Ultrasound Equipment Market Size, Share & Industry Analysis, By Product (Compact Cart-based/Standalone and Portable [Compact {Built-in Console, and Touchscreen}, and Handheld], and Tabletop), By Application (Radiology, Gynecology, Cardiology, Urology, and Others), By End User (Hospitals and Clinics), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

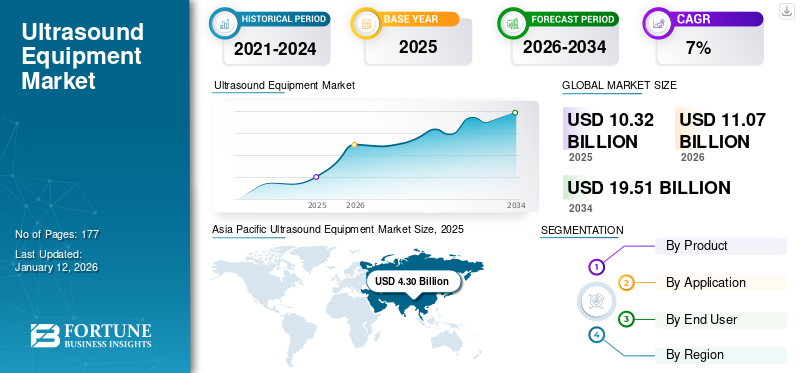

The global ultrasound equipment market size was valued at USD 10.32 billion in 2025. and The market is projected to grow from USD 11.07 billion in 2026 to USD 19.51 billion by 2034, exhibiting a CAGR of 7.30% during the forecast period. Asia Pacific dominated the ultrasound equipment market with a market share of 41.69% in 2025.

Ultrasound uses high-frequency sound waves to take images of anatomical structures, which healthcare professionals interpret to detect abnormalities in a patient. This equipment diagnoses several chronic disorders related to vital body parts, such as the heart, blood vessels in the abdomen, and joints. This technology is considered one of the safest, non-invasive diagnostic procedures to examine internal organs.

Recent advancements in this technology, the introduction of innovative medical equipment, and the development of healthcare facilities in emerging countries have influenced market players to develop easily operable devices. Additionally, the growing prevalence of chronic diseases and the expansion of applications of these systems are some of the major factors anticipated to propel the global ultrasound equipment market growth during the forecast period.

Additionally, the key players in the market, such as GE HealthCare, Koninklijke Philips N.V., FUJIFILM Corporation, CANON MEDICAL SYSTEMS CORPORATION (Canon Inc.), and others with advanced product offerings and engaging in strategic activities to expand the reach of their products in untapped regions. Rising technological advancements are increasing the focus of these companies on developing advanced products for a wide range of application areas.

Global Ultrasound Equipment Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 10.32 billion

- 2026 Market Size: USD 11.07 billion

- 2034 Forecast Market Size: USD 19.51 billion

- CAGR: 7.30% from 2026–2034

Market Share:

- Region: Asia Pacific dominated the market with a 41.69% share in 2025. This leadership is driven by higher sales volumes of ultrasound devices, as the region is a major manufacturer of cost-effective equipment.

- By Product: The Cart-based/Standalone segment held the largest market share in 2024. This is due to the high adoption rate of this equipment in hospitals and clinics, coupled with the increasing use of these devices for a wide range of diagnostic imaging procedures.

Key Country Highlights:

- Japan: As a key country in the dominant Asia Pacific region, Japan's market is driven by a high demand for advanced diagnostic equipment in its well-established healthcare system. The presence of major domestic players also contributes to innovation and market growth.

- United States: The market is fueled by a high prevalence of chronic diseases, particularly cardiovascular conditions. It is also a key market for innovation, with the U.S. FDA's approval of advanced devices such as Clarius Mobile Health's third-generation AI-powered ultrasound for musculoskeletal imaging.

- China: The market is expanding as a major manufacturer of cost-effective ultrasound equipment, which contributes to high sales volumes and a significant portion of the total revenue of major domestic companies such as CHISON Medical Technologies Co., Ltd.

- Europe: The market is propelled by a large geriatric population and a high prevalence of chronic diseases. For instance, in 2021, approximately 61 million adults in Europe had diabetes, a condition that often requires cardiovascular monitoring, thus driving the demand for ultrasound equipment.

MARKET DYNAMICS

Market Drivers

Increasing Prevalence of Chronic Diseases and Rising Geriatric Population to Accelerate Market Growth

Globally, the rising prevalence of chronic diseases has increased the demand for healthcare services, such as increased patient visits, hospital admissions, and surgeries.

The increasing incidence of chronic diseases, such as cardiovascular diseases, cancer, kidney diseases, and respiratory disorders, is leading to an increased demand for early diagnosis and treatment. Ultrasound imaging is a non-invasive, cost-effective diagnostic tool widely used to detect and monitor symptoms associated with heart disease, cancer, kidney diseases, and others.

The growing prevalence of cardiovascular diseases is augmenting the number of ultrasound imaging procedures across the globe.

For instance, according to the 2022 Heart Disease & Stroke Statistical Update Fact Sheet Global Burden of Disease, it was estimated that 244.1 million people were living with Ischemic Heart Disease (IHD). This disease was more prevalent in males (141 million) than in females (103.1 million) in 2020 on a global level. Such growing prevalence frequently leads to an increased demand for heart ultrasound, also known as echocardiography, to assess heart conditions, such as heart valve disease, cardiomyopathy, pericardial diseases, and others.

This, along with rise in the geriatric population globally suffering from chronic disorders, has led to a significant increase in the demand for medical imaging equipment, including those for diagnosis and treatment procedures. According to a National Council of Aging article published in October 2023, around 95% of adults aged 60 and above have at least one chronic condition. In contrast, nearly 80% have two or more chronic conditions.

Furthermore, over the past decade, applications of this technology have expanded to clinical specialties, such as surgery, gastroenterology, and musculoskeletal. These applications were limited to radiology, cardiology, obesity, and gynecology. Hence, recent developments and the launch of several products in the point-of-care (POC) segment and handheld systems have expanded the usage of these systems in primary care, anesthesia, emergency medicine, and critical care applications. This is expected to bolster the market’s growth during the forecast period.

Market Restraints

Product Recalls and Shortage of Trained Technicians to Limit Adoption of These Systems

Even though the market is witnessing notable advancements in ultrasound imaging equipment, certain factors, such as product recalls, warnings from regulatory bodies, and defective products hamper the brand image of major companies operating in the market. This results in lesser product sales, impacting revenue generation in the market.

For instance, in August 2021, Koninklijke Philips N.V. recalled its Class 2 Sparq ultrasound device. The recall was initiated owing to a battery data issue with the system, which intermittently caused system shutdown, regardless of the actual state of the battery or application of alternating current power. This, along with the shortage of trained technicians in countries, such as Australia, the U.K., and Canada, is expected to limit the market’s growth opportunities during the forecast period.

For instance, in April 2021, according to the Royal College of Radiologists’ workforce census report, there was an estimated shortage of 1,939 consultant radiologists, which was equivalent to 33% of the total workforce. And it is estimated that there will be a significant shortage of 3,600 radiologists by 2025. Also, according to the 2022 Clinical Radiology U.K. workforce census report, the U.K. had a 29% shortage of clinical radiologists, which is expected to rise to 40% by 2027 if no action is taken.

Market Opportunities

Expansion of Therapeutic Applications of Ultrasound to Provide Lucrative Market Growth Opportunities

Rising technological advancements and increasing demand for ultrasound equipment for treating a wide range of medical conditions rather than just diagnosing them will offer a lucrative growth opportunity to the market during the forecast period. The new-age ultrasound equipment can be used for cancer treatment, wound healing, neuromodulation, pain management, and even ultrasound-guided drug delivery. Such diverse application areas of ultrasound shift the focus of key market players toward increasing research & development and commercializing cutting-edge ultrasound equipment for different applications.

For instance, in May 2021, Insightec received market approval from the Brazilian Health Regulatory Agency (ANVISA) for its Exablate 4000 (Exablate Neuro) platform, which utilizes MR-guided focused ultrasound to target deep brain tissues non-invasively. This partnership with Strattner aimed to introduce focused ultrasound technology in Brazil for treating essential tremor, tremor-dominant Parkinson's Disease (PD), and neuropathic pain resistant to medication. Such product launches and regulatory approvals for new treatments will cater to the market's growth during the forecast period.

Market Challenges

Presence Of Alternative Diagnostic Technologies To Hinder Marker Development

The market faces challenges due to the presence of alternative diagnostic technologies, such as MRI, CT, and X-ray, which may offer more comprehensive imaging solutions. Additionally, the high cost associated with advanced ultrasound technologies limits their access in developing markets. Limited access to healthcare infrastructure in low-income regions exacerbates the challenge of market penetration for ultrasound devices. The unequal distribution of these devices, which are concentrated in urban areas, leaves rural populations underserved. Such scenarios tend to impose challenges on the growth of the market.

Other Challenges

- Stringent Regulatory Scenario Negatively Hinders the Market Growth: Regulatory hurdles across different countries increase product approval timelines and compliance costs, thereby acting as a significant challenge in the market growth.

- Growing Competitive Pressure Act as a Challenge for Already Established Players: Emergence of new players in the market with similar offerings at a cheaper cost act as a challenge for already established players’ revenue growth.

Ultrasound Equipment Market Trends

Introduction of Artificial Intelligence in Ultrasound Devices to Fuel Market Growth

Some of the leading market players are emphasizing developing advanced devices and systems integrated with artificial intelligence (AI). The AI algorithms aim to improve image quality and interpretation. These algorithms can be used to analyze ultrasound images in real-time, which, in turn, offers valuable insights and assistance in accurate diagnosis to healthcare professionals. Furthermore, integrating AI into this equipment leads to enhanced accuracy and efficiency of ultrasound examinations, resulting in better patient outcomes. This step is being propounded to overcome certain limitations associated with conventional devices, such as the long time required to conduct the examination, poor image quality in certain cases, high dependency on technicians to acquire and interpret images. Thus, key players' introduction of advanced systems with artificial intelligence-powered imaging is expected to boost the market's growth during the forecast period.

- For instance, in February 2023, the U.S. Food and Drug Administration (FDA) approved the HD3 by Clarius Mobile Health, a third-generation device with a new artificial intelligence application, for musculoskeletal imaging. The new cloud-connected model uses artificial intelligence to rapidly identify and measure foot, ankle, and knee tendon structures to help accelerate injury diagnosis and treatment.

Other Trends

Growing Penetration of Portable and POCUS Systems: The demand for portable and point-of-care ultrasound systems is growing, driven by the need for mobility and real-time diagnostics in remote or emergency settings.

Increasing Demand for 3D/4D Imaging: Enhanced visual clarity is driving the adoption of 3D and 4D systems in prenatal and cardiovascular imaging.

Growing Usage Ultrasound Imaging in Therapeutics: High-intensity focused ultrasound (HIFU) is gaining prominence for applications like tumor ablation and physiotherapy. This factor has been fueling the adoption of ultrasound in therapeutic area.

Download Free sample to learn more about this report.

Impact of COVID-19

The outbreak of COVID-19 had a negative effect on the ultrasound market. The pandemic created disruptions in the global supply chain of medical devices. Some of the major players operating in the market faced supply chain disruptions, especially from distributors in severely impacted developing countries, such as China, India, Brazil, and others. The manufacturing capacity of a few players was also affected by the unavailability of locally sourced raw materials or parts.

However, the resumption of routine medical diagnosis at hospitals and clinics after the pandemic augmented patient visits to healthcare settings, further boosting the use of this equipment globally. Thus, rising hospital visits by patients for diagnostic ultrasound post-COVID-19 pandemic and increased launch of and demand for portable devices at home healthcare settings & remote patient monitoring further propelled the market’s growth in 2023. The market is projected to witness strong growth prospects over the forecast period due to these factors.

Trade Protectionism and Impact on the Market

Trade restrictions complicate the market dynamics, affecting the availability and pricing of medical devices. Conversely, international trade agreements are crucial in shaping the medical device sector by facilitating smoother cross-border collaboration and export regulations. Manufacturers must adapt to these evolving trade policies. This dynamic landscape underscores the intricate interplay between trade policies and the medical technology industry. Additionally, the U.S.-China trade war significantly impacted the ultrasound equipment supply chains, leading to increased tariffs and trade barriers that have disrupted the flow of goods and driven up costs.

Segmentation Analysis

By Product

High Adoption of Tabletop Equipment across Healthcare Systems to Drive Market Growth

Based on product, the market is segmented into cart-based/standalone and portable. Portable segment is further sub-segmented into compact and handheld. The compact segment is segmented into built-in console and touchscreen.

The cart-based/standalone segment held the largest market share of 65.87% in 2026 owing to the higher rate of adoption of these equipment in hospitals & clinics and the increasing use of these devices for diagnostic imaging among patients across the globe. As per statistics published by Esaote SpA, a biomedical company, in 2021, more than 130,000 of its tabletop ultrasound equipment will be installed globally.

The portable segment is also expected to record a higher CAGR during the forecast period owing to the introduction of advancing technologies and market players' launch of new products in the handheld equipment segment. For instance, in February 2023, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. launched TE Air, a handheld device. The device combines enhanced point-of-care imaging with various practical benefits for radiologists. Moreover, the rising launch of handheld devices by major players and their adoption by healthcare professionals owing to key factors, such as their non-invasiveness and portability have propelled the segment’s growth. For example, in March 2021, GE HealthCare launched a new wireless handheld ultrasound device, the Vscan Air, for sale in the U.S. and Europe. The device is highly specific for branches of medicine, such as obstetrics and cardiology to aid in primary care.

To know how our report can help streamline your business, Speak to Analyst

By Application

High Demand of Ultrasound Systems in Radiology Propelled Segment’s Growth

Based on application, the global market is segmented into radiology, gynecology, cardiology, urology, and others.

The radiology segment was one of the leading segments in the market in 2024 owing to the increasing number of radiology centers and rising adoption of this technology in general imaging and diagnosis of medical complications. The segment is likely to hold 33.16% of the market share in 2026.

According to a study article published by the NCBI in November 2021, around 86.5 ultrasound examinations per 1,000 patients were reported in the radiology department of the Poland University Hospital in 2020.

The gynecology segment held the second-largest share of the market owing to the increasing number of pregnancies and women's health issues that require proper diagnosis. Also, increasing product launches for women's health examinations are expected to propel the growth of the segment in the market. For instance, in April 2024, GE Healthcare launched the Voluson Signature 20 and 18 ultrasound systems for women's health imaging applications. The device is integrated with advanced AI tools and has an ergonomic design, delivering a clearer picture of various conditions impacting women's health.

Moreover, the cardiology segment held the third-largest portion of the market. The segment is expected to exhibit a CAGR of 7.9% during the forecast period. The rising prevalence of cardiovascular disease and increasing need for early diagnosis to avoid chronic conditions is expected to boost the demand for this equipment for cardiology applications.

The point of care, urology, surgery, and other segments are expected to grow during the forecast period.

In July 2023, Konica Minolta, Inc. launched PocketPro H2, a new wireless handheld ultrasound device for general imaging in point-of-care applications. Such launches will propel the growth of the segment.

By End User

Surge in Patient Admissions Across Hospitals to Augment Segment’s Growth

Based on end user, the market is segmented into hospitals and clinics.

The hospitals segment dominated the market in 2024 owing to the increasing number of patient admissions in hospitals in developed and emerging economies and the well-established infrastructure of these medical settings. According to the data published by the U.S. Department of Health & Human Services in April 2024, around 13 million patients who visited physician offices were diagnosed with coronary atherosclerosis and other chronic ischemic heart diseases. The segment is expected to record a CAGR of 7.2% during the forecast period. Such conditions require proper diagnosis with ultrasounds to detect various heart ailments. These factors will boost the segment's growth in the market. According to data published by an investor presentation of GE Healthcare in 2022, more than 600 million ultrasound scans are performed annually in hospitals.

The clinics segment is expected to register a higher CAGR during the forecast period owing to the increased adoption of handheld and point-of-care (POC) ultrasound systems in these settings as they are easy to use, convenient, and cost-effective. Moreover, the rising number of patients at clinics undergoing medical imaging will further boost the segment’s growth during the forecast period. According to study data published by Hindustan Times in June 2023, on an average, one center/clinic performs up to 40 ultrasounds daily in India.

ULTRASOUND EQUIPMENT MARKET REGIONAL OUTLOOK

The global market report analyzes the market’s growth across regions, such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Ultrasound Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in Asia Pacific was valued at USD 4.30 billion in 2025, and in 2026, the market value stood at USD 4.67 billion. The growth of this region is attributed to the higher sales volume of these devices. China is also considered a major manufacturer of cost-effective equipment. This makes the region a lucrative market for these devices.

- In April 2022, CHISON Medical Technologies Co., Ltd., a Chinese company focusing on the ultrasound field, announced that it registered its overseas revenue at USD 50.1 million in 2021, accounting for 87.38% of its total revenue.

The market in China is expected to be USD 1.81 billion in 2026. Meanwhile, India is projected to be USD 0.37 billion and Japan is anticipated to hit USD 1.70 billion in 2026.

North America

North America held the second-highest global ultrasound equipment market share in 2024 owing to the constant focus of market players on new product development in the U.S. and Canada. The region is expected to be the second-largest market with a value of USD 3.00 billion in 2025, with a CAGR of 6.3% during the forecast period. The U.S. has witnessed new product launches and innovations in equipment, which were predominantly driven by the recent COVID-19 outbreak. The U.S. market size is estimated to be USD 3.00 billion in 2026.

- In October 2021, Mindray Medical International launched a new point-of-care ultrasound system, TE7 Max. The new system was designed to give physicians more comprehensive and customizable workflow protocols than the point-of-care ultrasound (POCUS) scanners.

Europe

Europe is expected to be the third-largest market with a value of USD 2.47 billion in 2026 and to register a significant CAGR during the forecast period owing to the widening pool of geriatric patients suffering from chronic diseases and a well-established healthcare infrastructure in countries, such as the U.K, Germany, and others.

- According to the International Diabetes Federation statistics, in 2021, around 1 in 11 adults (61 million) had diabetes in Europe.

The U.K. market size is estimated to be USD 0.40 billion in 2026. On the other hand, Germany is likely to be USD 0.65 billion in 2026. and France is expected to hit USD 0.45 billion in 2025.

Latin America and the Middle East & Africa

On the other hand, Latin America is likely to be the fourth-largest market with a value of USD 0.43 billion in 2026 and the Middle East & Africa accounted for a comparatively lower share of the global market owing to their developing healthcare infrastructure and a huge underpenetrated market. Saudi Arabia market is likely to be USD 0.16 billion in 2025.

Competitive Landscape

Key Industry Players

Rising Focus of Established Market Players on New Product Launches to Boost Their Growth

GE Healthcare dominated the market and accounted for the largest share in 2024. The company’s dominance results from its strong product portfolio and growing distribution network, which provides a competitive advantage. The market's competitive landscape is consolidated owing to the robust portfolio and wide distribution network of key players in major markets.

Players, such as GE Healthcare, Koninklijke Philips N.V., and Canon Inc. accounted for a dominant global market share in 2024. Also, a few other major players are utilizing the opportunities generated by the COVID-19 pandemic to further strengthen their market position.

- For instance, in June 2021, CANON MEDICAL SYSTEMS CORPORATION announced the commercial launch of the Aplio i-series/Prism Edition, a complete redesign of its premium ultrasound series. Similarly, its existing Aplio a-series device also received a routine-to-advanced imaging range upgrade.

Other players, such as Hitachi, Siemens Healthcare, Samsung Medison Co., Ltd., and Esaote are constantly focusing on introducing new systems with advanced technologies.

- In January 2023, Esaote SpA, an Italian company dedicated to MRI and medical IT in the biomedical market, announced the launch of the MyLabX90 premium ultrasound system.

LIST OF KEY COMPANIES PROFILED

- GE Healthcare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- FUJIFILM Corporation (Japan)

- Siemens Healthcare (Germany)

- Shantou Institute of Ultrasonic Instruments Co., Ltd (China)

- Butterfly network Inc. (U.S.)

- Konica Minolta, Inc. (Japan)

- Esaote SPA (Italy)

- BD (Becton, Dickinson and Company) (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2023 - Samsung Medison Co., Ltd. introduced V6, a new ultrasound system with 2D, 3D, and color image quality.

- November 2023 – BD introduced a new, advanced ultrasound system to enhance clinical efficiency.

- March 2023 - Shenzhen Mindray Bio-Medical Electronics Co., Ltd. launched a new handheld ultrasound device, TE Air, that provides enhanced point-of-care ultrasound imaging with an array of practical benefits for radiologists.

- June 2022 - Clarius Mobile Health, a provider of wireless ultrasound systems, and ImaCor Inc., a hemodynamic ultrasound company, announced a partnership to develop a handheld transesophageal echocardiography (TEE) system. This system was designed to manage and guide care for the most critically ill patients in an Intensive Care Unit (ICU).

- February 2022 - Koninklijke Philips N.V. launched Lumify, a handheld point-of-care ultrasound solution, to expand its portfolio and offer advanced hemodynamic assessment and measurement capabilities.

- September 2021 - Samsung introduced the V8 (Versatile 8), its new high-end ultrasound system, to offer enhanced usability, image quality, and convenience for all medical professionals while optimizing its use in almost all busy hospitals worldwide.

- December 2020 – Samsung Medison introduced its RS85 Prestige ultrasound diagnostic solution, designed to deliver efficient scanning performance, at the Radiological Society of North America (RSNA) 2020. This launch aimed to strengthen the company’s position in the global market.

FUTURE OUTLOOK

The future outlook for the ultrasound market presents promising growth opportunities, particularly through the adoption of portable ultrasound devices in low-income regions, which can significantly enhance access to medical imaging. Additionally, the emergence of AI-based diagnostic tools offers a transformative potential that could further revolutionize the field. However, key challenges, such as regulatory hurdles and increasing competition from novel diagnostic technologies must be navigated carefully. Market projections indicate substantial growth over the next 5-10 years, with significant opportunities for key players to capitalize on untapped regions and position themselves favorably in an evolving landscape.

REPORT COVERAGE

The ultrasound equipment market report provides a detailed market analysis and focuses on key aspects, such as leading companies, applications, products, and end-users. Besides this, it offers insights into the current market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.30% from 2026-2034 |

|

Unit |

Value (USD billion) and Volume (Units) |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 10.32 billion in 2025 and is projected to reach USD 19.51 billion by 2034.

In 2026, the market value is expected to reach at USD 11.07 billion.

The market will exhibit steady growth at a CAGR of 7.30% during the forecast period of 2026-2034.

By product, the cart-based/standalone segment will lead the market.

The rising prevalence of chronic diseases and increasing geriatric population across the world are the key drivers of the market.

GE Healthcare, Koninklijke Philips N.V., and Canon Inc. are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us