Liver Health Supplements Market Size, Share & Industry Analysis, By Product Type (Natural Supplements and Synthetic Supplements) By Type (Herbal Supplements, Vitamins & Minerals, and Others), By Dosage Forms (Capsules, Tablets, Powder, and Others) By Distribution Channel (Pharmacies, e-Commerce Platforms, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

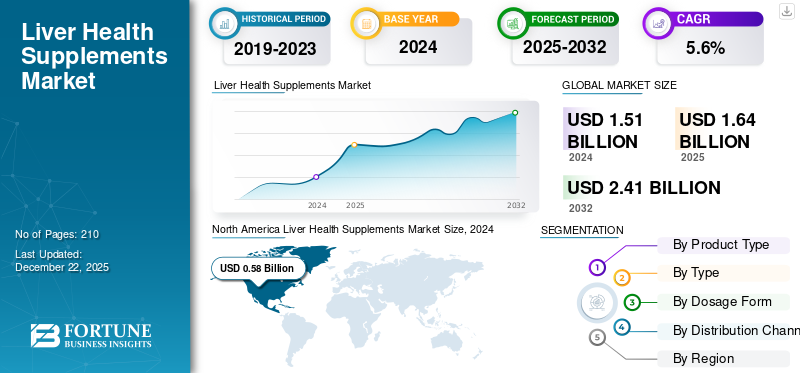

The global liver health supplements market size was USD 1.64 billion in 2025. The market is projected to grow from USD 1.77 billion in 2026 to USD 2.56 billion by 2034, exhibiting a CAGR of 4.75% during the forecast period. North America dominated the liver health supplements market with a market share of 38.62% in 2025.

Liver health supplements are the dietary products formulated to support and optimize the liver’s performance. These types of supplements help prevent occurrence of liver diseases, and improve liver health in the existing conditions. This organ has a critical role in the detoxification process within the body. It detoxifies the blood out of toxins, drugs, alcohol and any other related damaging substances. However, factors such as poor diet, alcohol consumption, drug intake, environmental contaminants, and other diseases weaken and affect the functioning of the liver.

Some nutrients, herbs, and compounds such as milk thistle, artichoke, vitamin B12, others are most effective in promoting liver function and assisting in its natural cleansing process. Furthermore, the liver health supplements market is witnessing significant growth trajectory during the forecast period due to rising prevalence of chronic liver diseases because of poor dietary habits and lifestyle modifications. Also, shifting focus of consumers toward herbal supplements, vitamins and minerals to maintain liver health and reduce liver damage is leading toward market growth.

Additionally, the presence of key strong players such as Amway, with extensive product offerings and innovative R&D activities is aimed to boost the growth of the market.

MARKET DYNAMICS

MARKET DRIVERS

Rising Prevalence of Liver Diseases to Boost Demand for Liver Health Supplements

One of the most critical drivers of the market is a significant rise in prevalence of liver diseases globally. The liver diseases such as liver cirrhosis, non-alcoholic fatty liver diseases (NAFLD), hepatitis, and alcoholic liver diseases. Increasing alcohol consumption, poor dietary habits, obesity and rising geriatric population are contributing toward the rising occurrence of these diseases.

- For instance, as per the data published by American Liver Foundation, the global prevalence of NAFLD is estimated to be more than a billion. It is one of the most common causes of liver disease in the U.S. and about 24.0% adults are estimated to have it. Also with time NAFLD can lead to cirrhosis and liver failure.

Thus, such serious issues associated with the disease, shifted the consumer focus toward preventive healthcare, boosting the demand for liver detox and health supplements and eventually leading toward liver health supplements market growth.

MARKET RESTRAINTS

Lack of Clinical Evidence and Safety Concerns to Hamper Market Growth

The rising burden of chronic liver diseases and limited therapeutic options has shifted the focus of patients toward supplements that claim to detoxify and cleanse the liver. However, the safety and efficacy of liver supplements is not determined as these supplements do not require Food and Drug Administration approval for safety and efficacy.

The lack of strict regulations for supplement formulation and labelling can mislead the consumers. Also, these supplements may interact with medications and pose safety risks.

- For instance, in March 2025, according to the study published in the American Journal of Gastroenterology, scientific evidence supporting the safety and efficacy of liver supplements is limited and inconclusive. Additionally, they also reported that the bestselling liver cleansing products via online channels in the U.S. lacks strong scientific evidence for safety or efficacy, with limited preclinical research. Such factors may hamper the customers’ health.

MARKET OPPORTUNITIES

Population Shift toward Nutraceuticals to Offer Lucrative Growth Opportunity

The population shift toward nutraceuticals is creating a strong growth opportunity in the liver health supplements market. As people become more conscious toward health and well-being, there is a growing preference for natural and preventive healthcare solutions. Thus, consumer focus is shifting toward nutraceuticals such as herbal supplements, vitamins, to support liver functions, for lifestyle related issues such as non-alcoholic fatty liver.

- For instance, in June 2023, as per the study published by RUHS College of Medical Sciences, Jaipur, India to study ‘Nutraceutical Use in Younger Population’. The study was performed with 575 participants aged between 15 and 30 years of age, of North India over a period of two weeks in October 2022. It was found that around 47.8% of the study subjects i.e. around 275 were using nutraceuticals. Such a high number of younger population adoption for health supplements to boost the market growth during the forecast period.

MARKET CHALLENGES

Damage Caused by Dietary Supplements Hamper Product Image

Adverse effects and safety concerns, especially organ damage with dietary supplements pose a key challenge to the image of products in the liver health supplement market. The increasing cases of organ damage linked to certain dietary supplements is negatively impacting the market growth.

Many reports have studied that liver toxicity, acute liver failure, or other organ-related side effects are caused by unregulated or poor-quality supplements have raised significant safety concerns among consumers and healthcare professionals. Some herbal ingredients, when consumed in excess or combined improperly, can be hepatotoxic.

- For instance, as per the data published by Healio Gastroenterology, quoted a study from JAMA Network Open, studied that around 15.6 million people in the U.S. are consuming botanicals. In which around 9,685 adults were surveyed, and it was found that 4.7% used at least one of six potentially hepatotoxic botanicals. Such serious side effects with long-term use of such products may hamper the brand images and product adoption, thus challenging the market growth.

Additionally, the lack of stringent quality control and misleading health claims by some manufacturers affects individual brands and diminishes the liver health supplement category.

LIVER HEALTH SUPPLEMENTS MARKET TRENDS

Expanding Indication of Different Dietary Supplements for Liver Disease Treatment

Expanding the indications of dietary supplements for managing liver diseases is a significant emerging trend in the market.

The increasing trials by the researchers to expand the indication of already available supplements for supporting liver health diseases paving the way for increased availability of adjunctive therapeutic options in liver disease care.

- For instance, in January 2025, the University of Plymouth illustrated the ongoing BOOST trial exploring the effects of β‑hydroxy β‑methylbutyrate (HMB) in patients with chronic liver disease. Historically used to promote muscle growth, HMB is now being rigorously tested as a therapeutic agent to improve physical function and quality of life in individuals with liver cirrhosis.

Such initiative reflects a broader shift of dietary supplements for specific therapeutic roles in liver disease rather than general wellness.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product Type

Based on product type, the segment is bifurcated into natural supplements and synthetic supplements.

The natural supplements segment held a significant share of global market with a share of 59.79% in 2026. The growth of the segment is driven by increasing demand for liver support products and rising focus toward herbal constituent supplements. Moreover, increasing new products launched by key players with herbal ingredients is expected to boost the segment’s growth throughout the forecast period.

- For instance, in June 2025, Guttify, launched the Liver Lift Kit for fatty liver management. The kit comprises ingredients such as milk thistle, dandelion, and moringa to support liver detox, reduces bloating, and enhances overall wellness.

On the other hand, the synthetic supplement segment is expected to grow with a considerable share of the market. Owing to the presence of a variety of vitamins, minerals, and antioxidants for liver function support and detoxification.

By Type

Product Launches and Shift Toward Herbal Supplements Lead to Segment Dominance

Based on type, the market is divided into herbal supplements, vitamins & minerals, and others.

The herbal supplements segment held the dominant liver health supplements market share with a share of 59.60% in 2026. The dominant share of the segment is augmented by increasing demand for dietary supplements to prevent diseases and rising cases of lifestyle disorders. Moreover, consumers prefer herbal formulations for detoxifying liver and supporting liver health. These supplements contain ingredients such as milk thistle, turmeric, dandelion root, and artichoke extract, which are believed to support liver detoxification, reduce inflammation, and protect against oxidative stress.

Furthermore, many key players of the market are focusing on new herbal product launches to boost the segment’s growth in the market.

- For instance, in July 2024, Zandu Care launched Introducing Zandu Care's Livital Liver Care Syrup with natural ingredients which helps in liver detoxification.

The vitamins & minerals segment is expected to grow considerably during the forecast period. The growth of the segment is augmented by the benefits associated with supplements consisting of certain vitamins and minerals for chronic liver diseases. These help in supporting metabolic functions, detoxification, and liver cell regeneration. Key nutrients such as vitamin E, vitamin C, vitamin B-complex (especially B12 and B6), zinc, and selenium are widely recognized for their antioxidant properties and ability to reduce liver inflammation and oxidative damage. Additionally, growing awareness of micronutrient deficiency and its linkage with liver dysfunction has driven demand for such formulations.

- For instance, in August 2022, Scientists at Duke-NUS Medical School, Singapore studied, found that vitamin B12 and folic acid could be used to prevent or reverse advanced forms of fatty liver disease. Such studies increase the customers’ trust and adoption of the products for liver health.

The others segment is expected to grow the during forecast period, owing to rising prevalence of liver diseases and shifting focus toward dietary and health supplements.

To know how our report can help streamline your business, Speak to Analyst

By Dosage Form

Easy Availability and Convenience Associated with Capsules Boost Segment’s Growth

Based on dosage form, the market is segmented into tablets, capsules, powder, and others.

The capsules segment dominated the global market share contributing 45.96% globally in 2026 owing to the availability of the majority of supplements in capsule form and benefits associated with it. Capsules are easy to swallow, absorb fast, and can mask the taste and odor of herbal or vitamin ingredients. Additionally, new product launches in capsule form and wide availability in stores propel the segment’s growth.

- For instance, in March 2023, Evogen Nutrition, a prominent company in the sports nutrition and supplementation launched liver support supplement in capsule form. This product is developed to optimize liver health and performance.

On the other hand, the tablets segment held the second-largest share of the market owing to its longer shelf life, and ability to accommodate multiple ingredients in a single dose. They are widely used for combining vitamins, minerals, and herbal extracts in liver health formulas.

Moreover, tablets can be customized in chewable, or extended release formulations and manufactured easily in large as per the need. Such factors boost the segment’s growth during the forecast period.

The powder segment is expected to grow during the forecast period. These formulations offer flexibility in dosing and are ideal for individuals who have difficulty swallowing pills.

By Distribution Channel

Rising Collaborations Amongst Key Retailers Bolster Pharmacies Segment Dominance

Based on distribution channel, the market is segmented into pharmacies, e-commerce platforms, and others.

Pharmacies hold a leading position in the liver health supplements market accounting for 43.72% market share in 2026 due to their widespread presence, consumer trust, and access to professional guidance. Additionally, these channels offer a curated range of clinically-backed products, enhancing consumer confidence. Also, many older populations prefer purchasing from these channels as they offer both preventive and supportive healthcare. Moreover, increasing collaboration activities amongst key retailers of nutrition products to advance their promotional strategies boost sales and segment’s growth.

- For instance, in October 2023, The Vitamin Shoppe collaborated with Jumpmind, Inc., a leading retail technology provider, with an aim to upgrade its in-store point-of-sale (POS) systems and unify its promotional strategy. The company’s technology helps to streamline promotions across both online and in-store channels.

E-commerce platforms are expected to grow significantly during the forecast period. This is driven by rising online health shopping trends and the availability of a wide product range and different brands. Additionally, convenience, customer reviews, detailed product information, and discounts offered by online stores, has shifted the focus toward e-commerce platforms.

Moreover, digital health awareness and wellness influencers have further boosted online purchases of liver supplements via these channels.

The others segment is expected to grow during the forecast period, with growing adaptability and availability of health supplements products and nutraceuticals at hypermarkets, or supermarkets.

LIVER HEALTH SUPPLEMENTS MARKET REGIONAL OUTLOOK

For the global liver health supplements market analysis, the regions are segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Liver Health Supplements Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 0.63 billion in 2025 and USD 0.68 billion in 2026. The growth of the region is due to the increasing lifestyle disorders associated with excessive alcohol consumption, unhealthy dietary choices, and smoking. This leads to an increase in the number of cases of liver diseases such as non-alcoholic fatty liver, cirrhosis and others. Moreover, rising awareness programs and focus toward adoption of dietary or herbal supplements to boost the market growth in the region.

U.S.

The U.S. dominated the North America region. The leading share of the country is augmented by increasing prevalence of liver injuries and rising awareness regarding healthy nutritional choices to keep liver healthy. These awareness programs help to promote product adoption and thus bolster the market growth in the country. The U.S. market is projected to reach USD 0.65 billion by 2026.

- For instance, in October 2024, American Liver Foundation observed October as National Liver Awareness Month to encourage people to understand the risk for liver disease, and try new 30-day liver healthy meal plans, to support liver health. Thus, boosting the adoption of these products in the country.

Europe

Europe held the second-highest position in the global market in 2024. The region's growth is augmented by the rising prevalence of diseases and increasing shift toward supplements to boost liver health and reduce the risk associated with the diseases. The UK market is projected to reach USD 0.12 billion by 2026, while the Germany market is projected to reach USD 0.09 billion by 2026.

- For instance, in January 2018, Liver Health UK launched LivOn! health drinks. It is a range of antioxidant, coffee-based drinks formulated to reduce the risk of developing a fatty liver.

Asia Pacific

Asia Pacific is expected to grow with the highest CAGR during the forecast period of 2025 to 2032. The region's rising geriatric population and increasing lifestyle modification leading to expansion in the cases of liver diseases in the region. Additionally, the presence of Ayurveda and Chinese medicine for liver support and detoxifications boosted the adoption and growth of the market in the region. The Japan market is projected to reach USD 0.09 billion by 2026, the China market is projected to reach USD 0.18 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

- For example, in June 2022, as per the study published in the Journal of Clinical and Experimental Hepatology, AIIMS analyzed and published a report on non-alcoholic fatty liver disease in India. The study stated that 38.0% of Indians have fatty liver or non-alcoholic fatty liver disease. Such a large percentage of the population suffering from liver diseases increases the demand for supplements to support liver functions.

Latin America and the Middle East & Africa

The markets in Latin America and the Middle East & Africa are anticipated to grow during the forecast period. The regional growth is due to the rising number of diseases and shifting focus toward adopting nutraceuticals for maintaining health and nutrition.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Companies with Wider Product Portfolio Account for Prominent Market Share

Amway and Himalaya Wellness Company are leaders of the liver health supplements industry. Strong product portfolios designed by important companies help to introduce newly developed health supplements, which resulted in a strategic advantage for market leadership. Furthermore, Moreover, many firms joined forces and signed partnerships to receive product approvals and also reinforce their place in the global market.

Among them, Jarrow Formulas, Inc. and Gaia Herbs are popular for launching marketing strategies, which have helped them to reach untapped regions. These include launch of novel supplements, expanding operations into upcoming markets, and a strong demand for dietary and vitamin supplements.

LIST OF KEY LIVER HEALTH SUPPLEMENTS COMPANIES PROFILED

- Jarrow Formulas, Inc. (U.S.)

- Gaia Herbs (U.S.)

- Life Extension (U.S.)

- Foresta Organics (India)

- Himalaya Wellness Company (India)

- Caruso's Natural Health (Australia)

- Amway (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Amway launched Nutrilite Triple Protect, a plant-based supplement powered by the natural strength of Acerola Cherry, Turmeric, and Licorice. This product aims to support immunity, reduce inflammation and offer antioxidant properties.

- June 2024: Plexus Worldwide, LLC. launched “Restore”. A product that offers liver support and an enhanced assistance to natural detoxification.

- January 2024: Cymbiotika announced the launch of Liver Health+. It is a combination of liver-protective vitamins, herbs, and nutrients, to keep the liver function optimal.

- December 2022: The Central Marine Fisheries Research Institute (CMFRI) India, signed a MoU with Emineotech, for the production of Cadalmin LivCure extract, from seaweeds, to combat non-alcoholic fatty liver disease (NAFLD).

- August 2020: Sabinsa, a nutraceutical company launched LivLonga. It is a new formula designed to support healthy liver function.

REPORT COVERAGE

The global liver health supplements market report centers on providing an industry overview and examining the market dynamics of the sector. This includes global market analysis, analyzing the drivers, restraints, opportunities, and trends influencing the market. The report highlights key developments within the industry, regulatory guidelines, and discusses the launch of new products by major players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 4.75% from 2026-2034 |

|

Segmentation |

By Product Type

|

|

By Type

|

|

|

By Dosage Form

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 1.64 billion in 2025 and is projected to reach USD 2.56 billion by 2034.

In 2025, the North America market stood at USD 0.63 billion.

The market is expected to exhibit a CAGR of 4.75% during the forecast period (2026-2034).

Based on type, the herbal supplements segment is estimated to lead the market.

North America region dominated the market in 2025.

The contributing factors, such as the rising prevalence of liver diseases, increasing shift toward nutraceuticals, are expected to drive the market growth.

The key trend in this market is the expansion of indication of available dietary supplements to support liver functions.

Amway and Himalaya Wellness Company are the top market players.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us