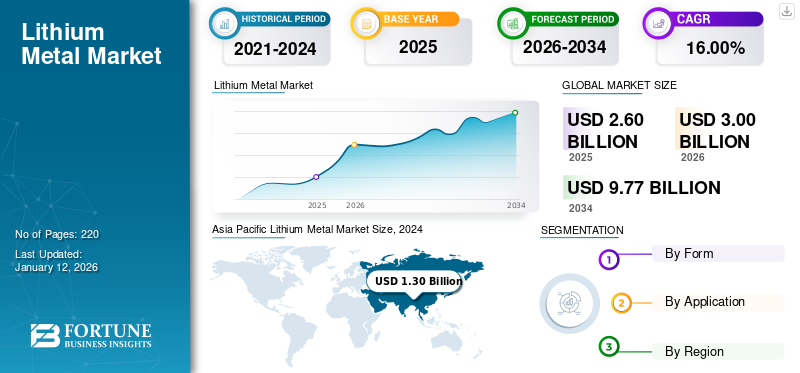

Lithium Metal Market Size, Share & Industry Analysis, By Form (Ingots, Powder, and Others), By Application (Batteries, Alloys, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global lithium metal market size was valued at USD 2.60 billion in 2025. The market is projected to grow from USD 3.00 billion in 2026 to USD 9.77 billion by 2034, exhibiting a CAGR of 16.00% during the forecast period. Asia Pacific dominated the lithium metal market with a market share of 59% in 2025.

Lithium metal is a highly reactive alkali metal, that plays a pivotal role in advancing energy storage technologies due to its superior electrochemical properties. It serves as a key component in next-generation batteries such as lithium-sulfur and solid-state batteries, offering higher energy densities and longer lifespans compared to traditional lithium-ion batteries. The increasing demand for electric vehicles, renewable energy storage solutions, and portable electronic devices is driving the growth of the market. Additionally, global initiatives aimed at reducing carbon emissions and transitioning to sustainable energy sources are further driving product adoption in various applications.

Key companies operating in this market include Ganfeng Lithium Group Co. Ltd., Techtone Inorganic Co., Ltd., Rio Tinto, Tianqi Lithium Inc., Merck KGaA, Albemarle Corporation, and Chengxin Lithium Group Co., Ltd.

GLOBAL LITHIUM METAL MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 2.60 billion

- 2026 Market Size: USD 3.00 billion

- 2034 Forecast Market Size: USD 9.77 billion

- CAGR: 16.00% from 2026–2034

Market Share:

- Asia Pacific dominated the market in 2025 with a 59% share, reaching USD 1.50 billion.

- By form, lithium ingots held the leading share due to their extensive use in next-gen battery manufacturing.

- By application, the batteries segment led the market, driven by rising EV production and renewable energy storage demand.

- In China, robust EV manufacturing and integrated battery supply chains contributed to substantial regional demand growth.

- North America showed strong momentum due to clean energy investments and government support for domestic battery supply chains.

Key Country Highlights:

- China: Dominates EV and battery supply chains, supporting Asia Pacific’s leadership in lithium metal consumption.

- United States: Significant government funding and battery R&D projects propel growth in solid-state and next-gen battery applications.

- Germany: EV adoption, advanced battery infrastructure, and sustainability regulations enhance lithium metal usage.

- Japan & South Korea: Advanced battery tech and consumer electronics drive regional demand.

- Middle East & Africa: Growing clean energy investments and lithium mining activity support future market expansion.

MARKET DYNAMICS

LITHIUM METAL MARKET TRENDS

Rising Investments In Solid-State Battery Development to Drive Market Growth

The market is experiencing strong momentum due to its critical role in next-generation batteries, especially for electric vehicles and advanced electronics. As industries seek alternatives to conventional lithium-ion technologies, lithium metal is gaining attention for its potential to extend battery life and energy capacity significantly. Ongoing R&D efforts, along with increasing investments in solid-state battery development, are accelerating the product adoption, positioning it as a key material in the future of energy storage solutions. Asia Pacific witnessed a lithium metal market growth from USD 2.05 billion in 2023 to USD 1.30 billion in 2024.

MARKET DRIVERS

Rising Adoption of Electric Vehicles (EVs) and Clean Energy Solutions to Boost Product Demand

The increasing shift toward electric mobility and clean energy, particularly in developed and emerging economies, is increasing demand for lithium metal in advanced battery technologies. As the adoption of EVs accelerates and renewable energy integration expands, the need for high-performance, energy-dense battery systems continues to rise, which directly boosts the consumption of this metal. The metal plays a crucial role in next-generation batteries, offering superior energy storage capabilities essential for EVs, grid storage, and portable electronics. Additionally, advancements in solid-state battery technology and ongoing investments in battery manufacturing infrastructure are reinforcing market growth. As the world moves toward decarbonization and sustainable energy solutions, product demand is expected to surge significantly.

MARKET RESTRAINTS

Raw Material Price Volatility and Limited Accessibility to Hinder Market Expansion

The market is significantly impacted by fluctuating prices of essential raw materials, particularly lithium chloride. Variability in raw material costs impacts lithium production expenses and profit margins for manufacturers. A rise in prices can lead to increased operational costs, while lower prices may offer temporary financial relief but are often unpredictable in long-term planning. In addition, the limited number of regions capable of producing and refining high-purity lithium compounds adds further pressure on supply chains. This leads companies to explore efficiency measures and alternative sourcing strategies to mitigate risks. However, the uncertainty and high dependency on specific materials remain major challenges, thereby restricting consistent market growth during the forecast period.

MARKET OPPORTUNITIES

Innovation in Extraction and Processing Techniques to Support Market Expansion

Advancements in lithium extraction and processing methods are opening new growth opportunities for the market. Techniques such as direct lithium extraction (DLE) and improved electrolysis are making lithium production more efficient, cost-effective, and environmentally sustainable. These innovations enhance lithium yield, reduce energy consumption, and enable access to new resource types, helping address supply limitations. As demand for high-purity lithium metal continues to rise, such technological progress is expected to drive lithium metal market growth in the coming years.

- According to the U.S. Department of Energy (DOE), funding of USD 10.9 million has been allocated for 10 projects across nine states in 2024, to develop innovative technologies for extracting and converting battery-grade lithium from geothermal brine sources. These government initiatives aim to enhance domestic lithium supply and support the long-term scalability of advanced extraction methods.

MARKET CHALLENGES

Environmental Regulations and Rising Operational Costs to Challenge Market Growth

Lithium production raises significant environmental concerns due to the energy-intensive and water-dependent extraction processes, prompting stricter environmental regulations across major regions. Compliance with these evolving standards requires heavy investment in cleaner and more sustainable technologies, thereby increasing operational costs for manufacturers. Additionally, the emergence of alternative battery technologies, such as sodium-ion and solid-state batteries, poses a competitive threat to lithium market dominance. These developments are compelling producers to enhance production efficiency and sustainability.

Download Free sample to learn more about this report.

Segmentation Analysis

By Form

Rising Use of Lithium Ingots In Battery Manufacturing Boosts Segment Growth

Based on form, the market is classified into ingots, powder, and others.

The ingots segment holds the dominant lithium metal market share, driven by its extensive use in battery manufacturing, particularly in next-generation lithium-metal and solid-state batteries. The high purity and density of ingot lithium make it ideal for industrial applications where consistent performance and durability are essential. The growing demand for EVs, energy storage systems, and advancements in battery technologies are boosting the consumption of lithium ingots. Moreover, increasing investments in battery production facilities further drive the growth of this segment.

The powder segment is witnessing high growth due to its versatile applications in pyrotechnics, chemical synthesis, and specialized alloys. Lithium powder’s high reactivity makes it suitable for advanced materials and research fields. Additionally, its potential in additive manufacturing and compact battery designs is gaining traction. Ongoing innovations, coupled with rising demand for high-energy density solutions, are expected to boost the growth of the lithium powder segment.

By Application

Rising EVs and Energy Storage Demand to Drive Batteries’ Segment Growth

Based on application, the market is classified into batteries, alloys, and others.

The market is witnessing rapid growth, with the batteries segment emerging as the dominant contributor. This growth is largely due to the global push toward sustainable mobility through electric vehicles, the expanding integration of renewable energy sources into power grids, and the increasing need for compact, efficient energy storage in consumer electronics. Lithium metal is a preferred material for innovative battery technologies such as solid-state and lithium-sulfur batteries, due to its high energy density and lightweight nature. Additionally, government support for green energy initiatives and growing investments in battery research and development are further driving product demand.

In the alloys segment, lithium metal is widely used in aluminum-lithium and magnesium-lithium alloys for aerospace, defense, and automotive applications due to its ability to enhance strength while reducing weight. The increasing focus on fuel-efficient and lightweight materials, especially in aircraft manufacturing, is accelerating demand. Additionally, advancements in material science and the expansion of the aerospace and defense industries are expected to drive growth in the segment during the forecast period.

Lithium Metal Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

Asia Pacific

Asia Pacific Lithium Metal Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific dominated the market with a valuation of USD 1.50 billion in 2025 and USD 1.74 billion in 2026, driven by the increasing demand from the electric vehicle sector, advancements in battery manufacturing, and high government support for clean energy initiatives in countries such as Japan, China, South Korea, and India. China plays a particularly significant role due to its large-scale EV manufacturing and integrated battery supply chain. Additionally, the rising demand for consumer electronics, growing investments in renewable energy storage, and increased industrial automation are further fueling market growth. Moreover, the region’s rich lithium reserves and advanced refining capabilities ensure a consistent supply and high consumption levels.

North America

North America is witnessing consistent growth in the market, driven by the region’s shift toward electrification and clean energy. Investments in building a domestic battery supply chain, along with the expansion of EV manufacturing facilities in the U.S. and Canada, are key growth factors. Government support for clean transportation, coupled with the increasing adoption of grid-scale energy storage systems to stabilize renewable power sources, further boosts product demand. The region also benefits from advanced battery research and development, with innovations extending the applications beyond conventional batteries.

In the U.S., lithium metal demand is accelerating due to the rapid growth of the electric vehicles and government initiatives promoting clean energy technologies. The country is also investing heavily in next-generation battery research, particularly in solid-state batteries that utilize lithium metal for higher energy density and safety.

Europe

In Europe, the market is shaped by strong environmental regulations, a push for carbon neutrality, and the region’s leadership in clean technology. The growing demand for EVs, supported by ambitious emission reduction targets and government incentives, is a major driver for lithium consumption. Countries such as Germany, France, and U.K. are heavily investing in advanced battery production and EV infrastructure. The region’s focus on responsible sourcing, recycling, and circular economy practices further supports market growth. With a well-established automotive industry and an increasing focus on innovative battery technologies, Europe remains a key player in the global market.

Rest of the World

In regions such as Latin America and the Middle East & Africa, the market is growing due to increasing investments in renewable energy, battery storage, and electric mobility solutions. The development of energy infrastructure, the adoption of clean technologies, and government-led sustainability initiatives are key growth drivers. Investments in mining, battery production, and energy storage systems are supporting the increasing product demand. Additionally, the push for economic diversification, foreign investments, and technological advancements further contributes to market expansion in these regions.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies Focus on New Product Launches to Strengthen their Market Presence

The market is highly competitive, with major players focusing on technological advancements, mergers & acquisitions, and capacity expansion to increase their market presence. Key global companies operating in the market include Ganfeng Lithium Group Co. Ltd., Techtone Inorganic Co., Ltd., Rio Tinto, Tianqi Lithium Inc., Merck KGaA, Albemarle Corporation, and Chengxin Lithium Group Co., Ltd. These companies compete based on purity levels, cost-effective processing techniques, supply chain integration, and regional dominance while also investing in sustainable extraction technologies to address environmental concerns. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY LITHIUM METAL COMPANIES PROFILED

- Ganfeng Lithium Group Co. Ltd. (China)

- Techtone Inorganic Co., Ltd. (China)

- Chengxin Lithium Group Co., Ltd. (China)

- Rio Tinto (U.K.)

- CNNC Jianzhong Nuclear Fuel Co., Ltd. (China)

- Albemarle Corporation (U.S.)

- Li-Metal Corp. (Canada)

- Tianqi Lithium Inc. (China)

- ATT Advanced Elemental Materials Co., Ltd. (U.S.)

- Merck KGaA (Germany)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Rio Tinto completed its USD 6.7 billion acquisition of Arcadium Lithium, positioning itself as a global leader in the supply of energy transition materials and significantly expanding its lithium portfolio to support the growing demand for clean energy solutions.

- August 2024: Arcadium Lithium acquired Li-Metal Corp.’s lithium metal business for USD 11 million in an all-cash deal. This acquisition included intellectual property, patents, and a pilot production facility in Ontario, Canada. This acquisition aimed to enhance Arcadium’s capabilities in producing lithium metal from various grades of lithium carbonate feedstock.

REPORT COVERAGE

The global market analysis provides market size and forecast for all segments included in the report. It includes details on the market dynamics and emerging market trends. It offers information on lithium metal in key regions, key industry developments, new product launches, details on partnerships, and mergers & acquisitions in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.00% from 2026-2034 |

|

Unit |

Value (USD Billion) Volume (Kiloton) |

|

Segmentation |

By Form

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 3.00 billion in 2026 and is projected to reach USD 9.77 billion by 2034.

In 2025, the market value stood at USD 1.50 billion.

The market is expected to exhibit a CAGR of 16.00% during the forecast period of 2026-2034.

By form, the ingots segment leads the market.

Rising adoption of EVs and clean energy solutions is driving the market growth.

Ganfeng Lithium Group Co. Ltd., Techtone Inorganic Co., Ltd., Rio Tinto, Tianqi Lithium Inc., Merck KGaA, Albemarle Corporation, and Chengxin Lithium Group Co., Ltd. are some of the top players in the market.

Asia Pacific dominates the market.

Increasing demand for high energy density batteries in EVs, renewable energy storage systems, and innovation in extraction and processing techniques are some of the factors expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us