Light Sensors Market Size, Share & Industry Analysis, By Function (Ambient Light Sensing, Proximity Detection, RGB Color Sensing, Gesture Recognition, and IR Detection), By Output (Analog and Digital), By Application (Consumer Electronics, Automotive, Industrial, Healthcare, and Others), and Regional Forecast, 2026–2034

Light Sensors Market Size

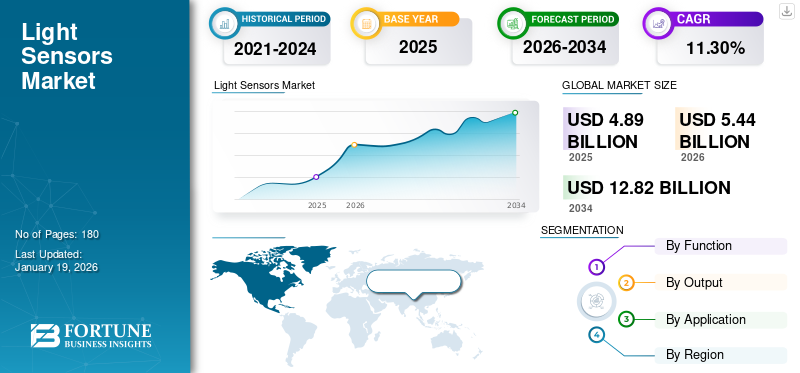

The global light sensors market size was valued at USD 4.89 billion in 2025. The market is projected to grow from USD 5.44

billion in 2026 to USD 12.82 billion by 2034, exhibiting a CAGR of 11.30% during the forecast period. Asia Pacific dominated the light sensors market with a market share of 44.30% in 2025.

Light sensors measure the intensity of light and are commonly applied in consumer electronics, automotive, industrial automation, and smart lighting solutions. Automatic brightness control, energy savings, and improved user experiences are possible through the use of these sensors. Demand for light sensors is expanding on the back of increasing adoption in smartphones, IoT devices, and autonomous vehicles. The market will witness robust growth in the coming years due to advancements in sensor miniaturization and AI technology integration.

A few of the key players in the market include ams OSRAM AG, STMicroelectronics N.V., Sharp Corporation, Broadcom Inc., and Vishay Intertechnology Inc. The growth of the market is driven by the leading companies' emphasis on smart city development, environmental surveillance, and growing usage in healthcare and wearable technology.

Impact of AI

Generative AI Strengthens Next-Gen Light Sensor Applications with Precision, Efficiency, and Cross-Industry Intelligence

Generative AI is revolutionizing the light sensor industry by supporting sophisticated data modeling and sensor fusion, greatly boosting accuracy and reliability. For autonomous vehicle applications, AI-powered light sensors can more accurately analyze dynamic environments by fusing outputs from diverse sensors, enhancing decision-making and safety. Smart devices are enhanced by AI-powered sensors via more accurate detection of ambient light for adapting displays and power efficiency. Generative AI in industrial applications enables predictive maintenance via analysis of patterns in sensor data to predict equipment failure. In general, AI integration is fueling smarter, more efficient applications of light sensors across industries, harnessing rapid innovation and marketplace expansion.

Impact of Reciprocal Tariffs

Tariff Pressures Threaten Global Supply Chains Discouraging Light Sensors Market Growth

Reciprocal tariffs are a substantial challenge to the light sensor market by elevating production and supply chain expenses. Tariffs on semiconductor components and raw materials have the potential to interfere with global sourcing tactics, compelling producers to find substitute suppliers or shift manufacturing, potentially resulting in delays as well as increased costs. Such elevated costs frequently materialize in end-product price hikes, impacting consumer demand as well as profitability. In addition, tariff-related uncertainties are likely to discourage investment in expansion and innovation. Since the light sensor market is most dependent on international trade, persistent tariff pressures can destabilize supply chains and decelerate market growth, especially in automotive and cost-sensitive consumer electronics markets.

Light Sensors Market Trends

Rising Demand for Smart Devices Fuels Shift Toward Digital Light Sensors

One of the major drivers for the light sensor market is the increasing demand for digital output sensors based on their superior accuracy, improved noise immunity, and simplicity of integration with microcontrollers and IoT platforms. While analog sensors provide variable and approximate data transmission, digital sensors provide consistent and accurate data transmission, which is perfect for today's electronics and embedded systems. Their support for digital communication protocols facilitates easy design and lower development time. Digital light sensors in IoT applications provide effortless connectivity, real-time processing of data, and automation. With the growing need for smart, connected products in all industries, manufacturers are giving high priority to digital sensors to achieve performance, reliability, and scalability needs.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Consumer Electronics’ Strong Demand for Compact, Power-Efficient Light Sensors Bolsters Market Development

The extensive adoption of light sensors across smartphones, tablets, laptops, and wearables is a key market growth driver. They offer automatic brightness control, which greatly enhances user experience while saving considerable power. Device screen lighting is optimized in response to ambient illumination, and battery life is preserved, which is an essential aspect for mobile devices. As the demand for smart and energy-saving devices from consumers grows, manufacturers are integrating light sensors as part of their normal components. Moreover, growth in wearable technology for monitoring health and fitness further drives adoption. This trend reinforces long-term demand for low-power, high-performance, and compact light sensors throughout the consumer electronics industry.

Market Restraints

Intense Price Competition Limits Innovation and Margins in Market

Intense competition among sensor vendors has emerged as a major deterrent in the light sensor market, especially in the consumer electronics market. Since light sensors tend to be viewed as low-cost, commoditized products, companies come under intense cost pressure, with declining profit margins. This has translated into a highly competitive market where cost-cutting is prioritized over innovation and performance. Smaller companies are unable to differentiate their products, while big companies use economies of scale to stay afloat in the market. The emphasis on volume sales rather than premium features constrains the incentive to create high-level or specialized sensors, stifling the light sensors market growth.

Market Opportunities

Digital Health Trends Unlock New Growth Avenues for Light Sensors in Medical Applications

Expanding digital health ecosystem and the need for non-invasive monitoring open up large opportunities for light sensors in diagnostics and medical wearables. Light sensors are central to technologies such as photoplethysmography (PPG) that record heart rate, blood oxygenation, and other essential measures non-invasively. With healthcare moving towards remote monitoring and individualized care, the demand for dependable, small, and low-power sensors grows. Wearables with medical-grade, home diagnostics, and telehealth platforms are increasingly adopting light sensors to support continuous, real-time monitoring of health. This growing digital health ecosystem is an attractive market opportunity for sophisticated light sensing solutions that are custom-designed for medical use.

Segmentation Analysis

By Function

Ambient Light Sensors Lead the Market with Strong Adoption in Consumer Electronics

On the basis of function, the market is sub-divided into ambient light sensing, proximity detection, RGB color sensing, gesture recognition, and IR detection.

The ambient light sensing function segment is projected to account for 38.97% of the total market share in 2026. Ambient light sensors are extensively integrated in smartphones, laptops, and other consumer electronics to enable automatic brightness control and maximize power efficiency.

The gesture recognition market is anticipated to grow at the highest-rate of 14.55% due to increasing adoption in AR/VR devices, automotive infotainment, and touchless human-machine interface applications.

By Output

Digital Light Sensors Dominate with Superior Precision and Integration

On the basis of output, the market is bifurcated into analog and digital.

The digital output segment is expected to lead the market, contributing 68.43% of the total market share in 2026. Digital output dominates the light sensors market share as a majority of contemporary consumer electronics and automotive applications need smooth integration with digital circuits. In 2024, the segment’s market size reached USD 2.98 billion as these sensors offer higher precision, improved noise immunity, and simplified system design.

Digital sensors will also observe the most rapid growth at 12.56% through increased demand for low-power, miniaturized, and intelligent sensor modules in IoT, automotive, and consumer electronics applications—further driving the trend away from analog technologies.

By Application

Consumer Electronics Holds the Top Position as its Drives the Largest Demand for Light Sensors

On the basis of application, the market is classified into consumer electronics, automotive, industrial, healthcare, and others (agriculture, street lighting, etc.).

The consumer electronics application segment is anticipated to hold a significant market share of 42.95% in 2026, as smartphones, tablets, laptops, and wearables incorporate light sensors for display optimization, power management, and enhanced user experience. With such wide usage, the segment’s market size accounted for USD 1.93 billion in 2024.

The fastest-growing application will be healthcare because light sensors will find increasing acceptance in medical wearables, diagnostic products, and non-invasive monitoring systems—growing use of digital health technologies will foster adoption of light sensors.

To know how our report can help streamline your business, Speak to Analyst

Light Sensors Market Regional Outlook

The market is studied in-depth and covers the following regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific is the dominant region as it holds a strong manufacturing base, accounting for a market value of USD 1.91 billion in 2024. Large scale automotive production and fast adoption of IoT devices in China, Japan, and South Korea is estimated to push the market’s growth to USD 2.16 billion in 2025. The Japan market is projected to reach USD 0.48 billion by 2026, the China market is projected to reach USD 0.5 billion by 2026, and the India market is projected to reach USD 0.35 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is estimated to account for a market value of USD 0.93 billion in 2025. North America and Europe are key markets for light sensors, driven by advanced automotive technologies, growing smart home adoption, and industrial automation. In North America, the U.S. propels the region’s growth and is anticipated to hold a market size of USD 0.91 billion in 2025. High investments in research and development support innovation in sensor accuracy and integration. The UK market is projected to reach USD 0.19 billion by 2026, while the Germany market is projected to reach USD 0.19 billion by 2026.

South America

South America is emerging steadily, with increasing smartphone use and infrastructure development boosting demand, expecting to reach USD 0.22 billion in 2025. The Middle East & Africa, while currently smaller, shows promising growth potential through smart city initiatives and expanding industrial applications. With these factors, the region is positioned to hit USD 0.29 billion in 2025. Across these regions, rising focus on energy efficiency, environmental monitoring, and IoT adoption continues to fuel light sensor market growth, supported by government policies promoting technological advancements and sustainability. In GCC, the market’s estimated value is USD 0.09 billion for 2025.

The U.S. market is projected to reach USD 0.99 billion by 2026.

Competitive Landscape

Key Industry Players

Competition Between Key Players Fuels Innovation and Market Expansion in Light Sensors

The market for light sensors is highly competitive with many global and local players competing to innovate and grab market share. Market leaders are working towards creating sophisticated sensors with better accuracy, reduced power consumption, and smooth integration capability for a wide range of applications such as consumer electronics, automotive, and industrial automation. Strategic alliances, mergers, and acquisitions are prevalent as companies seek to increase their product portfolios and geographical presence. Price competition is fierce, especially within commoditized segments, compelling manufacturers to weigh cost optimization against technological differentiation. Ongoing R&D investment and aggressive uptake of digital and smart sensor technologies define the competitive landscape in transition.

List of Key Light Sensors Companies Studied:

- ams OSRAM AG (Germany)

- STMicroelectronics N.V. (Switzerland)

- Broadcom Inc. (U.S.)

- Vishay Intertechnology Inc. (U.S.)

- Sharp Corporation (Japan)

- Analog Devices, Inc. (U.S.)

- Everlight Electronics Co., Ltd. (Taiwan)

- Texas Instruments Inc. (U.S.)

- ON Semiconductor (onsemi) (U.S.)

- ROHM Co., Ltd. (Japan)

- Panasonic Holdings Corporation (Japan)

- Renesas Electronics Corporation (Japan)

- Melexis NV (Belgium)

- Lite-On Technology Corporation (Taiwan)

- Sensortek Inc. (Taiwan)

Key Industry Developments:

September 2025 – Philips introduced MotionAware, a new feature that converts smart bulbs into motion sensors via radio-frequency (RF) sensing. This removes the requirement for standalone motion hardware, enhancing automation and privacy within smart home lighting systems.

June 2025 – Sony Semiconductor Solutions revealed the IMX479 stacked SPAD depth sensor for automotive LiDAR use that has 520 dToF pixels and can detect up to 300 meters. The sensor is aimed at advanced driver assistance systems and autonomous driving uses, with sample shipments starting in Autumn 2025 for JPY 35,000 (USD 230) per unit.

February 2025 – ams OSRAM announced solid Q4 2024 financials with revenues higher than expected and targeted free cash flow in excess of USD 100 million in 2025. Automotive semiconductor business of the company demonstrated structural growth while it embarked on strategic efficiency programs with the aim of achieving USD 79.5 million in savings.

January 2025 – ams OSRAM was approved by the EU Commission for USD 240.6 million investment grant under European Chips Act to increase semiconductor production in Austria. The overall investment will be USD 601 million by 2030, targeting next-generation optoelectronic sensors for medical and automotive uses.

Report Coverage

This report provides an in-depth study light trends market analysis including major trends, growth drivers, challenges, and opportunities. It analyzes top market players, technological trends, and regional themes and provides insights into new developments and competitive themes. The report further comprises detailed projections, enabling stakeholders to make informed choices based on prevailing market segments and future prospects.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| ARRTIBUTES | DETAILS |

| Study Period | 2021–2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2021–2024 |

| Growth Rate | CAGR of 11.30% from 2026-2034 |

| Unit | Value (USD Billion) |

|

By Function

By Output

By Application

By Region

|

Frequently Asked Questions

As per Fortune Business Insights, the market’s value was USD 4.89 billion in 2025 and is anticipated to reach USD 12.82 billion by 2034.

The market is expected to depict a CAGR of 11.30% over the forecast period.

The market’s growth is primarily driven by light sensors integration in in smartphones, tablets, laptops, and wearables.

Consumer electronics is the leading segment and held the largest share in 2025.

Asia Pacific holds the dominating market share and held a market value of USD 2.16 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us