Ion Exchange Resins Market Size, Share & Industry Analysis, By Type (Cationic, Anionic, and Others), By End-Use Industry (Power, Chemicals & Petrochemicals, Food & Beverages, Electrical & Electronics, Pharmaceuticals, Metals & Mining, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

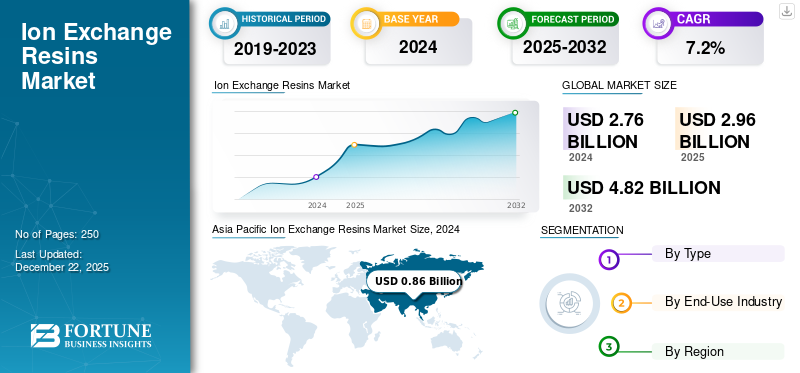

The global ion exchange resins market size was valued at USD 2.96 billion in 2025. The market is projected to grow from USD 3.17 billion in 2026 to USD 5.54 billion by 2034, exhibiting a CAGR of 7.20% during the forecast period. Asia Pacific dominated the ion exchange resins market with a market share of 31% in 2025.

Ion exchange resins are insoluble, porous polymer beads that contain fixed charged groups capable of exchanging ions with surrounding solutions. These synthetic materials have a cross-linked structure with either positively charged groups (anion exchangers) or negatively charged groups (cation exchangers) that selectively attract and bind oppositely charged ions from the solution.

The product applications span numerous industries, including water purification, pharmaceuticals, food processing, hydrometallurgy, chemical processing, chromatography, and nuclear waste treatment. Their high selectivity, capacity, and regenerability make ion exchange resins essential in processes requiring precise control of ionic composition, from household water filters to industrial-scale separation systems.

DuPont, Purolite, LANXESS, Thermax Limited, and Mitsubishi Chemical Corporation are key companies operating in the market.

Global Ion Exchange Resins Market Key Takeaways

Market Size & Forecast

- 2025 Market Size: USD 2.96 billion

- 2026 Market Size: USD 3.17 billion

- 2034 Forecast Market Size: USD 5.54 billion

- CAGR: 7.20% from 2026–2034

Market Share

- Asia Pacific dominated the market with a 31% share in 2025, supported by rapid industrialization, growing water scarcity, large-scale manufacturing activity, and strong adoption of advanced water treatment technologies across China, India, and Southeast Asia.

- By type, cationic resins held the dominant share due to their extensive use in water softening and demineralization applications across power, chemical, and municipal sectors.

Key Country Highlights

- China: Strong demand from manufacturing, chemical processing, and power generation sectors, combined with significant investment in industrial wastewater management.

- India: Rising urbanization, water scarcity, and government-led water treatment initiatives fuel significant uptake of ion exchange technologies.

- United States: Market driven by stringent water quality standards, power generation needs, and growing adoption of high-purity resins in pharmaceuticals and electronics.

- Europe: Strong regulatory focus on sustainability, circular economy practices, and advanced chemical manufacturing drives steady market growth.

ION EXCHANGE RESINS MARKET TRENDS

Growing Water Scarcity and Need for Purified Water Surges Market Growth

Intensifying global water scarcity and stricter regulations on water quality force industries to adopt advanced treatment technologies. As contamination from industrial processes, agricultural runoff, and urbanization escalates, ion exchange resins emerge as critical solutions for efficient purification. This creates unprecedented market growth as municipalities and corporations invest heavily in sustainable water management infrastructure to combat dwindling freshwater resources.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand from Power Generation Industry to Fuel Market Growth

The power generation industry’s need for ultrapure water drives substantial ion exchange resins market growth. As thermal and nuclear power plants require demineralized water to prevent equipment damage, scaling, and corrosion in boilers, turbines, and cooling systems, the demand for specialized resins intensifies. Stringent emissions regulations further compel power facilities to implement water treatment solutions for effluent management.

Additionally, the global energy transition toward cleaner technologies opens new application avenues. Renewable energy storage systems and hydrogen production facilities require high-purity water achievable through ion exchange processes. This dual pressure of maintaining existing infrastructure while supporting emerging technologies creates sustained market momentum.

MARKET RESTRAINTS

Emerging Technologies with Lower Operating Costs to Restrict Market Growth

Membrane-based technologies such as reverse osmosis and ultrafiltration increasingly displace traditional ion exchange resins due to lower operating costs and reduced chemical usage. As these alternatives demonstrate comparable or superior performance with smaller footprints and minimal waste generation, major industrial users pivot away from resin-based systems.

Additionally, advancements in electrode ionization, capacitive deionization, and biosorption further erode market share. The high regeneration chemical requirements and brine disposal challenges associated with ion exchange resins make these competing technologies increasingly attractive, especially as sustainability becomes a primary consideration in industrial water treatment decisions.

MARKET OPPORTUNITIES

Food Safety Demands and Consumer Concerns on Food Quality to Propel Market Growth

Increasing consumer concerns about food safety and quality drive food and beverage manufacturers to adopt superior purification technologies. As regulations tighten and contamination incidents rise, ion exchange resins provide crucial solutions for removing impurities, decolorizing products, and improving taste profiles.

Sugar refining, beverage clarification, dairy processing, and enzyme production increasingly rely on specialized resins to achieve consistent product quality. The expanding functional food market accelerates demand, as manufacturers require precise mineral content and acidity control. This specialized application segment offers premium margins and steady growth for resin producers.

MARKET CHALLENGES

Raw Material Price Volatility and Environmental Regulations Threaten Market Stability

Price volatility in petroleum-based raw materials increases manufacturing costs unpredictably, forcing resin producers to adjust margins. Simultaneously, stringent environmental regulations mandate costly compliance measures, advanced wastewater treatment systems, and sustainable production processes, creating dual pressure that elevates operational expenses, reduces market competitiveness, and constrains industry growth.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Cationic Segment Held Dominant Share Due to Its Superior Efficiency and Usage in Multiple Industries

Based on type, the market is segmented into cationic, anionic, and others.

Cationic resins accounted for the largest market share due to their widespread application in water softening and demineralization processes across multiple industries. Their superior efficiency in removing calcium, magnesium, and other positively charged ions makes them essential for power plants, chemical processing, and municipal water treatment, where hardness reduction is critical.

Anionic resins find extensive application in dealkalization, deionization, and removing negatively charged contaminants. These resins are vital in pharmaceutical manufacturing, semiconductor production, and laboratory applications where ultrapure water free from anions such as chlorides, sulfates, and nitrates is required for quality and performance.

By End-Use Industry

Power Segment Led the Product Demand Due to Superior Product Properties

Based on end-use industry, the market is segmented into power, chemicals & petrochemicals, food & beverages, electrical & electronics, pharmaceuticals, metals & mining, and others.

The power segment held the largest ion exchange resins market share, as thermal and nuclear facilities require massive volumes of demineralized water to protect boilers, cooling systems, and turbines from scale formation and corrosion. Stringent water quality requirements and continuous operational demands ensure steady consumption of cationic and anionic resins.

Chemicals and petrochemicals represent a significant market share, utilizing ion exchange resins for catalyst preparation, feedstock purification, and wastewater treatment. The segment’s growth parallels specialty chemical production expansion, where water purity directly impacts product quality and process efficiency.

Ion Exchange Resins Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Ion Exchange Resins Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest global market share in 2025, generating market revenue worth USD 0.93 billion. Asia Pacific represents the fastest-growing region fueled by rapid industrialization, increasing water scarcity, and expanding manufacturing capabilities. China and India lead growth as power generation capacity expands and regulations on industrial discharges tighten, necessitating greater investment in water treatment technologies.

North America

Market growth in North America is driven by stringent water quality regulations, aging water infrastructure requiring upgrades, and industrial expansion in specialty chemicals and pharmaceuticals. The region’s focus on reducing the environmental impact of industrial processes further accelerates the adoption of advanced ion exchange systems. The market in the U.S. is anticipated to grow due to the rising product demand for water treatment from industries such as chemicals & petrochemicals, electrical & electronics, metals & mining, and pharmaceuticals.

Europe

The European market has established water treatment standards and a substantial chemical manufacturing base supporting consistent demand. The region’s commitment to circular economy principles drives innovation in resin recycling and regeneration technologies to minimize waste generation.

Latin America

The Latin America market’s growth is concentrated in Brazil and Mexico, where expanding industrial activities and increasing awareness of water quality drive adoption. Mining operations particularly leverage ion exchange technology for resource recovery and meeting environmental compliance standards for discharge water.

Middle East & Africa

The Middle East & Africa market growth primarily focuses on Gulf Cooperation Council countries investing in desalination and water reuse systems. The region’s water scarcity drives innovation in specialized resins capable of handling challenging water conditions and high salinity levels common to local water sources.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Capacity Expansion Strategies to Increase Companies’ Market Share

To meet the increasing demand for ion exchange resin across water treatment, biopharma, and semiconductors, key players are expanding production capacities, developing specialized resins, and entering strategic partnerships. This includes launching advanced resins for hydrogen and biologics purification, setting up new facilities in Asia, and investing in local regeneration units, resulting in enhanced supply capabilities, regional access, and application-specific solutions across the ion exchange resins market.

LIST OF KEY ION EXCHANGE RESIN COMPANIES PROFILED

- DuPont (U.S.)

- Purolite (U.S.)

- LANXESS (Germany)

- Thermax Limited (India)

- Mitsubishi Chemical Corporation (Japan)

- Veolia (France)

- Samyang Corporation (South Korea)

- Ion Exchange Global (India)

- ResinTech, Inc. (U.S.)

- BASF (Germany)

KEY INDUSTRY DEVELOPMENTS

- May 2025 – DuPont has launched AmberChrom TQ1, an agarose-based anion exchange chromatography resin designed for purifying oligonucleotide and peptide for biopharmaceutical applications. It offers high loading capacity, increased throughput, and low-pressure operation, enhancing efficiency in both benchtop and large-scale purifications.

- October 2024 - Mitsubishi Chemical Group announced the expansion of ion exchange resin production at its Kyushu-Fukuoka Plant to meet the rising demand for ultrapure water in semiconductor manufacturing. The upgraded facilities are scheduled to commence operations in April 2026.

- April 2024 – Lanxess introduced specialized Lewatit UltraPure ion exchange resins for water purification in PEM electrolysis, which converts renewable electricity into hydrogen. These resins ensure high-purity water, essential for efficient, climate-friendly hydrogen production.

- February 2024 – Veolia Water Technologies declared the redevelopment of a brownfield site to establish its first ion exchange resin regeneration facility in China, aiming to enhance water purification services for strategic industries

- November 2023 – Purolite, an Ecolab company, declared the expansion of its global footprint with a new ion exchange resin manufacturing facility in China to meet rising regional demand and strengthen supply chain resilience across Asia.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) & Volume (Kiloton) |

|

Growth Rate |

CAGR of 7.20% during 2026-2034 |

|

Segmentation |

By Type

|

|

By End-Use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 2.96 billion in 2025 and is projected to reach USD 5.54 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 0.93 billion.

The market is expected to exhibit a CAGR of 7.20% during the forecast period of 2026-2034.

The power end-use industry led the market.

Increasing power generation demands to drive market growth.

DuPont, Purolite, LANXESS, Thermax Limited, and Mitsubishi Chemical Corporation are the top players in the market.

Asia Pacific dominated the market in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us