Wireline Services Market Size, Share & Industry Analysis, By Well Type (Open Hole and Cased Hole), By Service (Electric Line and Slick Line), By Location (Onshore and Offshore), By Application (Well Completion, Well Intervention, and Well Logging), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

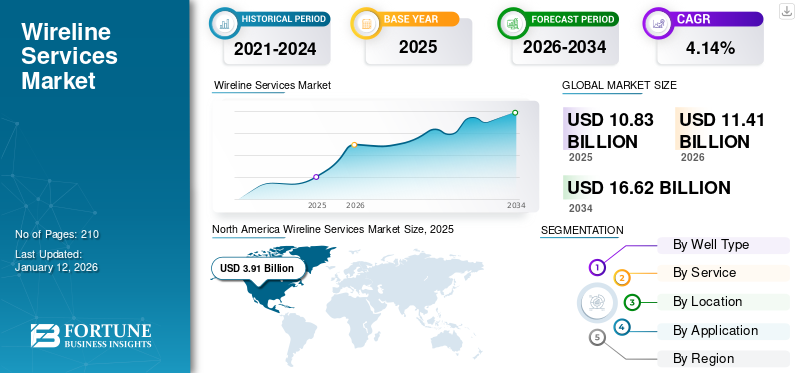

The global wireline services market size was valued at USD 10.83 billion in 2025. The market is projected to grow from USD 11.41 billion in 2026 to USD 16.62 billion by 2034, exhibiting a CAGR of 4.14% during the forecast period of 2026-2034. North America dominated the wireline service market with a share of 36.11% in 2025.

The wireline service market growth is driven by the increasing demand for oil & gas products and the rising exploration of shale gas reserves to meet energy needs. The increasing demand for oil and gas products across the globe, along with the discoveries of oil & gas reservoirs, is expected to propel the demand for wireline services. Oil well operators are increasingly investing in production & exploration activities to cater to the growing energy demand. Increasing oil & gas investments are fostering E&P activities at different locations, along with the adaptability for advanced techniques, which is expected to augment market growth in the near future. The market is expected to witness significant growth owing to factors such as the increasing demand for energy, significant technological advancement in wireline services, and the growing need to achieve higher accuracy in exploration activities.

Schlumberger is one of the prominent players and offers a range of wireline products and services for oil and gas wells, including logging, intervention, and tractors.

MARKET DYNAMICS

MARKET DRIVERS

Rising Awareness on Extending Life of Mature Oil Fields will Boost Growth

Growing initiatives for facilitating drilling techniques to augment the production and existence of mature and old wells in various regions is set to boost market growth. For instance, in January 2025, Saudi Aramco launched a tender worth USD 2 billion for capacity sustenance at the Safaniyah oilfield, which holds 37 barrels of oil reserves located in the Persian Gulf. Therefore, these companies are primarily focused on increasing recovery and extending the life of mature fields by using advanced technologies such as EOR technologies. Thermal EOR is used to improve the production of heavy oil, which helps to boost market growth.

Increasing Focus toward Technological Advancements in Wireline Services to Fuel Market Growth

Increasing focus on the operational performance of oilfield equipment and a decline in capital expenses have enabled the adoption of smart digitized devices, services, and solutions. Oilfield service providers are using advanced wireline technology in cabling technology for introducing down or lifting any type of instrument or equipment in and out of the wellbore. Moreover, market players are also focused on collaboration to expand their market offerings and increase their global footprint. For instance, in June 2020, Schlumberger collaborated with China Petroleum Logging Co. Ltd. to develop wireline downhole technology in China. This collaboration enhanced the manufacturing process of fit-for-basin wireline technology by China Petroleum Logging Co. Ltd. The primary functions catered by wireline services include intervention, pipe recovery, well completion, and evaluation of reservoirs, which are heavily adopted to increase the operational performance of oil wells, helping to drive the market growth during the forecast period.

MARKET RESTRAINTS

Volatility in Oil Prices and Rising Trend of Adopting Renewable Energy to Restrain Growth

The oil price is primarily subjected to the demand and supply of oil, which fluctuates significantly. The low cost of oil is likely to delay the upcoming projects and affect investments. The growing trend of integrating alternative energy sources, which includes solar, wind, and hydro, would reduce the dependency on fuels of oil & gas, which is likely to affect the services market in the oil & gas industry. Hence, volatility in oil prices, along with the growing trend for adopting renewable energy, will limit the market growth in the projected time frame.

MARKET OPPORTUNITIES

Increasing Oil & Gas Drilling and Completion Activities is Expected to Create Lucrative Opportunities

Increased drilling and completion activities are key aspects for the future outlook of the wireline services market. The factors mentioned above boost the requirement for precise, real-time downhole data to optimize well performance and recovery. As operators intensify exploration in both conventional and unconventional sources, especially in shale and deepwater environments, wireline services become critical for well logging, intervention, and completion tasks. This growing activity supports increased efficiency by reducing rig time and increasing well life through enhanced reservoir evaluation. Hence, the growing emphasis on efficient oil & gas drilling is expected to boost market opportunities in the coming years.

MARKET CHALLENGES

Technological Complexity and High Costs to Create Challenges for Market Players

The wireline services market is increasingly challenged by the technical complexity and high costs associated with advanced well intervention and logging operations. As oil & gas exploration is executed in geologically complex reservoirs, the need for sophisticated wireline tools, such as high-resolution logging sensors, real-time monitoring systems, and advanced perforation technologies, continues to grow. However, the expensive deployment and maintenance of these technologies make it difficult for smaller service providers to compete with larger and well-funded organizations. High operation costs, including specialized equipment, skilled labor, and research & development, further restrain the profitability in the market based on oil prices.

WIRELINE SERVICES MARKET TRENDS

Growing Investment in Subsea Oil & Gas Assets is a Current Trend

The offshore production is escalating the demand for oilfield services. Also, the increasing investment in subsea oil & gas assets would result in the wireline services market growth during the forecast period. Oil field operators are investing considerably in offshore assets to increase their well productivity, reservoir performance, and overall life cycle of the well. Deepwater activities are projected to grow in the coming year. For instance, in February 2025, BP announced plans to expand its operations in the Shah Deniz gas field offshore Azerbaijan with the drilling of an additional six wells. This is further resulting in the high demand for oilfield services, which includes wireline services, drilling, completion, and workover services across the globe.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The outbreak of the COVID-19 pandemic had the most significant impact on the downstream oil market by the crash in crude oil prices, which eventually harmed production and exploration activities as well. The key players in the oil & gas industry are struggling with declining demand, business stability, ensuring employee safety, oil price war, and consistently focusing on building a flexible business model that helps to lead to long-term resilience over the post-COVID scenario. The spread of coronavirus forced many oil & gas companies to slow down their operations, which hampered production in the upstream and downstream sectors. Amid the increasing transmission, many industries across the globe, such as automotive, aviation, power, manufacturing, and transportation, experienced a downfall in their business growth.

The spread of the virus posed a significant threat to the global wireline services market owing to the lockdown in transportation, industrial, and commercial operations, halt in upcoming exploration projects, and considerable hindrances in the supply chain of oil & gas. The oil & gas companies are seeking to achieve disruptive opportunities and formulating pioneering business models to achieve growth. Key companies across the globe also delayed major oil & gas projects. Furthermore, the pandemic affected crude oil prices, well operation, and production activities dramatically.

SEGMENTATION ANALYSIS

By Well Type

Benefits Provided by Cased Hole Type is Anticipated to Propel Growth of Well Type Segment

Based on well type, this market is segmented into an open hole and cased hole.

The cased hole segment is estimated to hold the largest market share owing to the benefits offered by the product, which include determining the state of cement, corrosion, and perforation. In a cased hole, both gamma-ray and neutron porosity can be run through. Additionally, better ideas regarding thermal decay and interval transit can be achieved through hydrocarbon saturation, porosity, and producibility measurements. The segment is expected to capture 87.52% of the market share in 2026.

The open hole segment is also projected to grow at a considerable CAGR of 5.98% during the forecast period (2025-2032), owing to the deployment of sensors to measure every aspect of reservoirs on-site and in real time.

By Service

Increasing Application of Electric Line During Exploration Activities to Boost Service Segment

Based on service, this market is segmented into an electric line and slick line.

The electric line segment is expected to hold the largest market share of 76.50% in 2025, as it improves efficiency and avoids capital wastage by having information on oil field capacity.

The slick line segment is growing steadily with a substantial CAGR of 6.19% during the forecast period (2025-2032), as standard cable wire is used to retrieve tools and equipment, and is estimated to grow owing to limited mechanical operation.

By Location

Surging Shale Gas Production from Onshore Locations to Augment Onshore Segment

Based on location, this market is divided into onshore and offshore.

The onshore segment accounted for the largest market revenue share of 63.37% in 2024, owing to the presence of large oil & gas reserves across the globe. The ongoing trend toward adopting cleaner sources of energy to reduce carbon emissions has witnessed considerable investments in shale gas production in the coming years. This has witnessed an increase in the onshore activities being carried out to explore shale gas. This trend for producing shale gas reserves is attributed to the growth of the onshore segment over the projected period. For instance, in February 2025, Rhino Resources announced the discovery of hydrogen carbons in Orange Basin, located in Offshore Namibia.

The offshore segment is also anticipated to grow significantly over the forecast period due to increasing investments in drilling activities.

By Application

To know how our report can help streamline your business, Speak to Analyst

Increasing Demand for Shale Gas will Aid Growth of Well Completion Segment

Based on application, the market is broadly categorized into well intervention, well completion, and well logging.

The well logging segment is estimated to hold a larger market share of 69.09% in 2025, owing to the increasing demand for drilling new wells for producing shale gas and crude oil exploration.

The well intervention segment is also projected to grow with a significant CAGR of 5.74% during the forecast period (2025-2032), owing to the existence of mature and aged oil wells, which creates the need to increase the efficiency of an oil well.

The well completion segment is also anticipated to grow owing to a growing concern for gaining real-time data for monitoring the well.

WIRELINE SERVICES MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Wireline Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Presence of Major Oil & Gas Reserves Drives Market Growth in the Region

North America accounted for the largest market share with a valuation of USD 3.91 billion in 2025 and USD 4.12 billion in 2026, which is mainly driven by the significant presence of oil and gas reserves in the region, particularly from shale formations, leading to high demand for well evaluation and intervention services through wireline logging to optimize production and enhance reservoirs. Furthermore, the market growth is also fueled by increasing drilling and completion activities in the U.S. and Canada, with the U.S. holding the dominant market share due to its robust shale development and growing energy independence.

U.S.

Rising Oil & Gas Exploration Activities Drive the Market Growth in the Country

The U.S. wireline services market share is driven by increasing oil & gas exploration, and shale formations, particularly in the Permian basin, supported by the high crude oil prices and increased upstream investment. Moreover, regulatory requirements for well integrity and environmental safety also contribute to market growth. The U.S. market is set to be valued at USD 3.09 billion in 2026.

Europe

Increasing Offshore Exploration Activities to Boost Market Growth in Europe

Europe is the second largest market set to be valued at USD 2.91 billion in 2026, exhibiting a CAGR of 5.14% during the forecast period (2025-2032). The European market is driven by increasing offshore oil & gas exploration, particularly in the North Sea, where aging wells require maintenance and intervention. The U.K. market continues to grow, projected to reach a market value of USD 0.26 billion in 2026. The increasing push toward energy security amid geopolitical tension in the region has led to renewed investments in domestic hydrocarbon production. Moreover, growing carbon capture and storage projects will also create new opportunities for wireline services in reservoir evaluation and monitoring over the forecast period. Norway is estimated to be worth USD 0.54 billion in 2025, while Russia is expected to reach USD 1.01 billion in the same year.

Asia Pacific

Increasing Investments Oil & Gas Exploration to Boost Market Growth in the Region

Asia Pacific is the third largest market anticipated to reach a market value of USD 2.08 billion in 2026. The Asia Pacific market is poised to witness lucrative growth driven by increased exploration for offshore oil & gas in India, Malaysia, and Australia to meet energy demand. Furthermore, growing investments in deep water projects supported by government policies and energy security initiatives are fueling market expansion. Moreover, the region’s focus on natural gas development, including LNG projects, is also contributing to the increased demand for wireline services in reservoir evaluation. India is predicted to be valued at USD 0.46 billion in 2026, while Southeast Asia is likely to reach USD 0.28 billion in the same year.

China

China is Largest Market in Region for Wireline Services Due to Presence of Major Oil & Gas Reserves

China poses a lucrative market for wireline services owing to the presence of substantial unconventional hydrocarbon resources, including shale gas and coal bed methane. The development of these resources necessitates specialized wireline services to understand the complex geological formations and to design effective extraction strategies. China is predicted to grow with a value of USD 0.54 billion in 2026.

Moreover, the Chinese government has been actively investing in the upstream oil and gas sector to enhance domestic production. Policies supporting exploration and production activities are expected to create a favorable environment for the wireline services market in the coming years.

Latin America

Presence of Potential Oil & Gas Reserves to Create Growth Opportunities for Wireline Services Industry Players

The growing demand for advanced well intervention and logging operations in both onshore and offshore oil fields is expected to drive market growth in the region. The expansion of oil and gas exploration activities, particularly in deepwater and unconventional resources, is fueling the demand for specialized wireline services such as logging, perforating, and reservoir monitoring. Furthermore, the rising focus on improving operational efficiency, reducing production downtime, and enhancing wellbore integrity is expected to drive demand for wireline services in the region over the forecast period.

Middle East & Africa

Robust Oil & Gas Production Drives Market Growth in the Region

The Middle East & Africa is the fourth largest market estimated to be worth USD 1.54 billion in 2026. The market in the Middle East & Africa is witnessing huge investments from regional companies in the oil & gas industry to increase the production of oil & gas, which results in the growth of the wireline services market. Hence, increasing production and exploration projects boost the application of wireline services for pipe recovery, intervention, reservoir evaluation, and other applications, which will further aid market growth. The GCC market is anticipated to reach a revenue share of USD 0.75 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Schlumberger and Weatherford Focus on Drilling Expansion to Foster Market Growth

Key players are developing advanced technologies and featured services for production and exploration in the oil & gas industry. For instance, in January 2025, Schlumberger was awarded a major offshore drilling contract by Shell PLC for the development of ultra-deepwater assets located in the North Sea, Tobago, and the Gulf of Mexico. Companies are also focused on undergoing different mergers & acquisitions, product development, and JV's to strengthen their position in a competitive environment. Companies are also focused on delivering a complete set of services and solutions for efficiently carrying out numerous tasks across all phases of the oil & gas industry.

List of Key Wireline Services Companies Profiled

- Schlumberger (U.S.)

- Baker Hughes (U.S.)

- Halliburton (U.S.)

- Weatherford (U.S.)

- China Oilfield Services Limited (China)

- National Oilwell Varco (U.S.)

- Archer Limited (U.K.)

- Superior Energy Service Inc. (U.S.)

- FMC Technologies (U.S.)

- Weir Oil and Gas (U.K.)

- Emerson (U.S.)

- Weltec (Denmark)

- Schneider Electric (France)

- Siemens (Germany)

- Petrofac (U.S.)

KEY INDUSTRY DEVELOPMENTS

- December 2024 – Halliburton launched the Intelli suite to cater to diagnostic well intervention wire logging services to enhance production with extended asset life and reduced operational costs.

- November 2023 – Noble Helium announced the completion of drilling at the Mbelele-2 well located in Tanzania with a wireline logging and sampling program.

- March 2023 – Halliburton Europe announced the completion of an offshore wireline services contract with Croatian INA Group in the Adriatic Sea. The contract included wire logging operations in four wells, which took 272 hours of operational time.

- February 2022 – ADNOC awarded wireline logging and perforation services contract to Schlumberger Middle East S.A., Weatherford Bin Hamoodah Company LLC., and Halliburton Worldwide Ltd Abu Dhabi worth USD 1.94 billion to boost oil wells drilling in the Middle East.

- February 2021 – Equinor awarded an integrated wireline supply contract within well intervention of Equinor’s fixed platforms for a duration of years starting from May 2021. The contract also includes a three year extension option with wireline services to other mobile operational units.

Investment Analysis and Opportunities

The wireline services market showcase steady investment potential, supported by ongoing demand for well logging, intervention, and completion in oil & gas exploration. As energy companies focus on maximizing output from mature fields, wireline tehcnologies remain essential, especially in complex and deepwell operation.

- January 2025 – Chevron Corporation announced expansion plans with the largest oilfield located in Kazakhstan, which is expected to boost crude oil production by 260,000 barrels per day (bpd), which will increase demand for wireline services in the region in the future.

- August 2024 – Oilmax Energy announced expansion plans with an investment of USD 100 million with the aim to double hydrocarbon reserves and increase oil & gas production in India. Moreover, the company also aims to boost hydrocarbon reserves from 60 million barrels to over 10,000 barrels of oil eq Barrels of Oil Equivalent Per Day (BOEPD). Such investment initiatives are expected to boost opportunities in the wireline services market in the coming years.

REPORT COVERAGE

The global wireline services market report delivers a detailed insight into the market. It focuses on key aspects, such as leading companies. Besides, it offers regional insights and global market trends & technology and highlights key industry developments. In addition to the factors above, it encompasses several factors and challenges that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.14% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Well Type, Service, Location, Application, and Region |

|

Segmentation |

By Well Type

|

|

By Service

|

|

|

By Location

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 11.41 billion in 2026.

The market is likely to grow at a CAGR of 4.14% during the forecast period of 2026-2034.

The well completion segment is expected to lead the market during the forecast period.

The market size of North America stood at USD 3.91 billion in 2025.

Rising awareness of extending the life of mature oil fields will boost market growth.

Some of the top players in the market are Halliburton, Schlumberger, Weatherford, and others.

The global market size is expected to reach USD 16.62 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us