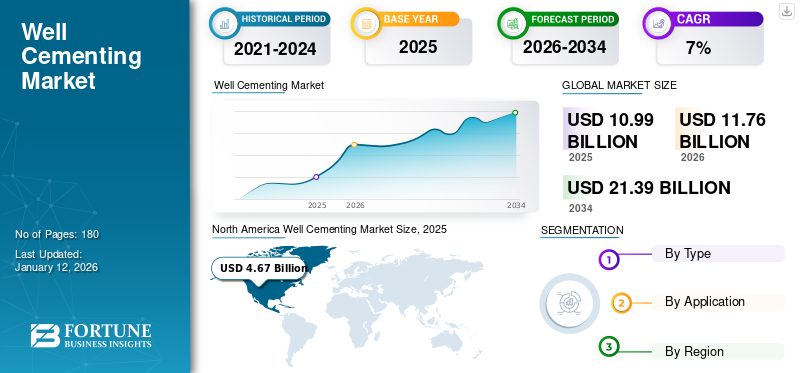

Well Cementing Market Size, Share & Industry Analysis, By Type (Primary Cementing and Remedial Cementing), By Application (Onshore and Offshore), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global well cementing market size was valued at USD 10.99 billion in 2025. The market is projected to grow from USD 11.76 billion in 2026 to USD 21.39 billion by 2034, exhibiting a CAGR of 7.77% during the forecast period. North America dominated the global market with a share of 42.50% in 2025.

Well cementing is an important part of completion and workover operations while drilling, as it offers structural integrity to the well casing and prevents fluid movement from the reservoir to the wellbore. Cementing involves a mixture of cement, water, and chemical additives, which are pumped into the wellbore through the casing and fill the gap between the casing and the wellbore.

Halliburton is one of the leading players in the well cementing market. The company designs and provides customized cementing solutions to meet the temperature, pressure, and operational requirements of each well. Its strong product portfolio and global presence are key drivers of its revenue growth.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Technological Advancements in Oil & Gas Sector to Spur Market Growth

Recent advancements in nano-engineered cement have led to enhanced strength and performance while improving fluid-loss control additives. Cutting-edge placement techniques such as stage cementing and optimized spacer designs have significantly improved cement placement. In addition, the integration of real-time monitoring systems is enhancing cementing operations by enabling better sealing of formations and effective zone isolation in deep wells under extreme conditions. All these factors are driving market growth.

Rising Exploration Activities to Fuel Market Growth

Many companies are continuously investing in the oil & gas sector due to the rising demand for crude oil in North America and the Middle East. Extensive exploration operations and the deployment of different methods to identify new oil and gas reserves across various geographies are further supporting this trend. In addition, growing investments for the expansion of the oil & gas sector are contributing to market growth. For instance, Egypt’s oil ministry has signed five agreements with various international companies for oil and gas exploration in the Western Desert, Gulf of Suez, and North Damietta in the Mediterranean. The total investment for these deals is estimated at a minimum of USD 221.23 million, according to a statement from the cabinet.

MARKET RESTRAINTS

Unpredictable Market Outlook of Oil & Gas to Hinder Market Growth

The oil & gas sector is unpredictable owing to frequent fluctuations in prices. These price changes lead to instability in investment and related operations. Crude oil prices in the international market are continuously fluctuating due to socio-political scenarios and economic slowdown. The oil crisis triggered by the Russia and Ukraine conflict disrupted investments and dampened demand in the oil and gas industry. This volatility has, in turn, negatively impacted the global well cementing market growth.

MARKET OPPORTUNITIES

Growing Demand for Oil & Gas Exploration to Create Growth Opportunities

Several companies are making massive investments in exploration and production activities to meet the unwavering demand for hydrocarbons. National and state-owned oil companies are investing enormously in drilling activities. For instance, in July 2024, Saudi Aramco invested USD 25 billion in a natural gas infrastructure through numerous contracts to address the increasing gas demand. Such initiatives are expected to boost market growth and strengthen its foundation. Such initiatives could steer the market in a positive direction during the forecast period.

MARKET CHALLENGES

Stringent Government Regulations May Hinder Market Development

Strict rules and regulations across multiple operational areas govern the oil & gas sector. Well-cemented services, being a crucial aspect of the industry, are also subject to strict government regulations owing to security and environmental concerns. For instance, in 2024, Mr. Biden proposed invoking a provision of the Outer Continental Shelf Lands Act, which could lead to a permanent ban on certain oil drilling operations in the upcoming years.

WELL CEMENTING MARKET TRENDS

Rise in Offshore Drilling Operations to Set New Industry Trends

Many countries are focusing on offshore drilling operations due to ongoing geopolitical tensions and supply issues within OPEC (Organization of the Petroleum Exporting Countries). This shift is contributing to the rising number of offshore oil rigs across several countries. New exploration projects will positively impact the well-cementing activities globally. For instance, in November 2024, India’s offshore exploration potential remains largely untapped, particularly in its sedimentary basins. Under the Open Acreage Licensing Policy (OALP), companies aim to increase offshore operations by 16% in 2025. Furthermore, by 2030, the Indian government intends to expand the nation’s survey land to 1 million square kilometers, further boosting India’s energy security.

Impact of COVID-19

The COVID-19 pandemic negatively impacted global well-cementing services and its related sectors due to disruptions in cementing manufacturing and a decline in global demand and supply. Moreover, reduced oil and gas operations in multiple regions led to lower production of oil, thereby decreasing the demand for the product. Major factors included the inaccessibility of raw materials, unavailability of machinery and workers, border closers, and disruption in import and export activities, all of which hindered market growth.

SEGMENTATION ANALYSIS

By Type

Increasing Exploration of New Oil & Gas Oilfields Boost Demand for Primary Cementing

By type, the market is fragmented into primary cementing and remedial cementing. Primary cementing holds the dominant share in the market, owing to extensive exploration activities globally, driven by rapid economic growth, which is fueling demand for effective well cementing services. Well cementing is a vital part of ensuring safe and productive drilling operations. Many oilfield service companies pay keen attention to primary cementing to prevent fluid movement between formations and avoid contamination of groundwater. Zonal isolation is also achieved through primary cementing to keep the casing economically productive and protect it from corrosion. Additionally, it ensures wellbore stability, which enhances the overall performance of the well.

Remedial cementing is the second leading segment, as it is carried out only if there is a fault or need to rectify issues with the primary cementing. However, the primary cementing is forecasted to outpace its counterpart, owing to its critical role while drilling.

By Application

Onshore Segment Leads Due to Low Operation Costs

As per application, the market is bifurcated into onshore and offshore.

Onshore holds the major share of 81.72% in the market in 2026 as most major oil companies prefer onshore exploration due to its several advantages and the feasibility of exploration & production (E&P). The onshore segment accounts for a substantial share of global oil production. Operational costs for onshore projects are quite low compared to offshore projects, mainly owing to the easy availability of workforce and more feasible transportation of equipment.

Offshore exploration requires high capital investment and involves environmental complexities that can lead to operational challenges. Therefore, growing investment in onshore applications is set to boost the segment growth.

To know how our report can help streamline your business, Speak to Analyst

WELL CEMENTING MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Extensive Exploration Activities Fuel Market Growth in North America

North America holds the dominant global well cementing market share, owing to the availability of manufacturers and service providers. The regional market value in 2024 was USD 4.40 billion, and in 2023, the market value led the region by USD 4.14 billion. Extensive exploration operations across the regions mainly drive the rising demand for well cementing services. In addition, the extensive adoption of well cementing techniques in the U.S. is boosting the market growth.

North America Well Cementing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

U.S.

Rising Oil Well Operations to Boost Market Development

The U.S. is the dominating country in North America owing to the high volume of ongoing oil well operations. The U.S. government offers several incentives, such as tax reductions and financial support, to encourage investment in the sector. In addition, businesses are focusing on raising oil production through high investments, further boosting market growth. The U.S. market size is estimated to hit USD 3.88 billion in 2026.

Europe

Growing Energy Demand to Influence Market Growth

Europe is expected to hold the third-largest market size of USD 1.98 billion in 2026. The market in Europe is growing slowly, owing to the multiple macro and micro economic factors. Geo-political instability in the parts of the region presents challenges to oil and gas production. Despite this, emerging countries such as Russia, Norway, and the U.K. continue to generate revenues from oil production, hence supporting the well cementing market. This growth is driven by the growing demand for energy in multiple sectors, such as residential and commercial. The market value in U.K. is expected to be USD 0.11 billion in 2026.

On the other hand, Norway is projecting to hit USD 0.19 billion and Russia is likely to hold USD 1.26 billion in 2025.

Asia Pacific

Rising Capital Expenditures for Exploration Activities to Boost Market Development

Asia Pacific is anticipated to account for the second-highest market size of USD 3.41 billion in 2026, exhibiting the second-fastest growing CAGR of 8.54% during the forecast period. It is one of the emerging regions globally, with demand influenced by rapid economic growth in key countries such as India and China. In addition, the paradigm shift of population toward urban areas is likely to increase further the consumption of oil and gas in different industry verticals, such as transportation, manufacturing, seaborne trade, and aviation. Consequently, major oil and gas companies are extensively increasing their Capex on exploration and production activities in the region. The market value in China is expected to be USD 2.08 billion in 2026.

On the other hand, India is projecting to hit USD 0.31 billion in 2026 and Thailand is likely to hold USD 0.40 billion in 2025.

Latin America

Growing Domestic Production Encourages Market Development

Latin America is home to some of the largest producers of oil and gas in the world, making it an important region for the well-cementing market. In Latin America, the growth is primarily driven by Brazil, Mexico, Venezuela, and Argentina, which concentrate on increasing domestic production of oil and gas. In addition, industrial development across these countries is further fueling demand, with well cementing services playing a vital role in supporting this expansion.

Middle East & Africa

Advancements in Technology to Boost the Market Growth in the Region

The Middle East & Africa is witnessing robust growth due to the adoption of advanced technologies. This region is the fourth-largest market expected to account for USD 0.89 billion in 2026. Countries such as UAE, Saudi Arabia, and Qatar are actively investing in the development of new technologies, with well-cementing playing an important role in enhancing oilfield operations. The Middle East is also a major exporter of crude oil, which makes it a leader in good oilfield services. The region’s growing oil production continues to boost demand for various oil well services, including cementing, thereby supporting market growth across the Middle East & Africa. Saudi Arabia is expected to hit USD 0.12 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Halliburton’s Advanced Solutions to Increase its Market Share Globally

Many leading players are operating in the global well cementing market. Halliburton plays a leading role in the global market, offering a comprehensive range of primary and remedial cementing services. The company provides advanced cementing technologies designed to ensure well integrity, zonal isolation, and long-term performance across various well types, including high-pressure, high-temperature, and unconventional wells. Halliburton’s solutions include innovative cement slurries, placement technologies, and real-time data analysis through its digital platforms, enabling precise execution and performance monitoring. For instance, in May 2024, Halliburton introduced the SentinelCem™ Pro cement system to its lost circulation solutions lineup. Packaged in single sacks, it allows for easier storage, especially in offshore and remote areas. Building on the previous version, SentinelCem Pro simplifies mixing by removing the need for pre-hydration or high-purity water, enabling more efficient rig operations through direct or batch mixing. With a strong global presence and decades of experience, Halliburton is a key partner in both onshore and offshore drilling projects, supporting operators in optimizing wellbore integrity and extending asset life.

List of Key Well Cementing Companies Profiled:

- Halliburton (U.S.)

- Schlumberger (U.S.)

- COSL – China Oilfield Services Limited (China)

- Baker Hughes (U.S.)

- C&J Energy Services (U.S.)

- Trican Well Service Ltd. (Canada)

- Superior Energy Services (U.S.)

- Weatherford (U.S.)

- Calfrac Well Services Ltd. (Canada)

- Allied Oil & Gas Services (U.S.)

- Sanjel Energy Services (Canada)

- Gulf Energy SAOC (Oman)

KEY INDUSTRY DEVELOPMENTS:

- October 2024- Uzma Bhd announced that its subsidiary, Uzma Engineering Ltd, has secured a three-year contract from Philippine Geothermal Production Company Inc (PGPC) to provide drilling cementing services for geothermal wells in the Philippines.

- August 2024- SLB, an oilfield services provider, announced the EcoShield geopolymer cement-free system that reduces CO2 emissions associated with well construction. This development eliminates around 85% of CO2 emissions compared to conservative well-cementing systems.

- August 2024- GA Drilling, a well service provider, declared a partnership with Petrobras, an energy company, to boost the advancement of next-generation deep geothermal drilling technology along with tubing, casing, and cementing.

- November 2023- Expro secured a corporate frame agreement with Equinor ASA to deliver well-testing services on the Norwegian Continental Shelf, covering the Barents, Norwegian, and North Seas. The Stavanger-based team, with support from the Haugesund Fluids Center of Excellence, will handle well flow management and production optimization. The four-year contract, with options to extend for up to six additional years, continues Expro's partnership with Equinor.

- February 2020: Saipem secured multiple EPCI contracts across various countries valued at over USD 500 million. Saudi Aramco awarded the first EPCI contract in the Kingdom of Saudi Arabia as a part of a long-term agreement. In addition, Saipem secured a contract with Eni Angola S.p.A. that was concerned with Cabaca and Agogo's early phase 1 development.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, competitive landscape, and leading source of cementing. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.77% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By Application, and By Region |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market was valued at USD 11.76 Billion in 2026.

The market is likely to grow at a CAGR of 7.77% over the forecast period (2026-2034)

The onshore segment holds the major market share.

The market size of North America stood at USD 4.97 Billion in 2026.

Technological advancements in the oil & gas sector drive market growth.

Some of the top major players in the market are Schlumberger, Halliburton, Weatherford, and Baker Hughes.

The global market is expected to reach USD 21.39 Billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us