Compostable Packaging Market Size, Share & Industry Analysis, By Material (Polylactic acid (PLA), Cellulose, Bamboo, Wood, Polyhydroxyalkanoate (PHA), and Others), By Product Type (Boxes and Containers, Bags & Pouches, Trays & Plates, Films & Wraps, Cups & Bowls, and Others), By End-use Industry (Food & Beverages, Healthcare & Pharmaceuticals, Retail & Consumer Goods, Personal Care and Cosmetics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

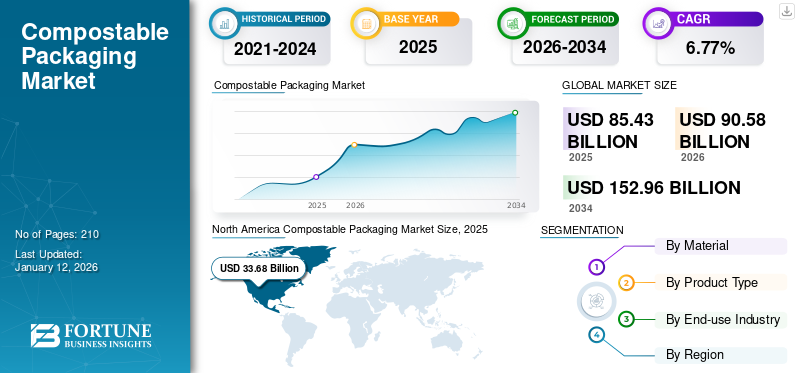

The global compostable packaging market size was valued at USD 85.43 billion in 2025. The market is projected to grow from USD 90.58 billion in 2026 to USD 152.96 billion by 2034, exhibiting a CAGR of 6.77% during the forecast period. North America dominated the compostable packaging market with a market share of 33.68% in 2025.

Compostable packaging is designed to offer sustainable and eco-friendly packaging materials that can be easily composted at home or in an industrial composting facility. It is an eco-friendly alternative to single-use plastics that reduces packaging waste in landfills. The rising awareness regarding biodegradable methods is the key factor driving the growth of the market growth. Augmenting demand for attractive product packaging also presents potential opportunities for market growth. Innovative developments in packaging by manufacturers drive global market growth.

It refers to materials that can break down into natural elements under composting conditions, typically within 180 days, without leaving harmful residues. These materials are derived from renewable resources such as plant-based polymers, starches, or cellulose, offering an eco-friendly alternative to traditional petroleum-based plastics.

Increasing environmental awareness among consumers in developed countries is leading to the rapid adoption of such packaging, thus driving market growth. Additionally, the awareness of traditional plastic packaging waste leakage has generated a huge demand for sustainable packaging solutions. It has forced manufacturers to opt for these packaging materials, thus contributing to the expansion of the market. The utilization of compostable packages in the food and beverages and personal care & cosmetics industry is also expected to boost market growth.

Amcor, Genpak, and Good Start Packaging manufacturers are studying to experience rapid growth in the upcoming years, thus boosting market growth.

Global Compostable Packaging Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 85.43 billion

- 2026 Market Size: USD 90.58 billion

- 2034 Forecast Market Size: USD 152.96 billion

- CAGR: 6.77% from 2026–2034

Market Share:

- North America dominated the compostable packaging market with a 33.68% share in 2025, driven by strong consumer awareness, robust regulatory frameworks, and a thriving food & beverage sector demanding sustainable alternatives.

- By material, polylactic acid (PLA) is expected to retain the largest market share in 2025, supported by its biodegradable nature, renewability, and wide usage across food, beverage, and personal care packaging sectors.

Key Country Highlights:

- United States: Market expansion is driven by heightened consumer environmental awareness, regulatory support for plastic reduction, and innovations in compostable cold cup and lid designs.

- Germany: Strong consumer willingness to invest in eco-friendly products and supportive European Commission policies drive demand for compostable packaging solutions.

- China: Rapid urbanization, rising income, and sustainability mandates fuel the growth of compostable materials across diverse sectors, including e-commerce and food service.

- Brazil: Environmental consciousness is prompting increased demand for compostable alternatives across industries, though economic volatility may impact short-term investments.

- Saudi Arabia: Growing e-commerce adoption and sustainability awareness are driving demand for eco-friendly packaging solutions that align with shipping and environmental standards.

MARKET DYNAMICS

MARKET DRIVERS

Growing Food and Beverage Sector Boosts Market Growth

The food and beverage sector is a major catalyst of the compostable packaging market growth. The growth of this sector, driven by the rising population and evolving consumer preferences for healthier choices, has created a heightened need for sustainable packaging that meets environmental criteria. It is essential to meet these demands by reducing plastic waste and adhering to regulations.

Consumers emphasize sustainability more in their buying choices, especially in the food and drink industry. With increasing awareness of environmental concerns, numerous consumers are looking for products that utilize sustainable packaging. This trend has prompted food and beverage companies to embrace these packaging options to satisfy consumer demands and improve their brand reputation as eco-friendly.

Growing Demand for Eco-friendly Packaging Boosts Market Development

Consumers are increasingly prioritizing sustainability in purchasing decisions, particularly in the food and beverage sector. As awareness of environmental issues rises, many consumers actively seek eco-friendly packaging products. Eco-friendly packaging, often made from recycled or renewable materials, minimizes waste and carbon emissions associated with production and disposal. Eco-friendly packaging, often made from recycled or renewable materials, minimizes waste and carbon emissions associated with production and disposal. This thus drives the market growth.

MARKET RESTRAINTS

High Initial Costs Hinder the Market Growth

A major obstacle to the widespread use of compostable packages is the higher initial production costs of these materials compared to conventional plastic packaging. Creating compostable materials typically necessitates specific raw materials and sophisticated technology, potentially resulting in higher production costs. Consequently, firms might be reluctant to transition from traditional packaging solutions due to perceived economic risks, particularly smaller enterprises that may not have the resources to handle these expenses.

MARKET OPPORTUNITIES

Companies Embrace Sustainability Initiatives to Fuel Market Expansion

Many companies are adopting sustainability as a core business strategy, driven by rising consumer demand and regulatory pressures. Corporate sustainability initiatives often include commitments to reduce plastic usage and invest in eco-friendly packaging solutions. Investments in research and development further support this trend by improving the cost-effectiveness of compostable materials.

MARKET CHALLENGES

Inadequate Composting Infrastructure Could Hinder Product Demand

A significant barrier to the effective use of compostable packages is the lack of adequate infrastructure. Many regions do not have sufficient composting facilities capable of processing compostable materials effectively. Without proper waste management systems, compostable packages may end up in landfills where it cannot decompose properly. This inadequacy limits the practical benefits of compostable materials and can lead to skepticism about their environmental advantages. North America witnessed a growth from USD 31.89 billion in 2025 to USD 33.68 billion in 2026.

Download Free sample to learn more about this report.

COMPOSTABLE PACKAGING MARKET TRENDS

Advancements in Material Science to Spur Market Development

Advancements in material science have led to the development of new biodegradable and compostable materials, such as polylactic acid (PLA), derived from renewable resources such as corn starch. These innovations enhance the performance and usability of compostable packages, making them a viable alternative to traditional plastics. Manufacturers are increasingly focusing on creating packaging that meets sustainability standards while providing functionality comparable to conventional materials.

IMPACT OF COVID-19

The emergence of the COVID-19 pandemic led to a long-term effect on many industries globally. The outbreak disrupted supply chains and manufacturing operations due to imposed lockdowns and other limitations, such as business shutdowns. The market also faced negative effects in the early stages, leading to a decrease in consumer demand subsequently. However, with the ease of lockdowns and regulations, the market will experience steady growth soon. The market will gain momentum due to the increasing consumer awareness regarding a sustainable environment.

SEGMENTATION ANALYSIS

By Material

Polylactic Acid (PLA) Segment Dominates Due to its Biodegradable Nature

Based on material, the market is segmented into polylactic acid (PLA), cellulose, bamboo, wood, polyhydroxyalkanoate (PHA), and others.

Polylactic acid (PLA) leads the segment’s growth and holds the largest compostable packaging market share. As it is edible, biodegradable, and carbon-neutral and can easily be broken down in the environment rather than crumble into harmful microplastics, the segment’s growth is flourishing. The segment held 31% of the market share in 2024.

Wood is the second dominating segment in the market. Wood fiber is a flexible substance derived from the fibers of timber. It is recognized as eco-friendly since it comes from renewable resources. Moreover, it is highly resilient and long-lasting, which makes it a superb option for multiple uses. It offers resistance against heat, cold, water, and grease.

By Product Type

Rising Demand for Bags & Pouches from Various End-use Industries Drives Segmental Growth

Based on product type, the market is segmented into boxes and containers, bags & pouches, trays & plates, films & wraps, cups & bowls, and others.

Bags & pouches are the leading segment. Bags and pouches are in great demand from end-use industries such as food and beverages, pharmaceuticals, and personal care packaging. Available in various types and used for multiple purposes, they are driving segment growth. This segment is estimated to gain 34% of the market share in 2025.

The boxes and containers segment holds the second largest share. With a growing number of individuals shopping online, there is a rise in demand for eco-friendly packaging solutions that are easy to dispose of. An increasing variety of shipping supplies are compostable, meeting the demands of environmentally conscious consumers and businesses. The segment is likely to grow at a CAGR of 5.50% during the forecast period (2025-2032).

By End-use Industry

To know how our report can help streamline your business, Speak to Analyst

Food and Beverages Lead the Market Due to Growing Online Food Delivery Services

Based on end use, the market is segmented into food & beverages, healthcare & pharmaceuticals, retail & consumer goods, personal care and cosmetics, and others.

Food and beverages hold the largest market share. The growing online food delivery services, the huge demand for healthy, ready-to-eat food products, and environmentally-friendly packaging have contributed to the segment’s growth. This segment is estimated to hold 51% of the market share in 2025.

Healthcare & Pharmaceuticals end-use industry holds the second-largest market share. Regulatory demands, technological advancements, and increasing consumer interest fuel this change making biodegradable packaging options essential for minimizing the ecological footprint of pharmaceutical goods. By implementing sustainable packaging, the pharmaceutical sector can contribute to a more environmentally friendly future while ensuring the safety and quality of products. The segment is foreseen to grow at a CAGR of 4.75% during the forecast period (2025-2032).

COMPOSTABLE PACKAGING MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Compostable Packaging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America's Strong Economy and Consumer Awareness Drives Market Growth

North America dominated the market with a valuation of USD 31.89 billion in 2025 and USD 33.68 billion in 2026, with the U.S. and Canada serving as key contributors. The region benefits from a strong economy, technological progress, and a solid consumer base with significant purchasing ability. The U.S. is witnessing expansion in the compostable package sector due to heightened consumer consciousness regarding environmental concerns and robust regulatory backing focused on minimizing plastic waste. Businesses are devising new solutions to comply with tougher sustainability regulations and appeal to environmentally aware consumers. Furthermore, progress in compostable materials and investments in sustainable technologies are driving adoption across various sectors, boosting market growth. The U.S. market is projected to be valued at USD 29.06 billion in 2026.

- In September 2024, Seda North America, a top supplier of sustainable packaging options, introduced its groundbreaking compostable Double Wall cold cups and EcoFit lids to the North American market. The latest products are created to address the increasing need for eco-friendly packaging that adheres to evolving regulations. The compostable Double Wall cold cups incorporate a distinctive patented air gap design that maintains colder drinks for extended periods while minimizing condensation and sweating. This cutting-edge design offers a better drinking experience than conventional paper or plastic cups.

Europe

Growing Consumer Awareness and Willingness to Invest in Sustainability Boosts Market Growth in Europe

Europe is the second largest market anticipated to be valued at USD 26.31 billion in 2026, exhibiting a CAGR of 5.49% during the forecast period (2026-2034, including nations such as the U.K., Germany, France, and Italy. The region is characterized by a mature market with an established infrastructure and consumer preferences. Europe is the foremost region, attributed to increasing consumer awareness regarding the environmental impacts of their buying choices. The U.K. market is foreseen to hold USD 4.30 billion in 2026. This shift is evident in research indicating that over 50% of European consumers are prepared to spend more on eco-friendly products. Consequently, worldwide companies are compelled to adopt and create sustainable packaging options that disrupt the waste disposal cycle.

- In November 2022, European Bioplastics (EUBP) welcomed the proposed new rules on packaging and bioplastics adopted today by the European Commission. “We appreciate the Commission’s first comprehensive policy framework on innovative bioplastic materials, acknowledging their potential to provide genuine environmental benefits. EUBP, in particular, commends the Commission’s endorsement of the important role of compostable plastic packaging in the proposed packaging rules in reaching the ambitious waste and climate targets,” says Hasso von Pogrell, Managing Director of EUBP, “however, we would have expected stronger support for the use of biobased feedstock.”

Germany is forecasted to reach USD 7.02 billion in 2026, while France is poised to be valued at USD 1.54 billion in the same year.

Asia Pacific

Asia Pacific Experiences Rapid Growth Due to Population, Income, Urbanization, and Sustainability Efforts

Asia Pacific is the third largest market estimated to reach a value of USD 17.16 billion in 2026, fueled by nations such as China, Japan, India, and Southeast Asia. Benefits from a large population, growing disposable income, and increasing urbanization, resulting in heightened demand for compostable packages. Japan's expansion in this sector is driven by its dedication to sustainability and technological advancements. The nation's focus on circular economy has prompted businesses to embrace sustainable packaging. Joint initiatives among government bodies, research organizations, and private companies are aiding in developing and expanding compostable packages to satisfy consumer demand for eco-friendly choices. China is estimated to reach a market value of USD 5.20 billion in 2026.

- An article from the website Global Ageing Times in 2021 stated that between 2015 and 2030, the number of people aged above 60 will increase by 56%, or from 901 million to 1.4 billion. By 2050, the global aging population will reach 2.1 billion, with Asia being the continent with the most aging population.

India is poised to be worth USD 3.92 billion in 2026, while Japan is set to acquire USD 2.90 billion in the same year.

Latin America

Economic Fluctuations and Political Instability may Influence Market Development

Latin America is the fourth largest market expected to hit USD 8.39 billion in 2026. Economic fluctuations and political instability in certain countries can influence market dynamics and consumer behavior. There is a significant rise in environmental consciousness among consumers and businesses in Latin America. As awareness of plastic pollution and its impacts on ecosystems grows, consumers and companies seek sustainable alternatives. This shift prompts an increased demand for compostable package solutions that minimize environmental impact and align with eco-friendly practices.

- As per Circular Economy Coalition for Latin America and the Caribbean, early estimates by the International Labour Organisation (ILO) indicate that, alongside the energy transition in the region, over a million jobs will be created by 2030. Additionally, the circular economy would generate a net total of 4.8 million jobs in Latin America and the Caribbean by 2030.

Middle East & Africa

E-commerce Growth in the Middle East & Africa Boosts Market Growth

The swift growth of e-commerce in the Middle East & Africa region offers fresh prospects for compostable product packaging solutions. With the rise of online shopping, there is a growing demand for eco-friendly packaging that can endure shipping conditions while remaining sustainable. This trend has led companies to embrace compostable choices that match consumer desires for sustainability.

- As per the Asian Development Bank, E-commerce continues to grow in the global economy, with a share of global gross domestic product (GDP) of 3.8% in 2019 and 5.6% in 2022, and is forecast to reach 6.4% in 2025. the Middle East and Africa witnessed a 21.3% growth rate in e-commerce sales in 2019.

Saudi Arabia market is expanding anticipated to stand at USD 1.92 billion in 2025.

TRADE PROTECTIONISM

Trade protectionism can impact the market by influencing the import and export of raw materials and finished products. Tariffs and trade barriers may affect the cost and availability of compostable materials, potentially hindering market growth.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Market Participants to Witness Significant Growth Opportunities with New Product Launches

The market is highly fragmented and competitive, with significant players dominating the market by offering innovative packaging solutions in the packaging industry. These major market players constantly focus on expanding their customer base across regions by innovating their existing range of products. The key developments by manufacturers will enhance the market expansion.

Major players in the industry include Mondi Group, Amcor plc, Genpak, Graphic Packaging Holding, International Paper, and others. Other companies operating in the market are focused on analyzing market trends and delivering advanced packaging solutions.

List of Key Compostable Packaging Companies Profiled

- Amcor (Switzerland)

- Genpak (U.S.)

- Good Start Packaging (U.S.)

- Graphic Packaging Holding (U.S.)

- International Paper (U.S.)

- Mayr-Melnhof Karton (Austria)

- Mondi (Austria)

- Pappco Greenware (India)

- Pactiv Evergreen (U.S.)

- Sealed Air (U.S.)

- TIPA (Israel)

- Ultra-Green Sustainable Packaging (U.S.)

- Vegware (U.S.)

- WestRock (U.S.)

- Baroda Rapids (India)

KEY INDUSTRY DEVELOPMENTS

- January 2025- Fresh-Lock closures and TIPA Compostable Packaging collaborated to develop a fully home compostable pouch for True. ApS’ True Dates product line aligns with the snack brand’s dedication to creating better products that help reduce environmental impact.

- November 2024- UPM Specialty Papers and Eastman introduced an innovative paper solution coated with biopolymers to improve grease and oxygen barriers for food use. This groundbreaking packaging solution combines Eastman’s biobased Solus performance additives with UPM’s cutting-edge barrier-based papers, aiming to meet the rising need for eco-friendly packaging solutions.

- October 2024- Nua Cosmetics, ITC Packaging, and ADBioplastics joined forces to create a compostable bio-based bottle using polylactic acid (PLA) for Provei Global’s brand, Biositivo. This program aligns with Provei Global’s dedication to eco-friendly packaging and sustainable infant care.

- September 2024- Pakka, a compostable packaging option producer, introduced a new line of flexible compostable packaging solutions. The innovative product line has been created to address the growing need for flexible packaging in the food and beverage industry with compostable options while contributing to a cleaner environment.

- April 2024- Eastman and SEE (formerly Sealed Air) launched a lightweight, certified compostable tray to replace traditional polystyrene foam alternatives in protein packaging applications. Eastman elaborates that it contains up to 43% recycled content certified by ISCC PLUS via a mass balance allocation process.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The market will witness astonishing growth with the growing collaborations, mergers, and investments. These initiatives help in increasing the importance of compostable packages in several sectors. In August 2024, Pakka Limited, a top producer of compostable packaging solutions, secured funding of USD 29.2 million, sanctioned by its board. The firm intends to use these funds to create the first compostable flexible packaging plant in Ayodhya, India. Pakka introduced its compostable flexible packaging items in collaboration with Brawny Bear, a nutrition firm, in October 2023. The company intends to solidify its position as a leading global brand for compostable flexible packaging with this fund. As part of its expansion plans, Pakka’s compostable flexible packaging facility, the Jagriti project, is expected to be operational by December 2025.

REPORT COVERAGE

The market research report provides a detailed market analysis, covering key aspects, such as top key players, competitive landscape, service types, market segments, Porter’s five forces analysis, and leading segments of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.77% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Product Type

|

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market valued at USD 90.58 billion in 2026.

The market will likely grow at a CAGR of 6.77% over the forecast period (2026-2034).

The polylactic acid (PLA) material segment leads the market.

The market size of North America stood at USD 33.68 billion in 2026.

The rising food and beverage sector and growing demand for eco-friendly packaging are boosting market expansion.

Some of the top players in the market are Mondi Group, Amcor plc, Genpak, Graphic Packaging Holding, International Paper, and others.

The global market size is expected to reach USD 152.96 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us