AI Accelerator Market Size, Share & Industry Analysis, By Type (Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), Central Processing Units (CPUs), Application-Specific Integrated Circuits (ASICs), and Field-Programmable Gate Arrays (FPGAs)), By Technology (Cloud-Based and Edge AI), By Application (Fraud Detection, Customer Experience Management, Predictive Analytics, Autonomous Vehicles, Intelligent Virtual Assistants, and Others), By End-Use (IT & Telecom, BFSI, Retail, Automotive, Healthcare, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

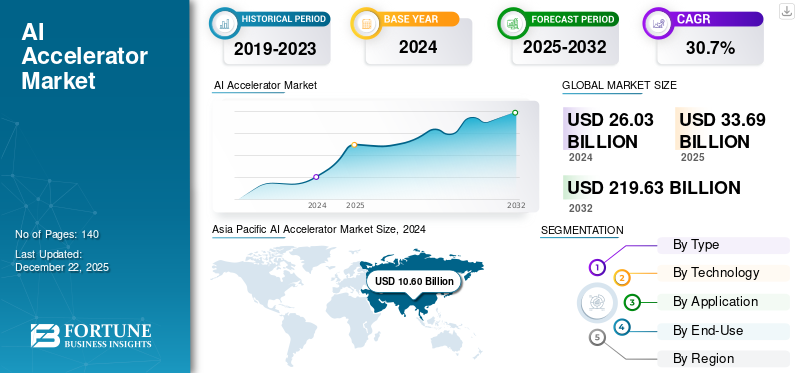

The global AI accelerator market size was valued at USD 33.69 billion in 2025 and is projected to grow from USD 43.75 billion in 2026 to USD 309.23 billion by 2034, exhibiting a CAGR of 30.7% during the forecast period. Asia Pacific dominated the AI accelerator market with a market share of 40.70% in 2025.

An AI accelerator is a dedicated hardware device created to execute the complicated calculations that are important for AI functions to work effectively. The market growth is driven by many factors, including the escalating demand for high-performance hardware solutions to power AI applications and extensive usage and buying of AI chips by cloud providers. An industrial analyst stated that data center and AI-related hardware can potentially reach USD 1.4 trillion by 2027.

There is a growing need for real-time data processing at the edge, rather than sending data to centralized data centers. Moreover, though emerging, long-term integration of quantum processors and AI acceleration capabilities can eventually revolutionize. Thus, these factors are increasing the market share.

The major players operating in this market are Nvidia Corporation, AMD (Advanced Micro Devices), Intel Corporation, TSMC (Taiwan Semiconductor Manufacturing Co.), Samsung Electronics, Apple Inc., Google LLC, Meta, Qualcomm Incorporated, and IBM Corporation.

The COVID-19 pandemic had a substantial impact on the market due to supply chain disruptions and chip scarcity owing to labor shortages. Gradually, certain companies, such as NVIDIA, took advantage of the circumstances by securing limited production capacity ahead of time, predicting the demand. This quick insight provided them with a significant supply advantage amid the surge in AI hardware.

IMPACT OF GENERATIVE AI

Integration of Generative AI leads to Innovative Architectures

Generative AI accelerates design processes by implementing AI-driven simulation and exploration. According to ISG 2024, spending on Gen AI initiatives will increase by 50% in 2025 compared to 2024. Additionally, it empowers generative design to uncover innovative architectures, with solutions such as Synopsys.ai Copilot incorporating LLMs into chip design workflows.

- According to Industry Experts, the market for chips powering generative AI will hit USD 50 billion by the end of 2025, with projections to rise to approximately USD 700 billion by 2027.

IMPACT OF RECIPROCAL TARIFFS

The effect of reciprocal tariffs is very strong since the production of AI accelerators is extremely globalized. Tariffs are disrupting the supply chain as imports and exports become more expensive. Additionally, increased tariffs lead to a surge in the expenses for data centers, startups, and all companies that need accelerators for model training and inference. Hence, companies may shift manufacturing or delay shipments to avoid higher costs.

MARKET DYNAMICS

Market Drivers

Growing Need for High-Performance Computing in AI Workloads Aids Market Growth

Standard CPUs frequently lack the speed necessary to perform the intricate calculations involved in training and inferring AI models. AI accelerators, built for parallel processing, can carry out these calculations more rapidly.

For instance, GPUs were designed for gaming and have now become an essential building block of AI computations due to their efficiency at handling large matrix operations. As a result, the complexity of AI models grows, thus increasing the demand for such accelerators to support these models.

Market Restraints

High Implementation Costs and Initial Investment to Hinder Market Expansion

Although the market has growth potential, it encounters obstacles rooted in high upfront investments and implementation expenses. Creating or buying AI accelerator hardware, setting up the needed infrastructure, and making these systems part of existing workflows would be costly.

Market Opportunities

Rise in Quantum Computing Accelerators to Create Lucrative Market Opportunities

Key providers are working together to merge quantum computing with AI, thus enhancing the processing capabilities significantly, while also looking for ways to combine AI accelerators with the emerging technology of quantum computing to create computational efficiencies. Quantum AI accelerators are anticipated to revolutionize the market trends and dynamics of these accelerators in areas such as material science, cryptography, and drug discovery. This addresses numerous intricate problems at a higher speed as compared to traditional hardware, advancing the boundaries of AI innovation, and opening up new growth opportunities across various industries.

AI Accelerator Market Trends

Increased Focus on Energy Efficiency to Emerge as a Key Market Trend

Download Free sample to learn more about this report.

There is an increasing focus on creating energy-efficient AI accelerators to tackle the significant power consumption linked to AI processing. Advances in chip design and production are aimed at minimizing energy consumption while preserving high performance, in line with worldwide sustainability objectives and decreasing operating expenses.

SEGMENTATION ANALYSIS

By Type

Demand for Handling Parallel Processing Boosted the Expansion of GPU segment

Based on type, the market is segmented into Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), Central Processing Units (CPUs), Application-Specific Integrated Circuits (ASICs), and Field-Programmable Gate Arrays (FPGAs).

By type, Graphics Processing Units (GPUs) dominated the market with a share of 30.07% in 2026. They have a high capability in parallel processing, which is required to manage all the large calculations required for AI and deep learning tasks. The broad utilization of GPUs in multiple sectors for AI-related applications has positioned them as the leading solution for high-performance computing activities.

The Application-Specific Integrated Circuits (ASICs) segment is set to achieve the highest CAGR during the forecast period. ASICs are increasingly used by cloud giants through partnerships and internal development. For instance, Google’s TPUs are ASIC-based and are widely used in its cloud services. Hyperscalers such as Google, Meta, and Amazon prefer custom ASICs due to their reduced power usage, improved efficiency, and lower total silicon expenses in comparison to standard GPUs.

By Technology

Cloud-based Technology Dominated the Market Due to its Essential Contribution to Cloud Computing Environments

Based on technology, the market is categorized into cloud-based and edge AI.

In 2026, the cloud-based segment led the market with a share of 59.21%. The dominance of this part is mainly due to its key role in cloud computing setups, where big data needs fast handling for AI usage. The advantages of cloud-based AI accelerators lie in their capability to deliver significant computational strength without the need for other hardware setups.

The edge AI segment is expected to witness the highest CAGR during the forecast period. The Edge AI Accelerators sector is expanding swiftly due to the rising demand for immediate data processing at the location where it is generated. Such accelerators also carry AI computations locally on gadgets in the form of smartphones, IoT devices, and self-driving cars, thus reducing the latency and bandwidth consumption.

By Application

Fraud Detection Dominated the Market with Its Widespread Usage in the Financial Industry

Based on application, the market is categorized into fraud detection, customer experience management, predictive analytics, autonomous vehicles, intelligent virtual assistants, and others.

In 2026, the fraud detection segment accounted for the largest AI Accelerator Market with a share of 32.89%. A surge in fraudulent activities is pushing the demand for high-performance computing infrastructure that is scalable. Most of these frauds occur within financial systems. This is a major factor contributing to the swift AI accelerator market growth, as companies look for hardware that can adapt to the changing dynamics of fraud and cybersecurity. According to Business Insider, Mastercard's AI platform, which processes over 159 billion transactions annually, has achieved up to 300% improvements in fraud detection rates while also reducing false declines.

The autonomous vehicles industry will register the highest CAGR during the forecast period. The rapid development of advanced AI and ML algorithms will aid the autonomous driving capabilities, especially for vivid advances in the robot's abilities for real-time perception, which is all creating demand for high-performance accelerators.

By End-Use

To know how our report can help streamline your business, Speak to Analyst

IT & Telecom Dominated Market Due to Increasing Need to Handle Extensive Data Flow in the Industry

Based on the end-use, the market is categorized into IT & telecom, BFSI, retail, automotive, healthcare, and others.

The IT & telecom segment was the dominant segment in 2024. This segment is leading due to the increasing demand for AI accelerators owing to massive data flow and space for efficiency in telecommunication processes. Additionally, the growing dependence on virtualized network functions and the deployment of IoT devices further fuel the necessity for AI accelerators in this industry.

The automotive sector is most likely to see the highest CAGR during the forecast period. AI accelerators will advance modern ADAS, self-driving capabilities, and real-time vehicle-to-everything (V2X) or real-time communication with the V2X capability vehicles. The adoption of EVs and the growing popularity of the autonomous car will push the automotive sector to accept these accelerators rapidly.

AI ACCELERATOR MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, Europe, South America, the Middle East & Africa, and Asia Pacific.

Asia Pacific

Asia Pacific AI Accelerator Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region captured the largest share of the market in 2024, fueled by a strong combination of strategic funding, infrastructure advancement, innovation networks, and a variety of applications. Asia Pacific dominated the market with a valuation of USD 13.7 billion in 2025 and USD 17.76 billion in 2026.Countries in the Asia Pacific region are increasing the capacity of data centers and enhancing high-speed connectivity to facilitate the growth of AI. For instance, according to Reddit, India has attracted more than USD 40 billion in investments for data centers. It has outpaced other Asia Pacific countries (excluding China) in terms of installed capacity, currently operating 950 MW and planning another expansion of 850 MW by 2026. The Japan market is projected to reach USD 3.9 billion by 2026, and the India market is projected to reach USD 2.43 billion by 2026.

China's AI accelerator industry is set to witness swift growth as a result of strong policy coordination, infrastructural enhancements, and an articulated step toward indigenous innovation. The China market is projected to reach USD 6.46 billion by 2026,

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is expected to experience the second-largest growth over the forecast period. The region is witnessing increasing investments in AI R&D, wherein numerous countries have incorporated AI into their national strategies. Demand for AI accelerators is significantly propelled by Europe's robust automotive and industrial sectors, pertaining to applications involving smart manufacturing and autonomous vehicles. The UK market is projected to reach USD 1.64 billion by 2026, while the Germany market is projected to reach USD 1.48 billion by 2026.

South America

The market in South America demonstrates gradual and consistent expansion, driven by an increasing need for AI applications in various sectors, including healthcare and infrastructure. However, there are challenges present, such as inefficient AI technology infrastructure and lower investment levels relative to more developed markets.

Middle East & Africa

The governments in Middle East & Africa countries are backing initiatives such as Saudi Arabia’s Vision 2030 and the UAE’s AI strategies across the region. On the other hand, the region faces challenges such as varying regulatory environments and political instability, in some areas, contributing to slower market expansion.

North America

North America is expected to notice the largest CAGR over the forecast period, driven by increased investments in AI and infrastructure, early technology adoption, and a strong presence of major tech companies. This provides a strategic advantage for the region, with the U.S. becoming the primary contributor to the market growth. The U.S. market is projected to reach USD 10.23 billion by 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Notable Players to Implement Strategic Initiatives to Expand Business Reach

Key players present in this market are offering an AI Accelerator to provide users with features such as enhanced AI performance and enabling new applications. They concentrate on holding contracts with small and local businesses to grow their business. Moreover, increasing mergers & acquisitions, partnerships, and investments will create a surge in demand for this technology.

List of Key AI Accelerator Companies Studied (including but not limited to)

- Nvidia Corporation (U.S.)

- AMD (Advanced Micro Devices) (U.S.)

- Intel Corporation (U.S.)

- TSMC (Taiwan Semiconductor Manufacturing Co.) (Taiwan)

- Samsung Electronics (South Korea)

- Apple Inc. (U.S.)

- Google LLC (U.S.)

- Meta (U.S.)

- Qualcomm Incorporated (U.S.)

- IBM Corporation (U.S.)

- UMC (United Microelectronics Corporation) (Taiwan)

- SMIC (Semiconductor Manufacturing Intl. Corp.) (China)

- GlobalFoundries (U.S.)

- Groq (U.S.)

- Axelera AI (Netherlands)

- EdgeCortix (Japan)

- Graphcore (U.K.)

- Alibaba Group (China)

- Rebellions (South Korea)

- Tenstorrent (Canada)

…and more

KEY INDUSTRY DEVELOPMENTS

- May 2025: EnCharge AI unveiled the EnCharge EN100, an AI accelerator in the industry that provides precise and scalable analog in-memory computing. Tailored to enhance AI functionalities in laptops, workstations, and edge devices, EN100 harnesses better efficiency to provide high computing power while adhering to the power limitations typical of edge and client platforms, including laptops.

- November 2024: IBM and AMD collaborated to provide AMD Instinct MI300X accelerators via IBM Cloud as a service. This service seeks to improve performance and energy efficiency for Gen AI models, including high-performance computing (HPC) applications for business customers.

- October 2024: AMD unveiled its newest accelerator and networking offerings designed to drive the next generation of large-scale AI infrastructure: the AMD Pensando Salina DPU, the AMD Instinct MI325X accelerators, and the AMD Pensando Pollara 400 NIC for Gen AI models and data centers.

- August 2024: IBM disclosed the architectural features of the new IBM Telum II Processor and IBM Spyre Accelerator. These updated innovations increase processing capability in the IBM Z mainframe systems, facilitating the simultaneous use of conventional AI models and Large Language AI models through an innovative ensemble AI approach.

- April 2024: Intel unveiled the Intel Gaudi 3 AI accelerator at the Intel Vision event to address the challenges in generative AI. Gaudi 3 offers customers flexibility by providing open community-driven software and using industry-standard Ethernet networking for more adaptable system scaling.

INVESTMENT ANALYSIS AND OPPORTUNITIES

This market has shown robust growth combined with a wide diversity of investment opportunities across public equities, private startups, M&A, and R&D-driven innovation—potential investors to consider, including edge AI, due to the rapid growth of energy-efficient and vertical-specific hardware. Continued dominance by U.S. and major Asian operators, and the sustained need for skills-based management, have risks associated with fast-moving technologies and globalization. Additionally, companies are investing in seeking out more opportunities. For instance,

- Intel is focusing on affordability with its Gaudi AI chips, designed to be about 50% cheaper than NVIDIA’s offerings. Intel is massively investing USD 20 billion in a new U.S. chip manufacturing facility to boost supply chain stability.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/types, and the leading end-use of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 27.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Technology

By Application

By End-Use

By Region

|

|

Companies Profiled in the Report |

Nvidia Corporation (U.S.) AMD (Advanced Micro Devices) (U.S.) Intel Corporation (U.S.) TSMC (Taiwan Semiconductor Manufacturing Co.) (Taiwan) Samsung Electronics (South Korea) Apple Inc. (U.S.) Google LLC (U.S.) Meta (U.S.) Qualcomm Incorporated (U.S.) IBM Corporation (U.S.) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 309.23 billion by 2034.

In 2025, the market was valued at USD 33.69 billion.

The market is projected to record a CAGR of 27.70% during the forecast period.

By Type, the Graphics Processing Units (GPUs) segment led the market in 2025.

Growing need for high-performance computing in AI workloads to aid market growth.

Nvidia Corporation, AMD (Advanced Micro Devices), Intel Corporation, TSMC (Taiwan Semiconductor Manufacturing Co.), Samsung Electronics, Apple Inc., Google LLC, Meta, Qualcomm Incorporated, and IBM Corporation are the top players in the market.

Asia Pacific held the highest market share in 2025.

By End-Use, the automotive segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us