Well Casing Market Size, Share & Industry Analysis, By Casing Type (Conductor Casing, Surface Casing, Intermediate Casing, and Production Casing), By Application (Onshore and Offshore), and Regional Forecast, 2026-2034

WELL CASING MARKET SIZE AND FUTURE OUTLOOK

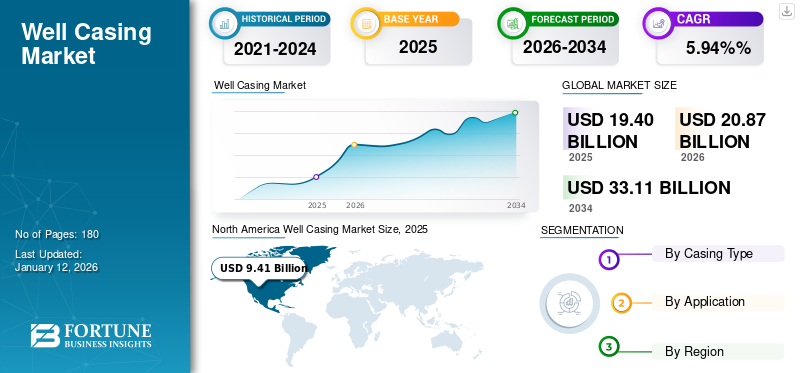

The global well casing market size stood at USD 19.40 billion in 2025. The market is expected to grow from USD 20.87 billion in 2026 to USD 33.11 billion by 2034, exhibiting a CAGR of 5.94% over the forecast period. North America dominated the well casing market with a market share of 48.52% in 2025.

Well casing refers to the operation involved in designing, dispensing, and installing casing systems in the oil, gas & water wells. This is used in various drilling activities, particularly in exploration and production. Well casing delivers structural support for the wellbore, stopping collapse and upholding the structure of the well. It basically consists of steel pipes cemented into the drilled hole.

Growing oil and gas exploration and production activities, rising energy demand, and stricter laws requiring well integrity and safety are the main factors propelling the worldwide well casing market. Furthermore, the demand for reliable casing solutions is fueled by the increasing number of deep-water and horizontal drilling operations.

Schlumberger is a leading player in the well-casing market. It delivers a variety of products and services for well casing, including casing repair, replacement, and evaluation solutions. A strong product portfolio and global presence are driving the company’s revenue growth.

MARKET DYNAMICS

MARKET DRIVERS

Technological Developments in the Drilling Operations Drive Market Expansion

The growing utilization of oil by various industrial sectors including manufacturing, transportation, power, shipping and others, increases the need for petroleum related products. To meet the demand, manufacturers and key players of well casing are focusing on technological advancements. Drilling techniques, hydraulic fracturing, robotics systems, expandable casing, and others, are boosting oil & gas production by delivering accurate support to the operations.

Focus on Enhancing Oil and Gas Production by Businesses to Influence Market Growth

Businesses are continuously investing in the oil & gas industry. This is owing to the growing demand for crude oil, mainly in North America and the Middle East. Ongoing exploration activities and deployment of various methods will grant new oil and gas opportunities across various geographical locations. For example, in July 2024, Saudi Aramco capitalized USD 25 billion in natural gas infrastructure over several contracts to meet growing gas requirements. These initiatives can drive the well casing market growth.

MARKET RESTRAINTS

Unpredictable Market Outlook and Growing Interest in Clean Energy Technology Hampers Market Growth

Crude oil prices in the international market are continuously fluctuating due to socio-political scenarios and economic slowdown. The oil crisis due to Russia and Ukraine crumbled the investment in the oil and gas industry. Additionally, excessive production by OPEC countries reduced the crude price in the international market, causing severe losses to operators. Besides, growing concern over greenhouse emissions and increased investment in clean energy technology set to restrict the growth of the well casing industry.

Download Free sample to learn more about this report.

MARKET OPPORTUNITIES

Growing Need for Oil & Gas Exploration to Generate New Market Opportunities

Oil & gas exploration activities are taking primary place in the energy sector. This is owing to the government's focus on reducing the oil dependency on other countries. In November 2024, India’s exploration potential remained untapped, covering sedimentary basins. The Open Acreage Licensing Policy (OALP) aims to increase operations by 16% in 2025. By 2030, the government intends to expand the nation’s survey land to 1 million square kilometers, further boosting India’s energy security.

MARKET CHALLENGES

Strong Government Regulations to Create Challenges in the Market

Well casing services are one of the crucial components in the oil & gas industry and hence are bound with strict regulation by the government. This is due to the safety and environmental concerns across different regions. In 2021, the Jal Shakti Department of Water Resources, River Development & Ganga Rejuvenation Central Ground Water Authority implemented new regulations for the well casing considering safety. Such initiatives can make a huge impact on service providers and create challenges in the well casing market share.

WELL CASING MARKET TRENDS

Rise in Offshore Drilling Operations to Set New Trends

Many countries are focusing on offshore drilling operations considering geopolitical tensions, OPEC+ supply issues, and others. As per the world oil globally, deep-water investment by oil producers is estimated to grow to around USD 79 billion in 2026 and 2027. This is owing to the rising number of offshore oil rigs in several countries. For instance, the offshore fleet is augmented by 17 to 639 rigs. Utilization scaled around 82%, the highest since 2014.

Impact of COVID-19

Limited Oil Production Impacted the Overall Market Development Amid Pandemic

The COVID-19 pandemic severely impacted the global well-casing market and its relevant areas. This is due to the adverse effect on global demand and supply. Moreover, the pause in oil and gas activities and processes in different regions, including the Middle East & Africa, Europe, North America, and others, led to low production of oil. Various crucial factors included the less access to raw materials, decrease in the availability of machinery, inaccessibility of workers, closed borders, and the restrictions on the import and export of materials, which hampered the market growth.

MARKET SEGMENTATION

By Casing Type

Production Casing Type Leads Due to its Numerous Benefits and Structural Well Integrity

By casing type, the market is segmented into conductor casing, surface casing, intermediate casing, and production casing.

Production casing is projected to dominate the casing type analysis. It is an essential type to provide structural well integrity and pressure control of the hydrocarbon during production.

Since production casing is the last casing string developed and is essential to the safe and effective extraction of hydrocarbons from the well, it commands the largest share of the global market. It is a bigger and more demanding market segment since it has to endure the highest pressures and corrosive environments. The segment is expected to capture 50.13% of the market share in 2026.

Meanwhile, other well casings are also used in well construction operations, such as conductor casing, surface casing, and intermediate casing. All the casings are necessary for good integrity and reliable operations.

Intermediate casing segment is set to grow with a considerable CAGR of 6.73% during the forecast period (2025-2032).

To know how our report can help streamline your business, Speak to Analyst

By Application

Onshore Segment Dominates due to its Economic Feasibility

The market is segmented into onshore and offshore, based on application.

The onshore segment holds the maximum share of the global market. Onshore E&P activities offer many advantages, such as economical and feasible operation, availability of equipment, and personnel. Onshore production is one of the well-known segments that encompasses ease of operation, competitive production, and operational cost compared to offshore production. This segment held 79.89% of the market share in 2026.

However, offshore production seems to grow at a steady rate owing to the high price of recovering untapped hydrocarbon potential.

WELL CASING MARKET REGIONAL OUTLOOK

Geographically, the market is analyzed across five main regions: Europe, North America, Latin America, Asia Pacific, and the Middle East & Africa.

North America

North America Well Casing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Growing Need for Advanced Technology to Stimulate the Market Growth in North America

North America dominated the market with a valuation of USD 9.41 billion in 2025 and USD 10.11 billion in 2026. The region dominates the well casing market due to increasing need for well casing across the region. In addition, widespread implementation of the advanced technique in the U.S. is boosting market growth. The Department of Energy (DoE) of the U.S. is co-operating with different companies to instrument the well casing project and increase production.

U.S.

Rapid Growth in the Well Casing Projects to Boost Market in the U.S.

The U.S. is the leading country in North America due to the numerous ongoing operations. The U.S. gives several incentives, such as tax reductions. In addition, businesses are focusing on raising oil production by providing high investments. Government initiatives to support oil producers are also one of the major factors that boost market growth. The U.S. market is predicted to be worth USD 8.91 billion in 2026.

Europe

Growing Energy Demand to Influence Well Casing Services across Europe

Unstable geo-policies in the European region are slowing the growth of oil and gas production. Despite this, many countries such as Russia, Norway, and the U.K. are continuously generating revenues from oil production and the well casing market. The U.K. market is likely to grow with a value of USD 0.15 billion in 2026. This is owing to the growing demand for energy in multiple sectors, such as residential and commercial. Norway is set to reach USD 0.33 billion in 2025, while Russia is estimated to gain USD 0.91 billion in the same year.

Asia Pacific

Fastest Growing Region Driven by High Oilfield Services

Asia Pacific is the third largest market projected to be valued at USD 2.24 billion in 2026. Asia Pacific is one of the emerging regions globally. This is owing to the massive demand for energy from India and China. Rising population, urbanization, and industrial growth created double growth in oil consumption that directly influenced well construction. China is expected to reach a market value of USD 1.30 billion in 2026. Hence, countries are increasing their investment in E&P activities to reduce foreign dependence on imports of oil and gas. India is set to be worth USD 0.39 billion in 2026, while Indonesia is likely to hold USD 0.26 billion in the same year.

Latin America

Industrial Development in Region Leads to Market Development

Latin America is anticipated to gain USD 1.83 billion in 2026. The region includes different large producers of oil and gas across the world. That is directly connected to the well-casing market. Casing instruments and services are generally deployed in Venezuela and Brazil to upsurge the production of oil. Additionally, countries are focused on developments that will help augment the market growth. This is due to the growth in the industrial verticals, where oil & gas plays vital roles.

Middle East & Africa

Emerging Countries in the Middle East & Africa to Increase Market Growth

The Middle East & Africa is the second largest market expected to hold USD 4.95 billion, registering a CAGR of 23.66% during the forecast period (2026-2034). The Middle East & Africa demonstrated higher growth owing to the adoption of technological developments in well casing. Saudi Arabia, UAE, and Qatar are thriving to innovate technologies where well-casing plays a crucial role. The Middle East is also a major exporter of crude oil, which makes it a leader in effective oilfield services. Oman’s market is predicted to acquire USD 0.83 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Rising Drilling Operations to Influence the Well Casing Market

The global well casing market is moderately competitive, characterized by a mix of large multinational companies and smaller regional competitors. Due to their wide range of products, global reach, and well-established distribution networks, major players including SLB, Vallourec, Halliburton, and Weatherford command a sizable portion of the market. The market does, however, also comprise a large number of regional producers and specialty casing suppliers that compete on the basis of cost, particular product offerings, or localized service.

List of Key Well Casing Companies Profiled:

- Schlumberger (U.S.)

- Halliburton (U.S.)

- Weatherford (U.S.)

- Baker Hughes (U.S.)

- Vallourec (France)

- Parker Drilling Company (U.S.)

- Odfjell Well Services (Norway)

- Gulf Oil & Gas International (UAE)

- Express Energy Services (U.S.)

- Nabors Industries (Bermuda)

- COSL – China Oilfield Services Limited (China)

- Noble Casing & Drilling (U.S.)

KEY INDUSTRY DEVELOPMENTS:

August 2024: A subsidiary of Zefiro Methane Corp., named Plants & Goodwin Inc., recently acquired a minority stake in Winter Hawk Well Abandonment Ltd. and obtained an exclusive U.S. patent license.

August 2024: GA Drilling- a well service provider, declared a partnership with Petrobras- an energy company, to boost the advancement of next-generation deep geothermal drilling technology.

March 2024: MCF Energy- a service provider, deployed production casing at Austria's Welchau-1 discovery of extensive condensate and oil-rich gas. Last licenses and drill rig procurement are expected to come in 2025.

November 2023: Oilfield service company Expro completed a well cement placement project for an unidentified "big international operator" in the Gulf of Mexico. Expro also delivered an inner-string cementing on a subsea well's 22" surface casing in a water depth of around 2,000 meters in the Mississippi Canyon area.

February 2020: Saipem secured multiple EPCI contracts in various countries around the world worth over USD 500 million. The first EPCI contract was awarded by Saudi Aramco in the Kingdom of Saudi Arabia as a part of a long-term agreement till 2021. In addition, Saipem secured a contract with Eni Angola S.p.A. that was concerned with Cabaca and Agogo's early phase 1 development.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, products, services, process, and competitive landscape. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.94% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Casing Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 19.40 billion in 2025.

The market is likely to grow at a CAGR of 5.94% over the forecast period (2026-2034)

The onshore segment is expected to lead the market due to the rapid electrification.

The market size of North America stood at USD 9.41 billion in 2025.

Technological developments in the drilling operations are driving the market.

Some of the top major players in the market are Schlumberger, Halliburton, Weatherford, and Baker Hughes.

The global market size is expected to reach USD 33.11 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us