Innovation Management Market Size, Share & Industry Analysis, By Component (Software and Services), By Function (Product Development and Business Process), By Enterprise Type (Large Enterprises and SMEs), By Application (Project Management Platforms, Design & Idea Management Platforms, Human Resource Platforms, Marketing Platforms, and Others), By End-user (BFSI, Retail, IT & Telecom, Healthcare, Education, Government, and Others), and Regional Forecast, 2026 – 2034

INNOVATION MANAGEMENT MARKET OVERVIEW AND FUTURE OUTLOOK

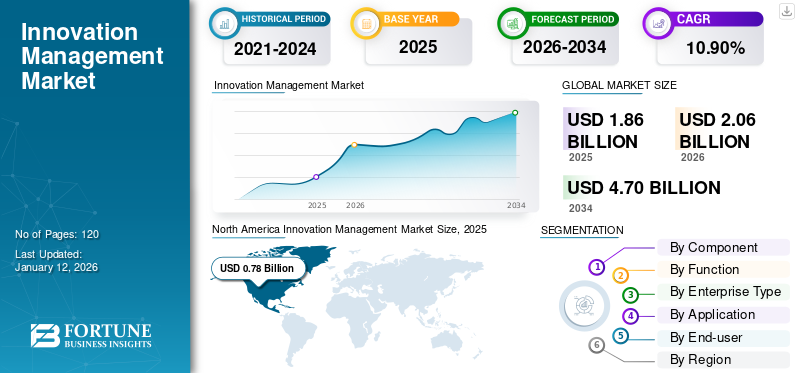

The global innovation management market size was valued at USD 1.86 billion in 2025 and is projected to grow from USD 2.06 billion in 2026 to USD 4.70 billion by 2034, exhibiting a CAGR of 10.90% during the forecast period. North America dominated the market with a share of 38.74% in 2025.

Innovation management refers to managing an enterprise's entire innovation lifecycle, from its initial stage of ideation to its final implementation stage. It encompasses the activities, decisions, and strategies of planning and implementing innovation strategy, enabling organizations to launch new products or business models successfully.

Businesses are increasingly focusing on the adoption of cloud-based solutions for flexible and scalable solutions such as innovation management software. These solutions help businesses to adapt to rapid changes in the market and drive digital transformation. Thus, a growing focus on digital transformation and technological advancements plays an important role in driving market growth during the forecast period.

The market is dominated by established key players, such as Traction Technology, IdeaScale, InnovationCast, Hype Innovation, and Qmarkets. These players focus on engaging in partnerships with AI, cloud, and data analytics companies to enhance their platforms’ technological performance. Additionally, companies are entering into co-development agreements with startups, universities, and research institutes to access new technologies.

The COVID-19 pandemic had a positive impact on the market, as the pandemic forced businesses across the globe to adopt digital solutions quickly to maintain operations and engage with customers. Governments of multiple countries across the globe introduced funding programs and innovation grants to support businesses affected by the crisis. The healthcare and technology sectors, in particular, received financial support to drive product development and research and development activities.

IMPACT OF GENERATIVE AI

AI-Driven Personalization and Customization to Aid Market Growth

Generative AI helps businesses implement new ideas and creative solutions more efficiently by identifying patterns, analyzing large datasets, and suggesting innovative concepts. AI-enabled businesses are capable of quickly and efficiently analyzing competitors’ strategies, customer behavior, and market trends to develop high-potential ideas and accelerate decision-making. AI models trained on strategic frameworks, historical data, and case studies will outpace traditional strategy consultants for fixed tasks. Additionally, generative AI helps businesses modify products and services according to customer needs by analyzing customer feedback and behavior. This approach boosts the development of personalized and customer-centric innovations. For instance,

- In April 2024, Qmarkets, a provider of an innovation management platform, launched a next-gen AI innovation management solution. The solution includes automated doc summary and automated idea summary, allowing customers to leverage the abilities of generative AI throughout their innovation tools.

MARKET DYNAMICS

Market Drivers

Increasing Investments in Digital Technologies to Drive Market Growth

Technology is one of the most significant driving factors of innovation. Technological innovation involves incorporating and developing novel technologies to improve products and services, helping businesses uphold a competitive edge and drive growth. Innovation tools play a crucial role in leveraging emerging and current technologies to achieve business goals. Companies are investing heavily in digital technologies to improve customer experience and business operations, ensuring seamless execution. Innovation management platforms help businesses effectively manage the influx of new ideas and digital initiatives. As a result, organizations are increasingly adopting digital tools and platforms for innovation management to streamline processes and boost efficiency.

- For instance, in October 2022, Miro, a collaboration platform provider, unveiled Miro Labs, a novel innovation program. The program is designed to help businesses inspect new product functionalities and combinations to improve teamwork of variable group sizes.

Market Restraints

High Implementation Costs and Complexity of Integration May Hinder Market Growth

Installing and maintaining an innovation management platform may require a large amount of initial investment for software installation, infrastructure deployment, and training models. This requirement of significant upfront investment may restrict small and medium-sized enterprises from adopting such platforms owing to the limited availability of funds. In addition, implementing these platforms with an organization’s existing infrastructure can be difficult and time-consuming. In a few cases, it may lead to operational disruptions and may cause a financial burden, thereby hindering market growth.

Market Opportunities

Rising Adoption of Artificial Intelligence and Machine Learning Among Businesses to Present Lucrative Opportunities for Market Growth

Artificial intelligence (AI) and machine learning (ML)-driven solutions can automate trend analysis, idea creation, and decision-making processes. Businesses are increasingly adopting these technologies to recognize market gaps and develop competitive solutions. Artificial intelligence is considered a powerful tool for innovation management, enabling businesses to analyze customer feedback and behavior effectively. The adoption of AI-driven innovation tools helps create personalized platforms and services to enhance customer experience. In addition, emerging economies in Asia Pacific, the Middle East & Africa, and South America are making massive investments in digital technology and modern infrastructure. This trend creates a lucrative opportunity for market players to expand their footprints in emerging markets.

- For instance, in June 2024, in Quarter 4 of 2023, SAP provided businesses with over 50 novel AI innovation solutions. These AI-driven solutions empower businesses to design data-driven, connected, and employee-centric solutions, leading to HR innovation and efficiency.

Innovation Management Market Trends

Growing Emphasis on Open Innovation Model is Fueling Market Growth

Increasing interest in open innovation is driving businesses to engage in partnership with external partners, including startups, research institutes, suppliers, and customers, to develop innovative solutions. This approach fosters a broader and more diverse innovation ecosystem. Furthermore, organizations are significantly adopting crowdsourcing platforms to gather insights from industry experts and customers. Open innovation models enable businesses to license technologies from external sources, fuel product development, and minimize research and development costs. The creation of an innovative platform allows businesses to involve customers directly in the product development process, improving customer engagement. Thus, these factors are expected to significantly fuel the innovation management market growth during the forecast period.

SEGMENTATION ANALYSIS

By Component

Rising Demand for Centralized Platform for Idea Management Boosted the Software Requirement

Based on component, the market is bifurcated into software and services.

The software segment captured the largest market share of 64.40% in 2026, as it provides a single platform for organizing, capturing, and analyzing ideas from sources such as partners, customers, and employees. Innovation management software is a structured database, ensuring that valuable insights are retained and acted upon promptly. Additionally, cloud-based software enables real-time collaboration among teams across different locations, enhancing communication and teamwork.

The service segment is anticipated to grow at the highest CAGR during the forecast period, as consulting services provide insights from experts to manage innovation processes. This plays an important role in helping organizations align innovation initiatives with overall business goals. Additionally, professional services provide training programs to equip the workforce with the skills needed to utilize innovation tools effectively

By Function

Increasing Demand for Novel Technologies to Optimize Business Processes Boosted the Popularity of the Segment

Based on function, the market is divided into product development and business process.

The business process segment captured the largest market share in 2024. In a fast-paced world, where technology is advancing rapidly, many businesses fall behind due to the lack of adoption of the latest technologies in their business model. As a result, businesses are increasingly focusing on integrating novel technologies into business processes to ensure that new products and services reach the market and gain faster demand. The segment is estimated to attain 60.86% of the market share in 2026.

The product development segment is expected to grow at the highest CAGR of 13.48% during the forecast period (2025-2032), as it focuses on creating new offerings to attract customers. This approach helps gain new customers and motivates repeat purchases from existing ones. In product development, businesses prioritize understanding the need of customers and designing products that fulfill those needs.

By Enterprise Type

Growing Emphasis on Partnerships and Open Innovation Encouraged Large Enterprises Segment Growth

Based on enterprise type, the market is bifurcated into large enterprises and SMEs.

The large enterprises segment captured the largest market share in 2024. Large enterprises have a large number of resources and significant market influence, enabling them to form partnerships with research institutes, startups, and technology providers. Such collaboration supports open innovation and cross-industry cooperation, driving innovation initiatives. The segment is set to hold 78.10% of the market share in 2026.

The SMEs segment is anticipated to grow at the highest CAGR of 9.10% during the forecast period. SMEs benefit from cost-effective cloud-based innovation management platforms and open-source tools to drive innovation without the need for large capital investment. Additionally, SMEs are more agile, enabling them to quickly develop and test new products or services, thereby shortening innovation cycles and improving responsiveness to market demands.

By Application

Early Risk Identification Boosted the Project Management Platforms Segment Growth

Based on application, the market is categorized into project management platforms, design & idea management platforms, human resource platforms, marketing platforms, and others (collective intelligence & prediction platforms).

The project management platform segment captured the largest market share in 2024, as it enables businesses to identify potential risks early in the innovation process, allowing for timely and appropriate actions. Advanced technologies such as artificial intelligence (AI) and data analytics help managers identify and handle risks beforehand, keeping projects on track. This segment is likely to capture 33.07% of the market share in 2026.

The marketing platform segment is expected to grow at the highest CAGR of 14.34% during the forecast period. This growth is driven by the growing uptake of new marketing strategies that enhance product promotion and customer engagement. These strategies involve innovative branding, leveraging digital marketing, or expansion into new markets.

By End-user

To know how our report can help streamline your business, Speak to Analyst

BFSI Segment Dominated due to Integration of Advanced Technologies

Based on end-user, the market is classified into BFSI, retail, IT & telecom, healthcare, education, government, and others (media & entertainment).

The BFSI segment captured the highest market share in 2024, as the innovation management solutions help banks and financial institutions design customer-centric offerings, such as AI-driven customer service, personalized financial products, and real-time fraud detection. The integration of AI and machine learning technologies with innovation platforms enables predictive analysis and the delivery of tailored financial recommendations. This segment is set to hold 27% of the market share in 2025.

The healthcare segment is anticipated to grow at the highest CAGR of 13.85% during the forecast period. Healthcare organizations are increasingly adopting innovation platforms to develop and expand telehealth services, enabling remote consultations and monitoring. Furthermore, AI-driven diagnostic tools and remote patient monitoring systems significantly enhance patient care while reducing the need for hospital visits.

INNOVATION MANAGEMENT MARKET REGIONAL OUTLOOK

Geographically, the global market analysis covers North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

North America

North America Innovation Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest innovation management market share with a valuation of USD 0.78 billion in 2026 and USD 0.72 billion in 2025, owing to the rise in funding programs by the governments of the U.S. and Canada. Through funding programs, governments aim to help businesses invest in research and development activities and innovation platforms. In addition, tech companies are also investing in innovation platforms to enhance their business process.

- For instance, in April 2022, Amazon.com, Inc., invested around USD 1 billion in the Amazon Industrial Innovation Fund (AIIF) to enhance supply chain and innovation in logistics operations. This investment aimed to improve employee productivity and customer experience.

Download Free sample to learn more about this report.

In the U.S., the presence of leading technology firms, such as Google, IBM, Microsoft, and Amazon, supports market growth. These companies are significantly investing in innovation platforms to drive product development and increase market competition. Moreover, U.S.-based companies are increasingly engaging in open innovation by partnering with research institutions, startups, and technology providers, significantly contributing to market growth across the country. The U.S. market is experiencing growth and is expected to hit USD 0.53 billion in 2026.

South America

The adoption of biometrics is growing significantly in South America. Companies operating in Brazil, Argentina, and Chile are using innovation management platforms to adopt smart manufacturing and precision agriculture techniques. The adoption of IoT and AI technologies plays an important role in improving crop yields, supply chain transparency, and resource efficiency in the agriculture sector. Furthermore, Fintech is a major driver of innovation, as many fintech firms across South America are majorly focusing on developing mobile payment systems and digital wallets to enhance customer experience.

Europe

Europe is the third largest market, anticipate to be valued at USD 0.46 billion in 2026. In Europe, the market is growing at a prominent pace. European manufacturers are increasingly adopting innovation platforms to implement industry 4.0 technologies, including IoT, robotics, and automation. The U.K. market continues to expand, projected to reach a value of USD 0.08 billion in 2026. For instance, the EU’s Horizon Europe program, a research and innovation programme for 2021-2027, has a budget of approximately USD 100 billion. Through this program, the EU supports innovation in areas such as healthcare, climate, and digital transformation across the region. Germany is set to grow with a valuation of USD 0.09 billion in 2026, while France is estimated to hold USD 0.07 billion in 2025.

Middle East & Africa

The Middle East & Africa is the fourth largest market, expected to attain USD 0.15 billion in 2026. This region is the second fastest to grow with a CAGR of 14.02% during the forecast period. The rise in strategic partnerships is playing a vital role in advancing innovation management services. For instance,

- In April 2024, Microsoft engaged in a partnership with Abu Dhabi’s G42, investing USD 1.5 billion to boost AI development and global expansion, showcasing technological advancements in the region.

Furthermore, Dubai has emerged as a hub for technological advancements, with events such as Fashion Futures Dubai highlighting the intersection of innovation and sustainability in the fashion industry. The GCC market is set to be valued at USD 0.04 billion in 2025.

Asia Pacific

Asia Pacific is the second largest market expected to hold USD 0.55 billion in 2026. The region is experiencing rapid urbanization and digital transformation, fueling the need for innovative products and business models. China is projected to reach a market value of USD 0.13 billion in 2026. Countries such as China, India, Japan, and South Korea are investing in digital infrastructure and research and development activities to support innovation platforms.

- For instance, according to a Bain & Company, Inc. report published in FY 2023, India’s Healthcare innovation opportunity was valued at USD 30 billion, driven by the healthcare and pharma sectors. The innovation opportunity is anticipated to reach approximately USD 60 billion by FY 2028, supported by structural ecosystem enhancements, such as partnership engagements.

India is estimated to reach a valuation of USD 0.09 billion in 2026, while Japan is expected to gain USD 0.11 billion in 2025.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Market Players are Focusing on Partnership and Acquisition Strategies to Expand Their Customer Base

Key players are focusing on expanding their global geographical presence by presenting industry-specific services. Major players are strategically pursuing acquisitions and collaborations with regional players to maintain dominance across various regions. Top market participants are launching new solutions to increase their consumer base. Additionally, continuous R&D investments for product innovations are enhancing market expansion. Hence, top companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

List of Key Innovative Management Companies Profiled:

- BrightIdea Inc. (U.S.)

- Planview (U.S.)

- Traction Technology (U.S.)

- IdeaScale (U.S.)

- InnovationCast (Portugal)

- Innovation Cloud (Luxembourg)

- Hype Innovation (Germany)

- Salesforce Inc. (U.S.)

- Qmarkets (Israel)

- Questel (France)

- Innosabi GmbH (Germany)

- Cognistremer (Belgium)

- Crowdicity Ltd. (U.K.)

- Medallia (U.S.)

- Sopheon (U.S.)

- ITONICS (Germany)

- TCGen Inc. (U.S.)

- Wazoku (U.K.)

- Nosco (Denmark)

- Anaqua, Inc. (U.S.)

….and more

KEY INDUSTRY DEVELOPMENTS:

January 2025: Salesforce engaged in a partnership with IBM Corporation. Through this collaboration, the company aims to develop a new AI Innovation Centre in Riyadh to upskill over 30,000 Saudi citizens by 2030.

February 2024: Wellspring Worldwide completed the acquisition of Sopheon, a provider of innovation management solutions. Through this acquisition, the company aimed to help customers efficiently manage the innovation process from the initial stage to the final stage of implementation.

February 2024: Hype Innovation, a software provider company, acquired Planbox. Through this merger, Hype Innovation aims to develop technologically advanced innovation platforms tailored to the needs of businesses.

January 2024: ITONICS engaged in a partnership with Navispace, a provider of open innovation competitions between startups and corporates. Through this collaboration, the company aims to provide an optimized end-to-end innovation workflow in the agriculture, healthcare, energy, and construction sectors.

November 2022: Coforge engaged in a partnership with the Mack Institute for Innovation Management. This collaboration supports academic and industry communities to transform research through innovative methods.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key players operating in the market, such as Traction Technology, IdeaScale, InnovationCast, Hype Innovation, and Qmarkets, are increasingly adopting IoT and big data technologies as they enable organizations with real-time insights into market trends, operational efficiency, and customer needs. Innovation-focused policies, especially in North America, EU, and GCC countries, are encouraging corporate investment in innovation platforms and programs. Industries such as healthcare, retail, and financial sectors are significantly investing in innovation platforms to address industry-specific problems, support agile transformation, R&D optimization, digital product developmet, and growth opportunities for vendors. These factors are expected to create a lucrative opportunity for market growth.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component, Function, Enterprise Type, Application, End-user, and Region |

|

Segmentation |

By Component

By Function

By Enterprise Type

By Application

By End-user

By Region

|

|

Companies Profiled in the Report |

BrightIdea Inc. (U.S.), Planview (U.S.), Traction Technology (U.S.), IdeaScale (U.S.), InnovationCast (Portugal), Innovation Cloud (Luxembourg), Hype Innovation (Germany), Salesforce Inc. (U.S.), Qmarkets (Israel), Questel (France), etc. |

Frequently Asked Questions

The market is expected to reach USD 4.70 billion by 2034.

In 2025, the market was valued at USD 1.86 billion.

The market is projected to grow at a CAGR of 10.90% during the forecast period.

By application, the project management platforms segment led the market in 2025.

Increasing investments in digital technologies are driving market growth.

BrightIdea Inc., Planview, Traction Technology, IdeaScale, InnovationCast, Innovation Cloud, Hype Innovation, Salesforce Inc., Qmarkets, and Questel are the top players in the market.

North America held the highest market share in 2025.

By end-user, the healthcare segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us