Isobutyric Acid Market Size, Share & Industry Analysis, By Type (Synthetic, and Renewable), By Application (Pharmaceuticals & Cosmetics, Animal Feed, Chemical, Food & Flavors, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

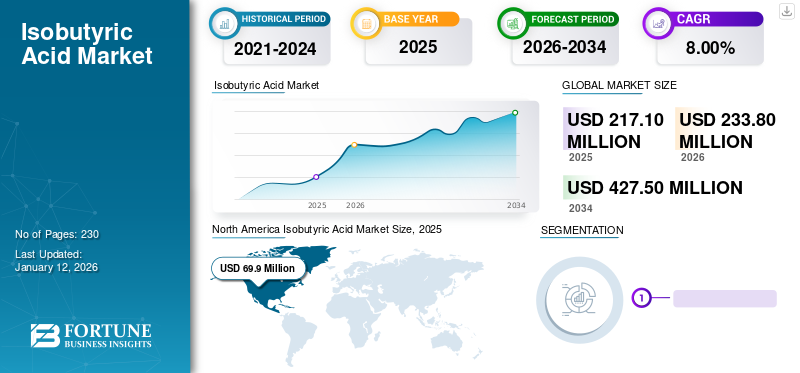

The global isobutyric acid market size was valued at USD 217.1 million in 2025 and is projected to grow from USD 233.8 million in 2026 to USD 427.5 million by 2034, exhibiting a CAGR of 8.00% during the forecast period. North America dominated the isobutyric acid market with a market share of 32.00% in 2025.

Isobutyric acid, also known as isobutanoic acid or 2-methylpropanoic acid, is a type of carboxylic acid exhibiting the structural formula (CH₃)₂CHCOOH. It is an isomer of n-butyric acid synthesized by different methods, including hydrolysis of isobutyronitrile, oxidation of isobutanol in the presence of potassium dichromate and sulfuric acid, and the reaction of 4-chlorophenol, chloroform, and acetone in the presence of an alkali. It is a colorless liquid with different applications, including chemicals, pharmaceuticals & cosmetics, animal feed, and food & flavors. The growing pharmaceutical industry and rising product preference from food and animal feed applications will drive market growth. The increasing awareness of bio-based product use among end-users will provide market growth opportunities during the forecast period.

GLOBAL ISOBUTYRIC ACID MARKET LANDSCAPE OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 217.1 million

- 2026 Market Size: USD 233.8 million

- 2034 Forecast Market Size: USD 427.5 million

- CAGR: 8.00% from 2026–2034

Market Share:

- North America led the global isobutyric acid market in 2025 with a share of 32.00%, growing from USD 69.9 million in 2025 to USD 75.4 million in 2026. The growth is attributed to strong demand from pharmaceutical, cosmetics, animal feed, and food & flavor industries.

- By type, the synthetic segment held the dominant share in 2024 due to its cost-effectiveness and well-established petroleum-based production processes.

- By application, the pharmaceutical & cosmetics segment accounted for the largest share in 2024, driven by high product usage in active pharmaceutical ingredient (API) manufacturing and personal care formulations. The food & flavors segment is expected to hold an 11.3% share in 2024, supported by growing demand for processed and packaged food products.

Key Country Highlights:

- United States: Dominates the North American market with high-value demand from pharmaceutical, animal feed, and flavoring applications. In 2024, the food & flavors segment is estimated to hold an 11% share.

- China: Industrial expansion and a rapidly growing pharmaceutical sector support demand, with increasing use in chemical and food applications due to rising consumer spending.

- India: Emerging as a major growth driver in Asia Pacific with expanding cosmetics, pharma, and food processing industries.

- Germany: Mature demand from pharma and cosmetics industries, but future growth driven by increasing animal feed applications and EU-backed sustainability initiatives promoting bio-based product use.

- Brazil: Industrialization, foreign investment, and a growing food sector support demand for isobutyric acid in Latin America.

- Saudi Arabia: Industrial growth, economic diversification, and demand for cost-effective chemical solutions are boosting market traction across sectors.

COVID-19 IMPACT

Disruption of Supply Chains during COVID-19 Pandemic Hampered Market Growth

The outbreak of the COVID-19 pandemic had a considerable impact on the market's growth. Movement restrictions and lockdowns imposed by the world's major economies during the pandemic disrupted supply chains, leading to shortages of raw materials required for the manufacturing of products. The scarcity of raw materials caused partial or complete stoppages in manufacturing by many market players. However, as control over the spread of the pandemic gradually improved in 2021, companies started production, and many companies were operating at full capacity from the beginning of 2022.

Isobutyric Acid Market Trends

Manufacturing of Products from Renewable Materials to Present Lucrative Market Opportunities

Conventionally, isobutyric acid is manufactured from petroleum-based raw materials, contributing to significant levels of carbon emissions. Manufacturing products from crude oil-based raw materials is associated with carbon emissions, making it difficult to comply with environmental regulations prescribed by governments of different countries and international organizations. This has prompted the manufacturers of isobutyric acid to focus on research & development and manufacturing of the product from renewable raw materials obtained from plant sources. Therefore, rising environmental awareness is pushing the production of bio-based products and presenting lucrative opportunities for market growth. North America witnessed a isobutyric acid market growth from USD 69.9 Million in 2025 to USD 75.4 Million in 2026.

Download Free sample to learn more about this report.

Isobutyric Acid Market Growth Factors

Rising Product Demand from Animal Feed and Food & Flavor Applications to Drive Market Growth

Isobutyric acid and its several derivatives are used in animal feed to enhance palatability and encourage feed consumption. It is also used to enhance the nutritional benefits and promote the animal's growth. The increasing scarcity of natural grazing land and the rising dairy industry across the globe are resulting in increased demand for animal feed, creating positive growth perspectives for market growth.

Isobutyric acid is also witnessing an increased demand for applications in food and flavors. It is increasingly being used as a flavoring agent for different food products, contributing to their aroma. The flavoring and aroma imparting characteristics of the isobutanoic acid make it ideal for processed and packaged food items such as butter, cheese, and beef. Therefore, increasing demand for processed and packaged food is anticipated to drive the isobutyric acid market growth.

RESTRAINING FACTORS

Concerns Associated with Storage and Handling of Product to Limit Market Growth

Isobutyric acid handling requires proper precautions due to its potential to cause burns to the eyes, skin, and mucous membranes upon contact. Prolonged exposure to heat may lead to the containers exploding, and its vapors can form explosive mixtures in the air. Inhalation of isobutyric acid causes throat pain, coughing, and other respiratory issues, while continuous exposure can impair vision. Such health hazards associated with the handling and storage of the product are anticipated to limit the market's growth.

Isobutyric Acid Market Segmentation Analysis

By Type Analysis

Synthetic Segment Accounted for the Largest Share owing to its Cost Effectiveness

Based on type, the isobutyric acid market is segmented into synthetic and renewable.

The synthetic segment held the largest share of the market in 2026 and is expected to maintain its dominance, accounting for 92.51% of the market with a size of USD 216.3 Million. The well-established method of manufacturing synthetic products from petroleum-based raw materials allows for lower production costs compared to renewable products.

Renewable products have emerged as an alternative to synthetic products. They are anticipated to witness a significant rise in their demand in the near future owing to the rising need for renewable products to avoid pollution and combat increasing carbon footprint.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Pharmaceutical & Cosmetics Segment Held the Largest Share Owing to Higher Product Demand

Based on the applications, the isobutyric acid market is segmented into pharmaceuticals & cosmetics, animal feed, chemical, food & flavors, and others.

The pharmaceuticals & cosmetics segment held the largest share of the market in 2026, accounting for 46.49% of the market with a size of USD 108.7 Million. The market due to higher product consumption in different applications, including solvent, intermediate, and development and manufacturing of active pharmaceutical ingredients. The product is used to manufacture different pharmacological products, including anti-inflammatory medications, anticonvulsants, and antibiotics. It is used for creams and lotions, perfumes and deodorants, shampoos, and antiperspirants in cosmetics.

The product is also widely used in animal feed to enhance the nutritional value and palatability of the feed. The increasing product adoption in animal feed will drive the segment growth. In the chemical industry, it is widely used as a solvent, starting material, and intermediate for synthesizing several drugs. In the food industry, it acts as a flavoring agent for processed and packaged foods, including butter, cheese, and meat. Hence, the growth of the chemical and food industries will drive product consumption in respective segments. The food and flavours segment is expected to hold a 11.3% share in 2024.

REGIONAL ISOBUTYRIC ACID MARKET ANALYSIS

Based on region, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America Isobutyric Acid Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest isobutyric acid market share in terms of revenue in 2025, owing to higher demand from major end-use industries, with the market size reaching USD 69.9 Million. Higher product prices in the region are one of the major reasons behind it holding the major share of the market in terms of revenue. Along with the higher demand for products from pharmaceuticals and cosmetics, the ever-growing demand for animal feed and food and flavors is anticipated to drive market growth in the region. The US market is projected to reach USD 60.7 Million by 2026.

- In North America, the food and flavours segment is estimated to hold a 11% market share in 2024..

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific held a significant global market share, witnessing significant industrial development in the 21st century. The region has a considerably well-developed pharmaceutical & cosmetics industry, the largest application for the product, which is anticipated to further grow significantly in the near future, driving the demand for the product. Major economies including China and India are witnessing industrialization at a higher rate and are anticipated to play a key role in driving product demand. The chemical and food & beverage industry in the region is growing faster owing to a significant rise in consumer expenditure, positively impacting the market's growth. The Japan market is projected to reach USD 12.5 Million by 2026, the China market is projected to reach USD 21.8 Million by 2026, and the India market is projected to reach USD 8.4 Million by 2026.

Europe is relatively mature in terms of the demand for the product for conventional applications in pharmaceuticals & cosmetics, and chemicals. The ever-growing animal feed industry in the region is anticipated to drive and keep the momentum of market growth owing to increasing demand for the product as an animal feed additive. The European Union to achieve net zero emissions by 2050 and is placing several efforts in place to achieve this target, coupled with initiatives to encourage the manufacturing of bio-based products, is anticipated to present lucrative opportunities for renewable product manufacturers. The UK market is projected to reach USD 12.1 Million by 2026, while the Germany market is projected to reach USD 15.1 Million by 2026.

Latin America and the Middle East & Africa are witnessing a considerable demand for the product owing to rising industrialization in the region. Factors such as relatively favorable tax laws, availability of labor at relatively lower cost, and less stringent environmental regulations are attracting foreign investment, fostering industrialization in these regions and positively impacting market growth.

List of Key Companies in Isobutyric Acid Market

Companies Focus on Expansion of Production Capacity and Development of Renewable Products to Gain a Competitive Edge

The market is moderately fragmented, with major players, including Eastman Chemical Company, OQ Chemicals GmbH, Tokyo Chemical Industry Co., Ltd. and Evonik Industries AG., holding considerable market share. These companies possess significant production capabilities for synthetic products and invest in research and development for renewable products. Other key players are focusing on enhancing their manufacturing capacities to meet the rising demand for products in this market.

LIST OF KEY COMPANIES PROFILED IN ISOBUTYRIC ACID MARKET:

- Eastman Chemical Company (U.S.)

- OQ Chemicals GmbH (Germany)

- Tokyo Chemical Industry Co., Ltd. (Japan)

- AFYREN (France)

- Shanghai Aladdin Biochemical Technology Co., Ltd. (China)

- Evonik Industries AG (Germany)

- Snowco (China)

- Nanjing Chemical Material Corp. (China)

- CAMEO Chemicals

- Yufeng International Group Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- January 2023: OQ Chemicals announced plans to increase its production capacity for carboxylic acids. The company also focused on investments in the reorganization of its global network of multi-purpose production facilities to enhance efficiency and strengthen its production capabilities.

- January 2023: AFYREN, a global greentech company that offers bio-based and low-carbon ingredients manufactured by using fermentation technology, and Mitr Phol, a Thailand-based company, a leading producer of cane sugar and its derivatives. They entered into a partnership to establish a bio-refinery in Thailand. With this move, AFYREN aims to target the Asian market, constituting 25% of the global carboxylic acids market.

- November 2018: Eastman Chemical Company announced the completion of its new isobutyric acid manufacturing plant at its Kingsport site in the U.S. Construction of this manufacturing facility enabled the company to double its isobutyric acid manufacturing capacity to meet the rising demand in the market.

REPORT COVERAGE

The research report provides both qualitative & quantitative insights into the market worldwide. Quantitative insights include market sizing in terms of value (USD Million) across each segment, sub-segment, and region profiled in the scope of the study. In addition, it provides market analysis and growth rates of segments, sub-segments, and key counties across each region. Qualitative insight covers the elaborative analysis of key market drivers, restraints, growth opportunities, and industry trends related to the market. The competitive landscape section covers detailed company profiling of the key players operating in the industry.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.00% from 2026-2034 |

|

Unit |

Value (USD Million), Volume (Kiloton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global market size was USD 217.1 million in 2025 and is projected to reach USD 427.5 million by 2034.

Growing at a CAGR of 8.00%, the market will exhibit steady growth in the forecast period.

By application, the pharmaceuticals & cosmetics segment held the market share.

Rising product demand from animal feed and food & flavor applications is driving the market.

North America held the largest market share in 2025.

Eastman Chemical Company, OQ Chemicals GmbH, Tokyo Chemical Industry Co., Ltd., and Evonik Industries AG are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us