IT and Telecom. The BFSI sector is also a major contributor, as financial institutions seek to enhance customer experiences through integrated solutions. As organizations continue to migrate to digital platforms, the demand for integration services is expected to rise, reinforcing North America's leadership in this market.

The U.S. is set for substantial growth, fueled by the rising adoption of advanced technologies such as cloud computing, the Internet of Things (IoT), and industrial automation. As organizations strive to enhance operational efficiency and streamline their IT infrastructures, the demand for robust system integration solutions has surged. The IT and telecom sectors play a pivotal role, with companies investing heavily in integrating their systems to improve connectivity and data management. Furthermore, the financial services industry is embracing digital transformation, leading to a heightened need for integrated solutions that can enhance customer experiences and optimize operations. Government initiatives supporting technological advancements across various sectors, including healthcare and manufacturing, further bolster this market's potential. The U.S. market is well-positioned for continued expansion, driven by technological innovation and strong industry demand.

Download Free sample to learn more about this report.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is witnessing steady growth in the market, supported by strong regulatory frameworks and a focus on enhancing operational efficiency across industries. The region's emphasis on digital transformation, particularly in sectors such as healthcare and manufacturing, is driving demand for integrated solutions that facilitate seamless communication and data sharing. European companies are increasingly investing in automation and smart technologies to remain competitive, which further fuels the need for effective system integration. Additionally, the rise of fintech and e-commerce platforms is creating opportunities for innovative integration solutions tailored to meet specific business needs. The UK market reaching USD 22.16 billion by 2026 and the Germany market reaching USD 38.05 billion by 2026.

Asia Pacific

The market in the Asia Pacific region is experiencing rapid growth, fueled by increasing investments in technology and economic expansion. Countries such as India, China, South Korea, and Singapore are at the forefront of this trend as businesses strive to modernize their operations and enhance efficiency. The expanding IT and telecom sectors are particularly influential, with an increasing demand for network integration services to support seamless connectivity. Government initiatives promoting digital transformation further drive the market, positioning Asia Pacific as a key player in the system integration industry landscape, leading to significant demand for these integration services in the region for those operating in the system integration field. The Japan market reaching USD 28.07 billion by 2026, the China market reaching USD 53.01 billion by 2026, and the India market reaching USD 36.65 billion by 2026.

South America

South America presents emerging opportunities for system integration as businesses increasingly recognize the importance of technology in enhancing operational efficiency. The region is gradually adopting digital solutions across various sectors, including retail and manufacturing, which creates a demand for integrated systems that can streamline processes and improve data management. However, challenges such as economic instability and varying levels of technological adoption across countries may impact growth rates.

Middle East & Africa

In the Middle East & Africa, the market is gaining traction due to increasing investments in infrastructure development and digital transformation initiatives. Governments in this region are prioritizing technology adoption to drive economic growth, leading to greater demand for integrated solutions across sectors such as healthcare, finance, and energy. The rise of smart cities and IoT applications further emphasizes the need for seamless integration of various systems to enhance operational efficiency. While challenges such as skill shortages and regulatory complexities exist, the potential for growth in system integration services remains strong as organizations embrace technological advancements.

Competitive Landscape

KEY INDUSTRY PLAYERS

Presence of Major Global Players and Strategic Partnerships in the Market Drives Innovation and Growth

The system integration market share is characterized by a diverse range of key players leveraging technological innovation and domain expertise to maintain a competitive edge. Major companies such as Accenture, Capgemini, IBM, and Cisco are at the forefront, offering comprehensive integration solutions that cater to various industries, including IT, healthcare, and finance. These players are heavily investing in advanced technologies such as cloud computing, IoT, and AI to enhance their service offerings and streamline operations for their clients. Additionally, firms such as HCLTech, Oracle, and Microsoft are also significant contributors, focusing on developing tailored solutions that meet the evolving needs of businesses in an increasingly digital landscape. The competitive landscape is further shaped by strategic partnerships, mergers, and acquisitions among these companies, enabling them to expand their capabilities and reach within the market. Overall, the presence of established global players alongside niche service providers fosters a dynamic environment that drives innovation and growth in the sector.

Long List of Companies Studied (including but not limited to)

- IBM Corporation (U.S.)

- Accenture (Ireland)

- Cisco Systems (U.S.)

- HCL Technologies (India)

- Infosys (India)

- Cognizant (U.S.)

- Tata Consultancy Services (TCS) (India)

- Fujitsu (Japan)

- Capgemini (France)

- Wipro (India)

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- Deloitte (U.K.)

- NEC Corporation (Japan)

- Atos SE (France)

- Tech Mahindra Limited (India)

- AVI-SPL (U.S.)

- Kinly (Netherlands)

- Solotech Inc. (Canada)

- Avidex (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2023: IBM Corporation announced the acquisition of Apptio, a company specializing in financial and operational IT management software. This acquisition aimed to help businesses manage the increasing complexity of technology spending across multi-cloud and hybrid-cloud environments. By leveraging Apptio's solutions, IBM seeks to enhance its IT automation capabilities and provide greater value to business leaders regarding their technology investments.

- June 2023: Cisco introduced a new Security Service Edge (SSE) solution designed to provide seamless and secure access across any location, device, and application. This service addresses challenges related to inconsistent access experiences and boosts productivity by intelligently directing traffic to both private and public destinations, thereby streamlining access management for improved efficiency.

- April 2023: Oracle Corporation launched new capabilities within the Oracle Fusion Cloud Applications Suite. These enhancements are expected to bolster supply chain planning, improve financial accuracy, and increase operational efficiency. Key innovations include usage-based pricing and advanced planning and rebate management capabilities within the Oracle Fusion Cloud Supply Chain & Manufacturing module.

- February 2023: Schneider Electric, Capgemini, and Qualcomm Technologies, Inc. unveiled an innovative 5G-enabled automated hoisting solution. This initiative replaces traditional wired connections with a state-of-the-art wireless 5G Private Network, enhancing the deployment of digital technologies at scale across industrial sites. The collaboration aimed to simplify and optimize the integration of digital technologies in industrial environments, highlighting significant advancements in system integration.

- February 2023: Cisco Systems, Inc. announced a partnership with NEC Corporation to integrate systems and explore opportunities in the areas of 5G xHaul and private 5G. This collaboration aimed to assist customers in transforming their architectures, enabling broader connectivity among people and devices.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service Type

By End User

By Region

|

|

Companies Profiled in the Report |

IBM (U.S.), Wipro (India), Nokia (Finland), Huawei (China), Cognizant (U.S.), Tech Mahindra (India), Accenture (Ireland), Capgemini (France), Oracle (U.S.), and Microsoft (U.S.). |

Frequently Asked Questions

The market is projected to reach USD 1,134.33 billion by 2034.

In 2025, the market was valued at USD 442.53 billion.

The market is projected to grow at a CAGR of 11.30% during the forecast period.

The infrastructure integration segment leads the market.

The Increasing complexity of IT environments necessitates seamless integration to enhance operational efficiency is the key factor driving market growth.

IBM, Wipro, Nokia, Huawei, Cognizant, Tech Mahindra, Accenture, Capgemini, Oracle, and Microsoft are the top players in the market.

North America holds the highest market share.

By end user, healthcare is experiencing the highest CAGR.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us