Italy Construction Equipment Market Size, Share & Analysis, By Equipment Type (Earthmoving Equipment, Material Handling Equipment & Cranes, Concrete Equipment, Road building equipment, Civil engineering equipment, Crushing and screening equipment, and Other Equipment), By Application (Residential, Commercial, and Industrial), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

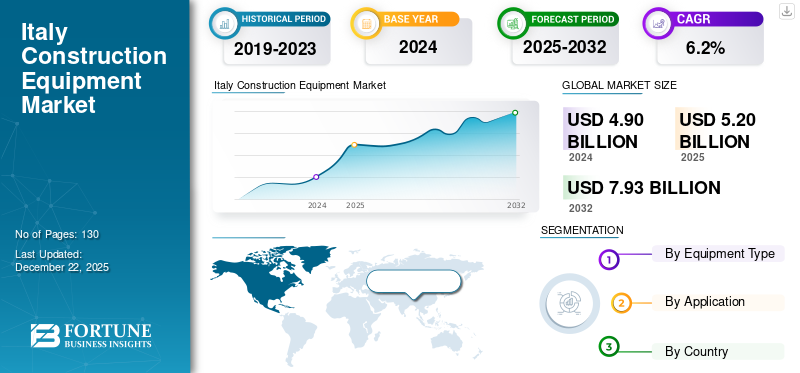

The Italy Construction Equipment market size was valued at USD 4.90 billion in 2024. The market is projected to grow from USD 5.20 billion in 2025 to USD 7.93 billion by 2032, exhibiting a CAGR of 6.2% during the forecast period.

Ongoing investments in public infrastructure, supportive government programs, smart industrial initiatives, and the expansion of public works are collectively fueling the growth of the market. In parallel, major industrial manufacturers are ramping up production capacity and committing significant capital expenditure, further strengthening the construction equipment market share. Transport investment is expected to prominently bolster the demand for earthmoving and other construction equipment in the country.

- For instance, the Recovery and Resilience Facility (RRF) grant of about USD 72 billion was awarded to Italy in July 2021 to meet climate objectives and digital transition.

To know how our report can help streamline your business, Speak to Analyst

Road and Rail Transport Infrastructure investment accounts for about 99% of the total transport infrastructure investment. The Italian market is expected to generate strong market demand for excavators, motor graders, trucks, trailers, asphalt pavers, cranes, and compactors, for earthworks, site preparation, transportation, and road construction.

Italy Construction Equipment Market Trends

Electrification and Automation of Construction Machines to Gain Market Traction

Remote monitoring, IoT-based, and sensor-based machines, such as loaders, dozers, and excavators to witness strong growth across the country. E-commerce industry growth is driving the adoption of automated material handling equipment, such as AGVs. Manufacturing companies are further expanding their domestic facilities to meet the rising demand for battery-powered equipment across the region.

- For instance, in September 2024, CNH Industrial expanded its Lecce plant and inaugurated a new production line. The new line will develop the New Holland W40X electric compact wheel loader to meet sustainability targets in the construction and agricultural industries.

Download Free sample to learn more about this report.

The e-commerce industry is generating strong growth in the Italian market owing to changing demographics, a rising number of online buyers, and growing disposable income. High demand for online purchases is surging the growth of efficient logistics and distribution centers, boosting the sales of material handling equipment such as AGVs, and forklift trucks.

Key takeaways

- The Italy Construction Equipment Market is projected to be worth USD 7.93 billion in 2032.

- In the by Equipment type segmentation, Earthmoving Equipment accounted for more than 60.2% of the Italy Construction Equipment Market in 2024.

- In the by Application Segment, the Industrial sector is projected to grow at a CAGR of 6.7% in the forecast period.

Italy Construction Equipment Market Growth Factors

Infrastructure Investment and Sustainability Targets to Drive Market Demand

Investment in large-scale public infrastructure projects, modernizing public transport, and expansion projects, further supported by stringent carbon emission policies, are driving the Italy construction equipment market share. Urban spaces decarbonization and residential renovations are significantly bolstering the market growth in the country.

- For instance, in April 2023, the Italian Government approved USD 5.8 billion of the National Plan for Recovery and Resilience (PNRR) for port infrastructure development and modernization.

Italy Construction Equipment Market Restraints

Rising Construction Costs and Limited Incentivized Programs to Limit Market Growth

According to the Bank of Italy, post-pandemic construction costs increased by up to 20% impacting construction activities across the country. The Italian government also introduced a renovation bonus named “Superbonus” that allowed consumers to claim up to 100% of the construction renovation costs. The Superbonus benefit was later limited to specific consumers in 2022. Temporary policies and limited investment in residential infrastructure modernization might pose a challenge for the Italian construction equipment market.

Italy Construction Equipment Market Segmentation Analysis

By Equipment Type

Based on equipment type, the market is divided into earthmoving equipment, material handling equipment and cranes, concrete equipment, road building equipment, civil engineering equipment, crushing and screening equipment, and other equipment.

Long-term infrastructure projects, multi-year modernization projects, driven by sustainability targets to boost the market growth of earthmoving equipment. Compact machinery such as excavators, loaders, and dozers is steadily driving the market demand for earthmoving equipment.

- For instance, Italian firm Autostrade per l'Italia (ASPI) has planned an investment of more than USD 30 billion to develop and expand the road network over the next 15 years.

Rising road infrastructure investment, upcoming pipeline projects are generating significant demand for pavers, rollers, planers, and other road infrastructure equipment. Several such factors contribute to boosting the market growth of road-building equipment.

By Application

Based on the application, the market is trifurcated into residential, commercial, and industrial.

Residential application to dominate the construction equipment market in Italy, owing to rising housing demand, supporting government incentives, urbanization, and steady investment in the real estate sector, to boost the market demand for construction equipment.

- For instance, the Italian government has introduced Bonus Ristrutturazioni, which allows 50% tax incentives for home renovation to Italian customers.

Rising demand for efficient warehouses and logistics centers, investment in public infrastructure, and demand for energy-efficient machinery to significantly drive the growth of the industrial sector.

List of Key Companies in Italy Construction Equipment Market

Liebherr Group, Volvo CE, and Caterpillar are a few of the key players driving the Italy construction equipment market growth using collaborative strategies and heavy investment in new product launches. Key players are expanding their presence by introducing battery-operated and energy-efficient compact machines catering to specific industry demand, including the transport infrastructure and logistics sector.

- For instance, in January 2025, Hitachi Construction Machinery introduced electric excavators in a public-private partnership port modernization project.

LIST OF KEY COMPANIES PROFILED

- Merlo (Italy)

- Liebherr Group (Switzerland)

- Volvo Construction Equipment (Sweden)

- Wirtgen Group (Germany)

- JCB (U.K.)

- Komatsu (Japan)

- Kion Group AG (Germany)

- Wacker Neuson (Germany)

- Jungheinrich AG (Germany)

- CNH Industrial (U.K.)

- Caterpillar (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Develon has introduced the DX17Z-7 mini excavator at the Genoa shipyard, which is a part of Renzo Piano’s waterfront project.

- June 2024: Hitachi introduced more than 100 Zaxis-6 mini excavators to SCAI in Italy between January to June 2024. The mini excavator models included ZX10U-6 and ZX65USB-6.

REPORT COVERAGE

The Italian construction equipment market report provides a detailed analysis of the market. It focuses on market dynamics and key industry developments, such as mergers and acquisitions. Additionally, it includes information about the growth in earthmoving equipment, concrete and material handling equipment, and applications. Besides this, the report also offers insights into the latest industry trends and the impact of various factors on the demand for construction equipment.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.2% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type

|

|

By Application

|

Frequently Asked Questions

Fortune Business Insights says that the Italy market was worth USD 4.90 billion in 2024.

The market is expected to exhibit a CAGR of 6.2% during the forecast period.

By equipment type, the earthmoving equipment segment to dominate the market.

Liebherr Group, Volvo CE, and Caterpillar are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us